ID: PMRREP36132| 241 Pages | 13 Feb 2026 | Format: PDF, Excel, PPT* | Energy & Utilities

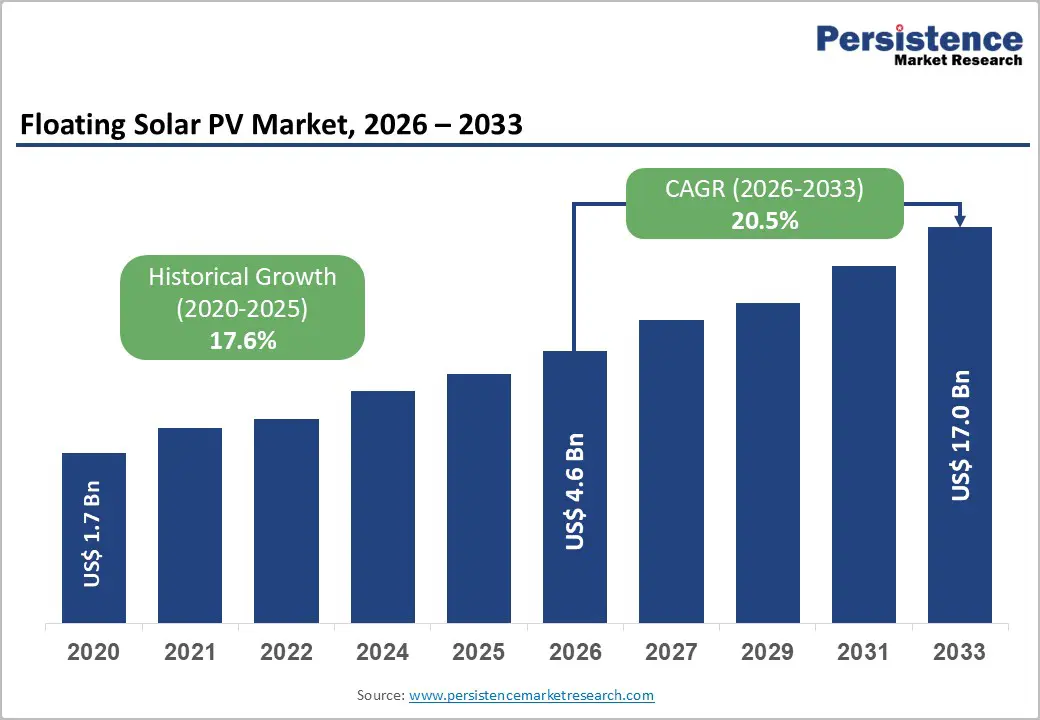

The global floating solar pv market size is likely to be valued at US$ 4.6 Billion in 2026 and is expected to reach US$ 17.0 Billion by 2033, growing at a CAGR of 20.5% during the forecast period from 2026 to 2033.

Rapid market expansion stems from acute land scarcity in densely populated regions combined with abundant water bodies, enabling deployment without competing agricultural or urban land use.

| Key Insights | Details |

|---|---|

| Floating Solar PV Market Size (2026E) | US$ 4.6 Billion |

| Market Value Forecast (2033F) | US$ 17.0 Billion |

| Projected Growth CAGR (2026 - 2033) | 20.5% |

| Historical Market Growth (2020 - 2025) | 17.6% |

Floating solar PV plays a vital role in addressing land scarcity across Asia Pacific’s densely populated industrial zones and agricultural regions. As urban expansion and manufacturing growth continue, availability of large land parcels for solar installations has become increasingly limited. Floating PV systems effectively utilize existing water surfaces such as reservoirs, irrigation ponds, and industrial water bodies, which collectively cover more than 10 million hectares worldwide. According to World Bank assessments, these installations eliminate land acquisition expenses that typically reach nearly USD 100,000 per hectare for ground-mounted solar projects.

In addition, natural water cooling helps maintain panel temperatures below 25°C, improving energy output by approximately 15%. When integrated with existing hydropower infrastructure, floating solar systems achieve combined capacity factors of 20%, compared to 15% for standalone solar. This makes floating PV especially important for countries targeting large-scale solar expansion, including national goals of reaching 500 GW by 2030 without impacting food security or urban development plans.

