ID: PMRREP35794| 189 Pages | 30 Oct 2025 | Format: PDF, Excel, PPT* | Consumer Goods

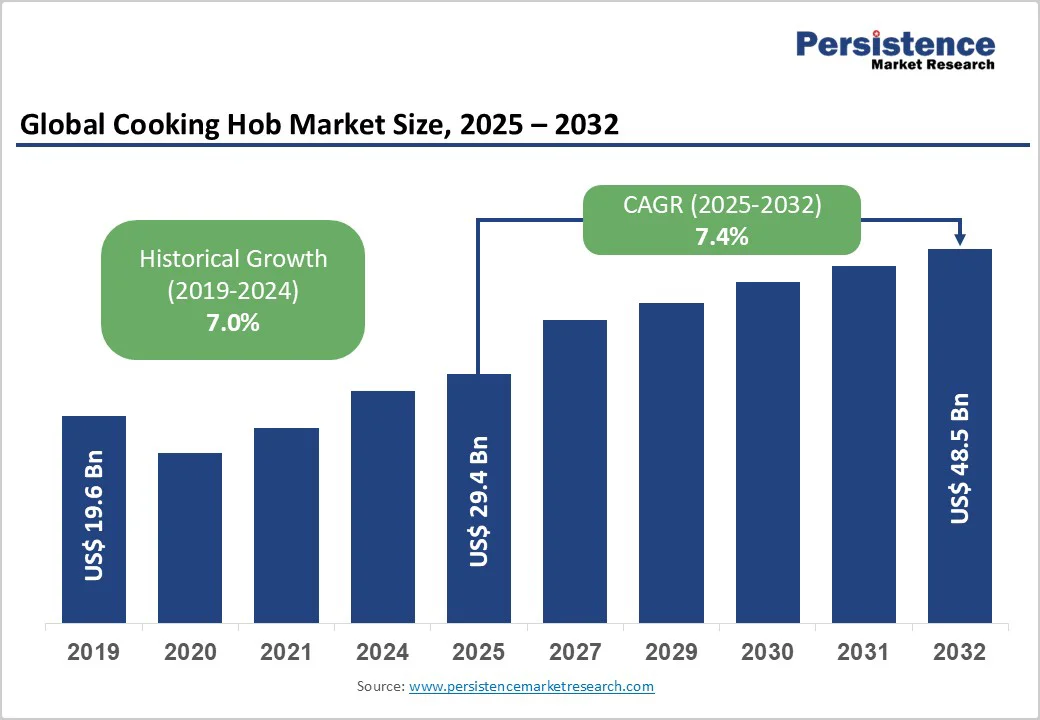

The global cooking hob market is expected to reach US$29.4 billion in 2025. It is estimated to reach US$48.5 billion in 2032, growing at a CAGR of 7.4% during the forecast period 2025 - 2032, driven by consumers' increasing focus on convenience, efficiency, and aesthetics in their kitchens.

Shrinking living spaces have further boosted the popularity of built-in hobs that fit modular kitchen layouts.

| Key Insights | Details |

|---|---|

| Cooking Hob Market Size (2025E) | US$29.4 Bn |

| Market Value Forecast (2032F) | US$48.5 Bn |

| Projected Growth (CAGR 2025 to 2032) | 7.4% |

| Historical Market Growth (CAGR 2019 to 2024) | 7.0% |

The growing adoption of space-efficient modular kitchen setups is driving demand for built-in cooking hobs. As urban homes become smaller, consumers prefer appliances that blend smoothly with cabinetry and countertops while saving counter space. Built-in hobs provide a clutter-free layout and a sleek aesthetic that matches modern interiors.

In markets such as India, China, and Singapore, the shift from traditional standalone stoves to integrated hobs has accelerated, with home developers now including them as a standard feature in premium apartments. The popularity of design-led kitchens exhibited on social media platforms and home décor shows is also influencing consumers to choose minimalistic and built-in cooking appliances.

The rapid growth of restaurants, cafés, and cloud kitchens worldwide has fueled the demand for high-performance, durable, and energy-efficient cooking hobs. Commercial kitchens are prioritizing hobs that deliver quick heating, precise temperature control, and easy maintenance to handle continuous use.

In 2025, several quick-service restaurant chains in the Asia Pacific and North America upgraded to induction-based commercial hobs to meet sustainability goals and reduce operational costs. The rise of food delivery platforms and specialty cuisines has further intensified kitchen throughput requirements. It has prompted businesses to invest in unique hob systems that improve both speed and safety in food preparation.

