ID: PMRREP31847| 199 Pages | 19 Jan 2026 | Format: PDF, Excel, PPT* | Industrial Automation

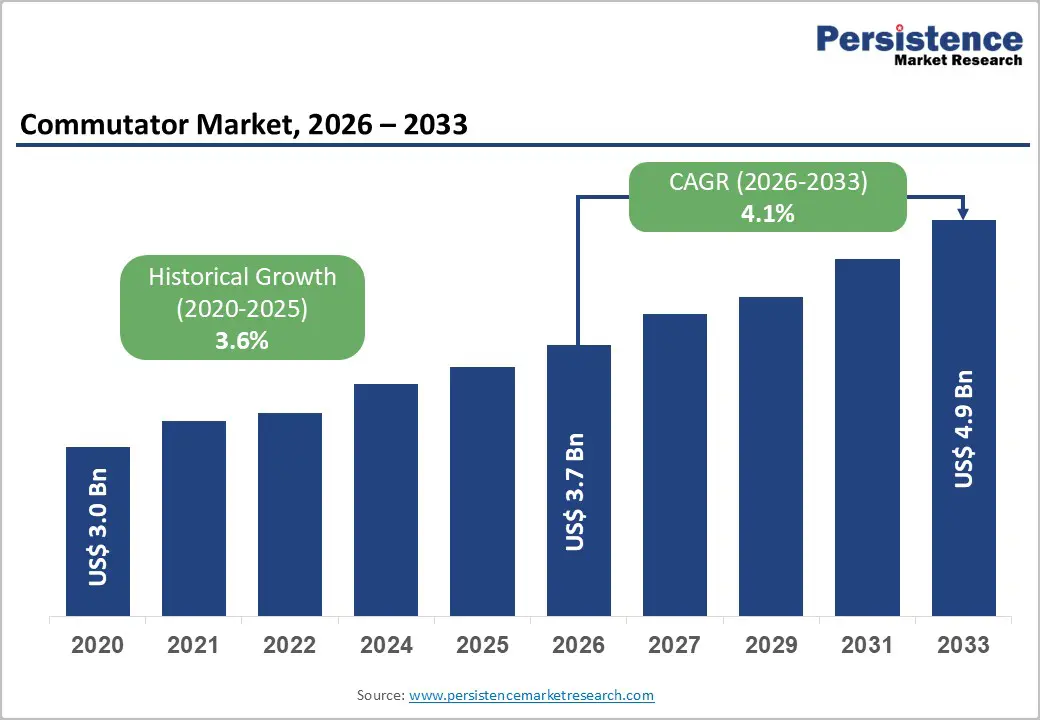

The global commutator market size is likely to be valued at US$3.7 billion in 2026, and is expected to reach US$4.9 billion by 2033, growing at a CAGR of 4.1% during the forecast period from 2026 to 2033, driven by the increasing prevalence of brushed DC motors in industrial machinery, rising demand for reliable commutators in railway traction, and advancements in copper and graphite material technologies.

Rising demand for durable, high-performance commutators, particularly in automotive and power tool applications, is driving wider adoption across industries. Ongoing advancements in silver- and aluminum-based alloys are further supporting this trend by improving conductivity and wear resistance. The growing awareness of the commutator’s role in enabling cost-efficient motor performance in emerging industrial markets remains a key factor driving market growth.

| Key Insights | Details |

|---|---|

| Commutator Market Size (2026E) | US$3.7 Bn |

| Market Value Forecast (2033F) | US$4.9 Bn |

| Projected Growth (CAGR 2026 to 2033) | 4.1% |

| Historical Market Growth (CAGR 2020 to 2025) | 3.6% |

The rising prevalence of mechanized industrial machinery reflects a fundamental shift in how manufacturing and processing industries operate. Companies are increasingly adopting mechanized systems to improve productivity, consistency, and operational efficiency in response to growing demand and competitive pressure. Mechanization reduces reliance on manual labor for repetitive, high-intensity, or precision-based tasks, enabling faster production cycles and minimizing human errors. This is particularly important in industries where uniform quality and high output volumes are critical.

Advancements in mechanical design, sensors, and control systems have made modern industrial machinery more reliable and adaptable across diverse applications. Machines can now be customized to handle a wide range of materials, production scales, and process complexities, enabling manufacturers to respond quickly to changing market requirements. Mechanized equipment also supports safer working environments by reducing worker exposure to hazardous processes and heavy loads. Although initial investments can be high, mechanized machinery lowers long-term operational costs.

