ID: PMRREP35683| 180 Pages | 7 Oct 2025 | Format: PDF, Excel, PPT* | Industrial Automation

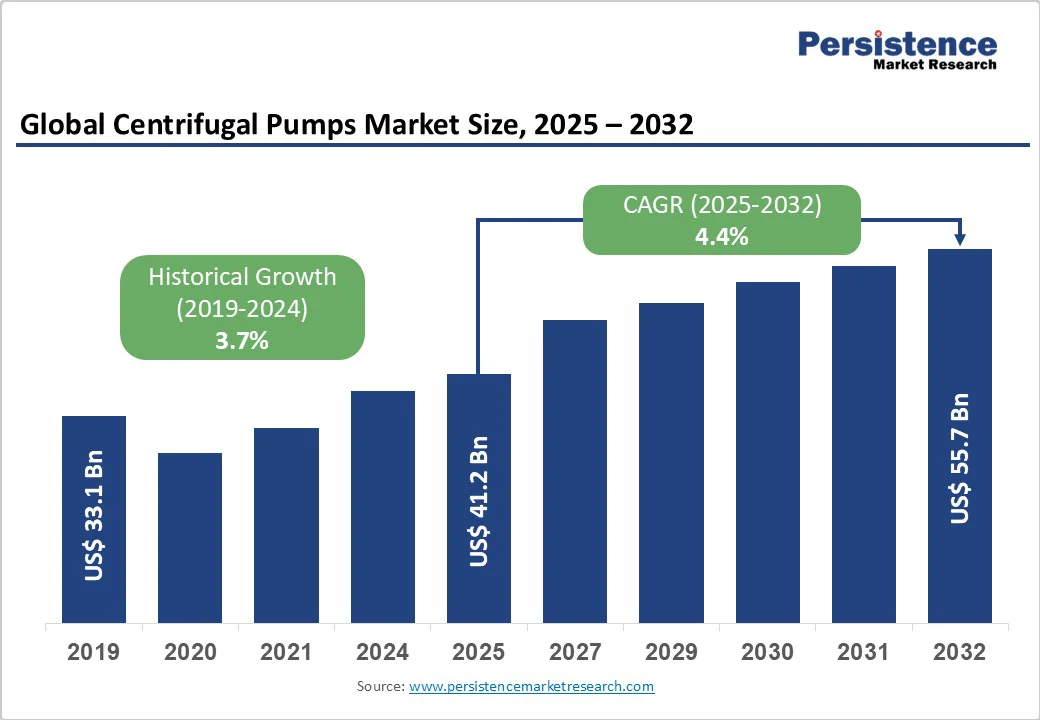

The global centrifugal pumps market size is likely to value at US$ 41.2 Billion in 2025 and is projected to reach US$ 55.7 Billion by 2032, growing at a CAGR of 4.4% between 2025 and 2032. Rising demand for efficient water management solutions across agriculture, manufacturing, and municipal sectors. Growing investments in infrastructure development, particularly in emerging economies, alongside technological advancements in pump efficiency and automation are creating sustained demand for modern centrifugal pumping systems.

