ID: PMRREP32828| 140 Pages | 30 Oct 2025 | Format: PDF, Excel, PPT* | Healthcare

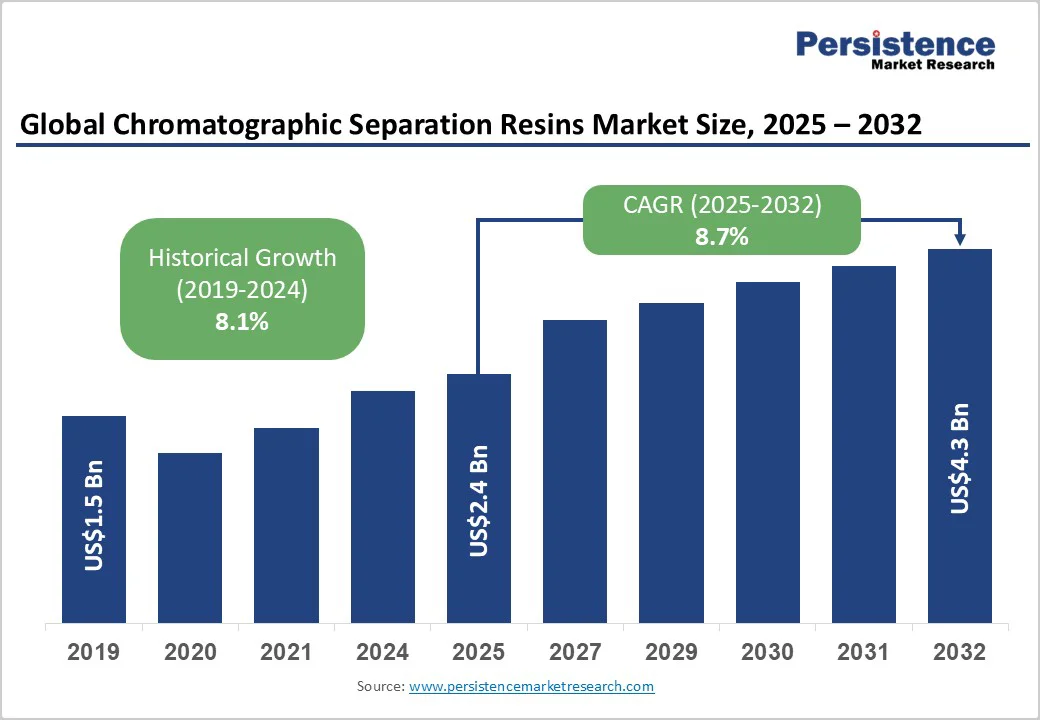

The global chromatographic separation resins market size is likely to be valued at US$2.4 Billion in 2025 and is estimated to reach US$4.3 Billion in 2032, growing at a CAGR of 8.7% during the forecast period 2025 - 2032, driven by the surging demand for high-purity biologics, including monoclonal antibodies, recombinant proteins, and novel therapies.

| Key Insights | Details |

|---|---|

| Chromatographic Separation Resins Market Size (2025E) | US$2.4 Bn |

| Market Value Forecast (2032F) | US$4.3 Bn |

| Projected Growth (CAGR 2025 to 2032) | 8.7% |

| Historical Market Growth (CAGR 2019 to 2024) | 8.1% |

The surging focus on biologics such as monoclonal antibodies, recombinant proteins, vaccines, and gene therapies is boosting the requirement for high-efficiency chromatographic resins. These complex molecules require precise purification to maintain stability and efficacy, making high-binding capacity and selective resins essential.

The U.S. Food and Drug Administration (FDA) approved over 55 biologics in 2024, reflecting the accelerating pace of development in this field. Companies are developing specialized resins customized to emerging modalities, including bispecific antibodies and viral vectors, used in gene therapy. For instance, in 2025, Cytiva and Purolite launched new Protein A and affinity resins designed specifically for high-yield purification of these unique therapeutics.

Regulatory agencies such as the FDA and EMA have strengthened quality and safety requirements for biopharmaceutical production, compelling manufacturers to integrate superior and validated purification technologies. High-performance chromatographic resins deliver superior reproducibility, impurity removal, and extensibility, complying with cGMP and quality-by-design principles.

