ID: PMRREP23815| 190 Pages | 14 Nov 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

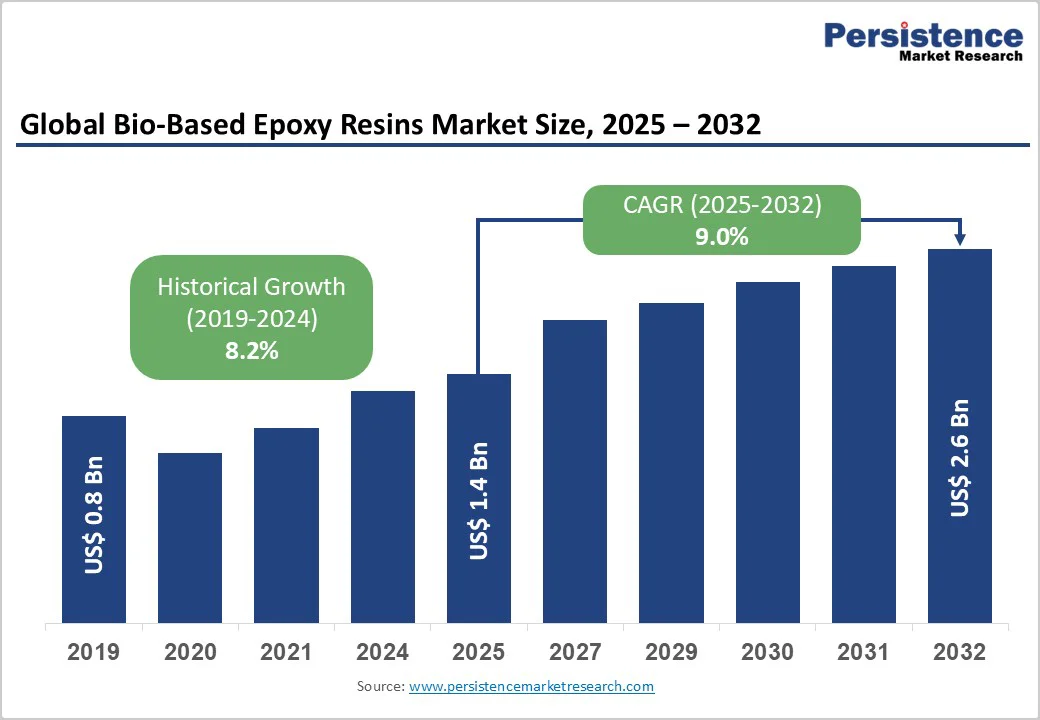

The global bio-based epoxy resins market size is likely to be valued at US$1.4 Billion in 2025 and is expected to reach US$2.6 Billion by 2032, growing at a CAGR of 9.0% during the forecast period from 2025 to 2032, driven by increasing demand for sustainable materials, rising adoption of eco-friendly alternatives, and advancements in green chemistry technologies. The ability of bio-based epoxy resins to provide high performance with reduced environmental impact has fueled their adoption across paints & coatings, composites, and automotive sectors.

| Key Insights | Details |

|---|---|

| Bio-Based Epoxy Resins Market Size (2025E) | US$1.4 Bn |

| Market Value Forecast (2032F) | US$2.6 Bn |

| Projected Growth (CAGR 2025 to 2032) | 9.0% |

| Historical Market Growth (CAGR 2019 to 2024) | 8.2% |

Rising Demand for Sustainable Materials

The rising demand for sustainable materials is a major force driving the growth of the bio-based epoxy resins market. As industries worldwide shift toward eco-friendly production and carbon-neutral goals, manufacturers are increasingly replacing petroleum-based products with renewable alternatives. Bio-based epoxy resins, derived from natural feedstocks such as vegetable oils, lignin, and plant-based glycols, offer lower carbon footprints, reduced toxicity, and excellent biodegradability.

Governments and regulatory bodies are implementing stricter environmental standards, such as the EU’s Green Deal and U.S. sustainability mandates, compelling industries like automotive, construction, and electronics to adopt greener materials. Consumer awareness of sustainability and corporate commitments to ESG (Environmental, Social, and Governance) goals are also accelerating this transition. Companies are integrating circular economy principles focusing on recyclability, energy efficiency, and waste reduction—into material innovation. Bio-based resins not only help meet regulatory and ethical requirements but also enhance brand value and market differentiation.