Floating solar PV offers strong water conservation benefits, making it highly attractive in water-stressed regions. By covering reservoir surfaces, these systems significantly reduce evaporation losses by 70%, helping preserve billions of cubic meters of freshwater annually. This advantage is particularly critical in countries like India, where nearly 600 million people face seasonal water shortages during peak summer months. Studies from the National Renewable Energy Laboratory show that even partial reservoir coverage can reduce evaporation by nearly 40%, supporting sustained irrigation supply and stable hydropower operations.

In regions such as California, floating solar installations on wastewater and treatment ponds have reduced algae growth by up to 50%, while simultaneously generating clean electricity to power facility operations. These combined benefits create dual revenue streams through energy generation and water savings, with water conservation values reaching USD 500 per acre-foot. As a result, more than 35 countries have introduced pilot programs and policy incentives supporting floating PV adoption.

Despite its benefits, floating solar PV faces higher installation complexity compared to land-based systems. Each project requires customized engineering designs for anchoring, mooring, and dynamic load analysis, which can increase overall capital expenditure by 25%. In deeper reservoirs, pile anchoring systems may cost around USD 50,000 per megawatt, while drag-anchor configurations often require detailed seabed geotechnical studies that can exceed USD 100,000 per site.

Exposure to wind, waves, and fluctuating water levels further increases engineering requirements. In typhoon-prone or cyclone-affected regions, mooring line fatigue has resulted in reported failure rates of nearly 30%, forcing developers to apply higher safety factors and stronger materials. These additional requirements significantly inflate project costs. Furthermore, environmental and water-use permitting processes remain lengthy, with approval timelines averaging 18 months in many emerging markets, increasing financing risk and delaying project commissioning.

Environmental uncertainty continues to slow floating solar deployment, particularly for large-scale projects. Limited long-term ecological data has made regulators cautious, especially regarding impacts on aquatic ecosystems and biodiversity. In the United States, compliance with NEPA regulations often requires environmental impact assessments lasting up to two years and costing around USD 2.5 million for utility-scale installations. Concerns related to fish habitats, oxygen exchange, and water temperature changes have delayed nearly 40% of proposed projects.

Offshore and large reservoir installations also face navigation and water-right conflicts, further complicating approvals. Hydropower-linked projects must secure FERC clearances, which typically extend beyond 24 months. Operational challenges such as biofouling reduce panel efficiency by 10% annually if proper maintenance systems are not in place. Additionally, concerns about microplastic release from aging float materials have triggered temporary restrictions and regulatory reviews in several European Union member states.

Hybrid integration of floating solar with existing hydropower infrastructure represents one of the strongest growth opportunities in the global renewable energy sector. More than 100,000 hydropower reservoirs worldwide offer immediate deployment potential exceeding 1,000 GW, supported by existing grid connections and dam infrastructure. These projects benefit from ongoing dam modernization programs, with global investments expected to surpass USD 500 billion by 2030.

According to the International Energy Agency, hydro-solar hybrid systems improve grid stability and provide up to 25% peak shaving benefits, enhancing operational efficiency. This integration also increases project internal rates of return by nearly 8% through diversified revenue streams. Large-scale deployments, such as China Three Gorges’ 600 MW hybrid project, have achieved capacity factors of up to 45%, far exceeding standalone solar averages. In Southeast Asia, World Bank-backed financing unlocked USD 1.2 billion in 2024, while India’s NHPC continues tendering multi-gigawatt reservoir-based solar projects targeting 2030 commissioning.

Floating solar PV is increasingly being adopted in agricultural and aquaculture environments, creating powerful dual-use revenue models. Irrigation ponds spanning nearly 5 million hectares globally provide ideal platforms for combining energy generation with water conservation. These systems reduce evaporation by around 40% while stabilizing water temperatures, improving crop irrigation reliability and fish health. In aquaculture operations, shading from floating panels has increased fish and shrimp survival rates while reducing feed costs.

Eco Green Energy’s deployment at shrimp farms in Ecuador cut diesel consumption by 80% and improved shrimp yields by 15%. In Japan, agrivoltaic pilots conducted by KUT demonstrated rice yield improvements of up to 20% under optimized shading conditions. Similarly, Israel’s desalination-linked floating solar projects now support more than 50 million cubic meters of annual water production. Strong policy backing continues, with the European Union allocating €200 million in Horizon funding to scale agrivoltaic deployment toward 10 GW by 2030.

