ID: PMRREP35860| 220 Pages | 18 Nov 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

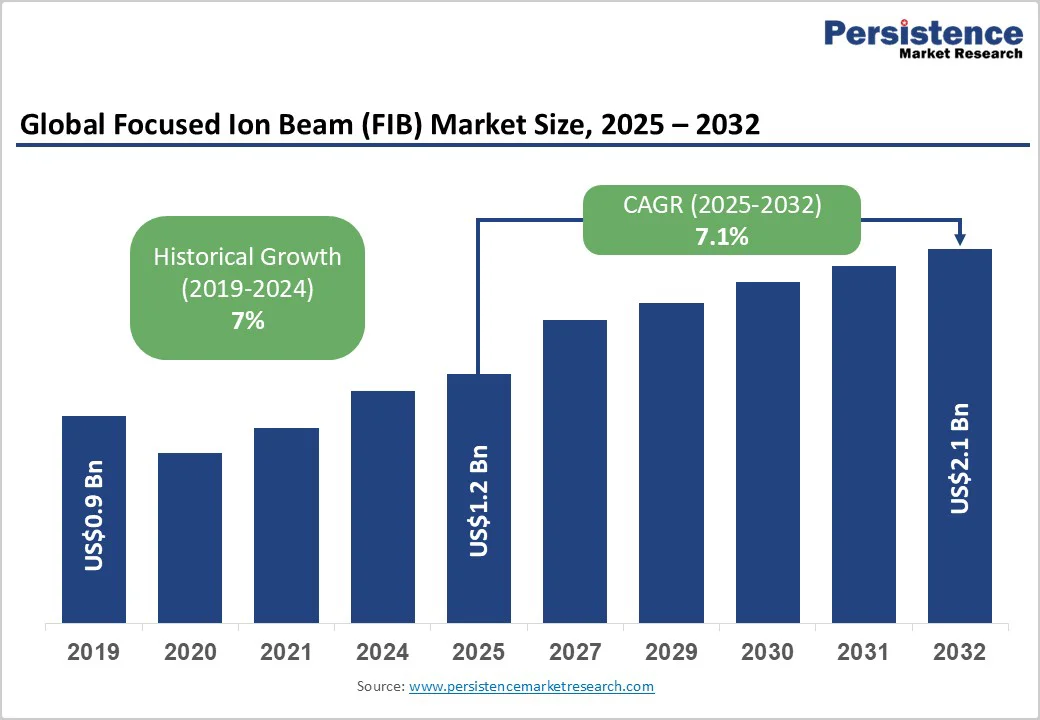

The global focused ion beam (FIB) market is expected to reach US$1.2 billion in 2025. It is estimated to reach US$2.1 billion by 2032, growing at a CAGR of 7.1% during the forecast period 2025 - 2032, driven by an increasing demand for advanced semiconductor manufacturing and growing adoption of novel applications in bioscience research.

Growth is driven by multi-beam systems and helium ion sources for higher resolution and lower sample damage, alongside rising semiconductor fab investments and bioscience applications such as connectomics and tissue engineering. Regulatory support and expanding R&D in healthcare and materials science further boost the market.

| Key Insights | Details |

|---|---|

| Focused Ion Beam (FIB) Market Size (2025E) | US$1.2 Bn |

| Market Value Forecast (2032F) | US$2.1 Bn |

| Projected Growth (CAGR 2025 to 2032) | 7.1% |

| Historical Market Growth (CAGR 2019 to 2024) | 7% |

The most influential driver fueling the focused ion beam market growth is the technological evolution toward multi-beam systems that integrate helium (He+) and neon (Ne+) ion sources alongside traditional gallium (Ga+) sources.

These multi-beam architectures are pioneering a new era of ultra-high-resolution imaging and nanofabrication capabilities, significantly reducing sample damage compared to legacy Ga+ setups. Helium ion sources specifically offer sub-nanometer resolution, a significant advancement over Ga+ sources (~3 nm), enabling detailed sample analysis in bioscience and advanced semiconductor failure analysis.

Government-supported research initiatives, including those from the U.S. National Science Foundation (NSF) and the European Research Council (ERC), are providing grants to enhance FIB technology at universities and national laboratories, thereby accelerating innovation.

International industrial partnerships, such as the European Union (EU)’s Horizon Europe program, which focuses on nanocharacterization technologies, are further catalyzing these developments by funding collaborative projects aimed at improving FIB resolution and throughput.

Despite promising growth, the FIB market faces structural restraints, mainly due to the high upfront capital costs of acquiring state-of-the-art focused ion beam systems.

