ID: PMRREP33627| 199 Pages | 16 Jan 2026 | Format: PDF, Excel, PPT* | IT and Telecommunication

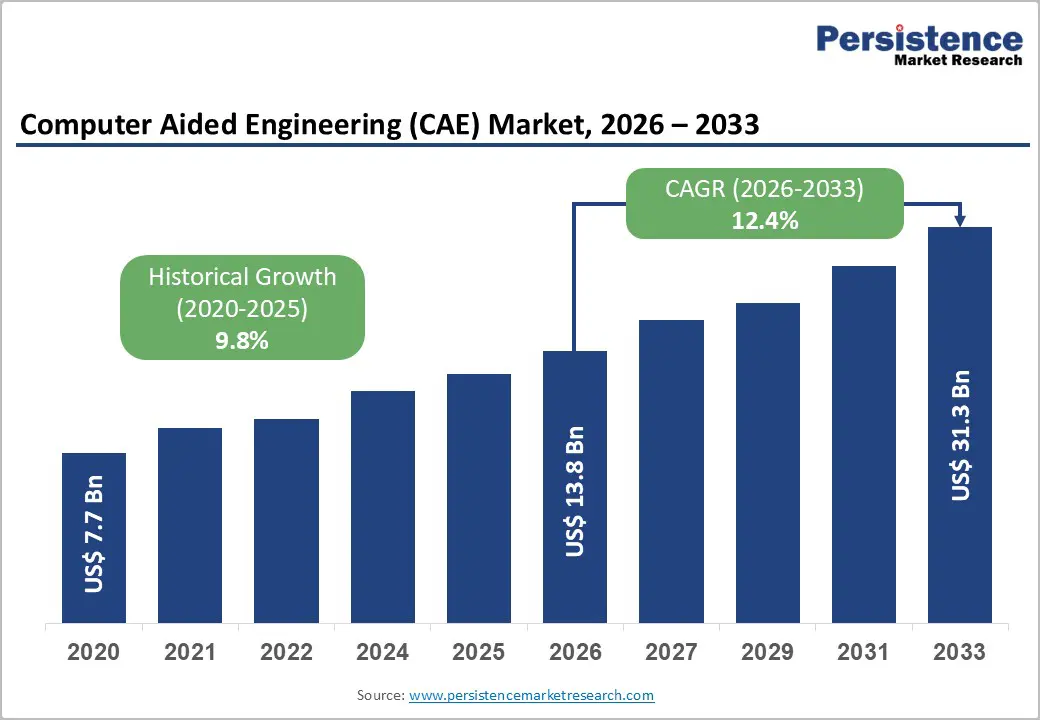

The global computer aided engineering (CAE) market size is likely to be valued at US$13.8 billion in 2026 and is projected to reach US$31.3 billion by 2033, growing at a CAGR of 12.4% between 2026 and 2033.

This expansion reflects accelerating digital transformation across manufacturing, aerospace & defence, and healthcare sectors seeking to optimise product design, reduce development cycles, and enhance innovation through advanced simulation capabilities. The convergence of artificial intelligence, high-performance computing, and cloud-native architecture has fundamentally transformed CAE from a specialised engineering tool into an essential platform supporting real-time digital twins, cross-disciplinary optimisation, and rapid prototyping workflows across global enterprises.

| Key Insights | Details |

|---|---|

| Computer Aided Engineering (CAE) Market Size (2026E) | US$ 13.8 Bn |

| Market Value Forecast (2033F) | US$ 31.3 Bn |

| Projected Growth (CAGR 2026 to 2033) | 12.4% |

| Historical Market Growth (CAGR 2020 to 2025) | 9.8% |

The Computer Aided Engineering (CAE) Market has become an essential infrastructure supporting the enterprise shift from physical prototyping toward virtual design validation and optimization. Digital transformation initiatives across manufacturing and aerospace sectors have created structural demand for CAE solutions, enabling companies to compress product development cycles, reduce physical prototype costs, and accelerate time-to-market for innovations.

The U.S. aerospace and defence industry generated over $995 billion in total business activity in 2024, with 914,000 direct workers and $138.6 billion in exports, demonstrating the scale of engineering-intensive sectors dependent on CAE for competitive advantage. European aerospace and defence turnover reached €325.7 billion in 2024, up 10.1% year-on-year, with direct employment at 1,103,000 workers and R&D investment reaching €23.4 billion, reflecting sustained investment in advanced simulation and digital technologies.

