ID: PMRREP35867| 183 Pages | 19 Nov 2025 | Format: PDF, Excel, PPT* | Consumer Goods

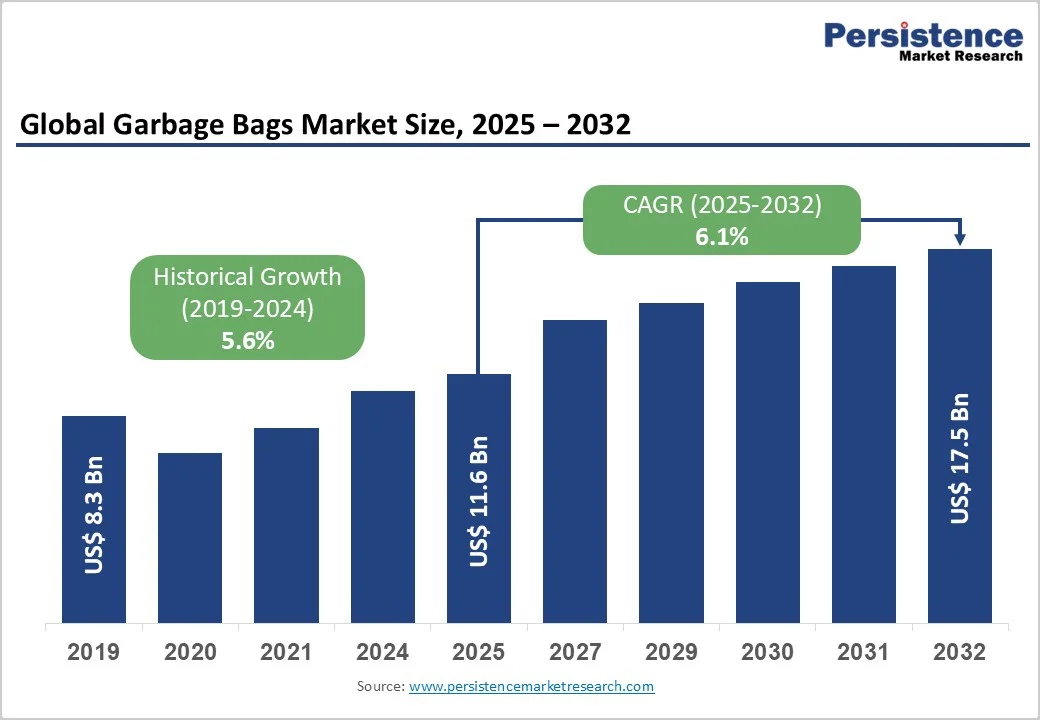

The global garbage bags market size is likely to value at US$11.6 billion in 2025 and is projected to reach US$ 17.5 billion, growing at a CAGR of 6.1% between 2025 and 2032.

This robust expansion reflects the convergence of rapid urbanisation, stringent waste management regulations, and heightened environmental consciousness, driving demand for effective waste containment solutions across residential, commercial, and industrial applications.

| Global Market Attribute | Key Insights |

|---|---|

| Garbage Bags Market Size (2025E) | US$ 11.6 Bn |

| Market Value Forecast (2032F) | US$ 17.5 Bn |

| Projected Growth (CAGR 2025 to 2032) | 6.1% |

| Historical Market Growth (CAGR 2019 to 2024) | 5.6% |

The acceleration of global urbanisation represents a fundamental driver propelling the garbage bags market expansion, with urban areas projected to house 68% of the world's population by 2050, according to United Nations projections. This demographic shift generates exponential increases in household and commercial waste volumes, creating sustained demand for reliable waste containment solutions.

In the United States, the EPA reported that total municipal solid waste generation reached 292.4 million tons in 2018, representing a substantial increase from 88.1 million tons in 1960, with the generation rate climbing from 2.68 pounds per person per day to 4.9 pounds over this period.

The waste composition analysis reveals that plastics account for 12.2% of total MSW, while food waste represents 21.6%, both categories requiring effective containment through garbage bags to prevent environmental contamination and facilitate proper disposal.

European markets demonstrate similar patterns, with the EU generating 2,233 million tonnes of waste in 2022, approximately 5 tonnes per capita, driven by construction activities accounting for 38.4%, mining and quarrying 22.7%, and households contributing 8.9% of total waste generation.

