ID: PMRREP15760| 199 Pages | 23 May 2025 | Format: PDF, Excel, PPT* | Healthcare

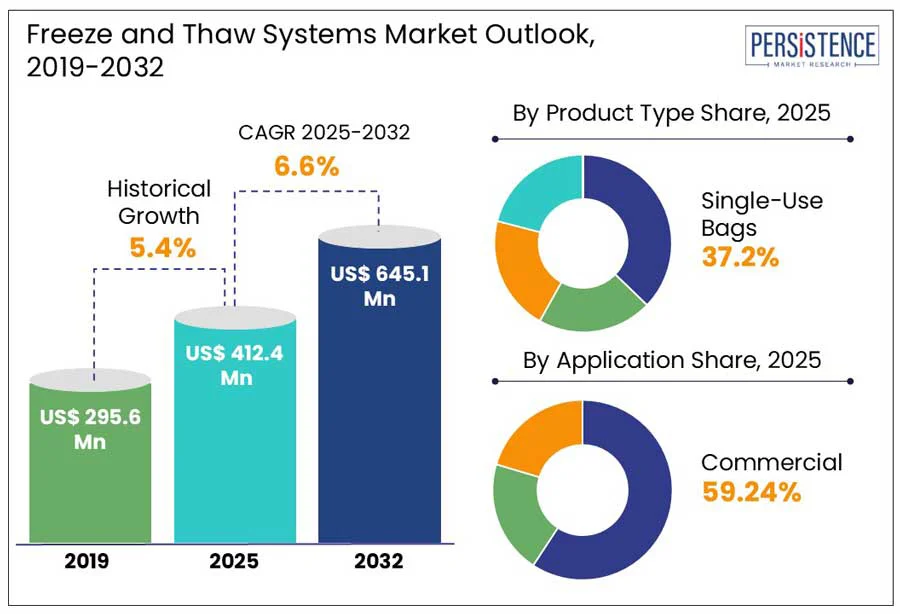

The global freeze and thaw systems market size is anticipated to reach a value of US$412.4 million in 2025 and witness a CAGR of 6.6% and value US$645.1 million by 2032. As an emergent technique, freeze and thaw systems offer high potential for growth, owing to the constantly evolving marketspace based on evaluation of past industry trends. The sales of freeze and thaw devices are evolving gradually as advancements in cryopreservation techniques have unfolded over the years. The pharmaceutical and biotechnology companies rely on freeze and thaw systems within their capacities for functional approaches, which include the adoption of freeze and thaw systems for the storage of products such as medicinal drugs. This factor is set to drive demand growth of freeze and thaw systems over the coming years. Freezing and thawing systems are essential for performing most primary manufacturing processes. These systems are containers for the process development of biopharma companies.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Freeze and Thaw Systems Market Size (2025E) |

US$ 412.4 Mn |

|

Market Value Forecast (2032F) |

US$ 645.1 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

6.6% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.4% |

Freeze and thaw systems are easy to use, easily transportable, and contain large storage volume capacity. Advanced freeze and thaw systems promote time-efficient solutions for product storage and transportation, thus promoting their use as a viable method for storing and transporting sensitive biological products. Furthermore, the rising adoption of disposable or single-use systems in pharmaceutical manufacturing, coupled with a transition from conventional stainless steel tanks to more flexible alternatives, attracts growth by improving operational efficiency and minimizing the risk of contamination. These factors are expected to promote the growth of the freeze and thaw systems market over the coming years.

The growth of the freeze and thaw systems market is associated with the high cost of these systems. Using multiple systems for freeze and thaw processes is not optimally expressive for a large batch size. Highly incurred cost of large-scale freeze and thaw modular platforms restricts small- and medium-scale players from investing in the production process.

Moreover, considering the single-use modality for such systems, several concerns regarding their durability exist. Freezing and thawing systems present slight defects while carrying out operational processes and are at risk of incurring mechanical damage during production or transportation. Single-use bags risk contamination of the contents stored. This causes concern owing to the loss of drug substance, rendering the high-quality liquid useless. This not only presents a risk for end-users but also results in financial loss for manufacturers.

The freeze and thaw systems market are expected to witness strong growth during the forecast period, driven by several promising factors. The introduction of advanced, novel-engineered designs equipped with high-performance monitoring capabilities enhancing product efficiency and appeal.

Additionally, untapped markets across various global regions present new opportunities for expansion and adoption of these systems. Manufacturers are also increasingly benefiting from high returns on investment by setting up production units in cost-effective regions such as Asia Pacific, the Middle East and Africa, and South America. These regions offer lower operational and labor costs, making them attractive for establishing manufacturing bases. Collectively, these trends are expected to fuel market expansion, encouraging key players to invest in innovation and regional growth strategies to capitalize on the rising demand for reliable freeze and thaw solutions across the pharmaceutical and biotechnology sectors.

