ID: PMRREP27700| 243 Pages | 20 Jan 2026 | Format: PDF, Excel, PPT* | Healthcare

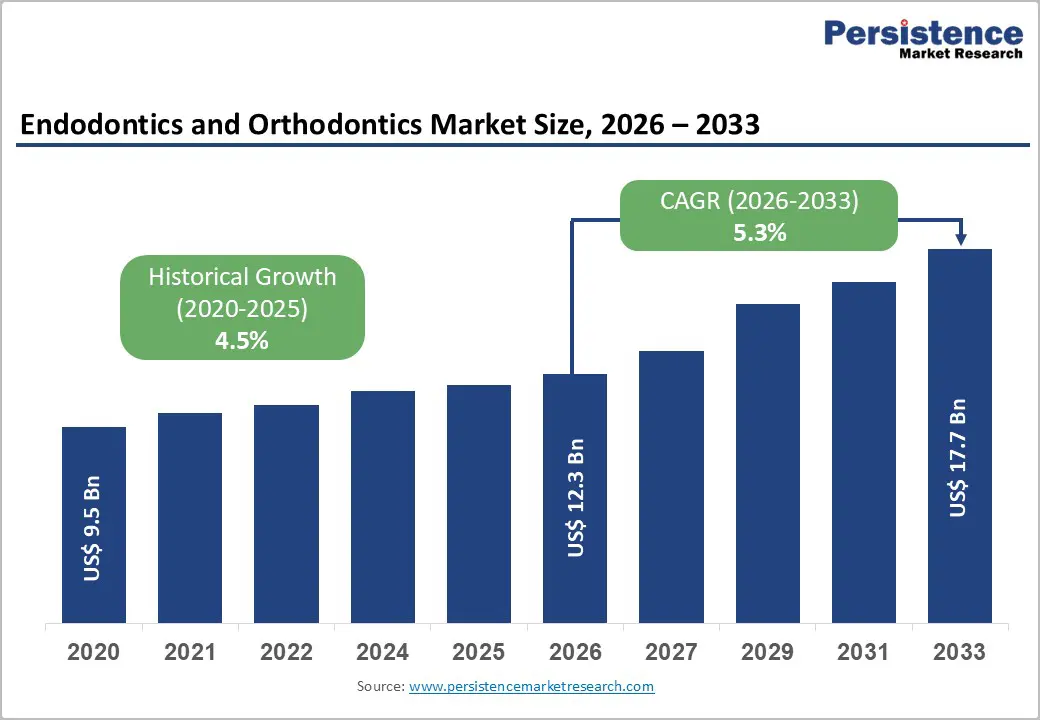

The global endodontics and orthodontics market size is expected to be valued at US$ 12.3 billion in 2026 and projected to reach US$ 17.7 billion by 2033, growing at a CAGR of 5.3% between 2026 and 2033.

Rapid growth is driven by the rising prevalence of dental caries and malocclusion, increasing preference for aesthetic dentistry, and expanding access to specialist dental services in emerging economies. The World Health Organization (WHO) recognizes malocclusion as one of the most important oral health problems after caries and periodontal disease, with prevalence estimates between 39% and 93% in children and adolescents, which underpins a large and sustained demand base for both endodontic and orthodontic procedures.

| Global Market Attributes | Key Insights |

|---|---|

| Endodontics and Orthodontics Market Size (2026E) | US$ 12.3 billion |

| Market Value Forecast (2033F) | US$ 17.7 billion |

| Projected Growth CAGR (2026-2033) | 5.3% |

| Historical Market Growth (2020-2025) | 4.5% |

A major growth driver for the endodontics and orthodontics market is the high and persistent burden of dental caries and malocclusion across both developed and emerging economies. The WHO and multiple epidemiological reviews recognize malocclusion as a priority oral health issue, with global prevalence around 56% and regional levels reaching 72% in Europe and 81% in Africa. Caries and pulp-related pathologies frequently necessitate root canal procedures and associated endodontic products such as files, permanent sealers, and obturation devices, while malocclusion drives long-term demand for orthodontic solutions, including dental braces and retainers. Urbanization, sugar-rich diets, and aging populations increase the pool of patients requiring complex restorative and alignment treatments, thereby sustaining procedure volumes in dental clinics and hospitals globally.

