ID: PMRREP33580| 200 Pages | 19 Dec 2025 | Format: PDF, Excel, PPT* | Consumer Goods

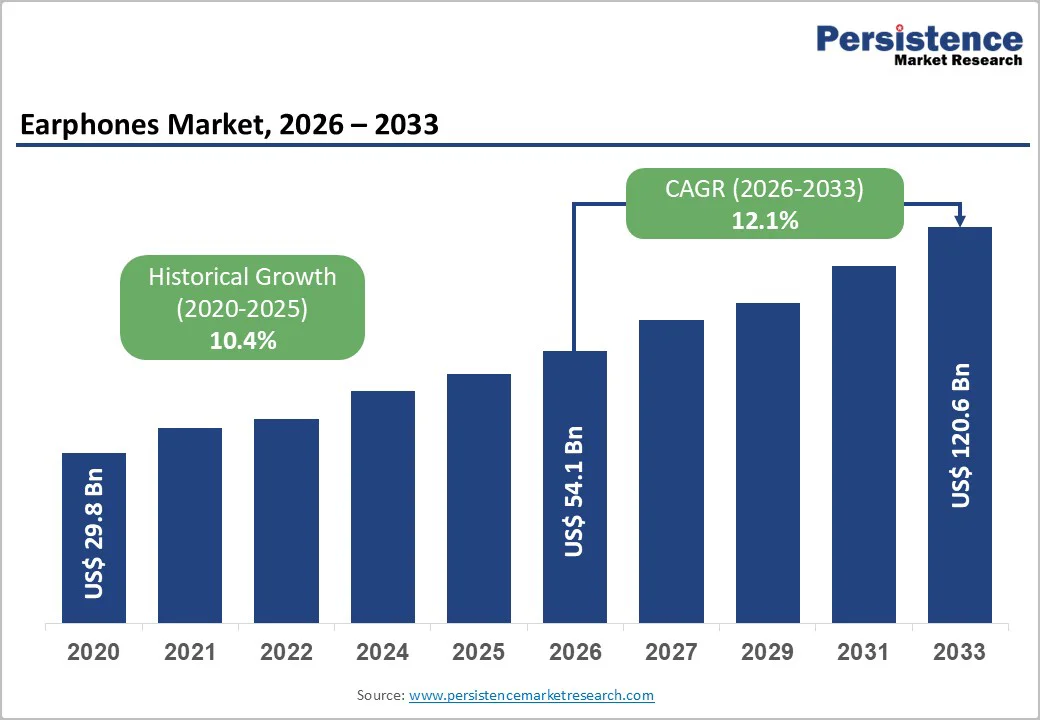

The global earphones market size is projected to reach US$54.1 billion by 2026 and further expand to US$120.6 billion by 2033, driven by a CAGR of 12.1% during the forecast period from 2026 to 2033.

This robust expansion is driven by accelerating smartphone penetration, the rapid adoption of true wireless stereo (TWS) earbuds, declining audio peripheral costs, and integration of advanced technologies, including active noise cancellation (ANC), spatial audio, and AI-powered voice assistants.

Emerging markets in the Asia Pacific, coupled with rising consumer demand for portable audio solutions across fitness, remote work, and entertainment verticals, are substantially amplifying market growth. The industry is witnessing a paradigm shift toward wireless connectivity, with 74% share dominated by wireless earphones compared to wired alternatives, demonstrating fundamental changes in consumer audio preferences globally.

| Key Insights | Details |

|---|---|

| Earphones Market Size (2026E) | US$ 54.1 billion |

| Market Value Forecast (2033F) | US$ 120.6 billion |

| Projected Growth CAGR (2026 - 2033) | 12.1% |

| Historical Market Growth (2020 - 2025) | 10.4% |

The global smartphone installed base exceeded around 7.1 billion units in 2024, creating an exponential addressable market for wireless audio peripherals. Smartphone manufacturers' discontinuation of 3.5mm headphone jacks since 2016 has fundamentally accelerated consumer migration toward wireless earphones and earbuds.

The International Data Corporation (IDC) reported that global smartphone shipments reached 1.1 billion units annually, with 87% of premium devices shipping without wired audio connectors. This structural technology transition has created an immediate ecosystem demand for Bluetooth-enabled audio alternatives.

Furthermore, the proliferation of connected wearables, smartwatches, fitness trackers, and health monitoring devices creates integrated audio ecosystems requiring seamless wireless connectivity. The average smartphone user now consumes 3-4 hours of audio content daily across music streaming, podcasts, and video content.