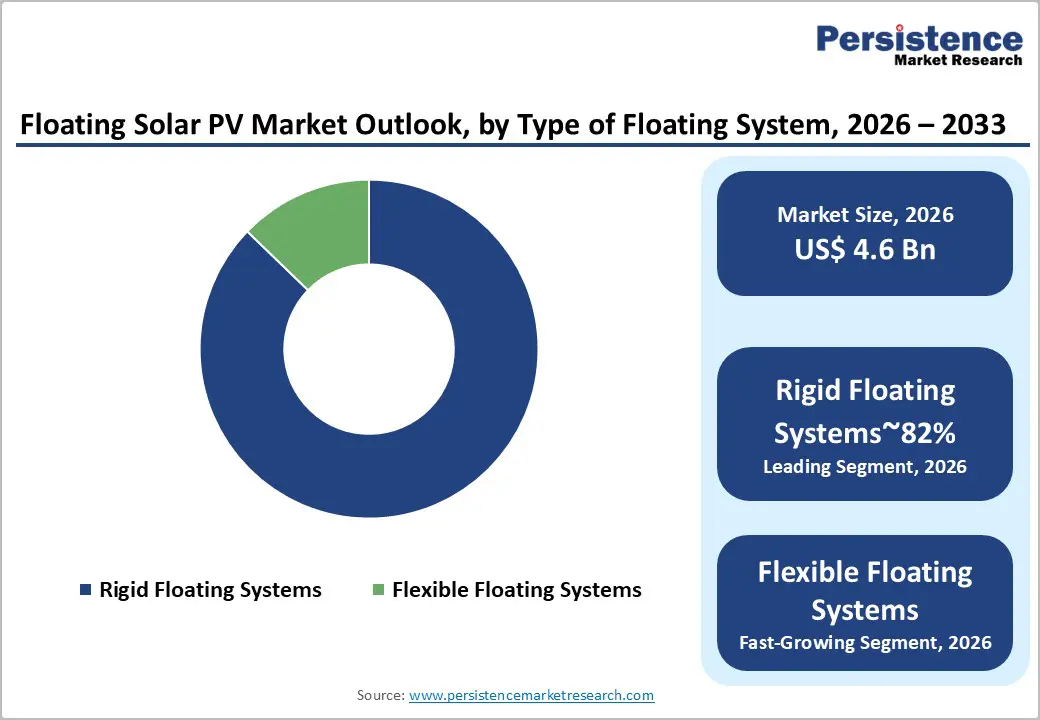

Rigid floating systems currently dominate the floating solar PV market, accounting for nearly 82% of global installations. Their strong market position is driven by proven structural reliability, with more than 3.2 GW deployed worldwide. Platforms such as Hydrelio have demonstrated failure rates below 0.1% over operational lifecycles exceeding ten years. Modular pontoon-based designs support extreme weather conditions, including wind speeds of up to 150 km/h and wave heights reaching two meters.

These capabilities enable large-scale projects exceeding 500 MW on major reservoirs. Pile-anchored systems achieve uptime levels of 99.9%, outperforming flexible systems that often suffer from motion-related efficiency losses. Additionally, fiber-reinforced polymer floats offer superior resistance to UV exposure, lasting three times longer than conventional HDPE materials. Standardized modular components also reduce installation timelines by nearly 40%, making rigid systems the preferred choice for utility-scale developers seeking long-term operational stability.

Utility-scale power generation remains the dominant application segment, contributing nearly 73% of total floating solar PV revenue. Large installations above 50 MW benefit from economies of scale and optimized system efficiency. Projects such as India’s 126 MW Omkareshwar floating plant generate over 200 GWh annually from a single reservoir site. Competitive cost structures further support adoption, with NHPC tenders reporting levelized costs of INR 2.60 per kWh, compared to INR 2.80 per kWh for ground-mounted solar.

This advantage is driven by improved panel cooling, elimination of land leasing expenses, and higher system efficiency. Hybrid hydro-solar configurations enhance performance further, enabling capacity factors of up to 45% by balancing solar output with hydropower generation. The integration of bifacial modules adds an additional 10% yield through water surface reflection. These reliability and performance benefits have helped secure long-term 25-year power purchase agreements at premium tariffs across multiple Indian states.