One of the key hurdles for the market is the high upfront and installation costs associated with built-in and induction models. Unlike freestanding stoves, built-in hobs require precise countertop cutting, proper ventilation setup, and, in some cases, electrical rewiring for high-power units. This added expense often discourages middle-income households from upgrading.

Induction hobs, despite their energy efficiency, remain more expensive due to the novel coil technology and sensor integration. In developing markets such as India and Indonesia, where affordability is a key purchasing factor, this price gap limits penetration, pushing several consumers to stick with traditional gas burners or low-cost portable cooktops.

Increasing awareness about indoor air pollution from gas stoves is emerging as a barrier to market growth for traditional gas hobs. Studies by the U.S. Consumer Product Safety Commission and Stanford University in 2024 revealed that gas cooking emits nitrogen dioxide and particulate matter at levels exceeding safe indoor air quality limits. These pollutants have been associated with increased risks of asthma and respiratory illnesses, especially among children.

Several cities in Europe and U.S. states are considering restrictions or phase-outs on new gas connections for homes. This regulatory shift and rising consumer concern are pressuring manufacturers to move toward electric and induction hobs, slowing demand for gas-based hobs.

The surging trend of smart home automation is creating new opportunities for cooking hob manufacturers to integrate remote-control functionality. Modern induction and electric hobs now come equipped with Wi-Fi or Bluetooth connectivity, allowing users to monitor and adjust cooking settings through mobile apps. This feature enables precise temperature management, automatic shut-off, and even recipe synchronization.

In 2025, Samsung and LG extended their smart kitchen portfolios with AI-supported induction hobs that can preheat pans or adjust heat levels based on the type of dish being cooked. Such connected features are appealing to tech-savvy consumers who prioritize convenience and energy management, paving the way for the next generation of intelligent kitchen appliances.

Consumers are now seeking hobs that deliver flexibility and adaptability to suit diverse cooking styles. Electric and induction hobs with multi-zone configurations are gaining impetus as they allow users to merge or split zones based on pan size or the number of dishes being prepared. Bosch and Siemens introduced flexible cooking zones in 2024 that automatically detect cookware position and adjust power output accordingly, improving precision and efficiency.

This customization trend caters to both gourmet cooks and households experimenting with various cuisines. As more consumers embrace home cooking, demand for modular, versatile hobs that balance performance and ease of use continues to rise globally.