This intensified multimedia consumption directly translates to elevated earphone demand across demographics ranging from Gen Z consumers (ages 18-24) to working professionals requiring communication devices for remote work environments.

Active Noise Cancellation (ANC) technology has evolved from premium-exclusive features to mass-market accessibility, reducing costs by 35-40% while improving performance accuracy. Modern ANC implementations achieve noise isolation ratios exceeding 30 decibels through advanced algorithms processing environmental sound signatures in real-time.

Bluetooth 5.2 and 5.3 standards enable multi-device pairing, reduced latency (15-20ms versus historical 100ms+), and improved power efficiency extending battery life to 8-12 hours on single charges. Spatial audio technologies, pioneered by Apple in AirPods Pro and adopted by Sony, Samsung, and Bose, create immersive three-dimensional soundscapes comparable to professional studio mixing.

Custom audio drivers, dual-microphone array systems, and adaptive EQ tuning enable personalized listening experiences. These technological convergences have elevated perceived value propositions, enabling manufacturers to maintain around 35-45% gross margins despite competitive intensity.

Private label and white-label manufacturers capture 12-15% market share, channeled through Amazon, Flipkart, and regional e-commerce platforms. This fragmentation creates customer acquisition cost inflation, triggering increased marketing spend (15-22% of revenue) to maintain brand visibility.

Supply chain disruptions in 2021-2023 created inventory corrections, driving discounting pressure. OEM relationships shift toward channel partners offering superior margin profiles, disadvantaging independent audio specialists lacking ecosystem integration.

The European Union's mandate for USB-C charging standardization (EU Directive 2022/1369) by December 2024 necessitates redesigned charging architectures, increasing R&D expenses and product development cycles by 8-12 months. Extended Producer Responsibility (EPR) regulations in Europe, China, and Japan require manufacturers to manage end-of-life recycling, adding $2-4 per unit compliance costs.

Battery regulations limiting lithium-ion energy density create engineering constraints affecting compact form-factor designs. FCC and CE electromagnetic compatibility testing requirements extend approval timelines by 90-120 days.

China's new e-waste regulations (adopted 2023) impose deposit-return schemes requiring 15-20% product price adjustments. These regulatory frameworks disproportionately burden emerging manufacturers lacking compliance infrastructure, consolidating market share toward established multinational corporations with established quality assurance systems.

Wearable health sensors embedded in earbuds represent ~$3.2B market opportunity by 2033, currently captured by only 8-12% of earphone units globally. Biometric sensors measuring heart rate variability, blood oxygen saturation, and stress hormones enable continuous health monitoring aligned with preventive medicine trends.

Apple Watch integration with AirPods and Samsung Galaxy Buds integration with SmartThings ecosystem demonstrates ecosystem convergence potential. Corporate wellness programs spending reached around $62B globally in 2024, with audio-based meditation, stress management, and real-time hydration prompts creating enterprise B2B opportunities.

Healthcare provider partnerships leveraging earphones for remote patient monitoring during cardiac rehabilitation and pulmonary therapy enable reimbursable medical device classifications expanding addressable markets.

Gaming earphone shipments reached approximately 185 Mn units in 2024, growing 22% annually versus overall audio market growth of 11.2%. Low-latency Bluetooth implementations (4-8ms versus 50-100ms standard) enable competitive gaming advantage, driving premium pricing (30-40% price premiums).

Esports equipment sponsorships from organizations like Team Liquid, FaZe Clan, and T1 create brand visibility among 2.7B global gamers. Spatial audio processing enables 360-degree environmental sound awareness critical to multiplayer game performance.

Gaming earphone customization markets (replacement ear tips, protective cases, audio profile presets) create recurring revenue streams. Metaverse and virtual reality application development creates emerging use cases requiring low-latency, immersive audio implementations, positioning earphones as critical hardware infrastructure.

Earbuds account for approximately 58% of the total earphones market, with True Wireless Stereo (TWS) models emerging as the fastest-growing and most influential sub-segment, driving earbuds category expansion.

Apple AirPods ecosystem captures around 25-29% of the global TWS market, followed by Samsung Galaxy Buds ~12%, Sony LinkBuds ~8%, and emerging brand portfolios from Anker, Noise, and boAt collectively representing a prominent share. The TWS form factor enables maximum portability, ergonomic comfort during extended wear periods, and seamless smartphone ecosystem integration.

Premium TWS models priced $150-350 USD demonstrate 31% gross margins versus mainstream earbuds ($50-100 USD) achieving 24% gross margins. Consumer preference for minimalist form factors, gesture-based controls, and one-tap device pairing mechanisms continue driving category expansion across demographic segments.

