ID: PMRREP12268| 199 Pages | 6 Dec 2025 | Format: PDF, Excel, PPT* | Food and Beverages

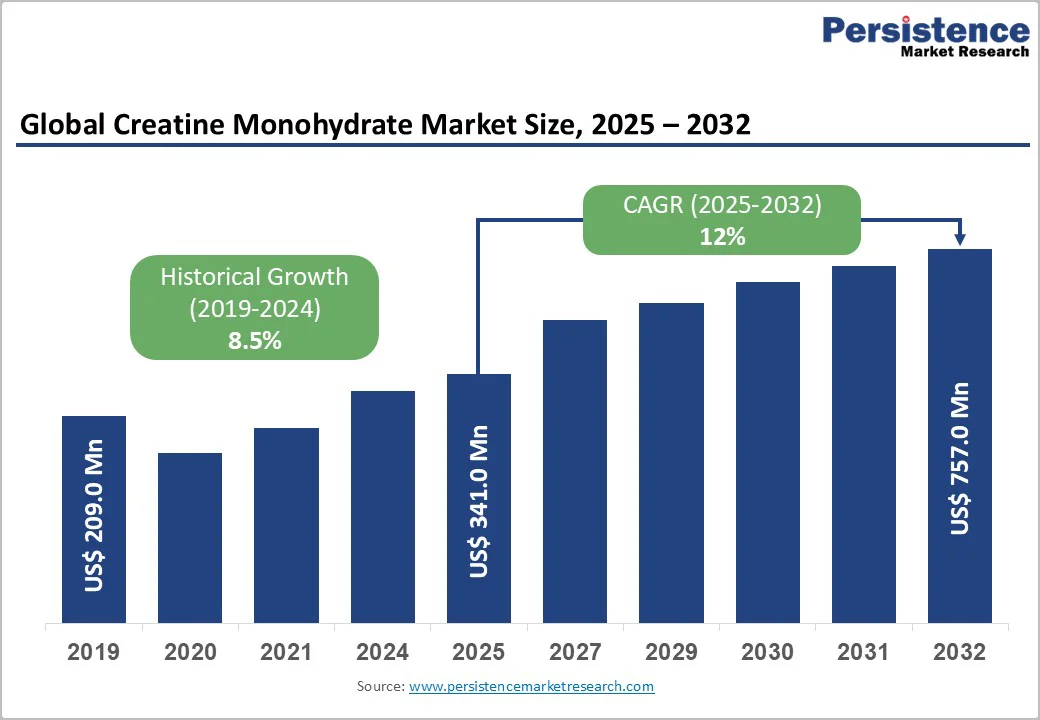

The global creatine monohydrate market size is likely to be valued at US$ 341.0 million in 2025, and is estimated to reach US$ 757.0 million by 2032, growing at a CAGR of 12% during the forecast period 2025−2032. Major growth factor for the market is the increasing consumer preference for dietary supplements that boost physical performance and overall health. Robust expansion is attributed to rising consumer participation in fitness and bodybuilding, increasing acceptance of sports nutrition products, and product innovation responding to clean label and convenience trends. Market innovation and geographic penetration are balanced by evolving regulatory requirements and growing customer emphasis on safety, efficacy and transparency

| Key Insights | Details |

|---|---|

| Creatine Monohydrate Market Size (2025E) | US$ 341.0 Mn |

| Market Value Forecast (2032F) | US$ 757.0 Mn |

| Projected Growth (CAGR 2025 to 2032) | 12% |

| Historical Market Growth (CAGR 2019 to 2024) | 8.5% |

Surge in Sports Nutrition and Fitness Activities

Deepening interest in athleticism and strength training is increasingly motivating people to seek effective ways to support their performance and recovery. Creatine monohydrate is widely recognized for its role in helping muscle cells maintain an energy supply during intense exercise or resistance training. By acting as a buffer for rapid energy transfer in muscle tissue, creatine enables individuals to sustain higher training volumes and engage in demanding physical activity with greater efficiency.

The popularity and adoption of this fitness culture is closely tied to the rising use of performance-enhancing, recovery-supportive supplements, with creatine leading the charge due to its well-documented effects on strength, endurance, and muscle recovery. Furthermore, creatine’s role in cellular energy production (ATP) and its emerging benefits for cognitive function have expanded its appeal. Gym chains, college sports programs, and even high school athletes are incorporating creatine supplementation into training routines.