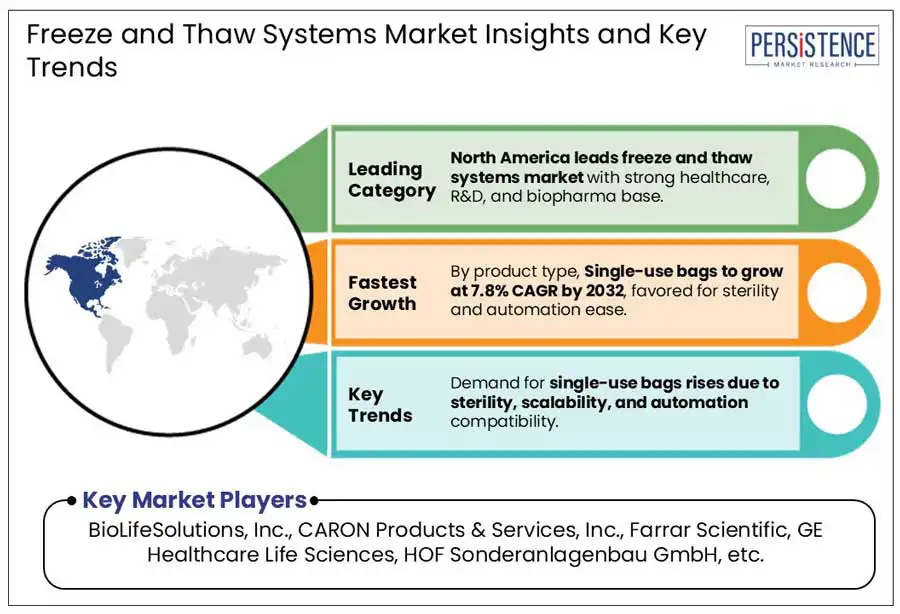

Single-use bags are expected to witness lucrative growth in the freeze and thaw systems market, projecting a CAGR of 7.8% during the forecast period. Accounting for nearly 37% of the market share in the product segment, these bags dominate due to their superior functionality and reliability. They offer sealed, leak-proof protection for biological materials, ensuring safety during storage and transportation. Their key advantage lies in the reduced time required for freezing and thawing processes, coupled with their ability to maintain sample integrity. These features make single-use bags a preferred choice for pharmaceutical and biotech companies handling sensitive drug substances and biologics.

In 2024, the commercial application segment dominated the freeze and thaw systems market, accounting for a significant 59.2% revenue share. This dominance is attributed to the growing need for cost-effective and reliable transportation solutions in large-scale biopharmaceutical production.

Commercial applications reduce logistical strain by ensuring product reliability and maintaining the integrity of sensitive biological materials during handling and transit. In addition to commercial use, R&D and pre-clinical and clinical applications also contribute to market demand, particularly in drug discovery and testing phases. Among these, the pre-clinical and clinical segment is projected to be the fastest growing, driven by increased investment in clinical trials and the rising development of biologics and personalized medicines across global markets.

The North America freeze and thaw systems market continues to witness strong growth, driven by robust demand across the biotechnology and pharmaceutical industries. The region benefits from advanced healthcare infrastructure, strong investment in research and development, and a high concentration of leading biopharma companies.

Among North American countries, the U.S. accounts for the largest market share, primarily due to the presence of established manufacturers that offer reliable protein drug and sample storage solutions. Additionally, the growing focus on biologics, cell and gene therapies, and personalized medicine is boosting the need for efficient freeze and thaw technologies. Rapid advancements in healthcare technologies coupled with increased clinical trial activity and regulatory support are further fueling market expansion. The U.S. market is also supported by the rising demand for novel therapeutics and temperature-sensitive drugs, reinforcing the need for systems that ensure product integrity and compliance throughout the storage and transportation process.

Europe freeze and thaw systems market is experiencing steady growth, fueled by increasing biopharmaceutical production, advancements in life sciences research, and growing demand for cold chain solutions. Countries such as Germany, the U.K., and France are leading contributors, supported by strong government funding for healthcare innovation and a well-established pharmaceutical sector. The region’s emphasis on regulatory compliance and high-quality standards is driving the adoption of advanced freeze and thaw systems that ensure the safety and integrity of biologics and other sensitive materials.

Europe's focus on sustainability and process optimization is encouraging the use of single-use technologies and modular freeze-thaw platforms to reduce contamination risks and operational downtime. Ongoing expansion of biosimilar production and personalized medicine initiatives across Europe further increases the need for reliable temperature-controlled storage and transport solutions. These factors collectively support a favorable outlook for the freeze and thaw systems market in Europe.

The Asia Pacific freeze and thaw systems market is poised for rapid growth, supported by expanding pharmaceutical manufacturing, increased clinical trial activity, and rising investments in biotechnological research. Japan leads the East Asia market with a 50.9% share and is projected to grow at a CAGR of 6.1% during the forecast period. This dominance is attributed to Japan's widespread use of single-use bags, not only within biopharmaceutical manufacturing units but also in the food and consumables sector, which boosts overall demand.

Furthermore, growing government support for life sciences innovation and local production incentives in countries like China, India, and South Korea are creating favorable conditions for market expansion. The increasing presence of contract manufacturing organizations (CMOs) and global biotech partnerships is also enhancing the regional outlook for freeze and thaw systems.

The global freeze and thaw systems market is competitive. Leading freeze and thaw system suppliers are developing advanced, innovative products to strengthen their portfolios and boost revenue. These innovations are tailored to meet specific market needs. Additionally, strategic partnerships and acquisitions are helping companies expand their offerings and enhance their market presence.

The global market is estimated to increase from US$ 412.4 million in 2025 to US$ 645.1 million in 2032.

Rising need for drug preservation, increasing chronic diseases, and advancements in biopharma research fuel demand for freeze and thaw systems.

The market is projected to record a CAGR of 6.6% during the forecast period from 2025 to 2032.

BioLifeSolutions, Inc., CARON Products & Services, Inc., Farrar Scientific, GE Healthcare Life Sciences, HOF Sonderanlagenbau GmbH, and Others.

Expansion into untapped regions, growing biopharma demand, and cost-effective manufacturing in emerging markets create strong growth opportunities.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Mn, Volume: As applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author