Organizations recognize that virtual prototyping through CAE delivers measurable benefits: accelerated design iteration, early detection of performance issues before physical manufacturing, cost reduction through optimized material usage, and improved product quality through comprehensive multiphysics analysis. The Market captures substantial spending as manufacturers increasingly view CAE as a non-negotiable competitive capability rather than a discretionary technology investment.

The integration of advanced technologies such as generative AI, machine learning, and GPU-accelerated computing is revolutionizing the CAE landscape. These innovations expand simulation capabilities, enabling real-time analysis and significantly enhancing design and development processes.

Dassault Systèmes' February 2025 launch of "3D UNIV+RSES" with AI-based services, integrating generative AI into the 3DEXPERIENCE platform, exemplifies the vendor's focus on embedding intelligence directly into Computer Aided Engineering (CAE) Market solutions. NVIDIA's March 2025 announcement that leading CAE providers, including Ansys, Altair, Cadence, Siemens, and Synopsys, are accelerating simulation tools by up to 50x using the NVIDIA Blackwell platform demonstrates the transformative potential of accelerated computing. These technological advances enable organisations to perform higher-fidelity simulations with greater design complexity, explore broader design spaces through parametric optimisation, and compress simulation-to-results timelines from days to hours.

The FLOWHEAD Project, EU-funded research in collaboration with automotive manufacturers, developed advanced gradient-based CFD workflows for vehicle aerodynamics, battery cooling, and HVAC optimization, exemplifying how advanced CAE techniques reduce lead times and enhance cost efficiency in automotive development. This computational acceleration creates competitive differentiation, enabling companies to achieve superior product performance while reducing engineering labour costs, thereby justifying enterprise investment in modern Computer Aided Engineering (CAE) Market solutions.

The Computer Aided Engineering (CAE) Market faces significant adoption restraint from the substantial capital and operational costs associated with enterprise CAE deployments. Comprehensive CAE solutions require not only software licenses but also high-performance computing infrastructure, specialized workstations, cloud computing resources for computationally intensive simulations, and professional services for implementation, customization, and training.

Mid-market manufacturers and emerging-market companies encounter budget constraints that limit CAE adoption to large enterprises with consolidated engineering functions and significant capital allocation for digital transformation. Proprietary software licensing models, while decreasing in prevalence with cloud-based consumption options, still create cost barriers that necessitate careful ROI analysis and multi-year procurement justification, slowing adoption cycles, particularly among resource constrained organizations.

The growing shift towards more flexible and scalable CAE solutions is opening up significant opportunities in the market. As organisations embrace cloud-native, subscription-based delivery models, they benefit from more efficient, cost-effective access to advanced simulation tools without the need for substantial upfront investment.

Cadence Design Systems' September 2025 acquisition of Hexagon's Design & Engineering business (including MSC Software) for approximately €2.7 billion demonstrates vendor recognition of multiphysics and subscription-model consolidation opportunities. Cloud-based Computer Aided Engineering (CAE) Market solutions enable geographic distribution of engineering teams, facilitate real-time collaboration across international offices, and support seamless integration with modern DevOps and digital product lifecycle management workflows.

The subscription model particularly appeals to mid-market manufacturers and contract engineers seeking to avoid large upfront capital commitments while maintaining access to the latest technologies, AI capabilities, and computing optimisation. This architectural shift expands the addressable market by democratizing access to enterprise-grade CAE, enabling smaller organizations to compete through advanced simulation without proportional capital investment, thereby capturing substantial incremental demand within underserved mid-market and emerging-market segments.

Integrating quantum computing into the computer-aided engineering (CAE) market offers a unique opportunity to accelerate engineering simulations that are currently constrained by classical computing capabilities. Ansys's November 2024 partnership with IonQ to incorporate quantum computing aims to speed up simulations, enhance design exploration, and shorten product development timelines. IonQ is also employing Ansys' multiphysics solutions to design next-generation quantum computers. Quantum algorithms are particularly effective for solving optimization problems, molecular simulations, and complex systems that require computational power beyond the reach of classical resources.

Although quantum computing is still in the early stages for CAE production workflows, its early integration by key players is positioning them for long-term competitive advantages as quantum hardware advances. Industries such as healthcare, pharmaceuticals, and materials science are set to benefit from quantum-accelerated simulations, including drug discovery, protein folding, and materials property prediction.