Regulatory Fragmentation and Compliance Barriers

Creatine monohydrate is strictly tied with the regulatory frameworks across global markets, resulting in compliance barriers for manufacturers and distributors. In the United States and much of the European Union (EU), creatine monohydrate is typically classified as either a dietary supplement or a food supplement, and the U.S. Food and Drug Administration (FDA) recognizes it as “Generally Recognized as Safe” (GRAS) under specific use conditions. In the EU, its use is permitted but strictly regulated by the European Commission (EC) under food additive and nutrition claims legislation. Products must comply with labeling, purity, and notification rules, while health claims require rigorous substantiation and approval by authorities such as EFSA.

The complexity is further exacerbated in countries where creatine is viewed as a drug or functional ingredient, subjecting it to pharmaceutical-level documentation and clinical safety dossiers, rather than the looser supplement protocols typical in Western markets. This global patchwork drives manufacturers to invest significantly in compliance, including validation of supply chain sources, routine purity assays, format-specific registration (powder, capsule, ready-to-drink), and reformulation to meet divergent maximum-allowed levels

Growing Role of Creatine beyond Sports Propels the Market

Creatine supplements are increasingly gaining recognition beyond their traditional use in sports and bodybuilding, unlocking new opportunities in the broader health and wellness market. Recent studies suggests that creatine plays a crucial role in brain function, cellular energy metabolism, and muscle preservation. Creatine supplementation can also improve cognitive performance, especially in tasks involving short-term memory and quick thinking, making it appealing to sports athletes and bodybuilders.

This shift in application is fueling demand among non-athletic demographics, including seniors and vegetarians who typically have lower natural creatine stores. Moreover, growing interest in nootropics and brain health supplements has opened doors for this ingredient to be included in cognitive-enhancing blends. As creatine becomes associated with holistic well-being, leveraging the trend, companies can present themselves as research-focused in the wellness market.

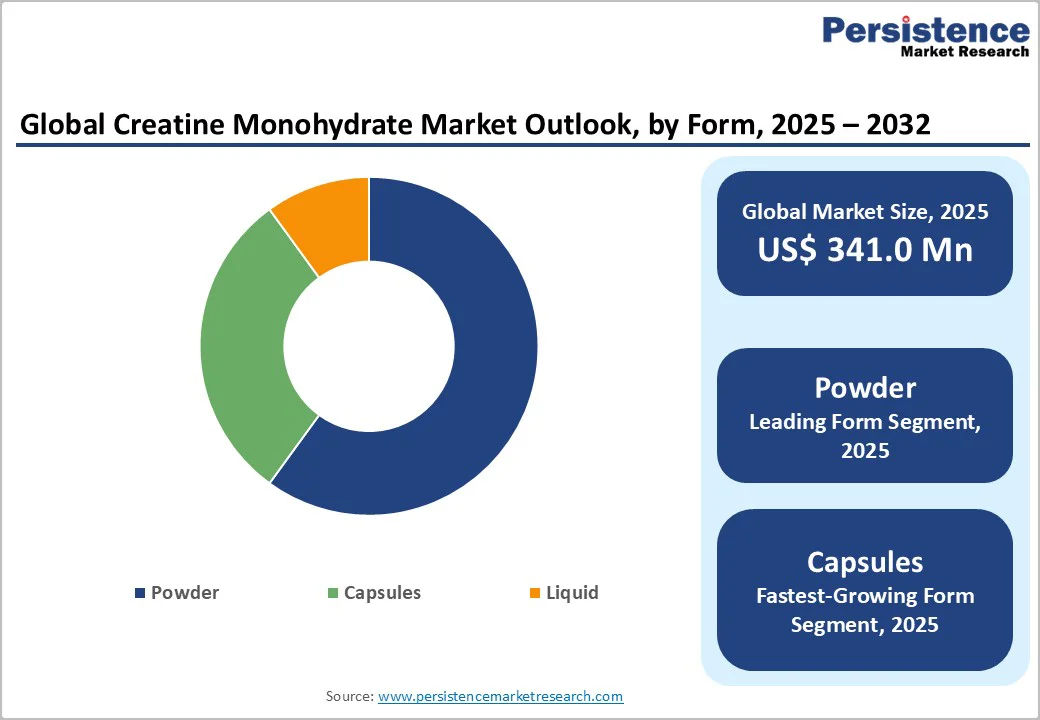

Form Insights

Powder is the leading form segment, capturing an estimated 60% of the creatine monohydrate market revenue share in 2025 due to its widespread use in sports nutrition and health supplements. Consumers prefer powder supplements as they can be easily mixed with other drinks or protein shakes, offering flexibility in consumption. The powder form is often more cost-effective compared to capsules or liquid forms, making it a popular choice among price-sensitive consumers. This form is particularly favored by bodybuilders and athletes who require larger doses to support their intense training regimens.

