ID: PMRREP21805| 196 Pages | 8 Dec 2025 | Format: PDF, Excel, PPT* | Energy & Utilities

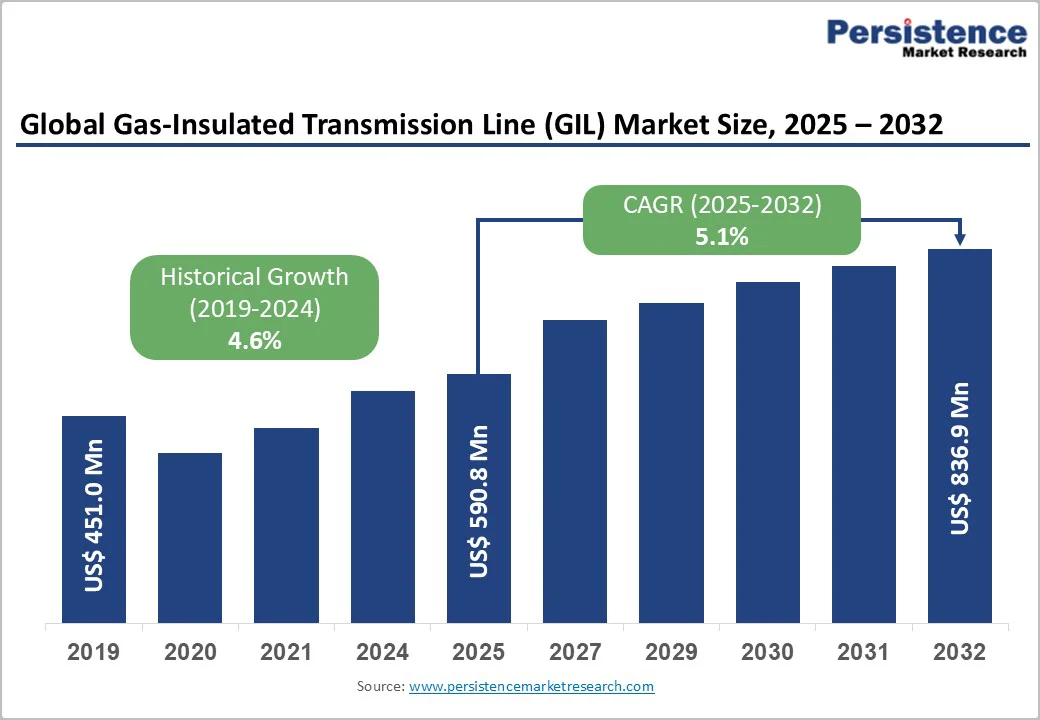

The global gas-insulated transmission line (GIL) market size is likely to be valued at US$ 590.8 million in 2025, and is projected to reach US$ 836.9 million by 2032, growing at a CAGR of 5.1% during the forecast period 2025 - 2032.

Escalating demand for space-efficient power transmission, rapid integration of renewable energy sources, and global power grid modernization initiatives are bolstering the sales of the gas insulated transmission lines across the globe. Increasing focus on reducing transmission losses, environmental concerns regarding traditional overhead lines, and technological advancements in high-voltage gas-insulated systems further support the market growth.

| Key Insights | Details |

|---|---|

| Gas-Insulated Transmission Line (GIL) Market Size (2025E) | US$ 590.8 Mn |

| Market Value Forecast (2032F) | US$ 836.9 Mn |

| Projected Growth CAGR(2025 - 2032) | 5.1% |

| Historical Market Growth (2019 - 2024) | 4.6% |

Global urbanization trends are accelerating demand for space-efficient gas-insulated transmission lines to overcome physical constraints in densely populated cities, where the urban population is projected to rise from 56% today to 68% by 2050.

Traditional overhead lines face increasing restrictions due to limited right-of-way availability and environmental concerns, while GIL enables compact underground or tunnel installations ideal for urban centers previously unsuitable for conventional infrastructure.

India's POWERGRID is advancing this trend through major transmission project foundations supporting grid modernization. European cities are enforcing strict visual pollution regulations that favor underground GIL deployment, justifying premium pricing for space-optimized solutions in high-density metropolitan regions.

The global renewable energy boom, adding over 300 GW annually, is creating substantial GIL demand for efficient long-distance transmission from remote wind and solar sites to urban demand centers, minimizing power losses across thousands of kilometers.

With renewables projected to surge to 60% by 2030, governments worldwide are investing heavily in grid modernization to meet sustainability mandates, particularly for offshore wind projects in the North Sea and Asia requiring specialized high-voltage connections.

GIL technology supports ultra-high voltage capacity expansion without proportional land footprint increases, positioning it as essential infrastructure for integrating geographically dispersed clean energy resources into modern power systems.