Recent updates to the EU GMP Annex 1 guidelines have emphasized contamination control, which has pushed biomanufacturers to use resins with high chemical stability and consistent batch performance. To meet these standards, companies such as Merck and Sartorius have launched resins engineered for greater alkaline tolerance and extended reuse cycles, ensuring compliance while lowering production risks.

One of the key challenges in chromatographic separation is the extended time required for purification, especially when dealing with large or complex biomolecules. The process often involves multiple stages, such as equilibration, sample loading, washing, and elution, each of which can be slow and labor-intensive. When scaling up for industrial applications, additional steps such as filtration and column regeneration further prolong turnaround times.

Although multi-column continuous chromatography systems have been developed to shorten processing times, most biologics manufacturers still rely on batch operations, which lengthen production cycles and delay product release.

Chromatographic purification requires expensive columns, high-quality resins, and large volumes of solvents and buffers, making it one of the costliest stages in biomanufacturing. Automated systems, while improving reproducibility, demand significant upfront investments and ongoing maintenance expenses. The cost of resins such as protein A is specifically high, accounting for a major share of downstream processing budgets.

Stringent cleaning and validation requirements further increase utility consumption and waste management costs. Although reusable and alkaline-stable resins are emerging to mitigate expenses, frequent replacement due to fouling or performance loss still adds to operational burdens, limiting cost-efficiency for small and mid-sized manufacturers.

The development of synthetic and hybrid resins is creating new opportunities for improving separation efficiency in complex bioprocesses. Mixed-mode resins that combine ion-exchange and hydrophobic interaction mechanisms allow for better selectivity and high recovery of challenging biomolecules such as antibody fragments and fusion proteins.

Cytiva and Repligen are investing in engineered polymer backbones that provide superior mechanical strength and chemical stability, enabling long resin lifespans and low cleaning requirements. In 2025, Merck introduced new mixed-mode resins under its Eshmuno platform optimized for continuous bioprocessing, demonstrating how hybrid resin chemistries are evolving to meet modern purification challenges.

Ongoing research into resin pore structures is unlocking potential for fast and efficient biomolecule transport within chromatography columns. By customizing pore size distribution and surface area, manufacturers can achieve high binding capacity and reduced diffusion limitations. These are essential for purifying large molecules such as viral vectors and plasmid DNA.

Recent studies from academic-industry collaborations in the U.S. and Japan have shown that resins with hierarchical pore designs can improve separation resolution in anion exchange chromatography by up to 40%. Such structural innovations are paving the way for next-generation resins that deliver quick processing times without compromising product purity or yield.