| Key Insights | Details |

|---|---|

|

Centrifugal Pumps Market Size (2025E) |

US$ 41.2 Billion |

|

Market Value Forecast (2032F) |

US$ 55.7 Billion |

|

Projected Growth CAGR (2025-2032) |

4.4% |

|

Historical Market Growth (2019-2024) |

3.7% |

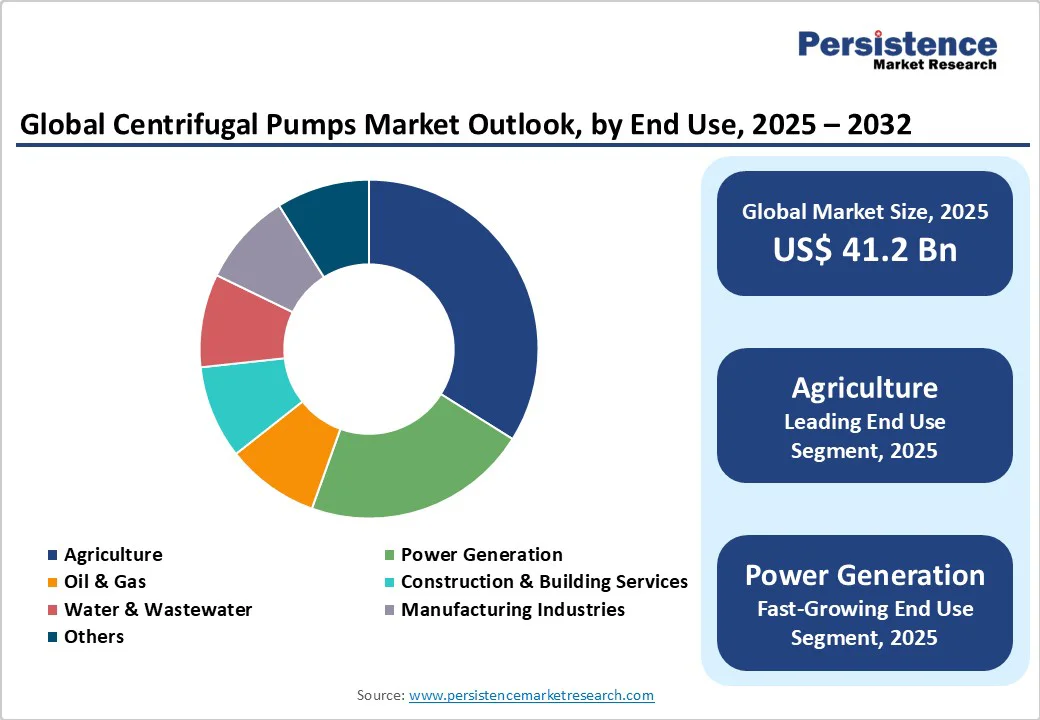

The agricultural sector dominates global centrifugal pump demand, representing approximately one-third of market consumption in 2025. Rising global food production requirements, driven by population growth and changing dietary patterns, necessitate efficient irrigation systems powered by centrifugal pumps. According to the Department for Environment, Food & Rural Affairs, average farm business income across UK farms increased from US$ 50,461 in 2020/21 to US$ 78,133 in 2021/22, indicating robust agricultural sector growth driving pump investments. The agricultural pumps market demonstrates a strong correlation with centrifugal pump adoption, as centrifugal pumps offer affordability, reliability, and capacity to handle high water volumes effectively. Modern agricultural operations increasingly rely on precision irrigation systems that utilize single-stage centrifugal pumps for their superior scalability from small 1 HP units to large multi-stage systems.

Rising urbanization and stringent water quality regulations are significantly expanding the water and wastewater treatment sector, creating substantial demand for centrifugal pumping solutions. India possesses the world's 5th largest market for water and wastewater treatment, anticipated to exceed US$ 15 billion value by 2032. Government initiatives such as National Mission for Clean Ganga (Namami Gange) and Jal Jeevan Mission in India, alongside the Safe Drinking Water Act (SDWA) in the United States, are spurring investments in water treatment infrastructure. The Water Pump Market expansion directly correlates with centrifugal pump growth, as these systems play crucial roles in water distribution, sewage transport, aeration processes, and sludge handling within treatment facilities. EU Waste Water Treatment Directive compliance requires the collection and treatment of approximately 90% of municipal wastewater throughout the EU, further driving centrifugal pump installations.

Centrifugal pump deployment faces significant barriers due to substantial upfront capital investments required for purchasing and installation, particularly deterring smaller companies and budget-constrained regions from adopting advanced pumping systems. The complexity of modern pump systems, coupled with specialized installation requirements and technical expertise needs, creates additional cost burdens that limit market penetration in price-sensitive segments. Industries operating with tight profit margins often struggle to justify immediate returns on investment, especially when considering long-term operational and maintenance expenses associated with sophisticated centrifugal pump systems.

Fluctuations in metal prices, particularly steel and aluminum used in pump manufacturing, significantly impact production costs and profitability margins for manufacturers. Supply chain disruptions and geopolitical uncertainties create additional challenges for consistent pump production and delivery schedules. These factors contribute to unpredictable pricing structures that complicate long-term procurement planning for end-users, potentially delaying capital equipment purchases and affecting overall market growth momentum

The convergence of Internet of Things (IoT) technology with centrifugal pump systems presents transformative opportunities for market expansion through enhanced operational efficiency and predictive maintenance capabilities. Smart pumps equipped with IoT sensors enable real-time monitoring, automated performance optimization, and energy consumption reduction of up to 50% compared to traditional systems. These intelligent systems utilize variable frequency drives (VFDs), embedded sensors, and cloud-based analytics to provide continuous feedback on system performance, allowing operators to monitor and adjust pump operations remotely.

The U.S. Environmental Protection Agency (EPA) launched new programs in 2024 supporting industrial systems efficiency, specifically targeting IoT-enabled centrifugal pumps for greenhouse gas emission reduction and energy consumption minimization. Industrial sectors increasingly adopt automation and digitalization, with IoT technology offering continuous monitoring alongside predictive maintenance functions to improve system uptime while reducing operational expenses.

Single-stage centrifugal pumps represent the fastest-growing segment, capturing 63% market share in 2025 due to their simplified design, cost-effectiveness, and versatility across diverse applications. The electric operation category dominates with over 50% share, driven by environmental sustainability initiatives and energy efficiency requirements. Electric variants are experiencing accelerated growth as industries transition from diesel and hydraulic alternatives toward cleaner energy solutions. Single-stage electric centrifugal pumps offer significant advantages in HVAC systems, municipal water distribution, and industrial process applications through their high flow rates, moderate head requirements, and simplified maintenance procedures.