Gas-insulated transmission lines face significant adoption constraints stemming from elevated capital requirements and complex installation demands. GIL system installation costs typically range from 2-3 times higher than conventional overhead transmission lines, creating substantial barriers for utilities operating under tight budget constraints, particularly in cost-sensitive emerging markets.

Specialized technical expertise and extended project timelines amplify total project expenses, while underground tunnel construction in challenging rocky terrain demands substantial capital investment and protracted execution schedules.

The limited pool of qualified manufacturers and specialized installation contractors restricts supply availability in developing regions, further constraining market penetration. Comprehensive feasibility studies and environmental assessments extend project timelines and increase expenses, creating acute challenges for rapidly urbanizing regions requiring urgent infrastructure development to meet growing electricity demand.

Sulfur hexafluoride (SF6), the primary insulating medium in conventional GIL systems, presents critical environmental constraints through its ultra-high global warming potential (GWP) of 23,500 times that of carbon dioxide, driving escalating regulatory restrictions and potential phase-out mandates in developed markets.

The European Union (EU)'s F-Gas Regulation and California's emissions restrictions exemplify stringent regulatory frameworks limiting SF6 usage, while the industry lacks adequate recycling infrastructure to recover insulating gases from decommissioned GIL systems.

However, technological innovation is mitigating these concerns through next-generation alternatives. For instance, GE Vernova's g³ gas achieves 99% reduction in global warming potential compared to SF6 while maintaining compatible dual-gas functionality, enabling utilities to transition toward environmentally sustainable solutions while managing regulatory compliance.

The rapid expansion of HVDC transmission technology is creating substantial market opportunities for specialized gas-insulated transmission lines that support compact converter stations and efficient long-distance renewable energy distribution with minimal losses.

Smart grid initiatives worldwide are leveraging GIL's compatibility with digital monitoring, automation, and real-time control systems to enhance grid stability, while cross-border interconnections, such as collaborations between India and the ASEAN, are stoking the demand for reliable transmission infrastructure managing variable renewable flows.

These advanced applications position GIL as essential for integrating remote clean energy sources into urban centers, with predictive maintenance capabilities enabling premium technology adoption among major utilities.

Emerging alternative insulating media, including fluoronitrile-based gases and dry air technologies, are addressing SF6 regulatory pressures by offering equivalent dielectric performance with dramatically lower environmental impact, supported by active R&D from manufacturers and research institutions.

Regulatory phase-down schedules for high-GWP gases, combined with government sustainability mandates, are accelerating commercialization of hybrid gas-insulated substation (GIS) solutions that reduce ecological footprints while maintaining reliability, enabling margin expansion through premium pricing for eco-compliant systems.

Standardization efforts and long-term supply security for these alternatives are facilitating mainstream market scaling, positioning GIL technology for sustained growth amid global energy transition imperatives.

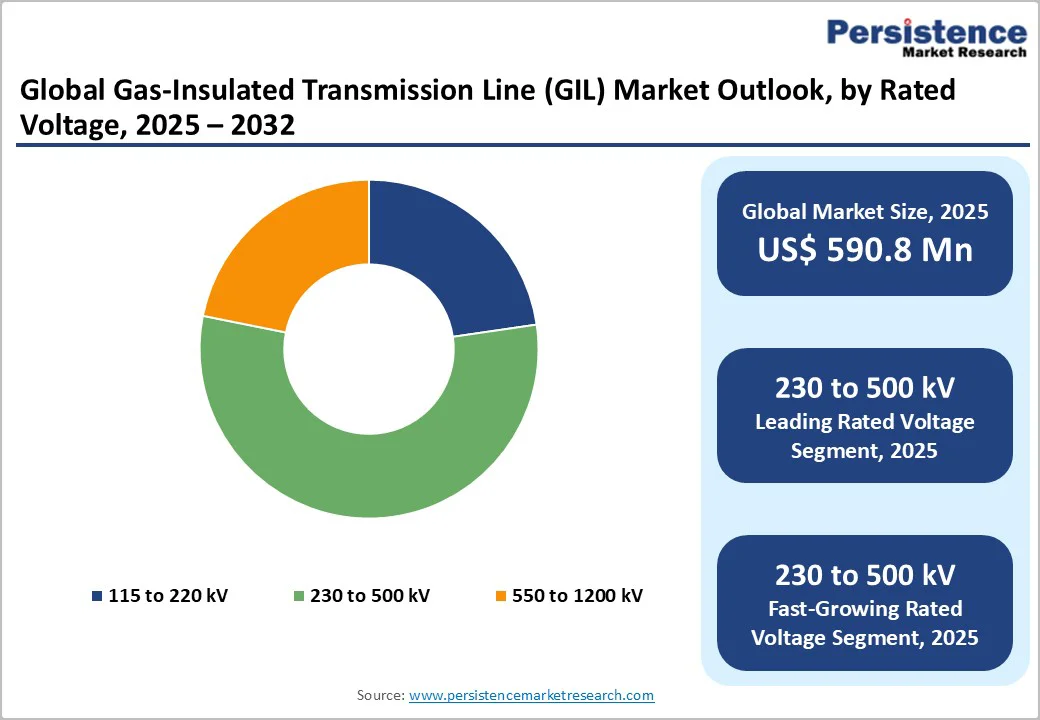

The 230-500 kV voltage segment commands approximately 46% of the gas-insulated transmission line market revenue share in 2025, driven by its widespread adoption for regional transmission networks, grid interconnections, and bulk power delivery across both developed and emerging markets.

