ID: PMRREP29575| 191 Pages | 15 Sep 2025 | Format: PDF, Excel, PPT* | Food and Beverages

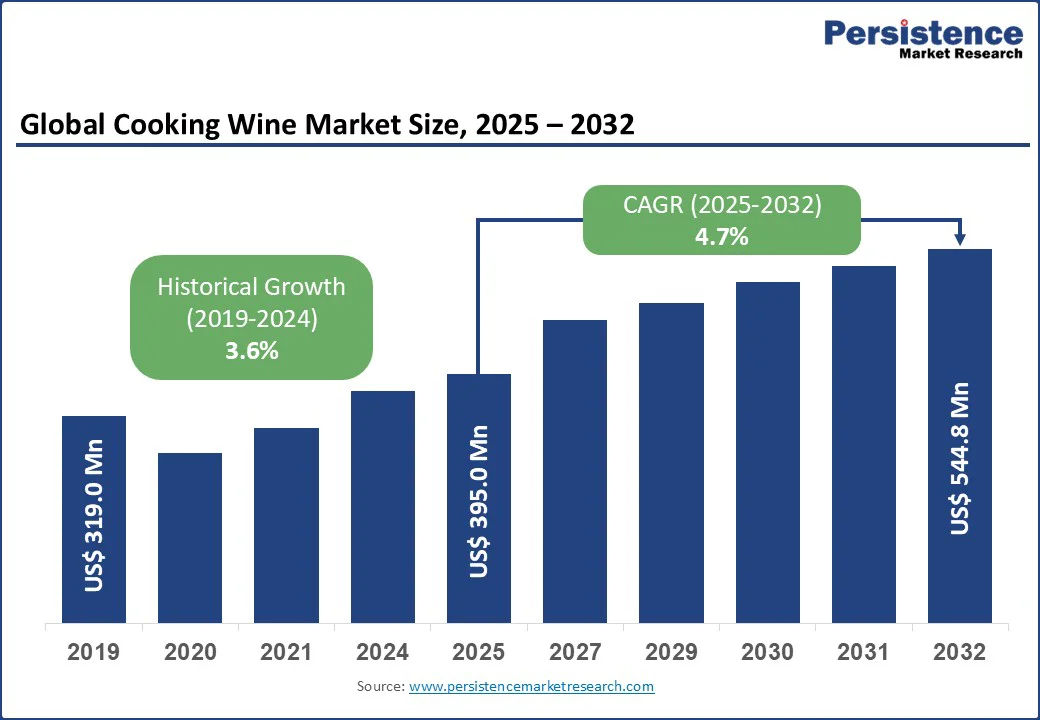

The global cooking wine market size is likely to value at US$395.0 Mn in 2025 to US$544.8 Mn by 2032, registering a CAGR of 4.7% during the forecast period from 2025 to 2032.

Key Industry Highlights:

|

Key Insights |

Details |

|

Cooking Wine Market Size (2025E) |

US$395.0 Mn |

|

Market Value Forecast (2032F) |

US$544.8 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

4.7% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.6% |

The cooking wine market is witnessing consistent growth, fueled by the surge in home cooking trends, technological advancements in food processing, and the rising consumer preference for flavor-rich culinary products.

The global surge in home cooking trends is a primary driver of the cooking wine market. According to a 2024 study by Instacart, over 60% of families ate dinner together more frequently during the pandemic compared to pre-pandemic times, with 31% of consumers cooking more at home in 2024. This rising trend, particularly in urban households seeking convenient flavor enhancers, underscores the need for cooking wines that provide quick taste improvements in everyday meals. In 2025, HelloFresh reported that most consumers expect to cook as much or more in the next 12 months, highlighting the demand for versatile ingredients such as cooking wine, especially for savory dishes where flavor depth improves significantly with addition.