The hydraulic pumps market complementary growth creates synergistic opportunities as industries seek integrated fluid handling solutions combining centrifugal and hydraulic technologies for comprehensive operational efficiency.

Electric operation centrifugal pumps command over 50% share in 2025, driven by environmental regulations, energy efficiency initiatives, and operational cost advantages compared to hydraulic and pneumatic alternatives. Electric pumps offer superior controllability through variable frequency drive (VFD) integration, enabling precise flow rate adjustments and significant energy savings.

The electric segment benefits from grid infrastructure expansion, renewable energy integration, and declining electricity costs in many regions. Modern electric centrifugal pumps incorporate advanced motor technologies, achieving 10-15% efficiency gains over the past decade through optimized impeller designs and improved magnetic materials. Industrial facilities increasingly prefer electric pumps for their reduced maintenance requirements, quieter operation, and compatibility with automated control systems. Smart pump technologies predominantly utilize electric drive systems, positioning this segment for continued growth as IoT adoption accelerates across industrial applications.

Agriculture dominates the centrifugal pumps market with approximately 33% share in 2025, driven by expanding irrigation infrastructure and precision farming adoption. Agricultural applications benefit from centrifugal pumps' ability to handle large water volumes efficiently, supporting flood irrigation, sprinkler systems, and modern drip irrigation installations. Rising global food production demands and water scarcity concerns necessitate efficient water management solutions where centrifugal pumps provide reliable, cost-effective operation. The segment encompasses diverse applications from small-scale 1 HP residential farming units to large multi-stage systems for commercial agriculture operations.

Agricultural pumps market growth directly correlates with centrifugal pump adoption, as farmers increasingly recognize their scalability advantages and compatibility with solar power systems. Government agricultural subsidies and irrigation modernization programs across the Asia-Pacific and Latin America regions continue supporting market expansion within this dominant end-use category.

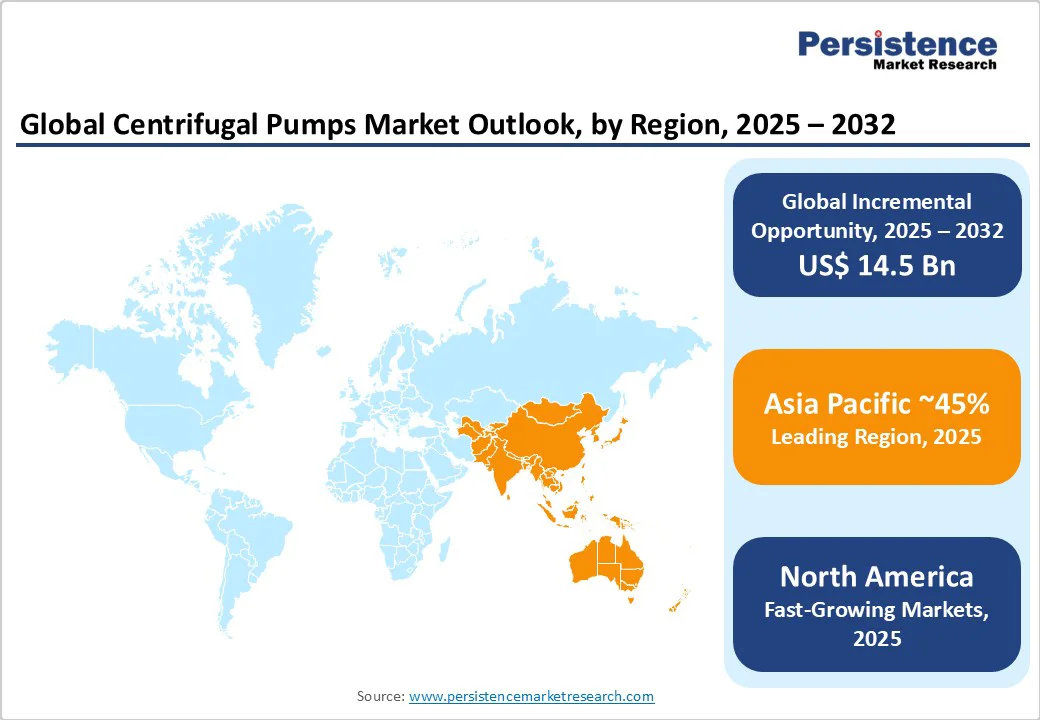

North America maintains market leadership position with established industrial infrastructure and technological innovation capabilities driving consistent demand for advanced centrifugal pumping solutions. The region generated US$ 10 billion revenues in 2024, with projected CAGR of 2.5% through 2032, reflecting mature market characteristics with a focus on replacement and efficiency upgrades. U.S. regulatory framework emphasizes energy efficiency and environmental compliance, spurring adoption of IoT-enabled smart pump technologies across industrial and municipal applications.