These extra-high voltage systems excel in managing long-distance power flows with minimal losses, making them essential for renewable energy evacuation from remote generation sites to urban demand centers. Regional transmission operators and major utilities favor this segment due to its proven technology maturity, operational reliability, and established performance track record in demanding applications.

Established infrastructure projects substantiate the segment's versatility, with deployments supporting critical grid modernization initiatives such as India's POWERGRID transmission expansions and European urban network upgrades.

The balance of technical capability and commercial viability positions 230-500 kV GIL systems as the preferred solution for high-capacity corridors where space constraints and environmental considerations preclude traditional overhead lines, ensuring sustained market dominance through the forecast period.

Underground/direct burial installations capture approximately 52% of the GIL market revenue share, attributable to their overwhelming preference in densely populated urban areas and environmentally sensitive regions where traditional overhead lines face regulatory and spatial constraints.

These methods enable seamless deployment in metropolitan centers, eliminating visual pollution, electromagnetic field concerns, and extensive land acquisition requirements that often delay or derail conventional projects.

By routing transmission infrastructure beneath city streets, tunnels, or direct burial corridors, GIL systems secure expedited regulatory approvals and strong community acceptance, positioning them as the preferred solution for modernizing power grids in space-constrained environments.

This installation dominance reflects the core value proposition of gas-insulated transmission lines, which is in the form of compact, high-capacity power delivery without surface disruption, making underground deployment the strategic market leader across both developed urban markets and rapidly growing megacities worldwide.

The power transmission and distribution sector dominates with an estimated 58% revenue share in 2025, owing to the extensive grid modernization programs and renewable energy integration initiatives worldwide. Utility operators are systematically deploying GIL systems to expand transmission network capacity, enhance infrastructure reliability, and accommodate surging electricity requirements from urban electrification and clean energy projects.

Major utilities favor GIL technology for its reduced carbon footprint and superior performance in high-demand corridors, enabling seamless network upgrades without extensive land acquisition or visual disruption.

This segment's dominance is powered by the critical role played by gas-insulated transmission lines in supporting long-term energy security objectives, from regional grid interconnections to national renewable evacuation infrastructure, positioning transmission utilities as the primary growth engine through the forecast period.