Asia Pacific, led by China and India, exhibits the fastest urbanisation rates, with China's waste-to-energy capacity expansion backed by feed-in tariffs driving 4.5% CAGR growth in waste management infrastructure.

India's urban per capita waste generation is projected to reach 0.7 kg/day by 2025, representing a four to six-fold increase from 1999 levels, while only 54% of collected waste undergoes scientific processing, leaving significant gaps that garbage bags help bridge by enabling proper waste segregation and collection.

Government regulations establishing stringent waste management protocols constitute a critical growth catalyst, compelling both institutional and consumer adoption of compliant garbage bag solutions.

European Union's Regulation (EU) 2025/40 on Packaging and Packaging Waste, adopted in December 2024 and entering force progressively from 2025 to 2030, mandates that all packaging must meet minimum Grade C recyclability standards by 2030, rising to Grade B by 2038, while imposing minimum recycled content thresholds that directly impact garbage bag manufacturing.

The EU Single-Use Plastics Directive, which took effect in July 2021, aims to collect 77% of plastic bottles by 2025 and requires PET bottles to contain at least 25% recycled content by 2025, increasing to 30% by 2030.

The market's evolution toward biodegradable and compostable garbage bags reflects accelerating consumer environmental awareness and technological advancement in bio-based polymers.

The global compostable and biodegradable refuse bags market is projected to experience strong growth, significantly outpacing conventional plastic bag growth rates. This expansion is driven by legislative initiatives such as France's 2017 ban on thin plastic bags, mandating compostable alternatives suitable for home composting, and Italy's 2018 requirement for biodegradable and compostable bags in large-scale distribution.

The Biodegradable Products Institute (BPI) certification framework and ASTM International standards provide validation mechanisms ensuring product efficacy, with manufacturers developing plant-based polymers from cornstarch and sugarcane-based PLA (polylactic acid) that decompose in 90-180 days under industrial composting conditions.

Europe's leadership position, holding 43.04% market share in 2023 for biodegradable refuse bags, stems from the stringent EU Plastics Strategy targets requiring all plastic packaging to be recyclable or reusable by 2030.

North America demonstrates the fastest regional growth potential, with cities like San Francisco, Seattle, and Portland implementing mandatory composting laws requiring organic waste separation, thereby necessitating compostable bag adoption. Vermont's Universal Recycling Law, which banned food scraps from landfills in 2020, resulted in a 40% increase in food donations and accelerated compostable bags.

The garbage bags market confronts significant challenges from petrochemical feedstock price fluctuations affecting primary materials like low-density polyethene (LDPE), high-density polyethylene (HDPE), and linear low-density polyethene (LLDPE). These petroleum-derived polymers represent the cost foundation for conventional garbage bags, with price variability creating margin compression for manufacturers unable to transfer cost increases to price-sensitive consumer segments.

The global energy market disruptions and supply chain constraints experienced during 2020 - 2024 demonstrated the vulnerability of polyethylene-dependent production systems, while geopolitical tensions affecting oil-producing regions introduce ongoing uncertainty into cost structures.

For biodegradable alternatives, dependence on agricultural feedstocks like cornstarch subjects manufacturers to agricultural commodity price cycles and seasonal availability constraints, while the nascent state of bio-based polymer supply chains creates limited sourcing options and premium pricing relative to conventional plastics.

The transition toward circular economy models presents transformative opportunities for garbage bag manufacturers to develop closed-loop systems incorporating post-consumer recycled (PCR) content while maintaining product performance characteristics.

Novolex's $10 million investment in expanding recycling capacity at its North Vernon, Indiana, facility, targeting doubled film recycling volumes, exemplifies industry movement toward integrating recycled polyethylene from "back-of-house" retail waste and consumer store drop-off programs.

The collaboration with Nova Chemicals to operate recycling facilities producing recycled polyethylene under the Syndigo™ brand demonstrates partnership models enabling manufacturers to secure sustainable resin supplies while meeting regulatory mandates for recycled content.

The European Commission's proposed Circular Economy Act, scheduled for adoption in 2026, aims to establish a Single Market for secondary raw materials and increase high-quality recycled content supply, creating policy-driven demand for garbage bags incorporating recycled plastics.

