ID: PMRREP35999| 200 Pages | 6 Jan 2026 | Format: PDF, Excel, PPT* | Food and Beverages

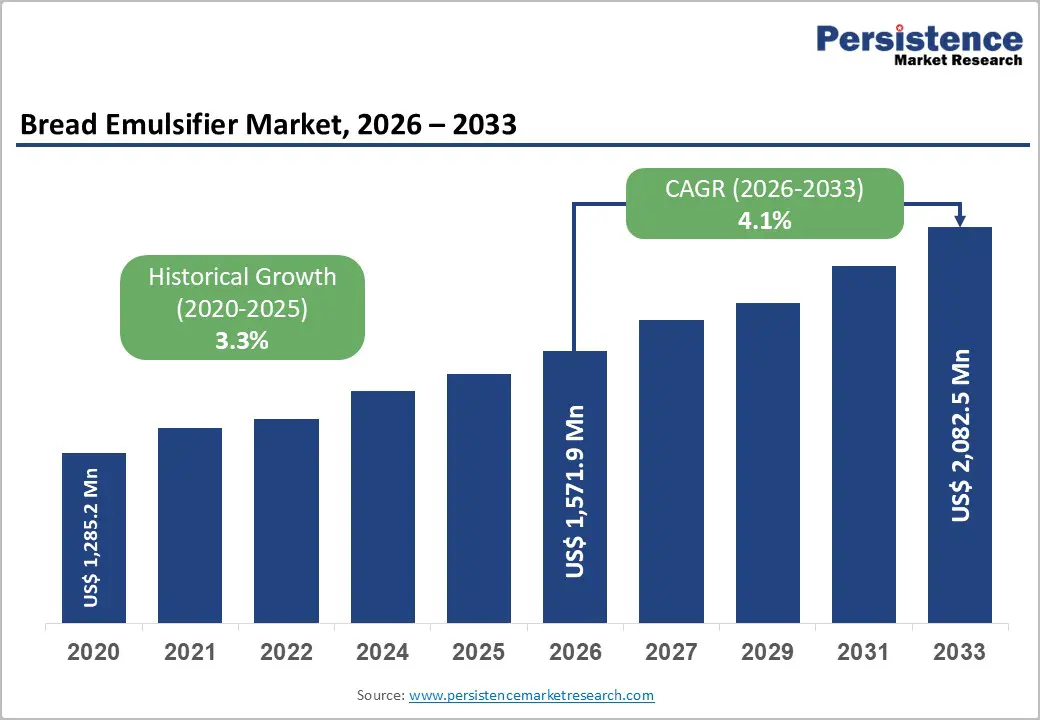

The global bread emulsifier market size is estimated to grow from US$ 1,571.9 million in 2026 to US$ 2,082.5 million by 2033, growing at a CAGR of 4.1% during the forecast period from 2026 to 2033.

The global market is witnessing dynamic growth as consumers increasingly seek softer, longer-lasting bread and specialty formulations that balance freshness, texture, and convenience. Rising e-commerce bakery channels, health-conscious choices, and clean-label trends are reshaping production, offering ample opportunities for both established players and innovative startups.

| Key Insights | Details |

|---|---|

| Global Bread Emulsifier Market Size (2026E) | US$ 1,571.9 Mn |

| Market Value Forecast (2033F) | US$ 2,082.5 Mn |

| Projected Growth (CAGR 2026 to 2033) | 4.1% |

| Historical Market Growth (CAGR 2020 to 2025) | 3.3% |

Growing preference for bakery products that deliver both freshness and texture is reshaping the bread industry, placing emulsifiers at the forefront of innovation. Consumers are increasingly seeking softer, longer-lasting bread that maintains its appeal from purchase to consumption, driving bakers to adopt advanced emulsifier solutions. These ingredients improve dough handling, enhance crumb softness, and extend shelf life, meeting evolving quality expectations.

Bread manufacturers are leveraging emulsifiers to deliver consistent texture, uniform volume, and delayed staling, enabling premium and everyday products to satisfy modern lifestyles. The integration of emulsifiers also supports clean-label and specialty formulations, allowing companies to innovate with whole grains, gluten-free, and enriched breads while maintaining freshness and consumer satisfaction.

Increasing regulatory scrutiny on synthetic food additives is reshaping the landscape for bread emulsifiers, creating challenges for manufacturers. Governments and food safety authorities are imposing stricter limits, labeling requirements, and safety assessments, particularly for artificial emulsifiers and stabilizers. Compliance with these evolving standards can delay product launches, increase testing costs, and complicate formulation strategies for bakeries and ingredient suppliers.

This tightening regulatory environment is pushing manufacturers to explore natural, plant-based, or enzyme-derived alternatives, which may require significant R&D investment and process adjustments. Smaller producers feel the impact more acutely due to limited resources for compliance. As a result, regulatory pressure on synthetic additives acts as a constraint, influencing cost structures, innovation timelines, and market entry strategies in the global bread emulsifier market.