Organizations that establish expertise in quantum-enhanced CAE workflows now will be well-positioned to leverage this technology as it moves from research to practical application, enabling simulations and optimization that were previously infeasible with classical computing.

Software dominates the computer-aided engineering (CAE) market, commanding approximately 74.0% in 2026, encompassing simulation engines (CFD, FEM, multiphysics), pre-processing and post-processing tools, visualization platforms, and integrated CAE suites. Software segment dominance reflects enterprise preference for comprehensive, integrated solution stacks that consolidate simulation capabilities, reduce tool fragmentation, and streamline engineering workflows across disciplines. The software segment encompasses both perpetual licensing models and emerging cloud-based subscription offerings, with leading vendors (Ansys, Altair, Cadence, Siemens Digital Industries Software, COMSOL) offering portfolios spanning structural mechanics, fluid dynamics, electromagnetics, thermal analysis, and system-level simulation supporting multiphysics optimization.

Services, including implementation consulting, customization, training, managed simulation services, and technical support, represent the fastest-advancing component segment. Many organizations lack internal expertise to design comprehensive CAE workflows, integrate simulation platforms with existing PLM and ERP systems, and establish best practices for multiphysics optimization. Professional services address the significant adoption gap between software capabilities and organizational ability to configure, deploy, and operationalise complex CAE systems effectively.

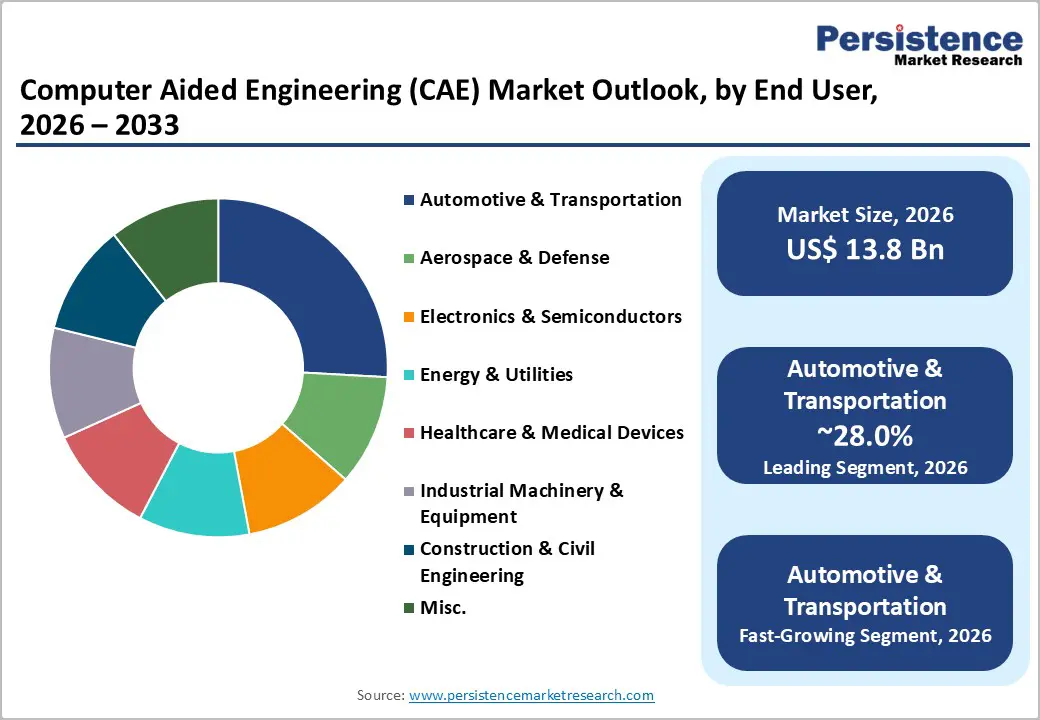

Automotive and transportation represent the leading end-use industry, commanding approximately 28% of the global market in 2026. Automotive manufacturers prefer CAE extensively for vehicle aerodynamics, crash simulation, thermal management design, and powertrain efficiency analysis, with electrification intensifying simulation requirements for battery thermal management, high-voltage system electromagnetic compatibility, and electric motor performance. European automotive manufacturers participate in initiatives such as the FLOWHEAD Project, developing advanced CFD workflows for vehicle aerodynamics, battery cooling, and HVAC optimization to reduce development timelines and enhance cost efficiency. The Computer Aided Engineering (CAE) Market captures substantial automotive spending as manufacturers compete through superior vehicle performance, faster model refreshments, and accelerated EV platform development, all dependent on CAE-enabled rapid virtual validation