Utility companies represent the largest end-user segment, accounting for approximately 65% of floating solar PV installations globally. State-owned utilities leverage reservoir ownership, existing transmission infrastructure, and long-term offtake guarantees to deploy projects at scale. More than 2.5 GW of floating capacity has been installed under utility-led models supported by 25-year power purchase agreements averaging USD 0.035 per kWh. Feasibility studies, such as NTPC’s Dumbur Lake project, indicate internal rates of return exceeding 8%, achieved through minimal grid connection costs and shared infrastructure.

In India, renewable purchase obligation mandates increasingly require utilities to allocate a portion of solar capacity to floating systems. NHPC’s pipeline exceeding 600 MW also highlights additional benefits, including improved flood management and reservoir-level stabilization that can reduce peak spillway discharge by nearly 20%. Government-backed bundling mechanisms continue to enhance project bankability, mobilizing over USD 1.2 billion in institutional financing.

North America is emerging as a high-potential floating solar market, led primarily by California’s water conservation initiatives. State-level assessments identify over 6,500 MW of technical potential across municipal and irrigation reservoirs. Water-saving incentives under Title 24 assign significant monetary value to evaporation reduction, reaching USD 1,200 per acre-foot. Regulatory support has strengthened through streamlined approvals for hydropower co-location, enabling large pipelines across federally managed lakes. Several pilot programs funded through energy efficiency grants now generate clean electricity while reducing municipal water losses by nearly 30%.

Innovation remains a key driver, with national laboratories developing advanced performance modeling tools capable of predicting yield improvements of up to 18%. Public funding continues to support technology advancement, including bifacial panel trials and floating platform optimization. Domestic manufacturing incentives under regional trade rules have also encouraged local float and module production, creating thousands of construction and engineering jobs across the solar value chain.

Europe’s floating solar market is expanding steadily, supported by strong regulatory frameworks and environmental standardization. Research institutions have validated efficiency gains of nearly 17% across quarry lakes and artificial reservoirs, reinforcing commercial viability. Several countries have introduced feed-in tariffs and premium pricing mechanisms for floating installations exceeding 10 MW. Subsidized national programs have enabled deployment across reclaimed land, canals, and polder systems while maintaining strict ecological safeguards.

Innovative anchoring solutions, including rock-bolt systems, have demonstrated strong resistance to extreme wind conditions. Harmonization under the EU Water Framework Directive has simplified cross-border certification, reducing permitting timelines by nearly 50%. Industry-led technical standards have further improved investor confidence. Horizon Europe continues to play a central role, allocating over €250 million toward research and deployment initiatives. The region aims to reach 25 GW of floating solar capacity by 2030, with particular emphasis on aquaculture integration and offshore hybrid applications in Nordic and Mediterranean regions.

