ID: PMRREP29554| 210 Pages | 7 Jan 2026 | Format: PDF, Excel, PPT* | Food and Beverages

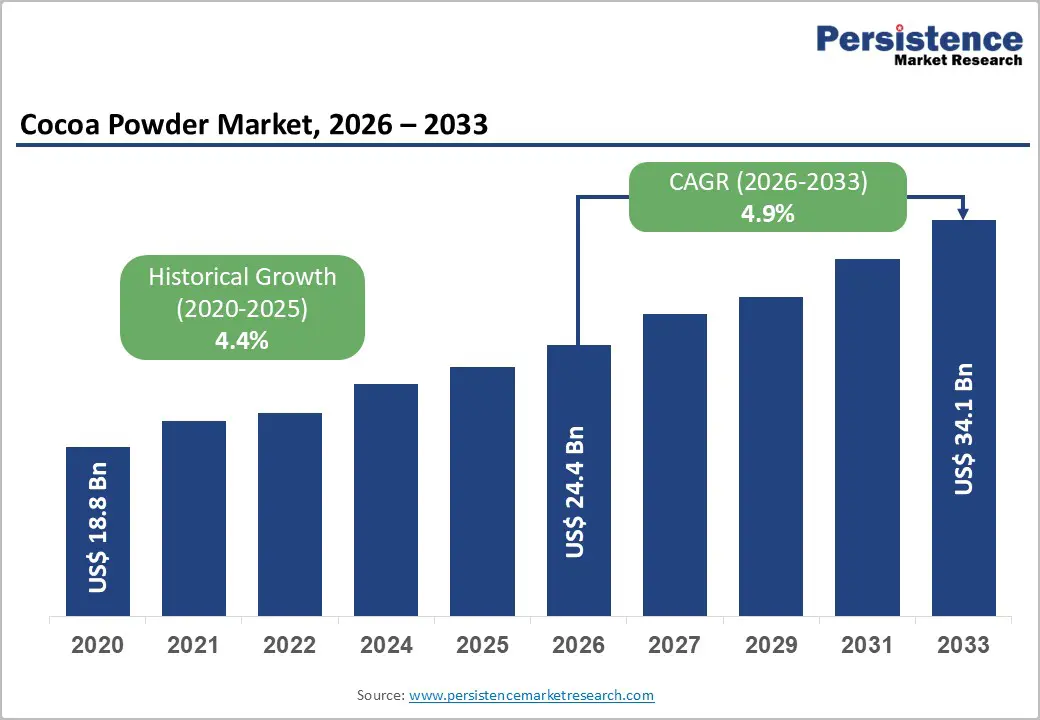

The global cocoa powder market size is likely to be valued at US$24.4 billion in 2026, and is expected to reach US$34.1 billion by 2033, growing at a CAGR of 4.9% during the forecast period from 2026 to 2033, driven by the increasing prevalence of premium chocolate consumption, rising demand for natural and Dutch-processed cocoa powder in bakery and beverages, and advancements in high-flavanol extraction technologies.

Rising demand for versatile, antioxidant-rich cocoa powder, particularly in the food & beverage and nutraceutical sectors, is driving adoption across various applications. Innovations in blended and organic varieties are further enhancing uptake by providing more flavorful, health-oriented options. The growing acknowledgment of cocoa powder as an essential ingredient for indulgent yet functional products, especially in emerging markets, continues to be a key growth driver.

| Key Insights | Details |

|---|---|

| Cocoa Powder Market Size (2026E) | US$24.4 Bn |

| Market Value Forecast (2033F) | US$34.1 Bn |

| Projected Growth (CAGR 2026 to 2033) | 4.9% |

| Historical Market Growth (CAGR 2020 to 2025) | 4.4% |

Global demand for premium chocolate is steadily increasing as consumers seek high-quality, indulgent confectionery experiences that go beyond standard mass-market options. Premium chocolate is distinguished by superior ingredients, artisanal craftsmanship, higher cocoa content, and ethical sourcing, qualities that appeal to discerning buyers.

Several factors are driving this growth. Rising disposable incomes in both developed and emerging markets enable consumers to spend more on luxury and premium food products. The growing interest in organic, ethically sourced, and unique flavor profiles is encouraging a shift toward high-end chocolates. Gifting occasions and seasonal demand also contribute, as premium chocolate is often selected as an elegant present. Expanding online retail channels further enhances accessibility, extending the reach of artisanal and specialty chocolate products.

Price volatility and fluctuations in raw materials pose a significant challenge for the cocoa powder market, largely due to its heavy reliance on cocoa beans as the primary input. Cocoa production is concentrated in a few geographic regions, making supply highly vulnerable to external factors such as unpredictable weather, prolonged droughts, excessive rainfall, and crop diseases. Any disruption in harvest volumes directly affects bean availability, leading to sudden price spikes or drops. The shifts in farming practices, labor shortages, and rising input costs further contribute to raw material price instability.