Neckband-style earphones demonstrate the second-highest growth trajectory within product type categories, expanding at 9.9% CAGR between 2026- 2033. Neckbands capture specific consumer requirements including extended battery duration (24-40 hours versus 8-12 hours for earbuds), convenient storage and retrieval on shoulder areas, and integrated microphone arrays optimized for vehicular and workplace communication.

Realme, boAt, and JBL-targeted positioning emphasizes affordability and functional durability for price-conscious demographics. The neckband segment penetration in Asia Pacific exceeds 18%, substantially higher than North American adoption rates of 4%, reflecting regional preference heterogeneity.

Wireless earphones and earbuds hold a dominant 74% market share, with Bluetooth 5.0+ technologies now serving as the industry benchmark for enhanced power efficiency, stable connectivity, and seamless multi-device integration. The wireless segment encompasses diverse connectivity architectures including standard Bluetooth (79% of wireless units), proprietary RF protocols (11%), and emerging WiFi 6E implementations (4%).

Consumer preference metrics demonstrate around 89% of new earphone purchasers prioritize wireless capabilities, abandoning wired alternatives except for professional audio engineering and aviation-regulated communication devices. Wireless earphones enable fitness and outdoor activity applications previously constrained by cable tangles and durability concerns.

Wireless segment CAGR of 14.1% significantly outpaces aggregate market growth, indicating fundamental market share transition away from wired architectures.

Wired earphones maintain a 26% market share with steady growth at 6.5% CAGR, appealing to specialized consumer segments including professional audio engineers, musicians, aviation personnel, and budget-constrained consumers. Wired segment resilience reflects persistent demand among 10-15% of consumer populations prioritizing unlimited battery duration and established 3.5mm audio jack compatibility with legacy consumer electronics.

Professional microphone applications and broadcasting equipment standardization around XLR and balanced audio connections sustain niche but profitable market segments. Regulatory requirements in commercial aviation (wired earphones maintain power continuity independent of battery degradation) create captive customer bases within institutional procurement categories.

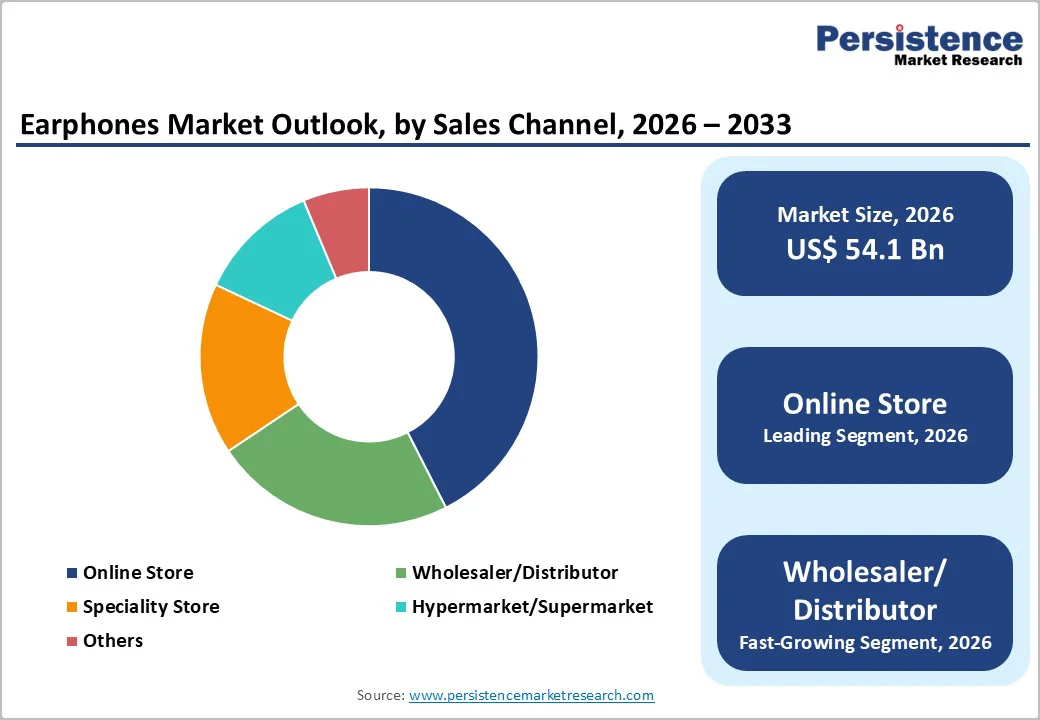

Online retail channels lead earphone distribution with a 43% market share, driven by major e-commerce platforms such as Amazon, eBay, Flipkart, Shopee, and Lazada, alongside rapidly expanding brand-direct D2C ecosystems. Online distribution advantages include unlimited inventory visibility, detailed product specification databases, verified customer review ecosystems, and competitive price transparency enabling informed purchasing decisions.