Technological advancements in food processing are significantly boosting market growth. Modern platforms, such as Mizkan America Inc.’s production systems, offer high stability and shelf-life, reducing spoilage and enabling faster distribution through real-time quality control. Industry insights indicate that advanced processing technologies can reduce production time compared to traditional methods, achieving high quality rates for flavored wines. Innovations such as low-alcohol formulations and AI-integrated flavor analysis further drive adoption, particularly in resource-limited settings where fresh ingredients are challenging.

Government initiatives and increased funding for food accessibility are also key growth drivers. In Europe, the Farm to Fork Strategy under the EU’s Green Deal promotes research into food ingredients, while in Asia, initiatives such as India’s Food Processing Scheme encourage investment in processed goods. In North America, USDA programs supporting food innovation expand access to culinary products, increasing demand for advanced wines. Favorable policies for food safety, coupled with heightened focus on home meals post-COVID-19, encourage food manufacturers to invest in cooking wine supplies.

The high cost of cooking wine production remains a significant barrier to widespread adoption, particularly in low- and middle-income countries. Advanced processing methods, equipped with features such as flavor stabilization and contamination-free bottling, require substantial upfront investment. Additionally, ongoing costs for sourcing, testing, and quality control increase the total cost of ownership. In regions such as Sub-Saharan Africa and rural parts of South Asia, where food budgets are constrained, these financial burdens limit access to cooking wine, despite rising culinary trends. The Food and Agriculture Organization notes that “the premium pricing of processed food products may be a disincentive,” highlighting high production costs as a barrier to widespread adoption in many countries.

The requirement for skilled personnel to formulate and apply cooking wine also hinders market growth. Blending and testing wine flavors demands specialized training in food science. A shortage of certified experts in culinary technology in developing regions exacerbates this challenge. This skills gap, combined with high training costs, restricts the adoption of premium products in emerging markets, slowing market expansion.

The development of low-alcohol and non-alcoholic cooking wine variants presents significant growth opportunities, enabling deployment in health-conscious cooking, mobile kitchens, and family meals. These variants overcome the limitations of traditional alcoholic wines, making them ideal for inclusive settings. For example, Roland Foods, LLC’s low-alcohol wines offer rapid flavor infusion within minutes, supporting use in quick recipes and health-focused diets. As food systems prioritize wellness, demand for such solutions is rising, particularly in regions with limited alcohol access.

The growing popularity of point-of-use applications, such as ready-to-cook kits with integrated wines, provides another avenue for market expansion. These applications require minimal preparation and deliver flavors quickly, making them suitable for busy environments. Flavored cooking kits help reduce meal preparation time compared to traditional methods, driving demand for innovative wines in trend-driven areas such as ethnic cuisines.

The integration of digital platforms for recipe sharing and data analysis further enhances market potential. Companies such as The Kroger Co. are incorporating app-enabled recipe suggestions, allowing real-time customization and proactive usage. This trend improves accessibility and operational efficiency, supporting market growth in both developed and emerging regions.

The cooking wine market is segmented into red wine, white wine, rice wine, sherry wine, and marsala wine. Red wine dominates, holding approximately 35.5% of market share in 2025, due to its critical role in enhancing savory flavors in dishes such as stews and sauces. Advanced red wine variants, such as those from Mizkan America Inc., are widely adopted for their robustness and quick integration, making them essential in recipe settings.

Rice wine is the fastest-growing segment, driven by increasing demand for Asian-inspired cuisines in global markets. Innovations in rice wine formulations, such as those from Marina Foods, Inc., offer authentic flavors and versatility, boosting adoption in high-volume culinary centers.