Capsules is likely to be the fastest-growing form segment through 2032, supported by convenience and ease of consumption. These forms are preferred by individuals who seek precise dosage control and portability, making them suitable for on-the-go consumption. The encapsulation technology has improved over the years, allowing for better stability and bioavailability of creatine. As a result, this segment is experiencing steady growth, especially among the general population who incorporate this ingredient into their daily supplement routine for health and wellness benefits.

Application Insights

Sports nutrition leads the global market, holding nearly 55% of the revenue share in 2025. This is mainly attributable to the deep-rooted adoption of the ingredient among both professional athletes and an expanding population of fitness-focused consumers. This dominance results from two principal drivers in the form of a robust scientific association between creatine monohydrate and measurable athletic performance gains, and its seamless integration into sports-specific supplement formulations such as pre-workouts, recovery blends, and muscle-building products.

Health supplements represent the fastest-growing application area for creatine monohydrate through 2032. A wide spectrum of consumers, including the general population, has incorporated creatine in their diets to support overall health and wellness. Its potential benefits in promoting brain health, combating neurodegenerative diseases, and supporting heart health have been subjects of scientific research, expanding its appeal beyond traditional sports performance contexts. This broadening application is expected to contribute to the sustained growth of the market over the forecast period.

End-User Insights

Athletes are naturally the dominant end-users with approximately 55% market share in 2025, owing to the supplement's proven efficacy in enhancing performance, endurance, and recovery. In competitive sports, where even marginal improvements in performance can be decisive, creatine supplementation is a standard practice. This segment's growth is also driven by the increasing competitive nature of sports and the ongoing pursuit of performance optimization.

General population is the fastest-growing segment from 2025 to 2032, as layman consumers are increasingly turning to creatine monohydrate for its perceived health benefits beyond athletic performance. This includes individuals seeking to maintain an active lifestyle, improve cognitive function, and support general health and wellness. As awareness of creatine's broader health benefits grows, this segment is expected to expand, contributing to the overall market growth. Further, as more scientific studies highlight the benefits of creatine for various age groups, its adoption among older adults and women is likely to increase.