Global market factors, including currency fluctuations and trade policies, also impact cocoa bean prices, creating uncertainty for manufacturers. Consequently, cocoa powder producers often struggle to maintain consistent pricing and stable profit margins. Frequent price changes complicate long-term agreements with food and beverage manufacturers and hinder effective cost planning. Smaller processors are especially affected, as they have limited capacity to absorb cost increases or mitigate market risks.

Advances in high-flavanol and clean-label cocoa powder delivery platforms are reshaping the global ingredient market by tackling two key challenges: nutrient loss and consumer trust. High-flavanol platforms are designed to retain 2-3 times more antioxidants, reducing dependence on extensive processing and enabling health claims in supplements. Techniques such as gentle drying, non-alkalized extraction, micronization, and antioxidant coating enhance potency, minimize bitterness, and lower formulation costs for brands and wellness initiatives.

Clean-label cocoa powders, such as organic natural varieties, non-GMO Dutch-processed options, roux blends, and fully traceable products, enhance transparency by minimizing additives and meeting consumer expectations for clean ingredients. These formats eliminate unnecessary chemicals, improve flavor, and provide versatile applications without relying on masking agents, making them well-suited for large-scale functional formulationsThe emerging technologies, including enzymatic debittering, bio-fortification, and advanced encapsulation methods, further enhance both taste and nutrient retention.

Natural cocoa powder is anticipated to dominate, accounting for approximately 50% of the revenue share in 2026. Its dominance is driven by authentic flavor, high flavanol content, and clean-label appeal, making it preferred for premium applications. Natural cocoa powder provides antioxidant benefits, ensures authenticity, and contributes to health positioning, making it suitable for large-scale beverage campaigns. For instance, Cargill’s NF Natural Cocoa Powder is widely used by food and beverage manufacturers for its authentic chocolate flavor and high flavanol content, making it a popular choice in premium hot chocolate mixes, specialty beverages, and functional drink formulations. Its retention of natural compounds supports antioxidant positioning, aligning with consumer health trends.

Dutch-processed cocoa powder is currently the fastest-growing segment, driven by its mild flavor and increasing use in bakery applications. Its alkalized profile enhances smoothness and reduces acidity, making it particularly suited for recipes that require a balanced taste. Ongoing innovations in processing are further expanding its versatility, fueling strong adoption across North America and Europe, where demand for baking-friendly cocoa continues to rise. Products such as Van Houten Cocoa Powder-Dark Brown Original Dutch Processed and Callebaut Cocoa Powder exemplify this trend. By neutralizing acidity and delivering a smoother taste with a richer color, these cocoa powders are highly valued by bakeries, pastry chefs, and large-scale commercial baking operations that rely on consistent flavor and texture.

Forastero is projected to maintain its leadership, accounting for roughly 70% of revenue in 2026, driven by high yields, large-scale production programs, and a strong global supply for bulk cocoa powder. Its dominance continues as processors increasingly scale up volume. At the same time, growing interest in Criollo premium and expanded Trinitario campaigns reflects an increasing emphasis on flavor diversity. Barry Callebaut AG, one of the world’s largest cocoa processors and chocolate manufacturers, sources significant volumes of Forastero beans from West Africa, ensuring consistent quality and supply for bulk cocoa powder and mass-market chocolate products. This dependable sourcing enables Barry Callebaut to reliably fulfill large commercial contracts with food and beverage producers worldwide.

Criollo is expected to be the fastest-growing segment, fueled by strong momentum in the gourmet sector and rising inclusion in luxury chocolate offerings. The shift toward fine-flavor cocoa, with its superior aroma and taste profile, is accelerating adoption. Innovations in small-batch sourcing and the introduction of premium blends into consumer trials are driving growth. For example, London-based artisan chocolatier Rococo Chocolates partnered with Italian chocolate producer Domori to launch a “Cru Criollo” truffle, made entirely from rare Venezuelan Criollo beans. Highlighting Criollo’s exceptional smoothness, low bitterness, and complex flavor, this high-end confection commands a premium price and reinforces consumer interest in fine-flavor chocolate.