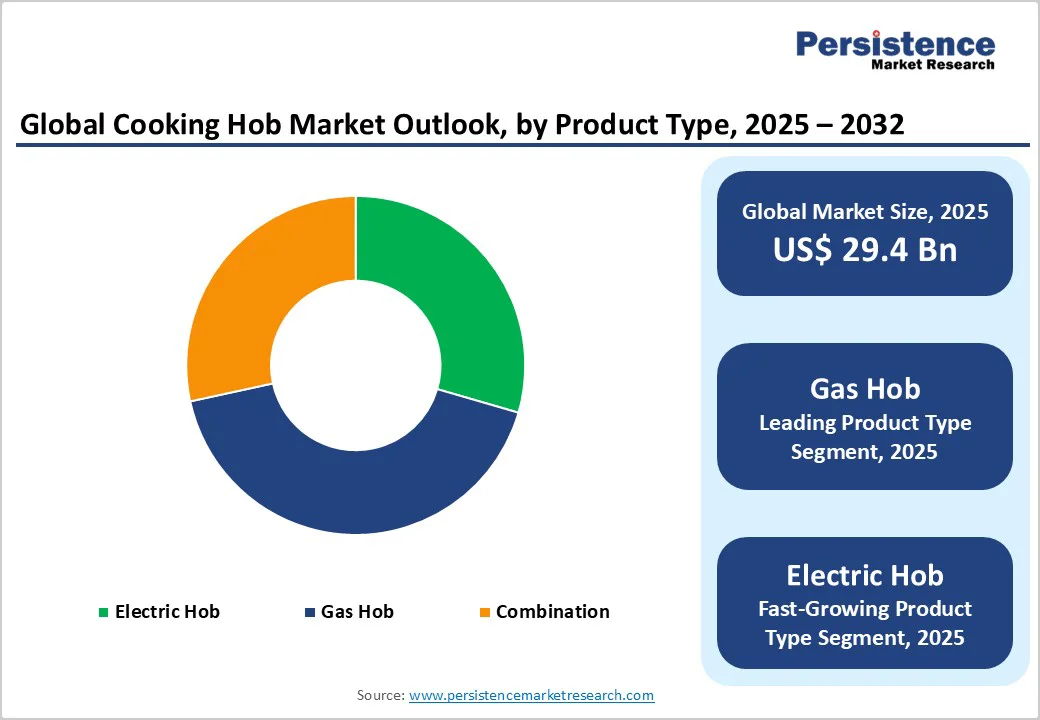

Gas hobs are predicted to dominate with nearly 42.1% of the market share in 2025, as they provide instant and visible flame control, which allows users to fine-tune heat levels precisely- something professional chefs and traditional cooks value deeply.

In Asia Pacific and Southern Europe, cuisines that rely on stir-frying, grilling, and flame roasting depend on the intense, direct heat that only gas burners can deliver. Also, gas hobs are more compatible with a wider range of cookware and are not affected by power fluctuations.

Electric hobs are gaining traction for their energy efficiency, safety, and sleek, modern designs suited to contemporary kitchens. The push for sustainable, emission-free cooking, especially after the recent health debates around gas stove emissions in the U.S. and Europe, has accelerated their adoption. Induction hobs, a type of electric hob, have become particularly popular because they heat only the cookware surface, reducing energy wastage by up to 90%.

Stainless steel is expected to capture around 49.7% of the share in 2025, due to its durability, corrosion resistance, and ability to withstand high temperatures. It is ideal for both residential and commercial environments, where heavy, repeated use is common.

Its non-reactive surface ensures food safety and easy cleaning, which appeals to busy households and restaurants. In 2024, several manufacturers, including Whirlpool and Faber, introduced brushed stainless-steel hobs with fingerprint-resistant coatings, addressing one of the few aesthetic drawbacks of the material.

Glass, particularly toughened or ceramic glass, has become a defining feature of modern electric and induction hobs, enhancing visual appeal while enabling novel functionality.

The smooth, flat surface makes cleaning effortless, and its ability to evenly distribute heat improves cooking performance. In 2025, Schott AG reported increased demand for its Ceran glass panels, which are now used in over 200 million cooktops globally, due to their heat resistance and recyclability.

Residential application will likely lead with about 68.2% of share in 2025, as urban lifestyles, modular kitchen designs, and compact apartments fuel demand for efficient and visually appealing cooking solutions. The rise of nuclear families and the popularity of home cooking post-pandemic have made built-in hobs a preferred feature in modern homes.

In India, China, and Japan, developers are increasingly delivering pre-fitted hobs in new apartments to attract young buyers. Smart home connectivity and user-friendly features such as automatic shut-off and child locks have further made hobs more desirable in residential settings.

Commercial spaces such as restaurants, cafés, and cloud kitchens are rapidly upgrading to high-performance hobs to meet increasing demand for fast and consistent cooking. The foodservice sector’s recovery after the pandemic, along with the rise of delivery kitchens, has boosted investment in heavy-duty gas and induction hobs capable of continuous operation. Induction hobs are gaining traction in commercial kitchens for their energy efficiency and low ambient heat generation, an important factor in maintaining kitchen comfort.

