ID: PMRREP35831| 199 Pages | 5 Nov 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

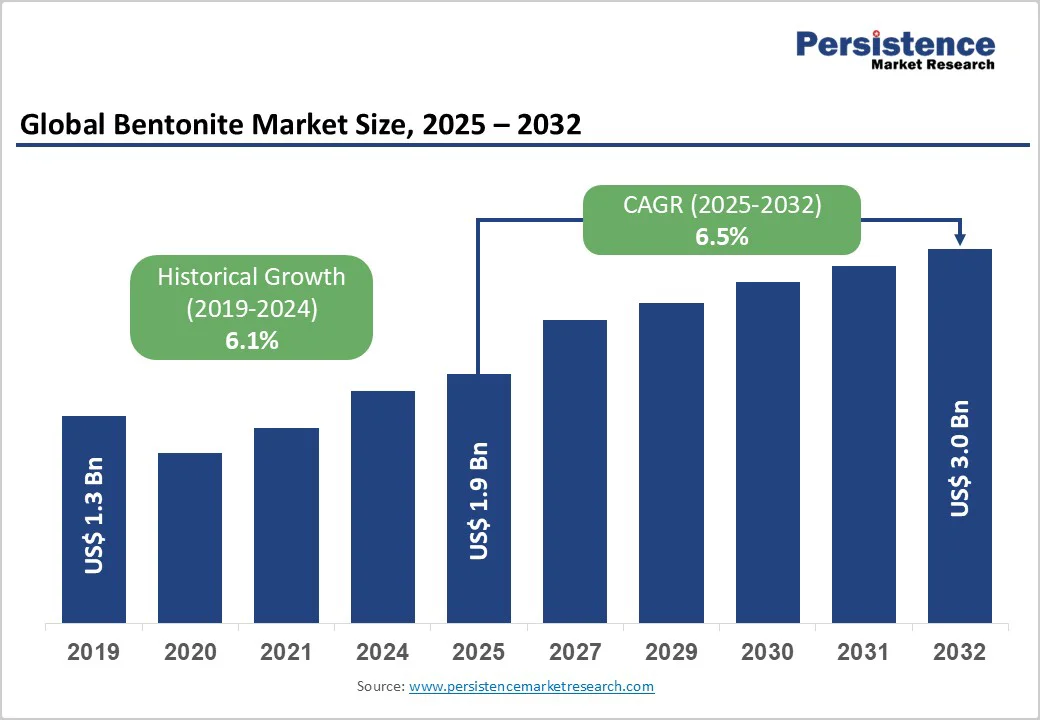

The global bentonite market size is likely to value at US$ 1.9 billion in 2025 and is projected to reach US$ 3.0 billion by 2032, expanding at a CAGR of 6.5% between 2025 and 2032.

The market growth is primarily driven by the rapid industrialization, rising infrastructural projects worldwide, and the growing use of bentonite in iron ore pelletizing and cat litter products.