High development and material costs present a significant barrier for companies advancing next-generation commutators and novel systems. Developing innovative grades such as high-conductivity silver, low-wear graphite, or lightweight aluminum requires extensive research, specialized forging, and advanced coating technologies, all of which are far more expensive than basic copper. Durability is an even greater challenge: many refined variants, high-speed lots, and low-spark products are sensitive to wear, heat, and arcing, requiring rigorous optimization to ensure they remain reliable throughout the lifecycle.

Achieving long-term performance often requires costly dynamometer trials, sophisticated testing, and the use of high-grade materials, thereby significantly increasing R&D expenditures. Meeting stringent regulatory expectations for noise levels, wear rates, and batch consistency requires multiple validation studies under various conditions and across several motor types. This adds both time and financial burden to development timelines. Scaling up manufacturing requires controlled foundries, specialized assembly lines, and quality-assurance systems, further driving up overall costs. For smaller manufacturers, these challenges can limit innovation or delay commercialization.

Advancements in high-conductivity and low-wear commutator delivery platforms are transforming the global motor landscape by addressing two major challenges: wear barriers and efficiency loss. High-conductivity platforms are engineered to achieve superior current transfer, reducing reliance on oversized brushes and enabling longer tool life. Innovations, such as silver-copper alloys, graphite composites, nanocoatings, and self-lubricating designs, significantly improve conductivity and reduce arcing, thereby lowering maintenance costs for industrial and automotive applications.

Progress in low-wear platforms, including diamond-coated copper, ceramic-graphite hybrids, modular segments, and precision machining, supports more durable operation by minimizing material loss, the commutator’s first line of defense against failure. These formats eliminate frequent replacements, extend lifespan, and enable versatile use without performance trade-offs, making them highly suitable for mass motor programs. New technologies such as laser etching, bio-adhesive coatings, and VLP-based monitoring further enhance longevity and response.

Copper is anticipated to dominate the market, accounting for approximately 60% of the market share in 2026. Its dominance is driven by superior conductivity, high durability, and cost-effectiveness, making it preferred for electric motors. Copper provides excellent current transfer, ensures longevity, and contributes to performance, making it suitable for large-scale motor campaigns. The Tesla Roadster is also the first commercially available automobile to feature an electric motor with a copper rotor. This innovative advancement in metallurgical technology increases efficiency, resulting in greater overall power and longer operating distances between charges.

Silver represents the fastest-growing segment, due to its ultra-high conductivity and expanding use in high-speed applications. Its premium profile makes it ideal for targeted performance, reducing resistance. Continuous innovations in silver alloys are further strengthening their appeal, driving rapid adoption across North America and Europe, where demand for high-efficiency commutators is accelerating. Checon, LLC, a U.S. manufacturer specializing in high-performance silver alloy electrical contacts and assemblies, produces components using silver and silver-based alloys for demanding applications such as motor starters, electric vehicle DC contactors, industrial switchgear, and power distribution systems.