The rapid rise of e-commerce in the bakery sector is creating a distinct demand for shelf-stable emulsifier systems capable of withstanding extended supply chains and variable storage conditions. As online orders increase, bakeries and packaged bread brands require emulsifiers that maintain texture, softness, and moisture retention during longer transit times and delayed deliveries. This shift opens opportunities for ingredient suppliers to develop robust, consistent, and reliable solutions tailored for e-commerce distribution.

Key players and startups can capitalize by offering customized emulsifier blends that support product longevity, resist staling, and preserve sensory appeal. Innovations in enzyme-based or multifunctional emulsifiers can enhance performance across diverse baked goods, enabling brands to expand into online retail channels while meeting consumer expectations for freshness and quality.

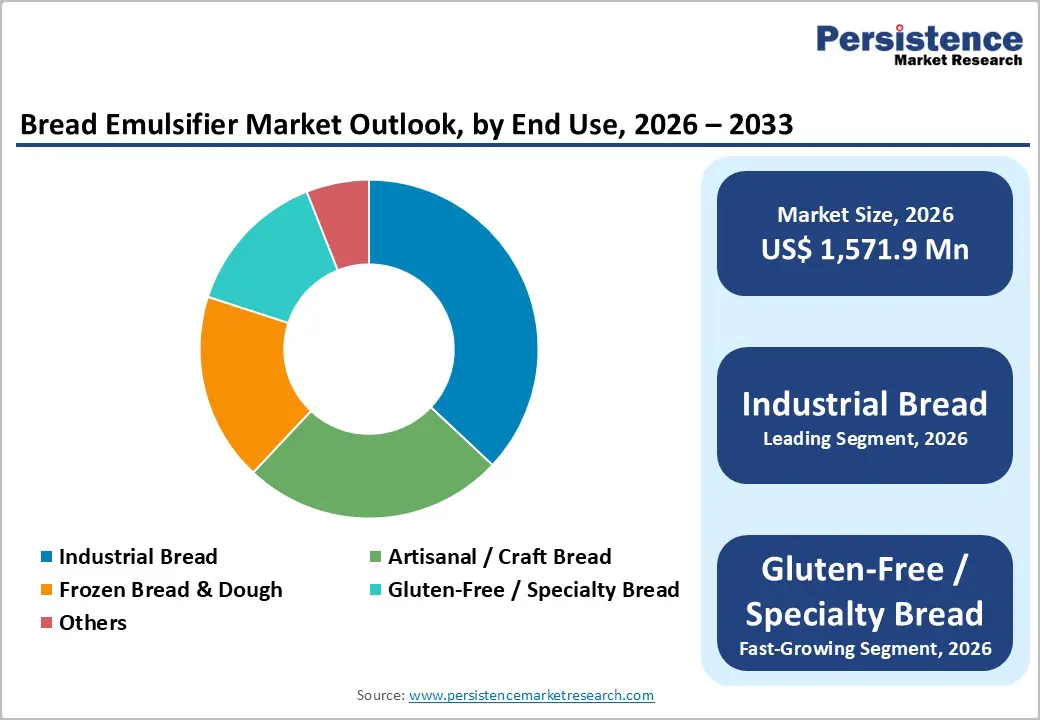

Industrial bread holds nearly 36% share as of 2025, leading the global bread market due to its consistent quality, cost-effectiveness, and suitability for mass production. Large-scale bakeries leverage advanced emulsifier systems to deliver uniform softness, extended shelf life, and stable texture, meeting the growing demand from retailers, foodservice chains, and packaged bread consumers. Industrial bread’s scalability and predictable performance make it the preferred choice for high-volume production and distribution across global markets.

Artisanal and craft breads appeal to niche segments with unique flavors, rustic textures, and premium ingredients, while frozen bread and dough offer convenience and extended storage for bakeries and foodservice providers. The dominance of industrial bread is reinforced by its adaptability, wide availability, and ability to satisfy everyday consumption patterns worldwide.

Gluten-free/specialty breads are projected to grow at a CAGR of 7.8% during the forecast period in the global Bread Emulsifier market, driven by rising health-consciousness and increasing awareness of gluten-related disorders such as celiac disease and gluten sensitivities. Consumers are actively seeking alternatives that provide the taste, texture, and freshness of traditional bread while adhering to dietary restrictions, creating strong demand for functional emulsifiers that improve crumb structure, moisture retention, and shelf life.

The specialty segment also benefits from growing interest in ancient grains, high-protein formulations, and clean-label ingredients, appealing to premium and wellness-focused buyers. Startups and established bakeries alike are innovating with enriched, fortified, and flavorful gluten-free offerings, supporting sustained market expansion and diversified product portfolios across retail and foodservice channels.