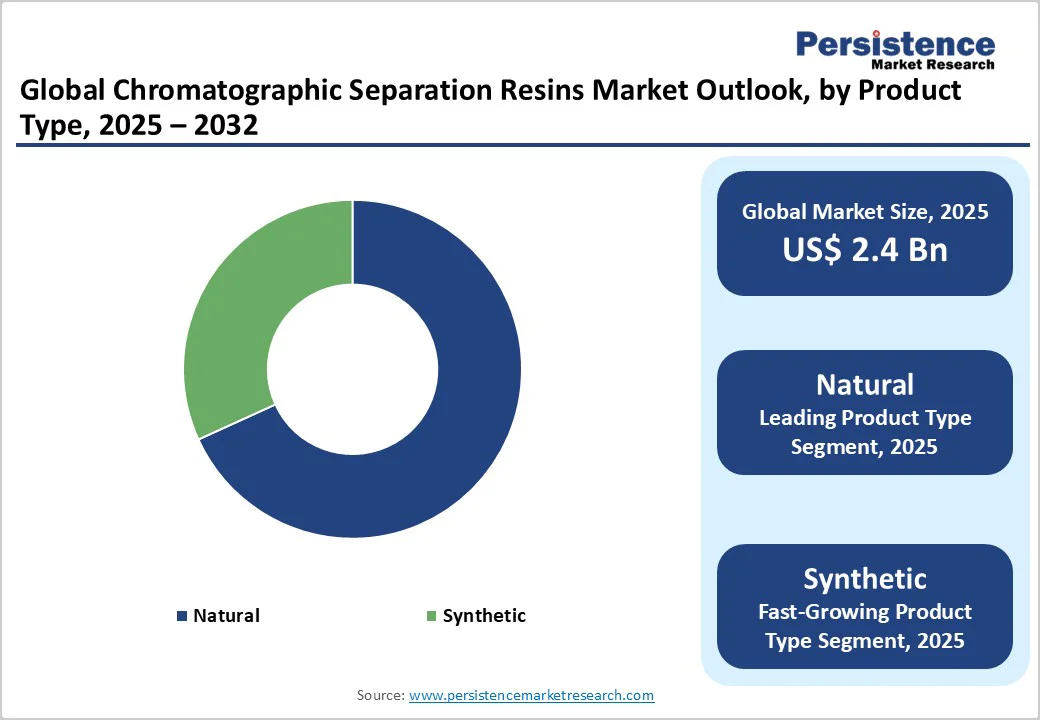

Natural chromatographic separation resins are expected to lead with nearly 68.2% of the share in 2025. These are widely preferred due to their biocompatibility and mild interaction with sensitive biomolecules. These resins deliver excellent hydrophilicity and minimal non-specific binding, making them ideal for purifying fragile proteins, enzymes, and antibodies without denaturation. Natural resins’ compatibility with biological systems ensures consistent product quality during large-scale bioprocessing.

Synthetic resins are gaining traction due to their superior chemical and mechanical stability, especially under harsh cleaning and continuous processing conditions. These resins, often made from polymethacrylate or polystyrene, can withstand strong alkaline solutions used in clean-in-place systems, extending operational life and reducing replacement costs. Their tunable pore structures also enable precise separation of complex biomolecules such as viral vectors and oligonucleotides.

Affinity chromatography is projected to capture approximately 31.5% of share in 2025 due to its unmatched selectivity and ability to achieve high purity in a single step. It is particularly essential in monoclonal antibody and recombinant protein production, where protein A-based resins can bind specifically to the target molecule. The efficiency of this method reduces downstream processing steps and total production time.

Anion Exchange Chromatography (AEX) is gaining momentum due to its effectiveness in removing impurities such as DNA, endotoxins, and host cell proteins during biopharmaceutical purification. Its versatility makes it suitable for polishing steps in monoclonal antibody and vaccine production. Recent studies have shown that optimized AEX membranes and resins can achieve high flow rates and impurity clearance without compromising recovery.

Biopharmaceutical companies are speculated to hold around 46.3% of the share in 2025, backed by their demand for high-purity biologics such as monoclonal antibodies, recombinant proteins, and gene therapy vectors. These companies rely on chromatography to meet stringent quality and regulatory requirements for product safety and efficacy. With rising FDA approvals for biologics, over 50 in 2024, the demand for novel resins continues to increase.

Clinical Research Organizations (CROs) are emerging as key users of chromatographic resins as they handle complex analytical and purification tasks for multiple clients. CROs conduct large volumes of bioanalytical testing, requiring precise separation of proteins, metabolites, and biomarkers. Their rising involvement in early-stage biologics development and biosimilar studies has expanded the use of small-scale chromatography systems for method development and validation.