Average order processing times of 2-3 days versus 14-30 days for wholesale channels accelerate consumer fulfillment expectations. Online channel margin profiles enable manufacturer ~25-35% gross margins while retailer platforms achieve ~20-28% take-rates after fulfillment cost absorption.

Live-streaming commerce innovations create interactive sales environments demonstrating product features in real-time, driving conversion rates 3-5x higher than static product listings.

Wholesaler and distributor-facilitated direct-to-retail partnerships expand at 11% CAGR, capturing increasing institutional procurement volumes from corporate IT procurement departments, telecommunications carriers, and hospitality enterprises.

B2B distribution economics enable volume discounts of 25-35% off consumer-facing MSRP, attractive for large-scale organizational deployments. Regional distributors maintaining logistics infrastructure across tier-2 and tier-3 cities access consumer segments underserved by centralized e-commerce warehouse distribution models. Channel partner margin structures sustain profitability despite lower ASP realization versus direct consumer channels.

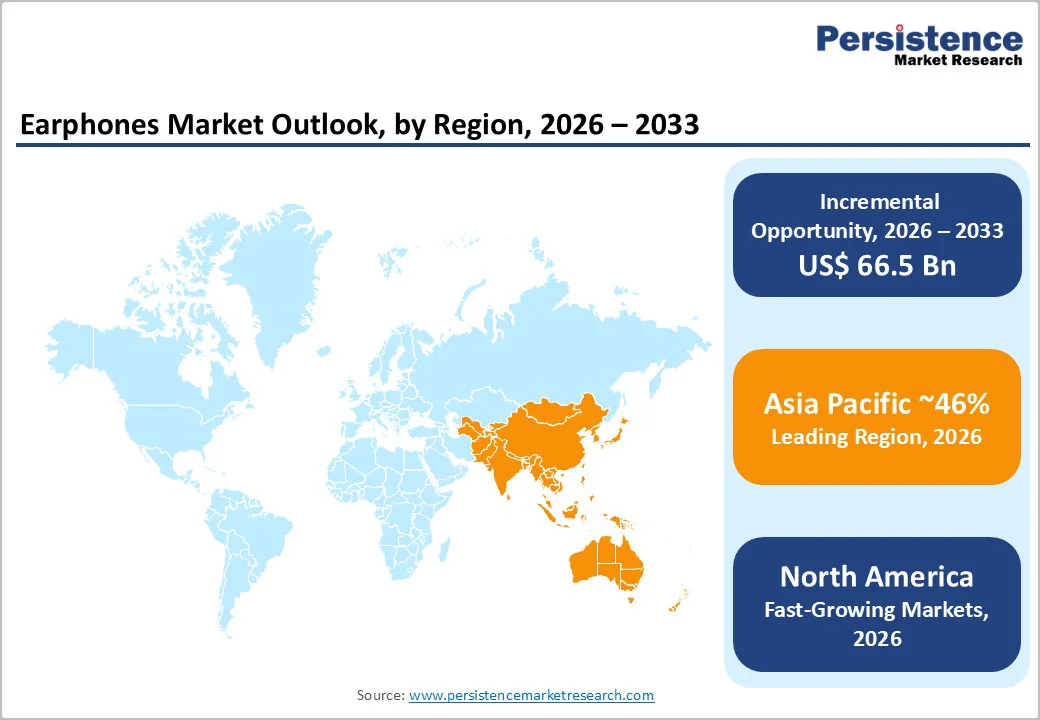

North America stands firmly as the global market’s second-largest powerhouse after Asia Pacific, accelerating at an impressive CAGR of 11.7% and reinforcing its position as a rapidly expanding growth hub. United States market leadership reflects ~76% smartphone penetration, consumer technology adoption rates reaching around 30-34% for premium audio equipment, and streaming service penetration exceeding 65% of households.

The Canadian market demonstrates similar technology adoption patterns, with audiophile consumer bases concentrated in major metropolitan areas (Toronto, Vancouver). Market value realization through premium segment concentration contrasts with emerging market strategies emphasizing volume-based revenue models.

Apple AirPods ecosystem captures significant regional market share, followed by Sony, Bose, and fragmented emerging player portfolios. Corporate technology spending on remote work infrastructure elevated earphone procurement through enterprise channels, creating institutional B2B demand complementing consumer segments.