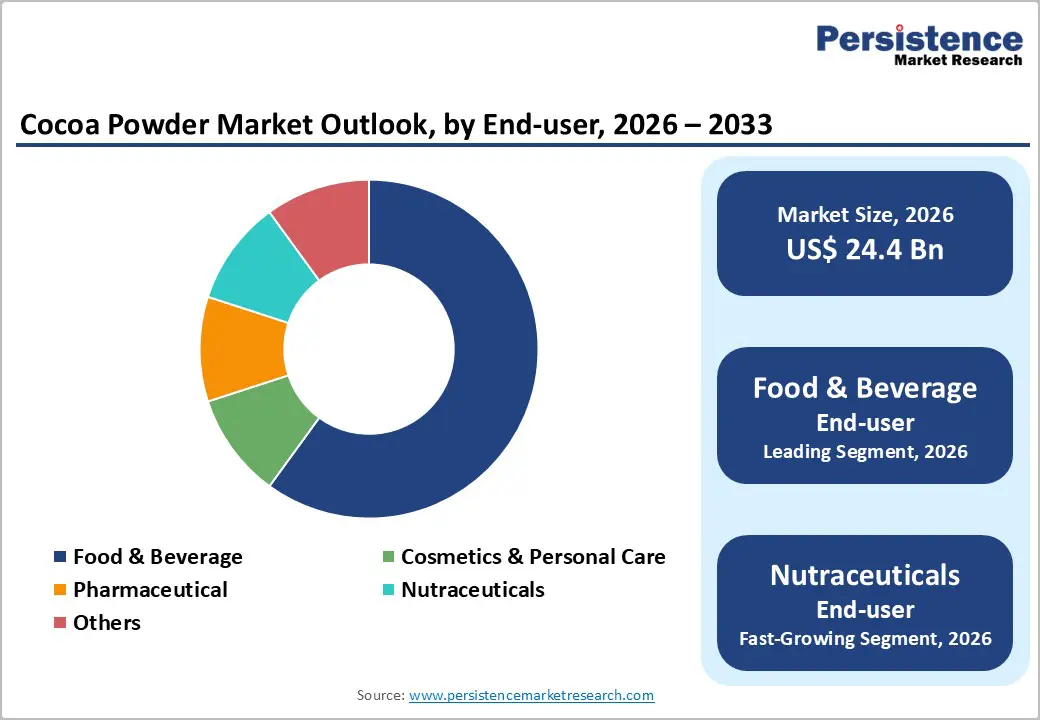

The food and beverage segment is expected to remain dominant, accounting for nearly 60% of revenue in 2026, as it continues to serve as the primary hub for chocolate and bakery applications, large-scale formulation programs, and diverse products requiring rich flavor. Strong operational integration, trained culinary teams, and the ability to manage both high-volume and premium blends drive higher consumption. The sector is also leading natural cocoa rollouts and pioneering trials with emerging Dutch-processed powders. Conagra Brands’ Swiss Miss hot cocoa mixes, made from cocoa powder, illustrate this trend, selling tens of millions of boxes annually in the U.S. alone and demonstrating cocoa powder’s revenue-driving role in ready-to-drink and instant beverage formats.

The nutraceutical segment is poised to be the fastest-growing, fueled by its strong wellness positioning and expanding use in antioxidant supplements. These products provide convenient, accessible health benefits, appealing to consumers seeking functional, low-calorie options. Increased outreach programs, a focus on flavanol content, and broader availability of both routine and premium powders are accelerating adoption in urban and semi-urban markets. For example, CocoActiv™ cocoa flavanol extract, developed through a partnership between Barry Callebaut and Naturex (now Givaudan), is designed specifically for dietary supplements and carries a European health claim for supporting blood circulation. Incorporated into pills and functional products, these flavanol-rich extracts highlight the growing role of cocoa derivatives in the nutraceutical industry.

North America’s growth is driven by the region’s advanced confectionery infrastructure, strong R&D capabilities, and high public awareness of flavanol benefits. Processing facilities in the U.S. and Canada support extensive formulation programs, ensuring broad availability of cocoa powder across food & beverage, nutraceutical, and cosmetic applications. Rising demand for natural, convenient, and easy-to-use formats is further accelerating adoption, as these products enhance flavor and reduce challenges associated with imports.

Technological innovation in cocoa powder, including stable high-flavanol formulations, improved Dutch-processed options, and targeted clean-label enhancements, is attracting substantial investment from both public and private sectors. Government initiatives and health campaigns continue to promote cocoa’s benefits against oxidative stress, indulgence trends, and emerging wellness concerns, sustaining market demand. The growing interest in organic grades and specialty applications, particularly in bakery, is broadening the range of opportunities for cocoa powder in North America.