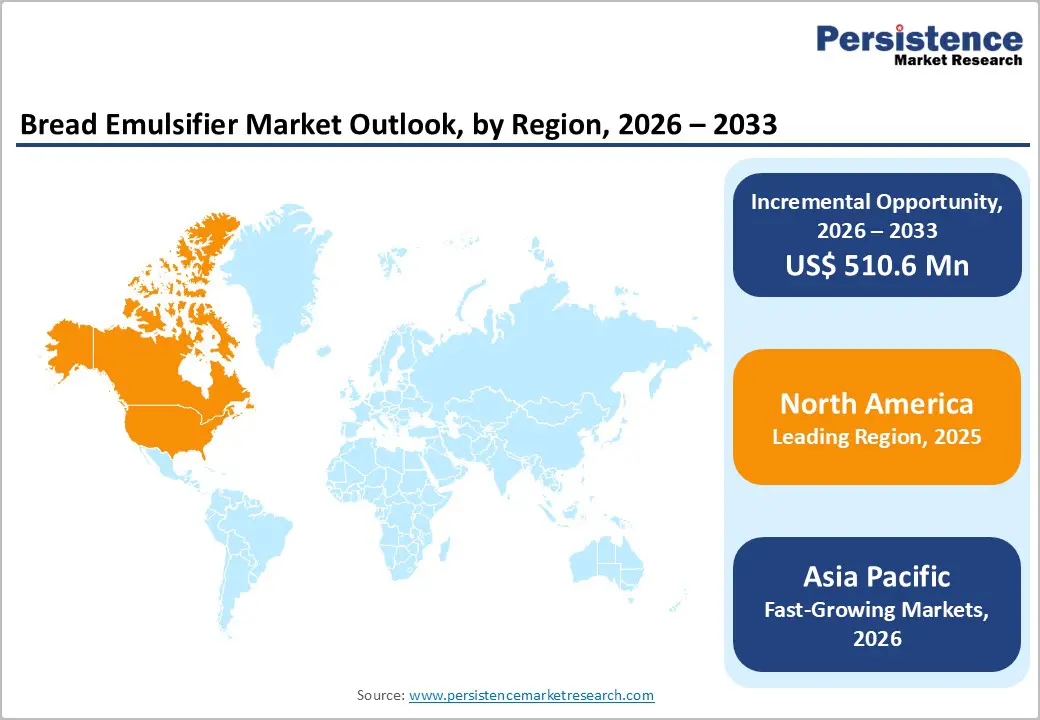

North America holds approximately 38% market share in the global Bread Emulsifier Market, reflecting strong consumer preference for high-quality, longer-lasting bakery products. In the United States, manufacturers are increasingly incorporating emulsifiers that enhance softness, volume, and shelf life in industrial, artisanal, and frozen bread formats. Rising demand for clean-label and gluten-free options is prompting bakeries to adopt emulsifiers derived from natural sources, ensuring product appeal while meeting regulatory and consumer expectations.

In Canada, growth is driven by expanding e-commerce bakery channels and ready-to-bake solutions that require stable emulsifier systems capable of withstanding extended supply chains. Specialty bread segments, including organic and whole-grain varieties, are gaining traction, encouraging innovation in emulsifier formulations to support texture, flavor, and freshness across diverse product offerings.

Asia Pacific Bread Emulsifier Market is expected to grow at a CAGR of 7.8%, driven by rising urbanization, evolving consumer lifestyles, and increased demand for convenient bakery products. In India, manufacturers are adopting emulsifiers that enhance softness and shelf life in packaged and artisanal breads, responding to the growing popularity of ready-to-eat and health-focused bakery offerings.

In China, Japan, and South Korea, innovation is focused on clean-label and natural emulsifiers that maintain texture and freshness in frozen, gluten-free, and functional breads. E-commerce bakery platforms and expanding retail networks are boosting demand for shelf-stable products. Across the region, premium bread formats, fortified bakery items, and convenient baking solutions are encouraging emulsifier suppliers to develop versatile formulations that balance performance, health claims, and consumer preference.

The global bread emulsifier market exhibits a moderately consolidated structure, with leading ingredient manufacturers competing through scale, innovation, and strategic expansion. Key players are investing in research and development to launch next-generation emulsifiers that enhance bread softness, shelf life, and texture while aligning with clean-label and natural ingredient trends. Companies are expanding production footprints globally to meet growing demand across industrial, artisanal, and frozen bread segments, often forming partnerships with bakery chains and retail brands. Regulatory compliance around additive safety and labeling is shaping product development and market entry strategies. Additional trends include plant-based emulsifiers, multifunctional formulations, and sustainable sourcing practices, with an emphasis on innovation that balances functionality, health claims, and consumer appeal across diverse global markets.

The global bread emulsifier market is projected to be valued at US$ 1,571.9 Mn in 2026.

Rising consumer demand for softer, longer-lasting bread is accelerating demand in the global bread emulsifier market.

The global bread emulsifier market is poised to witness a CAGR of 4.1% between 2026 and 2033.

The rapid expansion of e-commerce bakeries is driving demand for shelf-stable emulsifier systems capable of maintaining quality across extended supply chains, presenting a substantial growth opportunity for players in the Bread Emulsifier market.

Major players in the global Bread Emulsifier market include IFF, ADM, Cargill, Incorporated, Associated British Foods plc, Kerry Group plc., AAK Foods, BAKO Group Limited., Bob’s Red Mill Natural Foods, and others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Form

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author