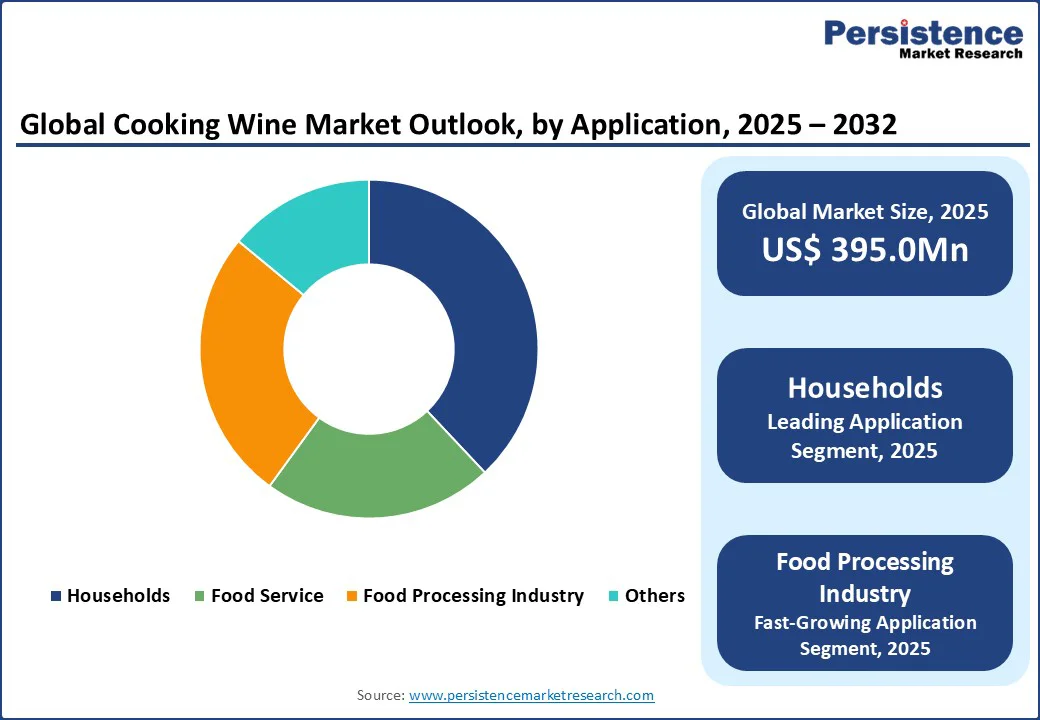

The global cooking wine market is segmented into the food processing industry, food service, households, and other segments. Households leads with a 38% of market share in 2025, driven by its widespread use in home meals and daily cooking. These applications simplify flavor addition, with millions of units consumed annually worldwide for family recipes.

The food processing industry is the fastest-growing segment, fueled by advancements in processed foods and the rising prevalence of ready meals. Its ability to provide consistent taste with high efficiency drives its adoption in advanced production facilities, particularly following the global convenience food boom.