| Key Insights | Details |

|---|---|

| Bentonite Market Size (2025E) | US$ 1.9 Bn |

| Projected Market Value (2032F) | US$ 3.0 Bn |

| Global Market Growth Rate (CAGR 2025 to 2032) | 6.5% |

| Historical Market Growth Rate (CAGR 2019 to 2024) | 6.1% |

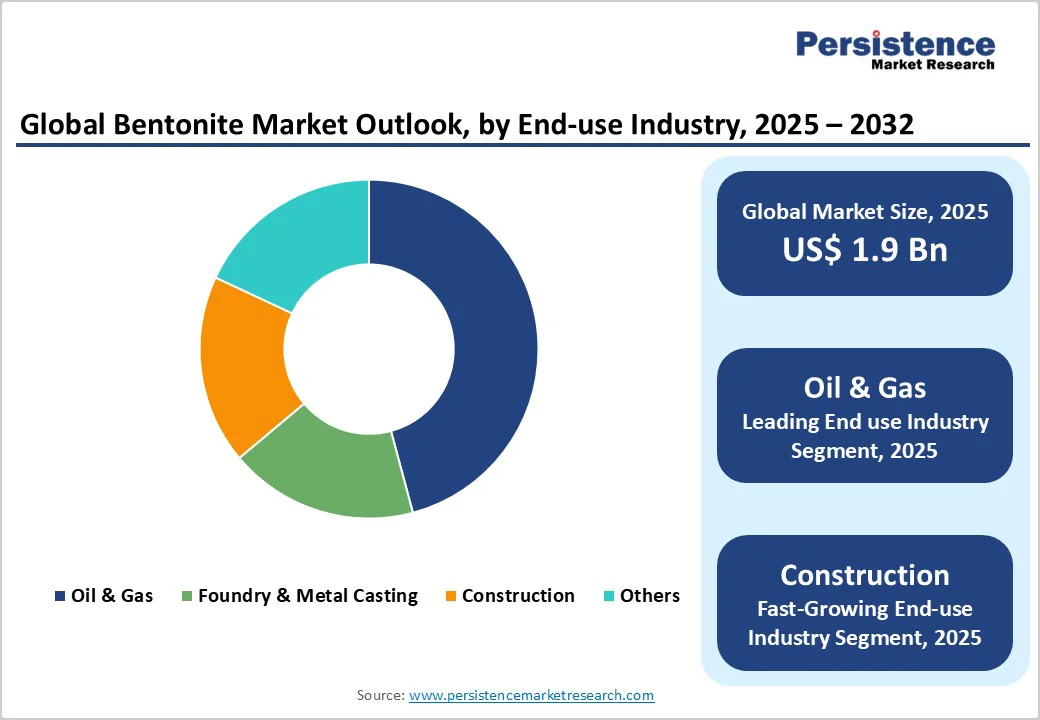

Bentonite’s critical role in the oil and gas sector, especially as a base component of drilling mud, remains a major growth driver. Sodium bentonite acts as a sealing and lubrication agent, facilitating borehole stability and efficient drilling operations.

Global oil exploration activities and enhanced offshore drilling projects are growing, despite fluctuating crude oil prices, driven by technological advancements in drilling and the need for unconventional resource extraction. U.S. and Middle Eastern investments in shale and deep-water drilling have increased bentonite consumption significantly

In 2025, global oil production is projected to increase by 2.7 million barrels per day (bpd), reaching 105.8 million bpd, with non-OPEC+ countries contributing 1.4 million bpd to this growth. This expansion is driven by significant investments in offshore drilling technologies and unconventional resource extraction. For instance, the U.S. Gulf of Mexico is set to boost offshore oil production, with companies like Chevron aiming to increase output by 50% by 2026.

These developments underscore the growing demand for bentonite in drilling operations, as its properties are crucial for the success of modern drilling techniques. The ongoing expansion and technological advancements in global oil and gas extraction are expected to further propel the demand for bentonite, solidifying its position as an indispensable material in the industry.

The foundry and metal casting industry heavily relies on bentonite for its use in foundry sands which require binding and thermal stability. This application holds a significant share of the bentonite market, reflecting its indispensable role in manufacturing castings with precision and dimensional stability.

With the automotive and infrastructure sectors rapidly expanding, especially in countries like China, India, Germany, and the U.S., the demand for high-quality cast metal parts is rising. Bentonite binds sand molds effectively, preventing breakdown during metal pouring and cooling, thereby ensuring higher yield and reduced defects.

The strong growth in heavy machinery, automotive OEMs, and industrial machinery sectors directly fuels foundry bentonite consumption worldwide.

Stringent environmental regulations related to mining, processing, and application of bentonite are creating challenges for market expansion. Many countries have implemented strict guidelines to minimize land degradation, dust emissions, and water pollution linked to bentonite extraction and processing.

Obtaining mining licenses necessitates comprehensive environmental impact assessments, and compliance costs have increased. Additionally, regulations concerning the disposal of spent drilling mud and foundry sands limit excessive waste, prompting companies to invest in treatment or recycling technologies. These restrictions raise operational costs and can cause delays in project start-up, especially for smaller producers or new entrants.

The bentonite cat litter market continues to emerge as a strong opportunity for bentonite suppliers. With increasing pet ownership globally and preference for absorbent, odor-controlling cat litters, bentonite’s superior absorption and clumping properties make it highly desirable.