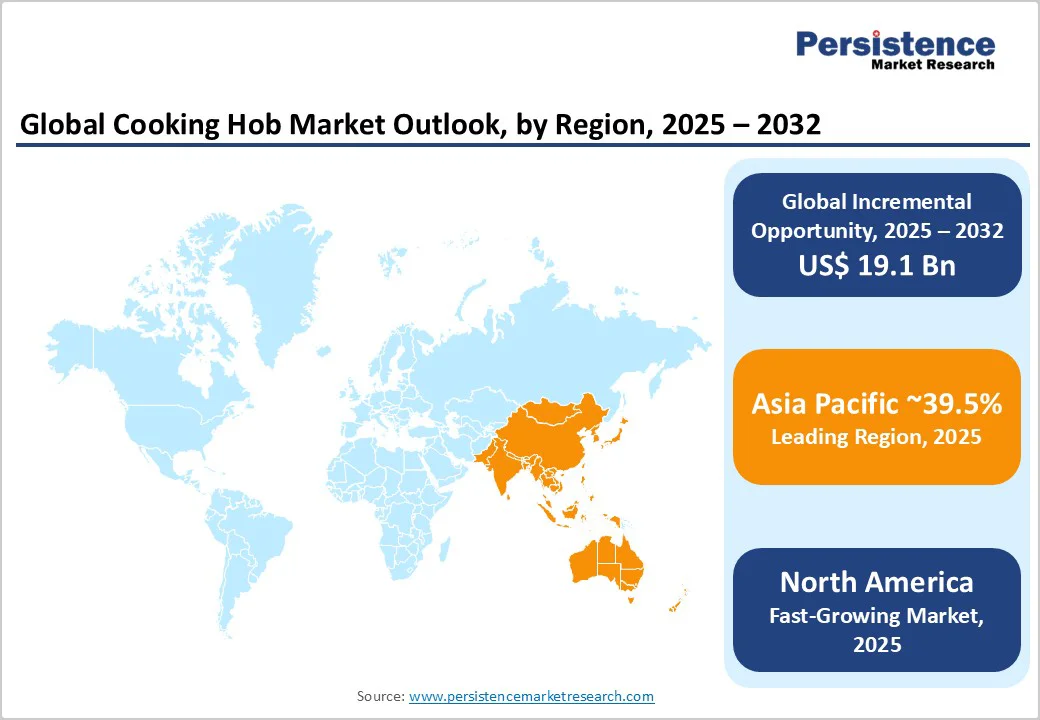

In 2025, the Asia Pacific is estimated to lead with approximately 39.5% of share as urbanization and the rise of modular kitchens boost demand for built-in and induction models. Consumers in China, Japan, and South Korea are moving toward smart induction hobs with features such as app control, auto shut-off, and quick heat adjustments. China-based brands, including Fotile and Robam, are dominating with region-specific developments such as integrated extractor hobs designed for heavy wok cooking.

India and Southeast Asian countries are still more gas-dependent due to affordability and inconsistent electricity supply. Government initiatives promoting energy-efficient appliances and the growing emphasis on power reliability are driving a steady shift toward electric and induction models. Online sales have surged, with mid-range induction cooktops gaining traction among first-time buyers seeking compact and efficient solutions for small apartments.

In North America, induction hobs are steadily gaining popularity, supported by rising consumer awareness about energy efficiency and indoor air quality. Gas cooktops still dominate, but recent policy changes in U.S. states such as California and New York, including rebates and incentives for electric cooking, are accelerating the switch to induction. Hybrid models that combine gas and induction are emerging to bridge consumer preference for flame cooking with the efficiency of electric cooking.

In 2025, Samsung and Whirlpool expanded their connected hob ranges in the U.S., integrating smart sensors and Wi-Fi-enabled controls for smooth kitchen automation. However, adoption is somewhat limited in older homes, where retrofitting electrical systems to support high-wattage induction units remains costly.

Europe leads the world in induction hob adoption, driven by stringent energy-efficiency regulations and the continent’s shift away from gas appliances. Germany, France, and the U.K. are witnessing a steady shift toward electric and induction cooking, supported by sustainability goals and indoor air-quality standards. Domestic brands such as Bosch, Miele, and AEG continue to dominate the premium segment, providing sleek built-in models with unique features such as flexible cooking zones, low noise levels, and integrated ventilation.

Countries in Scandinavia have gone a step further by promoting eco-designs and recyclable components in hobs. Southern European countries such as Italy and Spain are relatively slower to phase out gas due to cultural preferences. Still, modern housing projects and urban apartments are now opting for induction hobs as standard installations.

The global cooking hob market is becoming increasingly innovation-driven, with brands competing on design, technology, and energy efficiency rather than just price. Induction hobs are driving market transformation as consumers shift from gas to electric options, driven by rising environmental awareness and strict emission standards. In 2025, several Europe- and Asia-Pacific-based brands introduced unique induction hobs with quick heating and enhanced safety features, responding to the rising demand for energy-efficient kitchen appliances.

The cooking hob market is projected to reach US$29.4 Billion in 2025.

Increasing preference for modular kitchens and rising awareness of energy efficiency are a few key market drivers.

The cooking hob market is poised to witness a CAGR of 7.4% from 2025 to 2032.

Expansion of smart home ecosystems and booming foodservice establishments are the key market opportunities.

BSH Home Appliances Group, Whirlpool Corporation, and Electrolux AB are a few key market players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Material

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author