Healthcare and Medical Devices emerge as the fastest-growing industries driven by regulatory compliance requirements, patient safety considerations, and accelerating medical device innovation cycles. Medical device manufacturers use CAE for biomechanical simulation of implants, fluid dynamics analysis of surgical instruments and diagnostic equipment, electromagnetic field analysis for MRI devices, and system-level modelling for complex diagnostic platforms. Regulatory mandates from the FDA, CE marking, and international standards (ISO 13485) increasingly require comprehensive simulation documentation demonstrating device safety and efficacy, creating regulatory drivers for CAE adoption.

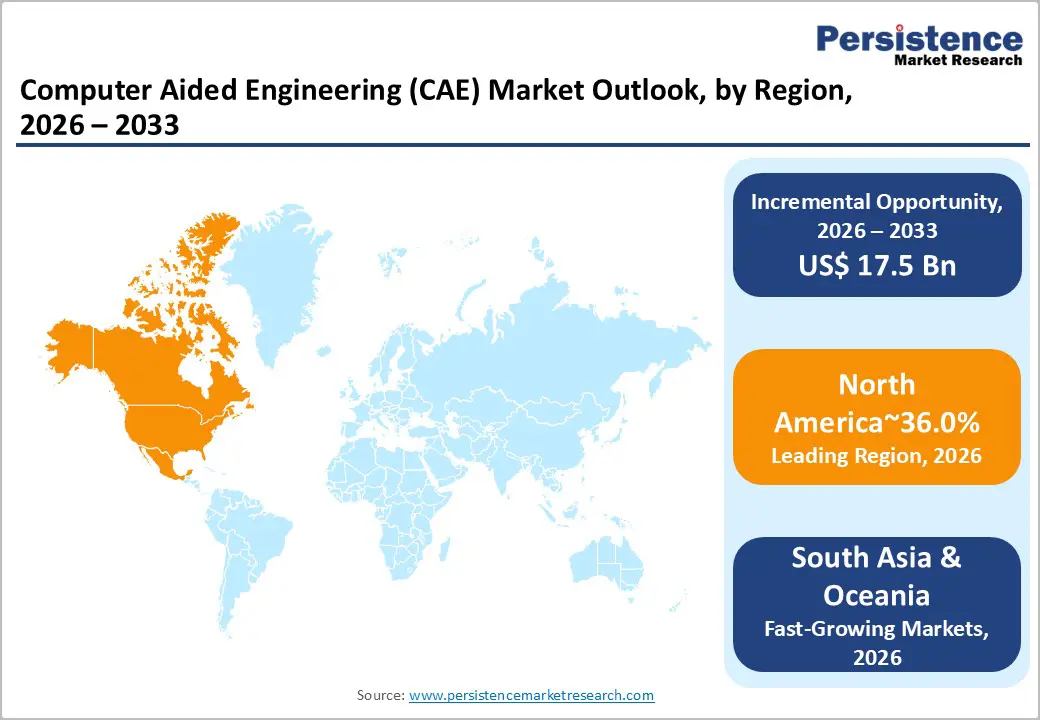

North America commands approximately 36% of the Global Computer Aided Engineering (CAE) Market, anchored by dominant aerospace & defence, automotive, and advanced manufacturing sectors. The U.S. aerospace and defence industry generated over $995 billion in total business activity in 2024, supporting 914,000 direct workers and generating $138.6 billion in exports, demonstrating the scale of engineering-intensive sectors dependent on CAE. NVIDIA's March 2025 announcement that leading CAE providers (Ansys, Altair, Cadence, Siemens, Synopsys) are accelerating simulation tools by up to 50x using Blackwell GPU acceleration exemplifies North American innovation leadership in CAE technology advancement.

The region hosts major CAE software vendors such as Ansys headquartered in Pittsburgh, Altair in Troy Michigan, Siemens Digital Industries Software with North American operations, creating concentrated competition and continuous product innovation cycles. Regulatory environments, including FDA medical device approval processes and NHTSA vehicle safety standards, create compliance drivers for CAE adoption across healthcare and automotive sectors. Investment trends favour AI-driven simulation automation, GPU acceleration integration, and cloud-based delivery models, with North American venture capital and corporate R&D funding substantial innovation initiatives in autonomous CAE and quantum computing integration.