High Production Costs and Limited Raw Material Availability

High production costs and limited raw material availability remain key challenges restraining the growth of the bio-based epoxy resins market. Unlike petroleum-based resins, bio-based alternatives require complex extraction, purification, and processing steps that increase manufacturing expenses. Feedstocks such as vegetable oils, glycerol, and lignin often involve variable supply chains dependent on agricultural yields, seasonal fluctuations, and regional climate conditions.

This inconsistency leads to price volatility and supply instability, making it difficult for producers to maintain competitive pricing. The infrastructure for large-scale bio-based resin production is still developing, with limited access to advanced biorefineries and high-purity bio-monomers. Research and development efforts to enhance yield efficiency and process optimization add further to upfront costs. Transportation and storage of bio-feedstocks can also be more challenging due to their shorter shelf life and susceptibility to degradation.

Innovations in Bio-Feedstock Technologies for Enhanced Performance

Innovations in bio-feedstock technologies are revolutionizing the bio-based epoxy resins market by enhancing performance, sustainability, and cost efficiency. Advanced processing techniques now allow the conversion of renewable resources such as lignin, vegetable oils, glycerol, and sugar derivatives into high-quality epoxy precursors with superior mechanical and thermal properties. Researchers and manufacturers are developing novel catalytic and enzymatic processes that improve molecular uniformity and cross-linking efficiency, resulting in better adhesion, durability, and chemical resistance.

The use of genetically engineered microorganisms and green chemistry approaches further optimizes feedstock conversion yields while minimizing environmental impact. Hybrid formulations that blend bio-based and synthetic components are also emerging to balance sustainability with performance consistency. Additionally, innovations in feedstock purification and functionalization are enabling the production of high-bio-content resins suitable for demanding applications in automotive, electronics, aerospace, and construction.

Product Type Insights

Soybean Oil-based dominates the product type segment, accounting for 25% share in 2025. This dominance stems from its low cost, high availability, and excellent compatibility, making it ideal for applications requiring flexibility, such as coatings and adhesives. Soybean oil-based systems, using renewable sources to achieve up to 50% bio-content, offer superior environmental benefits and processing ease, reducing the need for synthetic modifiers.

Cardanol-based is the fastest-growing segment, driven by its superior chemical resistance and sustainability for high-performance uses. Cardanol responds effectively to demanding conditions like heat and corrosion, without extensive additives. The increasing focus on green alternatives in regions such as Europe is accelerating the adoption of cardanol systems.