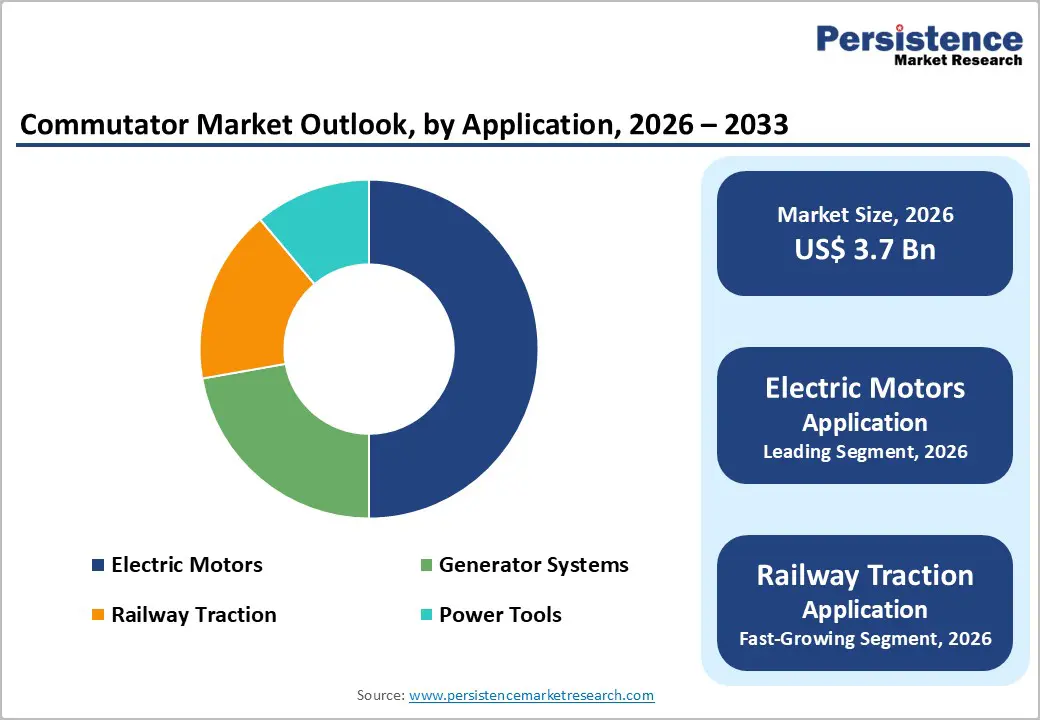

Electric motors lead the market, holding approximately 70% of the share in 2026, driven by widespread use, large motor programs, and strong global demand for DC applications. Their dominance continues as industries expand their machinery. Rising adoption of generator systems and expanded railway traction campaigns highlight the growing focus on multi-sector benefits. Siemens’ SIMOTICS DC motor range supports commutator-equipped motors with detailed maintenance instructions for commutator inspection, refurbishment, and servicing, reflecting the company’s role in supplying and sustaining these critical components for industrial use.

Railway traction is likely to be the fastest-growing segment, due to strong momentum in electrification and expanding inclusion in high-speed trains. The growing shift toward reliable platforms, along with greater durability, is accelerating adoption. Advancements in heavy-duty grades and the continued progress of traction motors entering production trials drive market growth. Siemens introduced new lines of energy-efficient AC and traction motors for industrial automation systems and railway traction applications, offering enhanced performance, reduced energy consumption, and improved lifecycle reliability.

Industrial machinery is likely to dominate the market, with approximately 45% share in 2026, driven by the high volume of DC motors and the strong global emphasis on reliable operation. Regular machinery schedules, performance requirements, and widespread access to copper commutators drive consistent demand. Rising focus on automotive and consumer electronics further strengthens industrial leadership. Siemens AG’s industrial motor deployments illustrate how industrial machinery continues to dominate the motor market. Siemens supplies a broad range of industrial motors that power critical equipment, including pumps, compressors, conveyors, and material-handling systems, in manufacturing plants around the world. These motors are designed for high reliability and continuous operation, meeting the stringent performance requirements of heavy industrial applications.

The automotive segment is likely to be the fastest-growing field, driven by rising demand for starter motors, increased susceptibility to wear, and expanding adoption of electric auxiliaries. Improved efficiency, tailored grades, and stronger integration for EV components support rapid uptake. The growing use of aerospace and consumer electronics in the high-tech sector further accelerates market growth. Mabuchi produces over 1.4 billion motors annually, with approximately 64% of its sales from automotive applications, including door mirrors, locks, actuators, and starter and auxiliary motors used in hybrid and electric vehicles.

Growth in North America is driven by the region’s well-established industrial machinery base, strong research and development ecosystem, and high awareness of the reliability advantages offered by advanced components. Manufacturing networks in the U.S. and Canada provide robust support for motor programs, enabling broad availability of commutators across the automotive, industrial equipment, and consumer electronics sectors.

Rising demand for copper-based, user-friendly, and easy-to-maintain designs is further accelerating adoption, as these solutions enhance performance while addressing the limitations of alternative technologies. Continuous innovation in commutator technology, including stable graphite formulations, improved aluminum integration, and targeted wear-resistance enhancements, is attracting substantial investments from both public and private stakeholders. Government initiatives and industrial programs aimed at reducing downtime, improving efficiency, and addressing emerging electrification challenges are also sustaining market momentum. Expanding emphasis on railway-grade and specialized applications, particularly in the aerospace and other niche sectors, is also broadening the scope of commutator adoption.

Europe is witnessing a steady growth in increasing awareness of reliability benefits, strong industrial systems, and government-led efficiency programs. Countries such as Germany, France, and the U.K. have well-established manufacturing frameworks that support routine motor use and encourage the adoption of innovative commutator delivery methods, including copper and graphite. These durable formulations are particularly appealing for industrial populations, regulation-conscious operators, and automotive users, improving longevity and coverage rates.

Technological advancements in commutator development, such as enhanced wear resistance, application-targeted delivery, and improved lightweight grades, are further boosting market potential. European authorities are increasingly supporting research and trials for commutators against both routine and specialized needs, strengthening market confidence. The growing emphasis on convenient, low-maintenance options is aligned with the region’s focus on preventive machinery management and reducing downtime. Public awareness campaigns and promotion drives are expanding the reach in both urban and rural areas, while suppliers are investing in materials and novel variants to increase efficacy.