The U.S. Environmental Protection Agency (EPA) launched comprehensive programs in 2024 supporting industrial energy efficiency, specifically targeting centrifugal pump systems for greenhouse gas reduction initiatives. Innovation ecosystems centered around major pump manufacturers like ITT Inc. drive technological advancement, with the company investing US$ 11 million to enhance pump testing capabilities, including facility expansions. North and Latin America Water Pumps Market expansion creates synergistic growth opportunities as integrated water management solutions gain prominence across municipal and industrial sectors.

Europe demonstrates strong regulatory harmonization, driving consistent pump standards across member states, with EU Waste Water Treatment Directive mandating 90% municipal wastewater collection and treatment compliance. Germany, the United Kingdom, France, and Spain lead regional demand through industrial modernization programs and infrastructure renewal investments. The UK centrifugal pumps market is projected to be worth US$ 750 million by 2032, reflecting steady demand from key industrial sectors.

Regional emphasis on sustainability and energy efficiency drives adoption of advanced pump technologies, with European Union environmental regulations promoting IoT-integrated systems for optimized energy consumption. Ebara Pumps Europe exemplifies regional innovation through its 3E/3ES vertical in-line pump series launch, featuring straight-line suction and discharge designs minimizing installation costs while supporting flow capacities between 25 and 3,600 L/min. Manufacturing centers across Germany and the Netherlands serve as technological hubs for pump development, focusing on energy-efficient solutions meeting stringent environmental standards.

Asia Pacific represents the fastest-growing regional market with a positive CAGR over the next five years, driven by rapid industrialization, urbanization, and infrastructure development across emerging economies. China, Japan, India, and ASEAN countries demonstrate robust manufacturing advantages and expanding end-user demand across agriculture, construction, and industrial sectors. India's centrifugal pumps market is expanding steadily at US$ 5 billion by 2032, reflecting strong domestic demand and manufacturing capabilities.

China's position as a global manufacturing hub provides cost advantages and production scalability, while Japan contributes advanced technology development through companies such as Ebara Corporation and Tsurumi Manufacturing. Regional growth dynamics benefit from government infrastructure investments, agricultural modernization programs, and expanding industrial capacity across chemicals, power generation, and water treatment sectors.

The global centrifugal pumps market exhibits a fragmented yet concentrated structure, with the top 20 players accounting for approximately 60% by volume. Market concentration increases significantly in specialized segments serving oil and gas or chemical processing industries, where technical expertise and compliance requirements create competitive barriers. Leading companies employ diverse expansion strategies, including research and development investments, geographical expansion, strategic acquisitions, and product portfolio diversification to maintain competitive positions.

The global centrifugal pumps market was valued at US$ 41.2 billion in 2025 and is projected to reach US$ 55.7 billion by 2032, growing at a CAGR of 4.4%.

Key demand drivers include expanding agricultural sector requirements, growing water and wastewater treatment infrastructure, urbanization trends, and increasing adoption of energy-efficient IoT-enabled smart pump technologies.

Single-stage centrifugal pumps lead the market with 63% share in 2025 due to their cost-effectiveness, operational simplicity, and versatility across diverse applications.

Asia Pacific represents the fastest-growing region with CAGR of 5.7% and 46.9% global market share, driven by industrialization and infrastructure development.

Key opportunities include IoT integration and smart pump technologies, expanding single-stage electric pump segments, and agricultural irrigation infrastructure modernization across emerging markets.

Market leaders include Grundfos Holdings A/S, Xylem Inc., Flowserve Corporation, ITT Inc., Baker Hughes, Ebara Corporation, and Kirloskar Brothers Limited.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 – 2024 |

|

Forecast Period |

2025 – 2032 |

|

Market Analysis |

Value: US$ Mn, Volume: As Applicable |

|

Geographical Coverage |

North America, Europe, East Asia, South Asia and Oceania, Latin America, Middle East and Africa |

|

Segmental Coverage |

Stage, Operation, End Use |

|

Competitive Analysis |

Grundfos Holdings A/S, Xylem Inc., Flowserve Corporation, ITT Inc., CIRCOR International, Baker Hughes, Gardner Denver, Ebara Corporation, Kirloskar Brothers Limited, Tsurumi Manufacturing, Schlumberger, Pumpen, PRORIL, HCP Pump, LEO Pump |

|

Report Highlights |

Market Forecast and Trends, Competitive Intelligence & Share Analysis, Growth Factors and Challenges, Strategic Growth Initiatives, Pricing Analysis, & Technology Roadmap, Future Opportunities and Revenue Pockets, Industry Market Analysis Tools |

By Stage

By Operation

By End Use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author