Application Insights

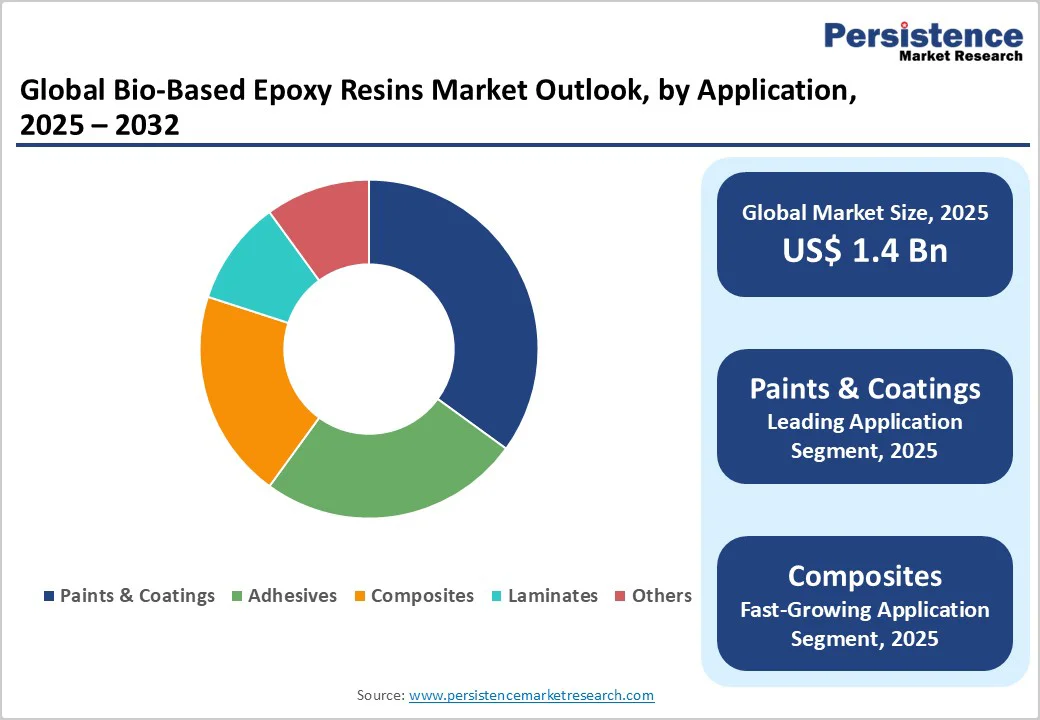

Paints & Coatings dominates the application segment, commanding 35% share in 2025. Its widespread use is attributed to its low VOC emissions, durability, and efficiency in protective finishes. Paints & coatings offer excellent adhesion and weather resistance, making them the preferred choice for construction and automotive. Leading manufacturers, such as Kukdo Chemical and Entropy Resins, leverage these for consistent performance and regulatory compliance, particularly in eco-friendly projects.

Composites is the fastest-growing application, driven by its potential for lightweight strength in renewables and transportation. These offer advantages such as high modulus, reduced weight, and compatibility with fibers, suitable for emerging sectors like wind energy. Innovations in composite technologies, such as improved curing speeds, are accelerating their adoption in next-generation applications, particularly in Asia Pacific.

End-use Insights

Building & Construction dominates the end-use segment, holding a 30% share in 2025. The segment’s dominance is driven by the increasing demand for sustainable sealants and laminates in green buildings, particularly in regions with strict codes. Companies like Sicomin Epoxy Systems offer advanced solutions that integrate with construction materials, enhancing durability. The segment’s growth is further supported by global trends toward LEED certifications and the rising adoption of bio-materials in infrastructure.

Wind Energy is the fastest-growing, fueled by the integration of high-strength resins in turbine blades. Resins mimic petroleum performance while reducing emissions, improving efficiency. The growing use in renewables, particularly in North America where installations are high, is driving rapid adoption. The segment’s growth is further supported by advancements in scalable formulations, enabling innovative applications in energy storage.