Growth in disposable pet products, expanding retail channels, and rising awareness about pet hygiene in emerging markets are propelling this segment. Innovations in eco-friendly and dust-free bentonite litter formulations also cater to evolving consumer preferences and strict regulatory mandates for product safety, enhancing market potential.

Increasing infrastructure development across developing nations and focus on sustainable construction practices underscore an opportunity for bentonite as a natural, low-impact construction material. Sodium bentonite is widely used for drilling sealants, slurry walls, and ground improvement techniques due to its impermeability and binding strength.

Governments’ emphasis on groundwater protection and erosion control has promoted its use in landfill liners and waste containment systems. Additionally, bentonite’s role in soil stabilization for road base preparation is gaining traction in regions undertaking large-scale road construction, bridging infrastructure expansion with environmental safety demands.

Among the product types, sodium bentonite dominates the market due to its exceptional swelling and water absorption properties, which enable diverse industrial applications. It has a high capability to expand and absorb water several times its dry volume, making it the preferred material for oil and gas drilling fluids, where borehole sealing is vital.

Its use in foundry sands and construction applications similarly capitalizes on these properties for molding and sealing purposes. The reliability and performance of sodium bentonite, coupled with increasing resource extraction from key deposits in the U.S., China, and India, facilitate its market leadership.

The foundry sands segment holds a significant portion of the bentonite market, accounting for about 28% share. Bentonite’s binding ability ensures compactness and strength of sand molds, which is critical during metal casting.

Increasing demand for automotive components, heavy machinery, and Industrial hydraulic equipment globally escalates foundry output, indirectly accelerating bentonite consumption. Technological refinements in foundry operations and growing adoption of green sand molding techniques, which emphasize natural binders to reduce emissions, further highlight bentonite’s relevance in this application.

The oil and gas sector accounts for the largest end-use share, driven by continued exploration and production, especially in shale and offshore reserves. Bentonite’s application as a key component in drilling muds is unparalleled, as it conditions the drilling fluid by enhancing viscosity and lubricating drill bits, minimizing friction and borehole collapse.

This ensures efficient extraction and reduces downtime. With global energy demand rising and unconventional drilling gaining momentum, oilfield bentonite usage is expected to sustain its dominant position, further strengthened by innovations in polymer-enhanced and environmentally-friendly drilling solutions utilizing bentonite.