East Asia represents approximately 22% in 2026, driven by automotive manufacturing concentration in China, Japan, and South Korea, alongside rapidly advancing aerospace and electronics sectors. Chinese automotive manufacturers competing globally require CAE capabilities for vehicle design optimisation, competitive feature parity with European and American manufacturers, and EV platform development supporting China's electrification ambitions.

The establishment of the "CIT Simulation Analysis Centre" at Changshu Institute of Technology in February 2023, through collaboration among BETA CAE Systems, Delft Software Technology, and academic institutions, exemplifies institutional commitment to building CAE expertise in Chinese manufacturing sectors.

East Asian semiconductor and electronics manufacturers utilise CAE for thermal management optimisation in high-density chip designs, electromagnetic compatibility analysis, and signal integrity simulation as device dimensions’ scale and performance requirements intensify. Government industrial policies emphasising advanced manufacturing and technology self-sufficiency drive public investment in CAE infrastructure and workforce development across China, Japan, and South Korea.

Europe represents approximately 24% of the computer-aided engineering (CAE) market, characterized by established aerospace & defense ecosystems, automotive manufacturing heritage, and stringent regulatory environments driving CAE adoption. European aerospace and defense turnover reached €325.7 billion in 2024, up 10.1% year-on-year, with direct employment at 1,103,000 and R&D investment reaching €23.4 billion, supporting the region's leadership in civil aeronautics and emerging defense modernization. EU-funded research initiatives such as the FLOWHEAD Project demonstrate institutional commitment to CAE innovation, enabling automotive manufacturers to optimise design efficiency and reduce development costs through advanced computational fluid dynamics.

The European Commission's emphasis on climate-neutral aviation and sustainable manufacturing reinforces CAE adoption for energy efficiency optimisation, emissions reduction, and circular economy principles. Regulatory environments, including CE marking, GDPR data residency requirements, and evolving automotive safety standards, create compliance drivers for comprehensive simulation documentation. Investment trends in Europe emphasise vendor-neutral CAE platforms, cloud-based solutions enabling distributed engineering teams, and integration of sustainability metrics into simulation workflows supporting Europe's green transition objectives.

The global computer-aided engineering (CAE) market is consolidated, dominated by a few major players with advanced technology portfolios and strong global presence. Leading companies such as Ansys, Dassault Systèmes, Siemens Digital Industries Software, Altair Engineering, PTC, and Autodesk hold significant market share, offering comprehensive solutions across structural, fluid, electromagnetic, and multiphysics simulations. These players leverage digital twin technologies, AI-infused simulation, and high-performance computing to enable faster product development, improved accuracy, and reduced time-to-market. The tech industry is highly driven by robust R&D investments and features high entry barriers, making it challenging for smaller companies to compete. Strategic partnerships, acquisitions, and cloud-based offerings are increasingly shaping competitive dynamics. Adoption of CAE across aerospace, automotive, industrial machinery, and healthcare sectors further fuels market growth. Overall, innovation, integration capabilities, and sector-specific solutions define leadership in this consolidated CAE market.

The global Computer Aided Engineering (CAE) market is projected to be valued at US$ 13.8 Bn in 2026.

The Automotive & Transportation segment is expected to account for approximately 28% of the global Computer Aided Engineering (CAE) market by end-use industry in 2026.

The market is expected to witness a CAGR of 12.4% from 2026 to 2033.

The growth of the global Computer Aided Engineering (CAE) market is driven by the acceleration of digital product development, virtual prototyping, and the integration of advanced technologies like AI, machine learning, and high-performance computing to optimize design, reduce costs, and shorten time-to-market.

Key opportunities in the global Computer Aided Engineering (CAE) market include the shift towards cloud-native, subscription-based services for cost-effective, scalable access to advanced simulations, and the integration of quantum computing to accelerate complex engineering simulations and enhance product development timelines.

Key players in the Computer Aided Engineering (CAE) market include ANSYS, Dassault Systèmes, Siemens Digital Industries Software, Altair Engineering, and MSC Software.

| Report Attribute | Details |

|---|---|

| Forecast Period | 2026 to 2033 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Billion for Value |

| Region Covered |

|

| Key Companies Covered |

|

| Report Coverage |

|

By Component Type

By Deployment Type

By Organization Size

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author