The PlastiCircle project, focused on converting packaging waste into value-added products, including garbage bags, through improved sorting and reprocessing technologies, represents the innovation pathways manufacturers can leverage to simultaneously address regulatory requirements and differentiate products through sustainability credentials.

The emergence of smart city initiatives globally creates opportunities for garbage bags equipped with sensing technologies that integrate into digital waste management platforms. Municipalities implementing IoT-enabled waste collection systems utilising 80% fill-level sensors to trigger pickups only when necessary have demonstrated 30% increases in route efficiency and 12% reductions in fuel consumption.

Garbage bags incorporating RFID tags or QR codes enable waste tracking from generation through disposal, supporting regulatory compliance with EU packaging regulation digital traceability requirements while providing municipalities with data to optimise collection schedules and processing allocation.

China's deployment of over 330,000 environmental monitoring sensors providing real-time waste volume and composition data illustrates the infrastructure scale supporting smart waste solutions.

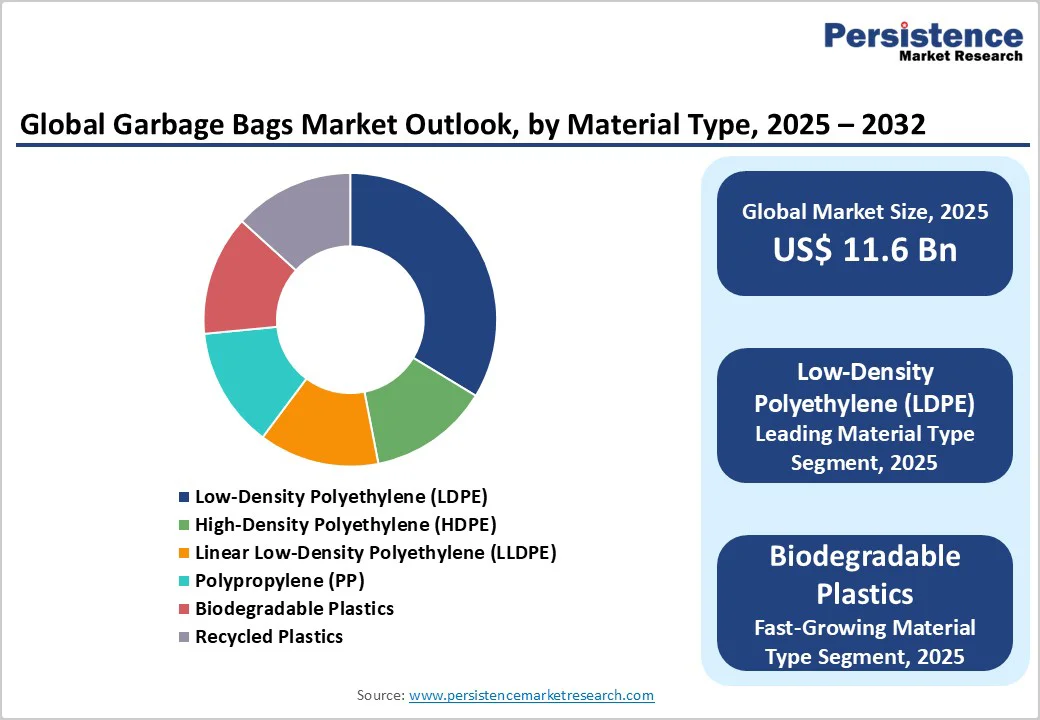

Low-Density Polyethylene (LDPE) maintains market leadership with 34.0% share in 2025 due to its superior flexibility, puncture resistance, and moisture barrier properties that make it ideally suited for kitchen and wet waste applications. LDPE's characteristic tensile strength and waterproof abilities prevent leakage from food waste and liquids, addressing primary consumer concerns about hygiene and convenience during waste disposal.

The material's elastic properties allow bags to stretch without tearing when handling sharp or angular waste items like broken glass or metal pieces, while its softer texture compared to HDPE enhances user comfort during handling and bag tying.

LDPE garbage bags are extensively deployed in residential kitchens, where food waste represents 21.6% of U.S. municipal solid waste and 24% of landfilled waste, necessitating reliable containment that prevents odours and bacterial proliferation.