Modern dual and multi-beam configurations cost between US$3 million and US$8 million per unit, which presents a significant investment barrier, particularly for small and medium enterprises (SMEs) and academic institutions in emerging economies. Operational complexity requires specialized personnel trained in microfabrication, electron/ion microscopy, and failure analysis, elevating maintenance and training costs.

Supply chain constraints, including extended semiconductor fabrication equipment lead times due to global component shortages, have exacerbated procurement challenges. Regulatory requirements from health and safety oversight agencies impose strict controls over ion source operations and vacuum system handling, reinforcing the need for compliance investments.

For example, the Occupational Safety and Health Administration (OSHA) in the U.S. and the European Chemicals Agency (ECHA) enforce stringent rules on handling gallium and rare gas ion sources to prevent occupational exposure. These barriers dampen immediate market expansion but also underline the growing importance of outsourced services and contract research organizations, which are becoming preferred options for cost-conscious clients.

Emerging applications within bioscience, particularly in connectomics and three-dimensional (3D) tissue imaging, represent a lucrative and largely untapped opportunity in the focused ion beam market. These cutting-edge applications involve utilizing FIB combined with scanning electron microscopy (FIB-SEM) to map neural circuits at nanoscale resolution and reconstruct complex cellular architectures.

This opportunity is underscored by increasing global research funding for brain mapping projects, such as the U.S. BRAIN Initiative and the European Human Brain Project, which collectively allocate billions annually toward detailed studies of neural architecture.

Clinical applications are also emerging, including advanced histopathology using resistive FIB sectioning combined with AI-enabled image analysis, heralding improved diagnostics.

Investments need to be directed toward catering to the increased demand for specialized cryo-capable FIB systems and software integration for automated sample preparation. Strategic partnerships between FIB equipment manufacturers and life sciences firms are intensifying, offering service bundles including advanced specimen preparation and imaging, further unlocking revenue potential.

In 2025, dual-beam FIB-SEM systems are likely to capture an estimated 55% of the FIB market revenue. This dominance stems from their unique ability to combine focused ion beam milling with high-resolution scanning electron microscopy in a single instrument, enabling correlative microscopy for real-time milling visualization and precise defect localization.

These systems have become indispensable in advanced semiconductor manufacturing, allowing manufacturers to accelerate failure analysis, circuit edits, and mask repair with unparalleled accuracy. The integration enables process engineers to observe material interactions during milling, dramatically reducing turnaround time and increasing yield.

Multi-beam systems, which incorporate varied ion sources such as gallium, helium, neon, and argon, represent the fastest-growing segment between 2025 and 2032. Their rapid adoption is owing to their ability to optimize ion source selection based on application-specific needs, such as minimizing sample damage with helium for sensitive biological specimens or employing argon or xenon for high-throughput milling.

These systems offer significant improvements in throughput and precision, driving their adoption in both semiconductor fabs and research institutions focused on nanofabrication and quantum device prototyping.

Failure analysis is slated to remain the dominant application segment in 2025, accounting for about 43% of the focused ion beam market revenue. Its leading position is sustained by the ongoing push for semiconductor miniaturization beyond 7 nm technology nodes, which necessitates more precise, non-destructive inspection and defect-localization tools.

The increasing complexity of integrated circuits, including 3D chip stacking and advanced packaging, underscores the importance of failure analysis as a critical quality assurance stage. The evolution of automated AI-based defect detection is also augmenting the traditional failure analysis workflow, enhancing throughput and accuracy, thus increasing equipment utilization rates.

Sample preparation is poised to register the highest CAGR from 2025 to 2032. Its growth is anchored in the expanding adoption of FIB-SEM workflows in bioscience research, including connectomics, tissue engineering, and 3D electron tomography. The segment's value is driven by advances in cryo-FIB techniques preserving biological ultrastructure during sample thinning, facilitating unprecedented insights into cellular architecture.

Pharmaceutical R&D and clinical research labs are increasingly using these capabilities for drug discovery and disease-mechanism studies. The growing sophistication of automated specimen preparation platforms that integrate AI-driven milling protocols is further widening the market by reducing barriers to operator expertise and accelerating sample throughput.

The electronics and semiconductor vertical is set to dominate with approximately 37% market share in 2025, driven by the rising criticality of failure analysis and circuit editing required by leading-edge semiconductor fabs, particularly in logic devices, memory technologies, and advanced packaging.

Foundries across major hubs are increasing investments to scale sub-7 nm and 3D NAND production capacities, compelling demand for high-precision FIB systems capable of detecting nanoscale defects and performing in-situ device characterization.

The bioscience vertical is the fastest-growing segment, with a CAGR of 10.5% or more between 2025 and 2032. Accounting for about 18% of the market in 2025, this segment is rapidly expanding due to scientific advances in brain connectomics, 3D tissue reconstruction, and molecular biology.