Asia Pacific Bio-Based Epoxy Resins Market Trends

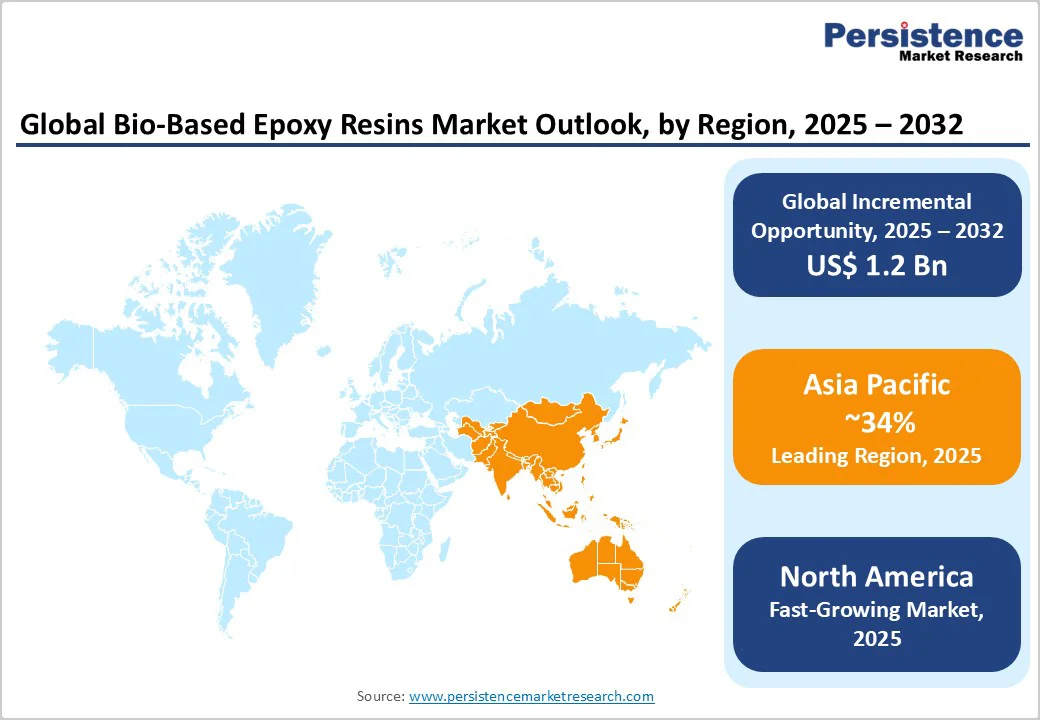

Asia Pacific dominates accounts for 34% share in 2025, driven by rapid industrialization, expanding manufacturing sectors, and increasing demand for sustainable materials across countries like China, India, Japan, and South Korea. The region benefits from abundant agricultural residues and vegetable oils that serve as cost-effective feedstocks for bio-based resin production, reducing dependence on petroleum-based raw materials. Government initiatives promoting green chemistry such as China’s “14th Five-Year Plan” and India’s focus on bio-economy development are further accelerating adoption.

Major end-use industries including automotive, construction, electronics, and coatings are shifting toward eco-friendly alternatives to comply with tightening environmental regulations and achieve carbon neutrality goals. The growing electric vehicle (EV) market and infrastructure projects are also fueling demand for lightweight composites and sustainable coatings. However, challenges such as raw material price volatility, supply chain constraints, and the need for scalable production technologies persist.

North America Bio-Based Epoxy Resins Market Trends

North America holds 28% share in 2025, rising sustainability commitments, industrial innovation, and a well-established manufacturing base. The region accounts for a significant share of global demand, driven by the automotive, construction, and electronics sectors’ growing preference for eco-friendly and high-performance materials. Government initiatives such as the U.S. Federal BioPreferred Program and state-level mandates promoting renewable and low-VOC materials are accelerating the shift toward bio-based solutions.

Abundant agricultural feedstocks such as soybean oil, glycerol, and corn derivatives provide a strong foundation for domestic production, reducing reliance on petroleum-based resins. The construction industry’s increasing focus on green buildings and the automotive sector’s drive toward lightweight composites further fuel adoption. However, high production costs, limited scalability, and fluctuations in agricultural commodity prices pose ongoing challenges. Despite these hurdles, continuous R&D investments and technological advancements are improving resin quality and cost efficiency.

Europe Bio-Based Epoxy Resins Market Trends

Europe hold 25% share in 2025, supported by strong regulatory frameworks and collaborative initiatives. Policies such as the European Green Deal and the Circular Economy Action Plan are encouraging industries to reduce carbon emissions and adopt renewable, bio-based raw materials. Countries such as Germany, France, and the United Kingdom are at the forefront, with strong demand from the automotive, aerospace, construction, and wind energy sectors seeking lightweight and sustainable composites.

Automotive manufacturers are incorporating bio-based resins to meet emission reduction and recyclability targets. European consumers and industries also place high value on eco-labels and sustainability certifications, often paying premiums for products with reduced carbon footprints. High production costs, limited scalability, and feedstock supply volatility remain key challenges for market expansion. Despite these constraints, Europe continues to serve as a global innovation hub for bio-based epoxy resin development, supported by collaborative research among governments, academic institutions, and chemical manufacturers.

The global bio-based epoxy resins market is highly competitive, driven by increasing demand for sustainable materials in industries such as automotive, construction, electronics, and coatings. Leading players are investing heavily in research and development to enhance resin performance, improve bio-content, and reduce carbon footprints. Companies are forming strategic alliances, mergers, and collaborations with raw material suppliers and end-users to strengthen their market presence and expand production capacities.

Manufacturers are focusing on developing innovative bio-based alternatives to petroleum-derived resins to meet stringent environmental regulations and consumer preferences for eco-friendly products. Expansion into high-growth regions such as Asia Pacific and Latin America is a key strategic move, supported by rising industrialization and government initiatives promoting green chemistry. Competitive differentiation also stems from advancements in resin formulation, offering superior mechanical strength, thermal stability, and recyclability.

Key Industry Developments

The global bio-based epoxy resins market is projected to reach US$1.4 Billion in 2025.

The market is driven by increasing demand for sustainable materials and advancements in green chemistry, supported by regulations reducing carbon emissions.

The market is expected to grow at a CAGR of 9.0% from 2025 to 2032.

Advancements in bio-feedstock innovations and expansion in renewables like wind energy offer key opportunities.

Kukdo Chemical, Entropy Resins, Sicomin Epoxy Systems, Bitrez Ltd, and Cardolite Corporation are among the key players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 – 2024 |

| Forecast Period | 2025 – 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author