The commercial foodservice sector relies heavily on LDPE bags for collecting organic waste from restaurants, hotels, and institutional cafeterias, where moisture resistance and tear strength are essential for maintaining sanitary conditions.

Biodegradable plastics represent the fastest-growing material segment, driven by intensifying environmental regulations, consumer sustainability preferences, and technological advancements in bio-based polymer performance.

These materials, primarily comprised of polylactic acid (PLA) from cornstarch or sugarcane and polyhydroxyalkanoates (PHA), offer the functional advantage of complete degradation into water, CO2, and biomass within 90-180 days under industrial composting conditions, compared to conventional plastics requiring hundreds of years for decomposition.

The European Union's broader Packaging and Packaging Waste Regulation restricts compostable packaging to specific applications like tea bags and coffee pods where they demonstrate bio-waste recovery, creating defined market niches for certified biodegradable products.

Star-sealed bags command 43% market share in 2025, attributable to their superior structural integrity, even weight distribution, and leak-resistant design that addresses critical performance requirements across residential, commercial, and industrial applications.

The distinctive star-seal configuration, featuring multiple sealed points on the bag base creating an X-pattern, prevents leakage by eliminating vulnerable single-seam weak points while distributing weight uniformly across the bottom surface.

This engineering advantage enables the bags to handle heavy, wet, or sharp waste without tearing or leaking, making them the preferred choice for municipal waste collection where contents vary widely and bag failure creates sanitation hazards.

The star-seal design's tensile strength and puncture resistance exceed flat-seal alternatives, allowing thinner gauge materials to achieve equivalent performance, thereby reducing plastic usage by up to 25% while maintaining durability.

Drawstring bags represent the fastest-growing bag type segment, driven by consumer preference for convenient closure mechanisms, residential waste management needs, and product innovations enhancing odour control and handling comfort.

The built-in drawstring design eliminates the need for separate bag ties, simplifying waste disposal processes, particularly for elderly users and busy households valuing time-saving conveniences.

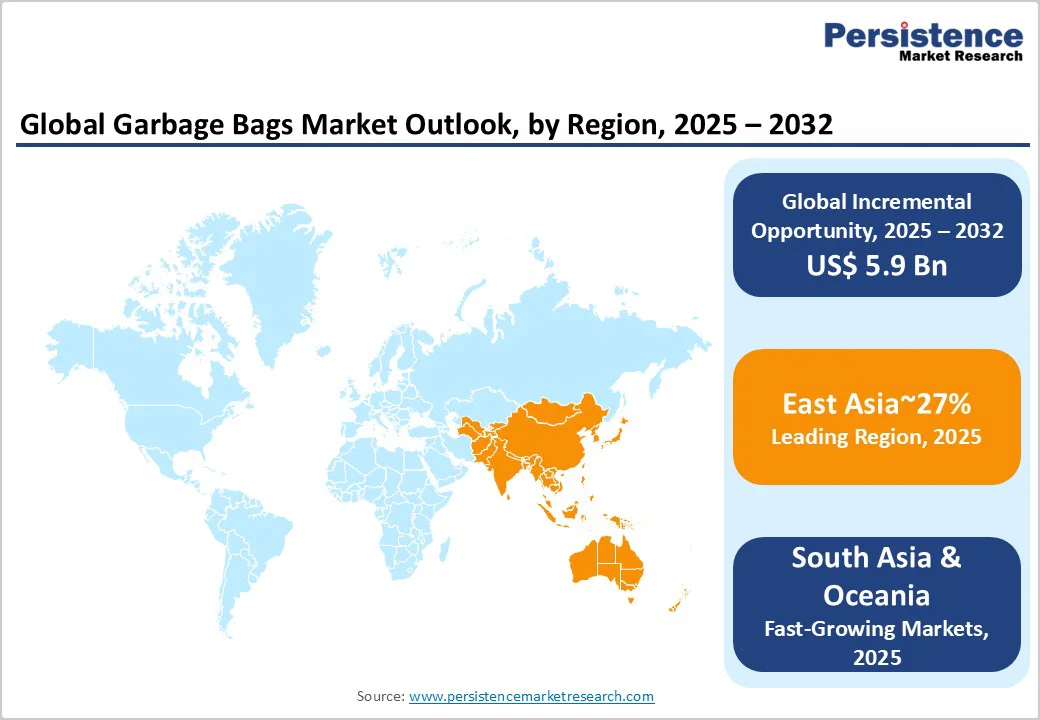

East Asia commands 27% of the global garbage bags market, with China leading regional growth at a 6.4% CAGR driven by extensive urbanisation, manufacturing sector expansion, and government-mandated waste management infrastructure development.