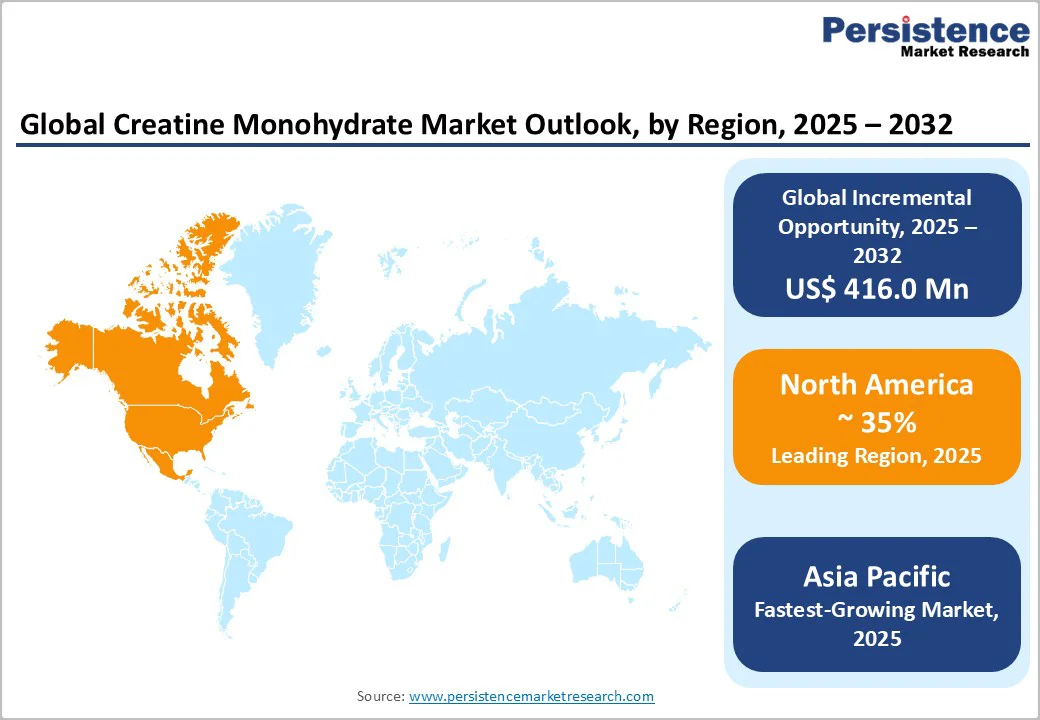

North America Creatine Monohydrate Market Trends

North America is set to command a significant portion of the creatine monohydrate market share at approximately 35% in 2025. This dominance is firmly rooted in the region’s mature and innovation-driven sports and nutrition sector, led by the United States. The U.S. boasts some of the highest athletic participation rates in the world, attributed to a well-developed collegiate sports system, a thriving professional athletics ecosystem, and an expanding recreational fitness segment.

In addition to this, the supplement is FDA-compliant and widely available across pharmacies, health stores, and e-commerce platforms, which boosts accessibility. Similarly, the strong fitness influencer culture and social media marketing strategies in the region play a major role in promoting creatine products to younger demographics. Strict regulatory framework has instilled confidence in manufacturers and built consumer trust for creatine, fostering innovation while minimizing gray market activity and regulatory ambiguity.?

Europe Creatine Monohydrate Market Trends

The market for creatine monohydrate market in Europe is defined by high product standards, regulatory harmonization, and evolving consumer preferences, with Germany, UK and France emerging as growth leaders. In these countries a strong fitness culture and widespread activities such as cycling, resistance training, and organized sports help propel the demand for creatine and other performance-enhancing supplements. This active lifestyle trend is supported by government initiatives and advanced retail and e-commerce infrastructure, ensuring consumers have access to quality supplements.

Investment in this region is rising not only in sports nutrition, but also in pharmaceutical and cosmeceutical segments, where traceability, scientific substantiation, and ethical sourcing become critical differentiators. These trends drive broader market participation and encourage continuous product innovation to address specific consumer demands across active, aging, and health-focused demographics. European consumers increasingly attract towards ethically sourced, technologically advanced formulations, reinforcing the region’s reputation for robust product quality and market sophistication

Asia Pacific Creatine Monohydrate Market Trends

Asia Pacific is anticipated to emerge as fastest-growing regional market through 2032, driven by powerful macroeconomic and sectoral trends. The region’s explosive growth is anchored in rapid urbanization and the explosion of the middle class in China and India, translating into heightened interest in personal fitness, bodybuilding, and organized sports. These two countries are also witnessing an astronomical rise in the proliferation of gyms, fitness centers, and sports complexes, supporting a surge in athletic participation and supplement consumption.

Regulatory modernization has played a crucial role, most notably through India’s Food Safety and Standards Authority (FSSAI) reclassification of creatine as a nutraceutical ingredient, which has streamlined legal compliance, spurred new product launches, and enabled domestic manufacturers to substitute imports. At the same time, the open import/export policies and transparent registration requirements in several Asian countries have smoothed the entry of global brands, increasing market competition and expanding consumer choice.

The global creatine monohydrate market is moderately concentrated, with top players such as Optimum Nutrition, NutraBio Labs, AlzChem Group AG, and Dymatize Nutrition collectively capturing approximately 45% of market revenue. These leading companies maintain dominance by consistently investing in research and development, forging strategic brand partnerships, and enhancing supply chain agility to meet growing consumer demands for high-quality creatine supplements.

While multinational brands command significant shelf space in global retail, the rise of contract manufacturers and original design manufacturers (ODMs) creates opportunities for small-batch innovators to enter the market and cater to niche consumer segments. This dual structure fosters a dynamic ecosystem where innovation is accelerated, and product variety increases, allowing the market to expand steadily. The growing global focus on fitness, muscle recovery, and personalized nutrition fuels this growth, positioning creatine monohydrate as a cornerstone supplement within the sports nutrition and health sectors.

The global creatine monohydrate market is projected to reach US$ 341.0 million in 2025.

Growing global interest in athleticism and strength training has augmented the demand for creatine monohydrate as a proven performance supplement.

The market is poised to witness a CAGR of 12% from 2025 to 2032.

Increasing acceptance of sports nutrition products, product innovation responding to clean label and convenience trends, and evolving regulations around health supplements are key market opportunities.

AlzChem Group AG, Optimum Nutrition, NutraBio Labs, and Dymatize Nutrition are some of the key players in the market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 – 2024 |

| Forecast Period | 2025 – 2032 |

| Market Analysis | Value: US$ Bn/Mn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Form

By Application

By End-User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author