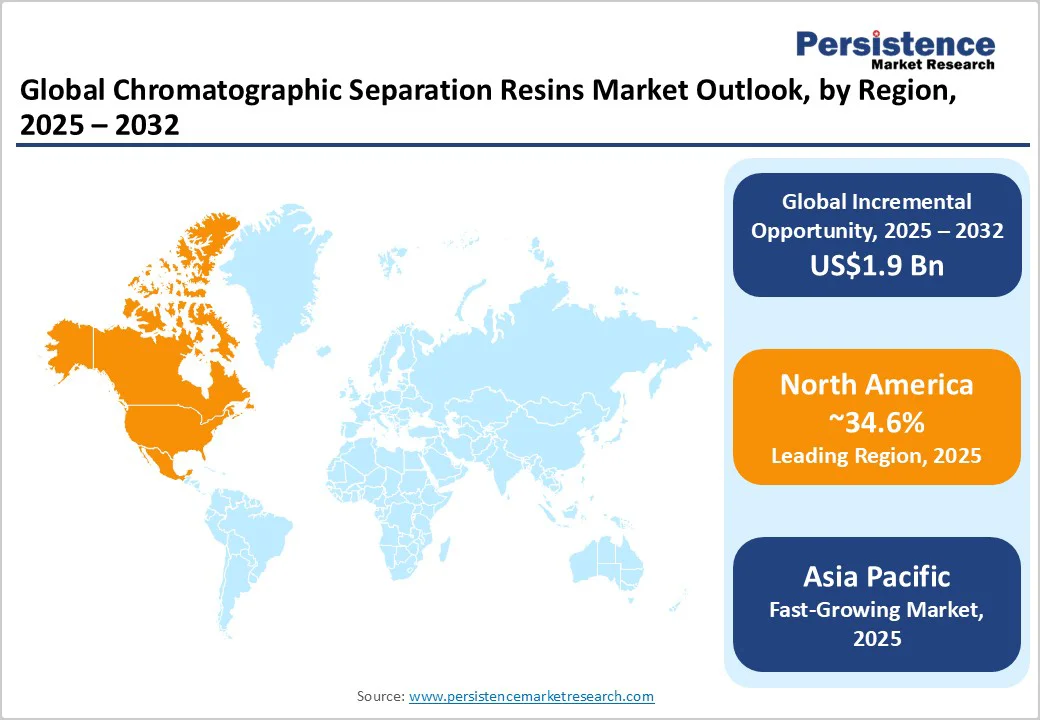

North America is estimated to account for approximately 34.6% of the share in 2025, owing to high demand from the biopharmaceutical and contract manufacturing sectors, especially in the U.S. Companies are investing heavily in domestic resin production to reduce supply chain risks exposed during the pandemic.

For instance, Cytiva expanded its manufacturing capacity in Massachusetts and New Jersey as part of its global US$1.5 Billion investment plan to boost resin output and ensure supply security for local biopharma clients.

Ecolab’s Purolite has strengthened its resin production and research and development presence in Pennsylvania, focusing on high-performance protein A resins for monoclonal antibody purification. The region’s focus is now on onshoring, process efficiency, and novel resins that can withstand continuous and high-throughput bioprocessing.

In Asia Pacific, the market is witnessing rapid expansion due to a surge in biologics manufacturing in China, India, and South Korea. Regional governments are supporting local production of biologics and biosimilars, pushing the demand for cost-effective and high-capacity resins. Cytiva has recently opened resin manufacturing lines in China to serve domestic CDMOs and reduce dependence on imports.

South Korea’s surging biopharma ecosystem, led by companies such as Samsung Biologics and Celltrion, is also fueling partnerships with global resin suppliers to localize purification solutions. Meanwhile, India-based players are collaborating with multinational firms to expand resin availability for vaccine and biosimilar production. The focus here is on localization, affordability, and technological transfer to strengthen regional self-sufficiency.

In Europe, the market is more mature and innovation-driven, with rising emphasis on process intensification and sustainability. Cytiva’s Uppsala facility in Sweden remains one of the world’s key resin production hubs, recently upgraded to double output and integrate unique automation.

Merck KGaA and Sartorius are also leading developments in eco-efficient resins designed for high durability and alkaline stability, supporting continuous manufacturing processes that reduce waste and operating costs.

Europe further benefits from a dense network of biotech clusters in Germany, the U.K., and Switzerland, where collaboration between resin manufacturers and biopharma companies propels innovation. The region’s competitive edge lies in advanced research capabilities, regulatory reliability, and ongoing adoption of high-performance resin chemistries customized for next-generation biologics.

The global chromatographic separation resins market is highly consolidated, dominated by a few major players such as Cytiva (Danaher), Merck KGaA, Sartorius, Thermo Fisher Scientific, Purolite (Ecolab), Bio-Rad, and Repligen. These companies lead the market with superior portfolios of Protein A, ion-exchange, and multimodal resins essential for biopharmaceutical purification.

New entrants or regional suppliers mainly compete on cost or focus on niche resin types. However, large-scale biologics manufacturers usually prefer established brands due to their reliability and global supply assurance.

The chromatographic separation resins market is projected to reach US$2.4 Billion in 2025.

Expanding production of complex biologics and the shift toward single-use bioprocessing are the key market drivers.

The chromatographic separation resins market is poised to witness a CAGR of 8.7% from 2025 to 2032.

The development of alkaline-stable Protein A resins and innovations in resin pore architecture are the key market opportunities.

Bio-Rad Laboratories, Inc., Agilent Technologies, and Thermo Fisher Scientific Inc. are a few key market players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Technology

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author