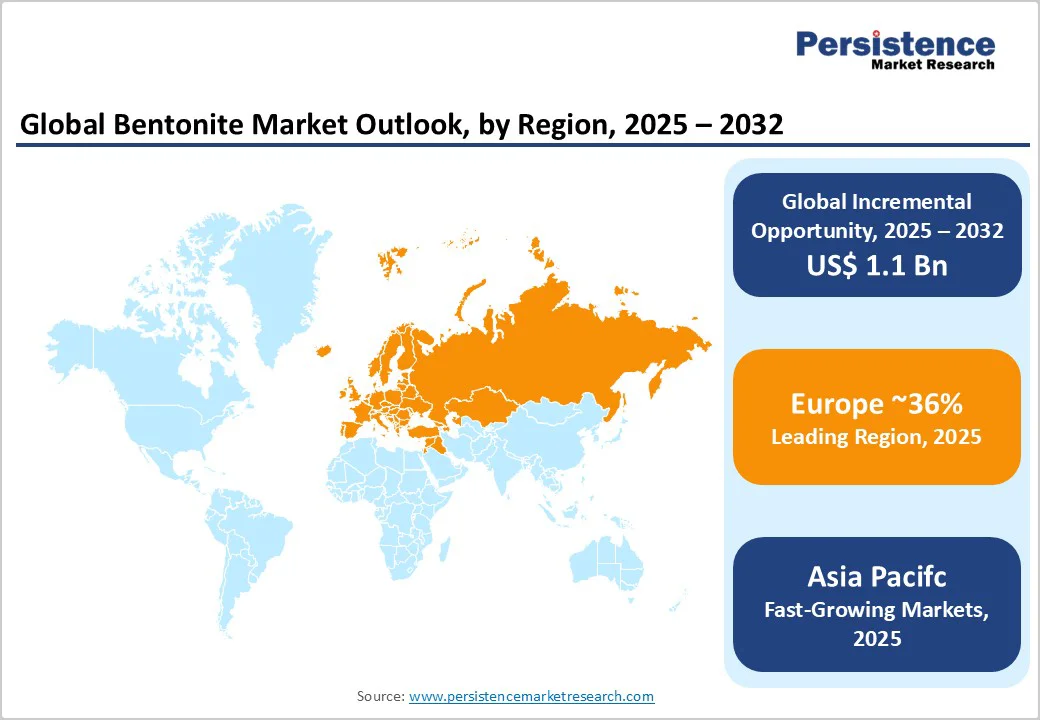

North America remains a crucial market with significant bentonite production, primarily in the U.S., which hosts some of the largest sodium bentonite deposits. The region leads in innovation around bentonite-enhanced drilling fluids for unconventional oil and gas development, including hydraulic fracturing operations. Additionally, regulatory frameworks aimed at environmental protection influence product formulations and mining practices, ensuring sustainable operations.

The mature foundry industry and rising construction activities, especially in infrastructure development and remediation projects, maintain steady bentonite demand. North America’s leadership also lies in adopting advanced processing and quality enhancement technologies to meet stringent industry specifications.

In Europe, bentonite is extensively used in foundry operations, construction sealants, and environmental applications such as landfill liners. Germany, France, the U.K., and Spain dominate the regional market, with rising infrastructural investments driving consumption growth. Regulatory harmonization under EU environment directives facilitates the adoption of bentonite as a natural alternative to synthetic binders in various applications.

Additionally, Europe’s increased focus on sustainable construction practices and growing automated foundries incorporates bentonite in advanced mold technologies. Emerging interest in bentonite for environmental remediation, particularly in water purification, enhances regional market dynamics.

Asia Pacific is the fastest-growing bentonite market, driven by industrial expansion and infrastructure projects in China, India, Japan, and ASEAN countries. China leads the regional market fueled by its vast foundry industry, which produces automotive and heavy machinery components extensively.

Expansion in oil and gas exploration, especially offshore fields in Southeast Asia, is another significant bentonite driver. The construction sector’s growth, coupled with governmental focus on sustainable and resilient infrastructure, boosts bentonite demand for slurry walls, soil stabilization, and sealing applications. Lower production costs and increasing mining capacities in mining hubs propel Asia Pacific as a dominant producer and consumer.

The bentonite market exhibits a moderately consolidated structure, with a few large multinational players controlling significant production and distribution capacities, alongside several regional and local producers. Top participants focus on vertical integration, controlling mining, processing, and product formulation, and expanding geographic reach to improve supply chain resilience.

Product innovation, such as the development of specialty bentonites with enhanced purity or tailored particle size distribution, remains a key competitive differentiator. Companies are also investing in environmentally sustainable mining practices and resource recycling to align with regulatory trends. Strategic partnerships and acquisitions in emerging markets further underpin growth strategies.

The global bentonite market is expected to reach US$ 3.0 billion by 2032, up from US$ 1.9 billion in 2025.

Growth is primarily driven by expanding oil and gas drilling activities and increased demand for bentonite in foundry sands due to growth in automotive and industrial manufacturing.

Sodium Bentonite dominates the product segment with approximately 60% market share, favored for its swelling and absorption capabilities.

Asia Pacific leads in production and consumption, supported by rapid industrialization and infrastructure development, particularly in China and India.

Expanding applications in environmentally friendly construction and the growing Bentonite Cat Litter Market present significant opportunities for growth.

Key market players include Ashapura Group, Bentonite Performance Minerals LLC., and Clariant AG, recognized for quality production and extensive geographic reach.

| Report Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2032 |

| Historical Data Available for | 2019 to 2024 |

| Market Analysis | US$ Billion for Value;Tons for Volume |

| Key Regions Covered |

|

| Key Market Segments Covered |

|

| Key Companies Profiled in the Report |

|

| Report Coverage |

|

By Product Type

By Application

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author