Primary growth catalysts include rising hybrid work adoption, wellness trend expansion incorporating audio-based meditation and fitness applications, and gaming entertainment vertical growth. Regulatory environment stability and the absence of tariff barriers maintain competitive neutrality across manufacturers.

Leading players emphasize ecosystem integration (Apple/iPhone, Samsung/Android), premium feature differentiation (Sony spatial audio, Bose noise cancellation), and direct consumer engagement through flagship retail locations.

Europe captures 19% of the global market and grows at a strong 10% CAGR, with Germany, the UK, France, and Spain accounting for over 60% of regional demand fueled by advanced consumer electronics adoption and disposable income levels supporting premium audio spending.

German market emphasis on engineering excellence and acoustic fidelity drives disproportionate premium segment concentration, with ~31% of German earphone sales exceeding €120 ASP. UK market demographics skew toward younger populations (18-35 age cohort representing 47% of purchasers) with gaming and music streaming enthusiasm driving TWS adoption.

Regulatory environment harmonization through EU directives standardizing charging protocols and environmental compliance creates unified market dynamics but necessitates increased manufacturer compliance investments. Sennheiser, Bang & Olufsen, and regional German audio manufacturers maintain competitive advantages through heritage brand recognition and engineering reputation.

EU USB-C standardization mandate (effective December 2024) required significant manufacturer R&D reallocation. Sustainability regulations and packaging reduction requirements add €1-2 compliance costs per unit. GDPR personal data processing frameworks govern voice assistant data collection, limiting certain AI-powered features versus North American implementations.

Regional investment capital concentration supports emerging European audio brands including Nothing Technology (UK), Technics (Germany), and premium audio startups navigating expansion pathways through established distribution networks.

Asia Pacific dominates globally with 46% market share, with China representing ~31% of regional market value driven by manufacturing scale and around 900M smartphone-connected consumers. India's emerging market status demonstrates 15.8% CAGR, outpacing global averages through rapid smartphone penetration, rising disposable incomes, and a local manufacturing ecosystem supporting affordable product tier expansion.

Japan sustains premium market positioning with ~65-68% of volume concentrated in $100+ price bands, reflecting audiophile consumer preferences. Southeast Asian markets (Vietnam, Thailand, Indonesia) expand at 17-18% CAGR driven by digital commerce penetration and telecommunications carrier partnerships.

Manufacturing advantages, including established supply chains for semiconductor components, battery technologies, and wireless transmission modules, concentrate competitive edge toward regional manufacturers, including Xiaomi, Oppo, Huawei, and emerging brands, capturing 30-34% collective regional market share.

Asia Pacific manufacturing cost advantage of 35-45% relative to Western production enables price-competitive positioning, capturing volume-sensitive consumer segments. Local brand proliferation captures around 28% market share through region-specific marketing, financing partnerships, and distribution networks penetrating rural populations.

Government initiatives supporting electronics manufacturing accelerate regional production capacity expansion. Cross-border e-commerce integration enables Chinese brand distribution across Southeast Asian markets, intensifying competition and accelerating price deflation.

The global earphones market remains moderately fragmented, with leading players collectively holding 40-45% of total revenue while the remaining 55-60% is dispersed across 450+ global and regional manufacturers.

Established brands such as Apple, Sony, Samsung, Bose, and Sennheiser dominate premium segments, while emerging Chinese players, Xiaomi, Oppo, OnePlus, and Anker-Soundcore, expand rapidly through aggressive pricing and strong e-commerce penetration, contributing to notable annual market share fluctuations.

The global earphones market is valued at US$54.1 Billion in 2026 and is projected to reach US$120.6 Billion by 2033.

The earphones market is propelled by the surge in 7.1B global smartphone connections, widespread removal of 3.5mm audio jacks, and rapid advancements in ANC, spatial audio, and Bluetooth 5.2+ technologies. Growing disposable incomes and strong premiumization trends across Asia Pacific further reinforce sustained demand.

The earphones market is projected to grow at a 12.1% CAGR between 2026 - 2033.

Key market opportunities arise from integrating health and wellness monitoring features, expanding into the fast-growing gaming and esports segment, and developing affordable product tiers tailored for high-volume emerging markets.

Market leadership is commanded by Apple Inc., Sony Corporation, Samsung Electronics, Bose Corporation, Sennheiser, Xiaomi, Anker-Soundcore, Oppo, Huawei, and Noise Electronics collectively representing dynamic competitive landscape characterized by moderate fragmentation and emerging brand market share expansion through aggressive pricing and e-commerce channel specialization.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Bn/Mn, Volume: As applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Connectivity

By Sales Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author