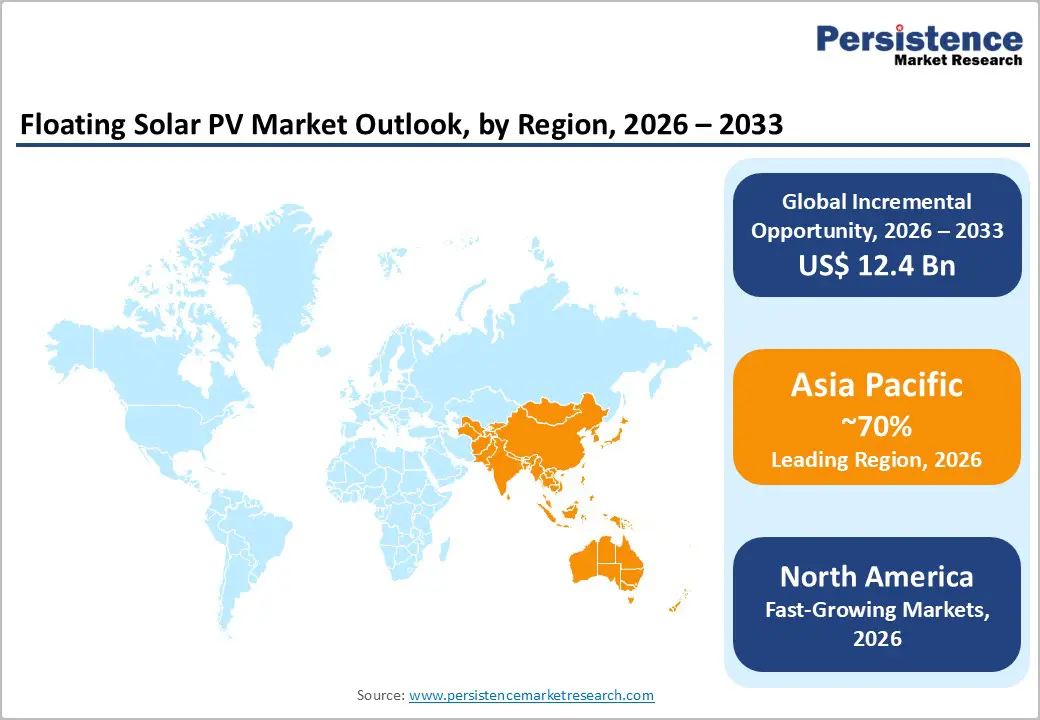

Asia Pacific remains the global leader in floating solar PV deployment, accounting for the majority of installed capacity worldwide. China alone contributes nearly 40% of global installations, supported by provincial mandates promoting solar development on idle water bodies. Large-scale projects on mining lakes and hydropower reservoirs now generate terawatt-hour-level electricity annually. India is rapidly expanding its footprint through national tenders, with reservoir-based projects achieving highly competitive tariffs and capacity factors approaching 45% when combined with hydropower.

Japan continues to advance agrivoltaic innovation, demonstrating improved crop productivity under controlled shading. Across Southeast Asia, floating solar is increasingly used to support base-load power generation on major river systems. Government-backed viability gap funding and bundled renewable tenders have strengthened project economics. These policy-driven mechanisms position Asia Pacific to contribute nearly 65% of global floating solar capacity additions through 2033, making it the fastest-growing regional market.

The floating solar PV market remains moderately fragmented, with the top ten players collectively holding approximately 35% market share. However, consolidation is accelerating as developers pursue joint ventures and strategic partnerships to scale rapidly. Leading companies differentiate themselves through proprietary floating technologies, marine-grade engineering expertise, and vertically integrated offerings combining floats, inverters, and monitoring systems. Platforms with multi-gigawatt deployment track records continue to command strong customer trust.

Innovation focus has shifted toward extending asset lifecycles to 60 years using advanced composite materials that resist UV exposure and biofouling significantly longer than conventional solutions. Financial innovation is also reshaping the market, with yield insurance and performance guarantees attracting institutional investors. These risk-mitigation mechanisms are unlocking multi-billion-dollar capital inflows from infrastructure funds and pension investors. As global demand accelerates, competitive advantage increasingly depends on durability, bankability, and the ability to deliver large-scale projects efficiently across diverse water environments.

The global Floating Solar PV market will reach US$ 17.0 Billion by 2033 from US$ 4.6 Billion in 2026, growing at 20.5% CAGR driven by 7.7 GW installed capacity and 1,000 GW hydro-hybrid potential across 100,000+ reservoirs.

Key drivers include land scarcity affecting 10 million hectares of viable water bodies, 15% efficiency gains from water cooling, 70-90% evaporation reduction preserving billions m³ annually, and hybrid hydro integration boosting capacity factors 2x traditional solar.

Rigid Floating Systems dominate with 82% share, proven across 3.2 GW deployments featuring <0.1% failure rates, 150 km/h wind resistance, and FRP composites extending asset life 3x versus flexible alternatives.

Asia Pacific commands 70% capacity led by China's 40% global share across reservoir mandates and India's 2 GW Omkareshwar pipeline, achieving INR 2.60/kWh LCOE through bifacial hydro-synergy.

Hydro-reservoir hybrids unlock 1,000 GW potential utilizing USD 500 billion global dam modernization, delivering 45% capacity factors, 25% peak shaving, and 8% IRR uplift across 25-year PPAs.

Leaders include Ciel & Terre, China Three Gorges, Ocean Sun, Sungrow, and Statkraft, holding largest share.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Bn, Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Type of Floating System

By Application

By End-user

By Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author