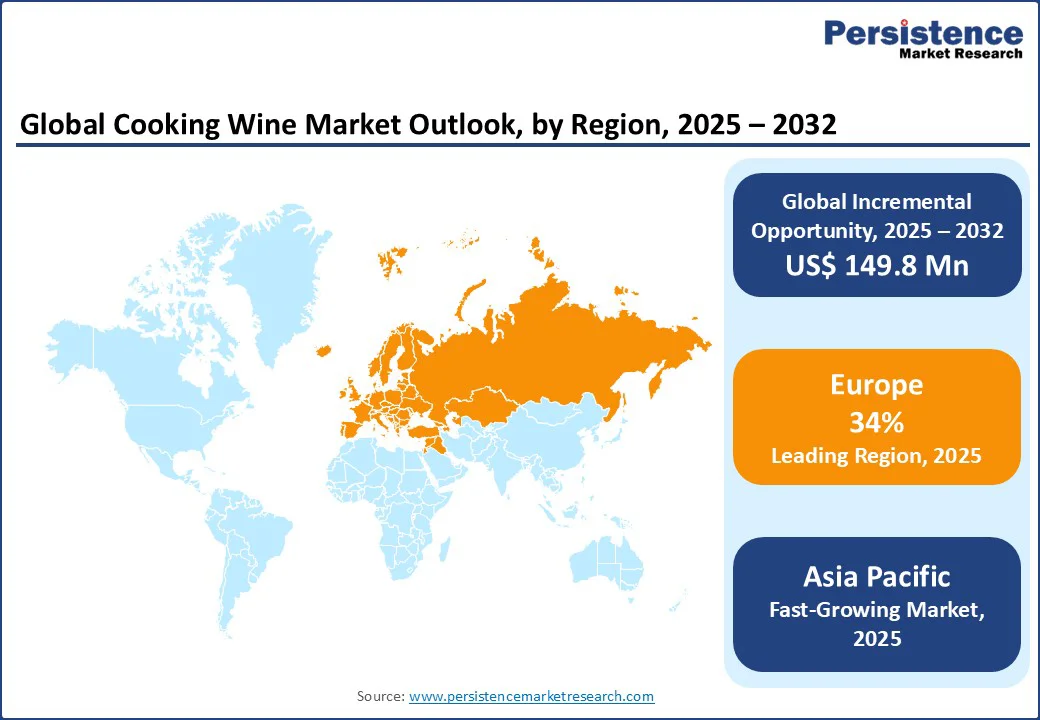

Europe dominates the global cooking wine market, expected to account for 34% of the cooking wine market share in 2025. This dominance is driven by a strong culinary heritage, advanced food infrastructure, and high demand for premium ingredients in countries such as France, Italy, and Germany. The European Food Safety Authority reports significant growth in culinary product consumption annually, underscoring the need for flavor-enhancing solutions. Leading brands such as ECOVINAL, S.L.U. and Elegre are developing innovative platforms to support cooks with quality, convenience, and versatile methods.

Consumer preferences are shifting toward organic and low-alcohol wines with integrated recipe solutions, such as Iberica Export’s products, which enhance meal quality and appeal. Stringent EU regulations prioritize food safety, encouraging the adoption of reliable, high-quality components. Favorable policies for sustainable food practices further incentivize manufacturers and retailers to invest in advanced supplies, supporting market growth.

Asia Pacific represents the fastest-growing market for cooking wine, driven by expanding food infrastructure, increasing culinary awareness, and rising investments in processed food technologies. India remains a key growth engine, where rising home cooking trends and government programs such as the Food Processing Scheme boost demand for affordable, versatile wine solutions. Domestic manufacturers such as Batory Foods and Marina Foods, Inc. cater to local needs with cost-effective products designed for both urban and rural settings.

In China, rapid market expansion is supported by large-scale kitchen upgrades, growing adoption of flavored wines, and the presence of leading players such as AAK AB. Japan’s market is characterized by demand for high-precision flavors used in traditional and fusion cuisines, with companies such as Stratas Foods gaining market share. Across the region, increased food spending, digital recipe platforms, and an emphasis on convenient meals are collectively accelerating adoption, making Asia Pacific a critical hub for future market growth.

In North America, the U.S. is a key market, driven by high home cooking rates, advanced food infrastructure, and growing culinary trends. The USDA reports substantial growth in home meal preparations annually, highlighting the need for flavor-enhancing solutions. Leading brands such as Mizkan America Inc. and The Kroger Co. are developing innovative platforms to support cooks with quality, convenience, and versatile methods.

Consumer preferences are shifting toward low-alcohol, organic wines with AI-integrated recipe suggestions, such as Roland Foods, LLC’s products, which improve meal quality. Stringent FDA regulations prioritize food safety, encouraging the adoption of reliable components. Favorable policies for food innovation further incentivize manufacturers and retailers to invest in advanced supplies, supporting market growth.

The global cooking wine market is highly competitive, with global and regional players vying for market share through innovation, competitive pricing, and reliability. The rise of low-alcohol and organic wines intensifies competition, as companies strive to meet stringent regulatory standards and consumer demands. Strategic partnerships, mergers, and certifications are critical differentiators in this dynamic market.

The cooking wine market is projected to reach US$395.0 Mn in 2025.

Rising home cooking trends, advancements in food processing technologies, and government initiatives for food accessibility are the key market drivers.

The cooking wine market is poised to witness a CAGR of 4.7% from 2025 to 2032.

Innovations in low-alcohol variants and point-of-use applications present significant growth opportunities.

Mizkan America Inc., Roland Foods, LLC, and The Kroger Co. are among the leading market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Mn Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Wine Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author