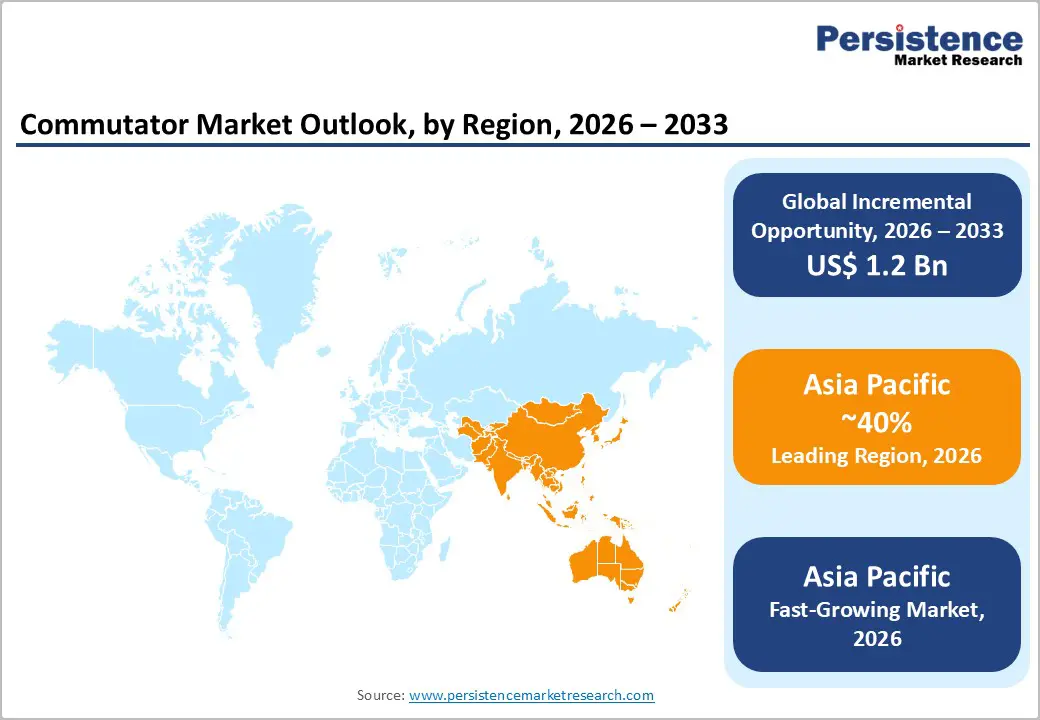

Asia Pacific is the dominant and fastest-growing region, accounting for over 40% of the market share in 2026, supported by rising industrial awareness, increasing government initiatives, and expanding application programs across the region. Countries such as India, China, Japan, and Southeast Asian nations are actively promoting motor campaigns to address manufacturing growth and emerging railway needs. Commutators are particularly attractive in these regions due to their cost-effective administration, ease of scaling, and suitability for large-scale motor drives in both urban and rural populations.

Technological advancements are enabling the development of stable, effective, and easy-to-maintain commutators that can withstand challenging operational conditions and minimize wear dependence. These innovations are critical for reaching remote facilities and improving overall motor coverage. The growing demand for electric motors, railway traction, and power tool applications is driving market expansion. Public-private partnerships, increased industrial expenditure, and rising investments in material research and manufacturing capacity are further accelerating growth. The convenience of commutator delivery, combined with improved durability and reduced risk of failure, positions commutators as a preferred choice.

The global commutator market is characterized by competition between established electrical leaders and emerging regional manufacturers. In North America and Europe, Mitsubishi Electric and Siemens lead through strong R&D, distribution networks, and industry ties, bolstered by innovative grades and performance programs. In the Asia Pacific, Nidec Corporation advances with localized solutions, enhancing accessibility. Copper-based solutions enhance electrical conductivity, reduce wear-related risks, and support large-scale integration across global markets. Strategic partnerships, collaborations, and acquisitions combine technical expertise, broaden product portfolios, and accelerate commercialization timelines. Lightweight material formulations address efficiency challenges, supporting deeper penetration in electric vehicle-related applications.

The global commutator market is projected to reach US$3.7 billion in 2026.

The rising prevalence of brushed DC motors in industrial machinery and the demand for reliable commutators are the key drivers.

The commutator market is poised to witness a CAGR of 4.1% from 2026 to 2033.

Advancements in self-adjusting technologies and lightweight commutator designs represent the primary market opportunities, as they enhance efficiency, extend service life, and support adoption across a wider range of applications.

Mitsubishi Electric, Siemens, General Electric, Schneider Electric, and ABB are the key players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Material Type

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author