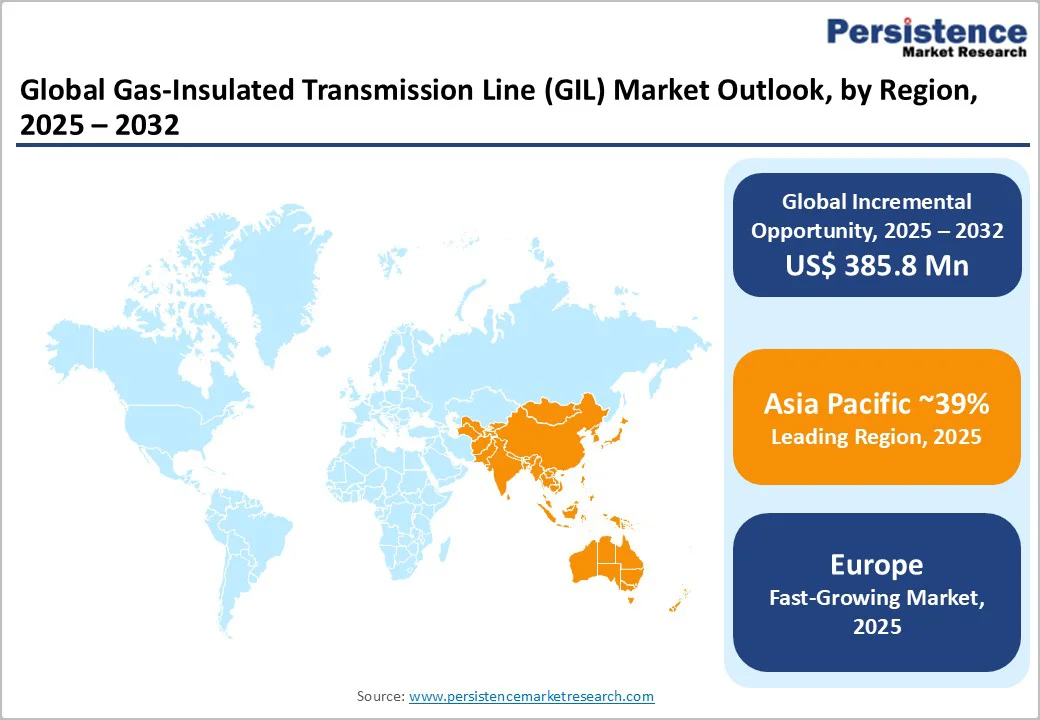

North America maintains a commanding position, holding approximately 35% of the gas-insulated transmission line market share, driven by aging infrastructure upgrades and aggressive renewable energy integration programs.

The U.S. Department of Energy (DOE)'s US$ 7 billion allocation for grid modernization initiatives is accelerating GIL deployments in urban transmission corridors, particularly along the East Coast and California where environmental regulations and land constraints mandate underground solutions.

Expanding HVDC systems and multi-state transmission projects are creating specialized opportunities for compact GIL technology to support high-capacity renewable evacuation and electric vehicle charging infrastructure growth.

Canadian utilities are also actively adopting GIL for efficient transmission of hydroelectric and wind resources to densely populated southern centers, while regulatory mandates emphasizing grid reliability and resilience are fueling investments in hurricane- and seismic-prone regions.

The convergence of federal funding, distributed energy resource integration, and stringent urban deployment requirements positions North America as a premium GIL market, with utilities prioritizing long-term infrastructure durability amid escalating electrification demands.

Europe demonstrates highest GIL adoption rates on the back of stringent environmental regulations and renewable energy commitments. EU environmental directives, including the F-Gas Regulation limiting SF6 usage, are accelerating technology transition toward alternative insulating media.

German infrastructure projects including Berlin and Munich metropolitan areas implementing underground transmission networks. North Sea offshore wind farms requiring specialized transmission systems connecting to continental power grids.

Regulatory harmonization across EU member states supporting streamlined product certification and cross-border technology deployment. France and Spain renewable energy targets requiring transmission infrastructure expansion supporting the gas-insulated transmission line market development.

Offshore transmission projects in the region, especially wind farm connections, are stimulating the uptake of GIL systems. Environmental consciousness among utilities and government agencies supporting premium technology adoption aligned with sustainability objectives.

Asia Pacific dominates with approximately 39.2% GIL market share, driven by rapid industrialization and unprecedented growth in electricity demand. China's grid modernization initiatives and renewable energy capacity additions exceeding 100 GW annually creating massive transmission infrastructure demand.

Massive, long-term investments such as the INR 39,300 crore transmission project in Gujarat by the Government of India provide strong support for regional market development.

In Japan and South Korea, the requirement for robust underground transmission infrastructure in densely populated metropolitan centers is rising at an intense pace. ASEAN member countries including Vietnam, Thailand, and Indonesia are investing in grid infrastructure supporting industrial development.

Regional manufacturers are focused on localizing production capacity to reduce import costs and enhance supply chain resilience. Cross-border power trading initiatives including India-ASEAN interconnections require specialized transmission systems, strengthening regional energy cooperation.

Leading suppliers such as Siemens AG, GE Grid Solutions, ABB, and Hitachi ABB have secured 40-45% of the global gas-insulated transmission line market revenues through diverse technology offerings, extensive distribution channels, and longstanding utility partnerships.

Tier-two competitors including AZZ Incorporated, LS Cable & System Ltd., and Tatung Co. have captured key regional niches via tailored applications and competitive pricing strategies. Chinese firms such as TBEA Energy and Jiangnan Group continue leveraging manufacturing efficiencies and local expertise to strengthen domestic penetration.

Industry participants have intensified capacity expansions, alternative insulation R&D, and alliances with engineering firms to sharpen differentiation. Firms prioritize sustainable gas substitutes, real-time diagnostics integration, bespoke engineering solutions, and collaborative ventures to enhance positioning and expand influence across evolving grid requirements.

The global gas-insulated transmission line (GIL) market is projected to reach US$ 590.8 million in 2025.

Primary market drivers include rapid urbanization requiring space-efficient underground transmission infrastructure, renewable energy capacity additions exceeding 300 GW annually requiring long-distance transmission systems, and environmental regulations restricting traditional overhead line deployment.

The market is poised to witness a CAGR of 5.1% from 2025 to 2032.

Alternative insulating media development and HVDC integration targeting environmental compliance, long-distance renewable energy transmission, and smart grid modernization are anticipated to open up the highest-growth opportunities.

Siemens AG, ABB Ltd., and GE Grid Solutions are some of the key players in the market.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis Units | Value: US$ Bn/Mn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Rated Voltage

Installation Method

By End-Use Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author