Growing awareness of dental aesthetics and the social importance of an aligned smile is significantly accelerating the adoption of advanced orthodontic and endodontic procedures. The orthodontic supplies market, which includes brackets, wires, and aligners, is forecast to grow strongly, supported by expanding adoption of clear aligner therapies and self-ligating brackets, which offer shorter treatment times and greater comfort. Leading players such as Align Technology, Inc., 3M, and Dentsply Sirona, Inc. continue to invest in digital workflows, including intraoral scanners and 3D printing, which improve treatment planning and efficiency. These technological advances enhance the patient experience, enable minimally invasive approaches, and support premium pricing, collectively boosting revenue growth across both endodontic and orthodontic product categories.

High costs associated with complex endodontic and orthodontic treatments remain a critical barrier, especially in low- and middle-income countries. While high-income countries may provide partial reimbursement for functional orthodontic or endodontic procedures, purely aesthetic treatments are often excluded from public schemes, pushing patients toward out-of-pocket payments. This cost sensitivity constrains the adoption of premium technologies such as digital workflows, clear aligners, and advanced obturation systems in cost-conscious segments, particularly in regions where per-capita dental expenditure remains low and public oral health coverage is limited.

Another structural restraint is the shortage and unequal geographic distribution of trained endodontists and orthodontists. Many low-income and rural regions lack sufficient specialist dentists, leading to delays or underutilization of complex treatments despite clinical need. Training pathways for specialist dental professionals are lengthy and resource-intensive, and capacity expansion often lags behind the rising oral disease burden. This limits procedural volumes and slows market penetration for high-value endodontic and orthodontic systems, especially outside major urban centers and developed markets.

A key future opportunity lies in the rapid expansion of orthodontic products in the Asia Pacific, driven by growing middle-class populations, increased awareness of dental aesthetics, and improved access to specialist dental care. Countries such as China, India, and ASEAN members are experiencing strong growth in orthodontic procedures, driven by rising disposable incomes and the proliferation of private dental chains. The orthodontic supplies space, including dental braces, wires, molar bands, and clear aligners, is benefiting from aggressive investments in local manufacturing and digital practice management, enabling more affordable offerings tailored to regional needs. Market participants that leverage localized production, tele-orthodontics models, and partnerships with urban and tier-2 city dental clinics are well-positioned to capture this high-growth demand.

There is a substantial opportunity for companies offering technology-enhanced endodontic solutions integrated into comprehensive digital dentistry workflows. Innovations such as nickel-titanium rotary files, bioceramic permanent sealers, improved obturation devices, and image-guided systems are enhancing procedural safety and outcomes, reducing chair time and retreatment rates. At the same time, integration of cone-beam CT imaging, intraoral scanners, and practice management software enables precise diagnosis, treatment planning, and documentation across endodontic and orthodontic care pathways. Vendors that provide interoperable platforms, training, and clinical education to dental clinics and hospitals can differentiate beyond product cost, building long-term relationships and recurring revenue from consumables and digital services.