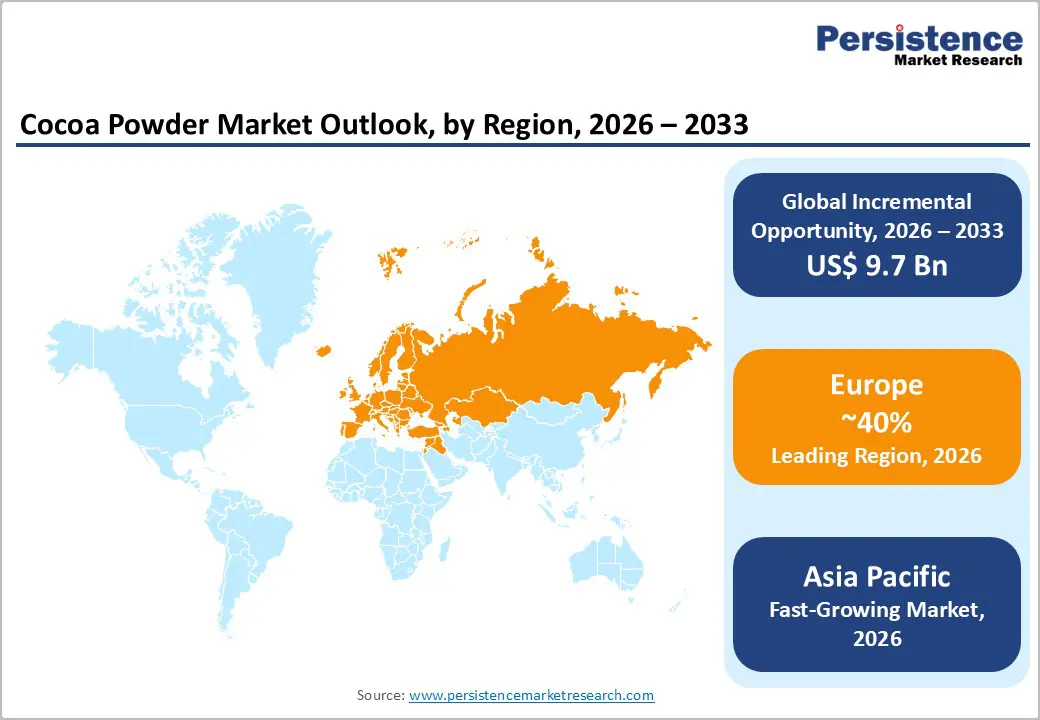

Europe is projected to lead the cocoa powder market with a 40% share in 2026, driven by growing awareness of premium benefits, strong chocolate manufacturing infrastructure, and government-led sustainability initiatives. Countries, including Germany, France, and Belgium, have well-established confectionery systems that support routine use and encourage adoption of innovative cocoa powder delivery methods. These enriched formulations appeal to bakery professionals, health-conscious consumers, and nutraceutical users, enhancing both indulgence and product coverage.

Technological advancements, such as improved flavanol retention, application-specific delivery, and higher-quality organic grades, are further expanding market potential. European authorities are increasingly backing research and trials for powders that address both routine and specialized applications, boosting market confidence. The rising demand for convenient, clean-label options aligns with the region’s focus on preventive wellness and reducing synthetic additives. Public awareness campaigns are expanding reach in urban and rural areas alike, while suppliers continue investing in processing innovations and novel variants to enhance product efficacy.

Asia Pacific is expected to be the fastest-growing market for cocoa powder, driven by rising indulgence awareness, expanding government initiatives, and broader application programs across the region. Countries such as India, China, Japan, and Southeast Asian nations are actively promoting cocoa powder to support bakery growth and emerging functional needs. Its versatility, ease of processing, and suitability for large-scale confectionery production make cocoa powder particularly appealing in both urban and rural markets.

Technological advancements are enabling the development of stable, effective, and easy-to-formulate cocoa powders that withstand challenging climatic conditions and reduce nutrient degradation. These innovations are crucial for reaching remote facilities and ensuring consistent flavor quality. Growing demand across food & beverage, nutraceutical, and cosmetic applications is further driving market expansion. Public-private partnerships, rising indulgence spending, and increased investment in processing research and manufacturing capacity are accelerating growth. The convenience of powder delivery, combined with enhanced richness and minimized risk of blandness, reinforces cocoa powder as a preferred choice in the region.

The global cocoa powder market is shaped by competition between established chocolate leaders and emerging specialty processors. In North America and Europe, companies such as Barry Callebaut and Cargill, Incorporated, lead through robust R&D, extensive distribution networks, and strong industry relationships, supported by innovative grades and flavor programs. In Asia Pacific, Olam International Limited is driving growth with localized solutions that improve accessibility. High-flavanol delivery platforms enhance efficacy, reduce oxidation, and enable widespread integration across regions. Strategic partnerships, collaborations, and acquisitions are helping companies combine expertise, expand sourcing capabilities, and accelerate commercialization. Organic formulations address sustainability concerns, facilitating penetration into premium market segments.

The global cocoa powder market is projected to reach US$24.4 billion in 2026.

The rising prevalence of premium chocolate consumption and demand for natural cocoa powder are key drivers.

The cocoa powder market is poised to witness a CAGR of 4.9% from 2026 to 2033.

Advancements in high-flavanol and clean-label delivery platforms are key opportunities.

Barry Callebaut, Cargill, Incorporated, Olam International Limited, Nestlé, and Mars, Incorporated are the key players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Cocoa Variety

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author