Life sciences research centers and pharmaceutical companies incorporate FIB-SEM as essential tools for detailed cellular imaging, with NAS-funded projects and international consortia allocating billions for fundamental neurobiological research. The demand for cryo-FIB and AI-augmented imaging further propels adoption.

North America is expected to hold an estimated 32% of the focused ion beam market share in 2025, underpinned by a robust ecosystem of semiconductor fabs, life sciences research, and innovation-friendly regulatory frameworks.

The U.S. dominates the regional market, propelled by major foundry expansions led by Intel’s US Fab 42 and TSMC’s Arizona facility, both of which integrate cutting-edge FIB tools for post-fabrication defect analysis and yield enhancement. The National Institutes of Health (NIH) and the U.S. Department of Energy (DOE) provide significant funding to develop advanced FIB-based methodologies in biomedical and materials science research.

Regulatory support, including the U.S. CHIPS Act, has incentivized the expansion of the domestic semiconductor ecosystem, facilitating capital investments in related equipment. The regional market also benefits from an innovation-driven culture, with numerous collaborations between equipment providers and system integrators focusing on AI automation and multi-beam system development.

Europe, with around 23% of the FIB market share in 2025, is growing steadily at an estimated CAGR of 6.5%. The regional market is making marked progress on the back of advanced manufacturing hubs in Germany, the U.K., France, and Spain, complemented by a harmonized regulatory environment through the European Chemicals Agency’s REACH regulation and occupational health standards, facilitating safe and compliant ion source management.

Investment is concentrated in aerospace component analysis, pharmaceuticals, and advanced materials research, supported by Horizon Europe programs that fund industrial digitalization and nanomaterial characterization.

Germany’s semiconductor landscape, notably Infineon’s expansion, is ramping up the demand for failure analysis and device modification systems. Collaborative platforms between equipment providers and universities drive customized FIB solutions for heavy industry and biomedical sectors, enhancing Europe’s technology diversification in the global market.

Investments focus on improving energy efficiency and automation in FIB systems, aligning with the European Green Deal objectives, creating opportunities for sustainability-linked market differentiation.

Asia Pacific is forecasted to lead the global FIB market with approximately 35% share in 2025 and is also anticipated to post the highest CAGR from 2025 to 2032. This regional dominance is anchored by China, Japan, South Korea, India, and emerging manufacturing bases in ASEAN.

The region commands over 60% of global semiconductor fabrication capacity, with industry giants such as TSMC, Samsung, and SK Hynix expanding fabs and pushing node shrinkage below 3 nm, necessitating high-end FIB capabilities for failure analysis and nanofabrication.

Government-sponsored initiatives such as China’s Made in China 2025 plan and India’s Semiconductor Mission are accelerating infrastructure investments and supply chain localization. Regulatory frameworks, though heterogeneous, are progressively maturing to support advanced manufacturing technologies, enhanced safety, and environmental standards critical for ion beam tool deployment.

The competitive environment here hosts both established multinational corporations supplying high-end tools and several indigenous players increasingly entering the market. Massive capital investments are financing new R&D centers and service hubs specializing in advanced FIB applications, notably in bioscience research linked to the burgeoning pharmaceutical and healthcare sectors.

The global focused ion beam (FIB) market structure exhibits moderate concentration. The leading five companies, Carl Zeiss Microscopy GmbH, Thermo Fisher Scientific Inc., Hitachi High-Technologies Corporation, Raith GmbH, and JEOL Ltd., have collectively captured an estimated 65% of the market share as of 2025. These players dominate across system manufacturing, ion source innovation, and service provision, leveraging integrated FIB-SEM platforms and multi-ion source technologies to secure competitiveness.

Beyond this dominance, a fragmented landscape exists with regional specialists and contract research organizations gaining traction through niche technology offerings, particularly in bioscience and materials applications. Investment in strategic collaborations, mergers, and acquisitions is rising as players seek to expand technological capabilities and global footprints. Firms innovating in AI integration, automated workflows, and advanced nanofabrication techniques are strategically positioning themselves to capture emerging demand pockets.

The global focused ion beam (FIB) market is projected to reach US$1.2 Billion in 2025.

Increasing demand for advanced semiconductor manufacturing and the growing adoption of novel FIB-SEM applications in bioscience research are driving the market.

The focused ion beam (FIB) market is poised to witness a CAGR of 7.1% from 2025 to 2032.

Technological advancements such as multi-beam systems and helium ion source, which enable higher resolution and reduced sample damage, accelerating investment in semiconductor fabs, and the advent of connectomics and tissue engineering are key market opportunities.

Carl Zeiss Microscopy GmbH, Thermo Fisher Scientific Inc., and Hitachi High-Technologies Corporation are a few key market players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By System Type

By Application

By End-User Vertical

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author