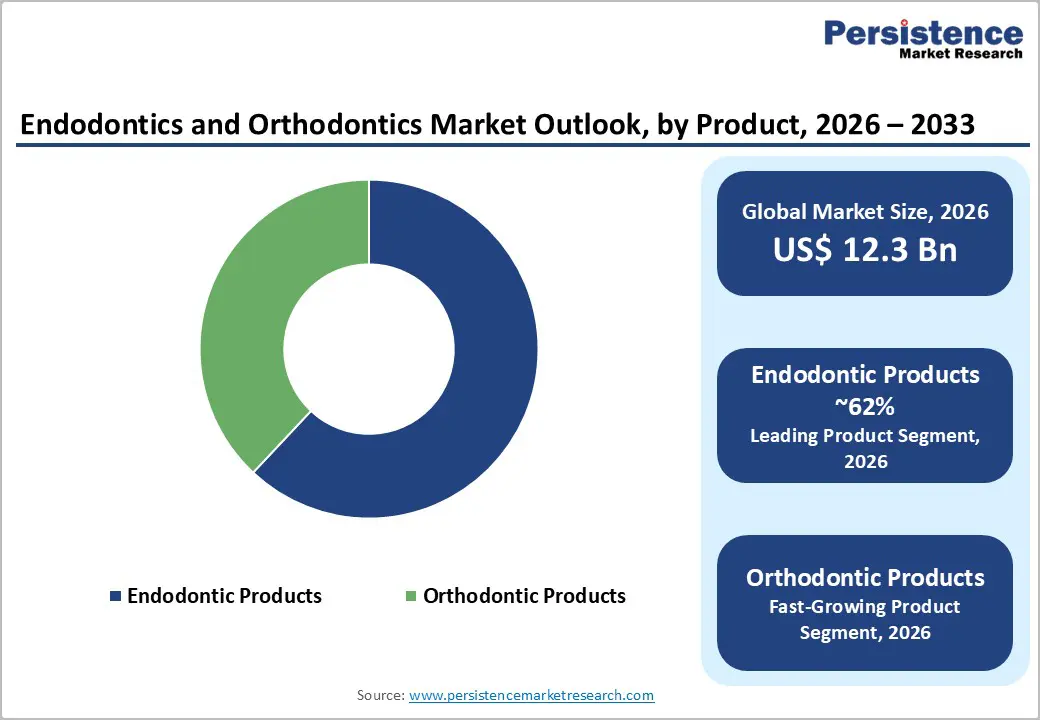

Among products, endodontic products represent the leading segment, accounting for about 62% market share in 2025, supported by high volumes of root canal and restorative procedures worldwide. The rising prevalence of dental caries and pulpal disease in both adults and children drives sustained demand for endodontic files, permanent sealers, and obturation devices, which are essential consumables in routine dental practice. The segment benefits from continuous innovation in rotary instrumentation, irrigants, and sealing materials that enhance procedure efficiency and outcomes, encouraging dentists to upgrade and restock regularly. In parallel, efforts to preserve natural dentition versus extraction align with global oral health policies, further reinforcing clinical preference for endodontic therapies and associated products.

By End User, dental clinics emerge as the leading end-user segment, estimated to contribute roughly 72% of global revenues around 2026, as reflected in industry analyses of endodontic and orthodontic utilization patterns. Clinics are the primary setting for routine restorative and orthodontic care, handling the majority of malocclusion, caries, and root canal cases compared with hospital environments that focus more on complex maxillofacial or medically compromised patients. The growing number of private multi-chair clinics and chain networks, particularly in North America, Europe, and the Asia Pacific, enhances access to specialist care and facilitates the adoption of advanced devices, digital workflows, and branded treatment protocols. These clinics frequently invest in repeat purchases of consumables and incremental equipment upgrades, making them a key commercial focus for manufacturers across both endodontic and orthodontic portfolios.

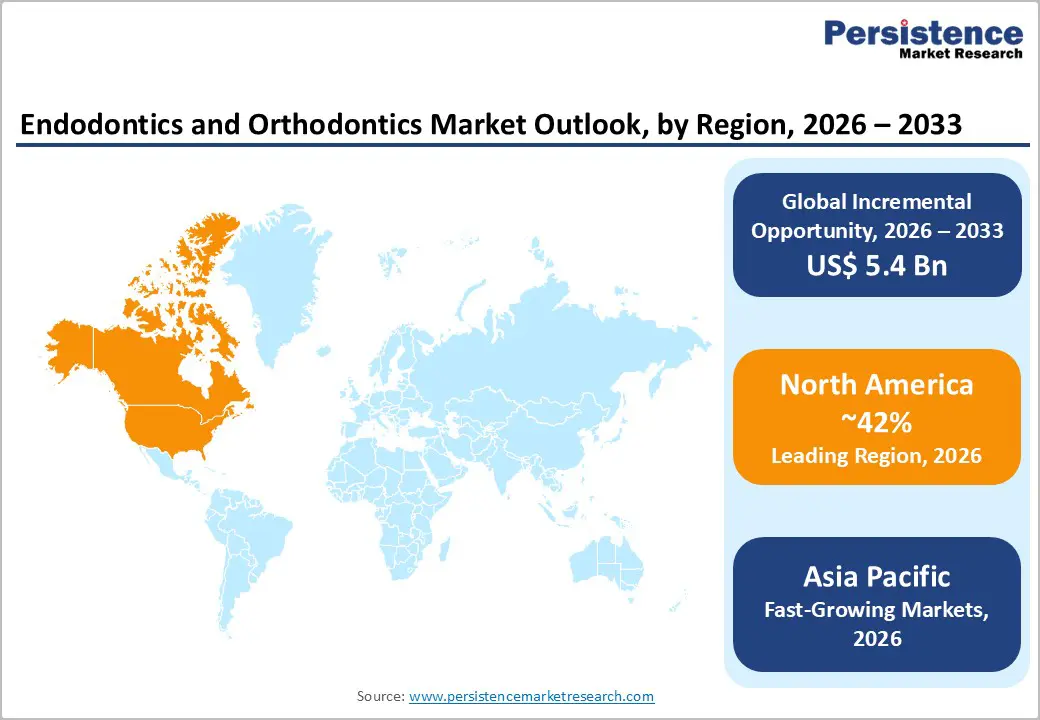

North America holds a leading share of the endodontics and orthodontics market, estimated at around 42% in 2025, anchored by strong procedure volumes in the U.S. The region benefits from a well-established dental care infrastructure, high per capita dental expenditure, and a large pool of board-certified endodontists and orthodontists. Robust private insurance coverage for medically necessary procedures, coupled with strong consumer willingness to pay for aesthetic orthodontic solutions, supports consistent demand for advanced products and technologies.