China generated substantial municipal solid waste volumes requiring organised collection systems, with the waste-to-energy sector expanding capacity backed by feed-in tariffs that incentivise waste processing over landfilling.

The country's Zero-Waste City Program, scaling from 11 pilots to 113 municipalities during the 14th Five-Year Plan, establishes performance metrics, earmarked funding, and compliance incentives that drive garbage bag adoption for mandated four-stream waste sorting, separating recyclables, food waste, hazardous materials, and residual waste.

Japan's waste management practices, characterised by strict separation protocols and high recycling consciousness, sustain mature market conditions with a 4.6% CAGR growth focused on premium biodegradable and compostable products aligned with environmental sustainability values.

North America accounts for 21% of the global garbage bags market. The U.S. generated 292.4 million tons of municipal solid waste in 2018, with per capita generation at 4.9 pounds per person daily among the world's highest rates, creating sustained demand for waste containment solutions across residential and commercial segments.

80% of the urban population generates concentrated waste volumes in metropolitan areas where municipal collection services mandate containerized waste requiring garbage bags for sanitary handling and transport. State-level regulatory fragmentation, with 19 states enacting jurisdiction-wide single-use plastic bans while 19 others preemptively prohibit local restrictions, creates complex compliance landscapes where manufacturers must navigate diverse requirements.

California, the largest state market, requires plastic trash bags to contain 10% post-consumer recycled content minimum, creating substantial demand for recycled polyethylene while encouraging manufacturing investments in recycling infrastructure.

Europe holds 23% of the global garbage bags market, distinguished by stringent environmental regulations, advanced waste management infrastructure, and leading adoption of biodegradable and compostable alternatives. The region's 2,233 million tonnes of annual waste generation in 2022, equivalent to 5 tonnes per capita, necessitates comprehensive waste containment solutions across construction, mining, manufacturing, and household sectors.

The EU Packaging and Packaging Waste Regulation (EU) 2025/40, requiring all packaging to meet minimum recyclability standards by 2030 and mandating recycled plastic content thresholds, compels garbage bag manufacturers to reformulate products incorporating postconsumer recycled materials while maintaining performance specifications.

The global garbage bags market is moderately consolidated, with a few dominant multinational companies controlling a significant portion of the market while numerous regional and private-label manufacturers compete in niche segments. Berry Global Inc., Novolex, Reynolds Consumer Products, Poly-America L.P., Inteplast Group, and International Plastics are among the leading players shaping product innovation, sustainability initiatives, and large-scale distribution networks.

These companies leverage strong brand portfolios, advanced recycling technologies, and global supply chains to maintain competitiveness. Smaller participants such as Plasta Group, Four Star Plastics, and Cosmoplast operate in regional or specialised segments, contributing to healthy competition within the market.

The global garbage bags market is projected to be valued at US$ 11.6 Bn in 2025.

The Low-Density Polyethylene (LDPE) segment is expected to hold around 34% market share in 2025, driven by its flexibility, puncture resistance, and suitability for wet-and-food-waste-containing applications.

The market is poised to witness a CAGR of 6.1% from 2025 to 2032.

Rapid urbanisation, rising municipal solid waste generation, and stringent environmental regulations are driving the growth of the garbage bags market by creating sustained demand for efficient and compliant waste containment solutions.

Integration of circular economy models and adoption of advanced recycling technologies create major opportunities for manufacturers to develop sustainable, high-performance garbage bags using post-consumer recycled and smart materials.

The top key market players in the global Garbage Bags Market include Berry Global Inc., The Clorox Company, Novolex Holdings LLC, Reynolds Consumer Products, Inteplast Group Ltd., and Poly‑America L.P.

| Report Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2032 |

| Historical Data Available for | 2019 to 2024 |

| Market Analysis | USD Million for Value |

| Region Covered |

|

| Key Companies Covered |

|

| Report Coverage |

|

By Material Type

By Bag Type

By Capacity

By End Use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author