The U.S. innovation ecosystem supported by academic dental schools, professional bodies such as the American Association of Orthodontists (AAO) and American Association of Endodontists (AAE), and active investment by companies like Align Technology, Inc., 3M, and Dentsply Sirona, Inc., drives rapid uptake of digital workflows, clear aligners, and high-performance endodontic systems. Regulatory oversight from the U.S. Food and Drug Administration (FDA) ensures high-quality and safety standards, fostering clinician and patient trust in new device launches while supporting premium pricing for innovative products.

In Europe, demand for endodontic and orthodontic care is underpinned by a high prevalence of malocclusion and caries, with some studies reporting malocclusion prevalence around 72% in regional populations. Countries such as Germany, the U.K., France, and Spain maintain strong dental infrastructures, supported by mixed public-private reimbursement models that often cover functional orthodontic interventions for children and adolescents. This drives procedural volumes for conventional braces and associated consumables, while adult aesthetic demand is increasingly shifting toward clear aligners and lingual systems.

Regulatory harmonization under European Union (EU) medical device regulations (MDR) has raised requirements for clinical evidence and post-market surveillance, influencing product lifecycle strategies for endodontic and orthodontic manufacturers. At the same time, Europe hosts a number of key players and manufacturing hubs, including companies active in brackets, bands, and dental materials, which leverage strong R&D capabilities and export-oriented production. Growing focus on minimally invasive dentistry and digitalization in practices across Germany, the U.K., and Nordic countries is expected to further support the adoption of advanced systems and digital planning tools.

Asia Pacific is the fastest-growing region in the endodontics and orthodontics market, driven by demographic expansion, rising incomes, and growing awareness of oral health and aesthetics. Epidemiological data show substantial prevalence of malocclusion and caries in China, India, Japan, and ASEAN countries, creating a large addressable patient pool for both restorative and alignment procedures. Governments and professional associations are increasingly emphasizing preventive and restorative dental care as part of broader non-communicable disease strategies, improving access to primary and specialist dental services.

The region also offers significant manufacturing and cost advantages, with local and multinational companies investing in the production of brackets, wires, and endodontic consumables tailored to regional price points. The rapid expansion of private dental clinic chains in urban centers, combined with growing medical tourism in countries such as India and Thailand, supports the accelerated adoption of advanced orthodontic and endodontic solutions. As digital dentistry tools become more affordable, the Asia Pacific is expected to remain the fastest-growing regional market over the forecast horizon.

Market Structure Analysis

The competitive landscape of the endodontics and orthodontics market is moderately concentrated, featuring a mix of global leaders and regional specialists. Major players such as Dentsply Sirona, Inc., 3M, Align Technology, Inc., Danaher Corporation (Ormco), and others compete on product performance, digital integration, training support, and brand reputation. Key strategies include investments in R&D for novel materials and digital platforms, mergers and acquisitions to expand product portfolios and geographic reach, and partnerships with dental clinics and laboratories to promote workflow integration. Emerging business models leverage subscription-based software, treatment planning services, and direct-to-clinic education programs to build sticky customer relationships.

Key Market Developments

The global endodontics and orthodontics market size is estimated at US$ 12.3 billion in 2026, supported by steady procedure volumes in restorative and aesthetic dental care across major regions worldwide.

Key demand drivers include high prevalence of dental caries and malocclusion, rising aesthetic awareness, and rapid adoption of digital dentistry and clear aligner solutions in clinics and hospitals globally.

North America leads with 42% share in 2025.

Major opportunities lie in Asia Pacific’s fast‑growing demand, alongside technology‑driven integrated solutions that combine advanced consumables, digital imaging, and treatment planning platforms for clinics and hospitals.

Leading companies include Dentsply Sirona, Inc., 3M, Align Technology, Inc., DENTAURUM GmbH & Co. KG, FKG Dentaire SA, Ivoclar Vivadent Inc., Patterson Companies, Inc. and Others.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis Units | Value: US$ Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

Product

End User

Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author