ID: PMRREP34563| 210 Pages | 2 Jan 2026 | Format: PDF, Excel, PPT* | Industrial Automation

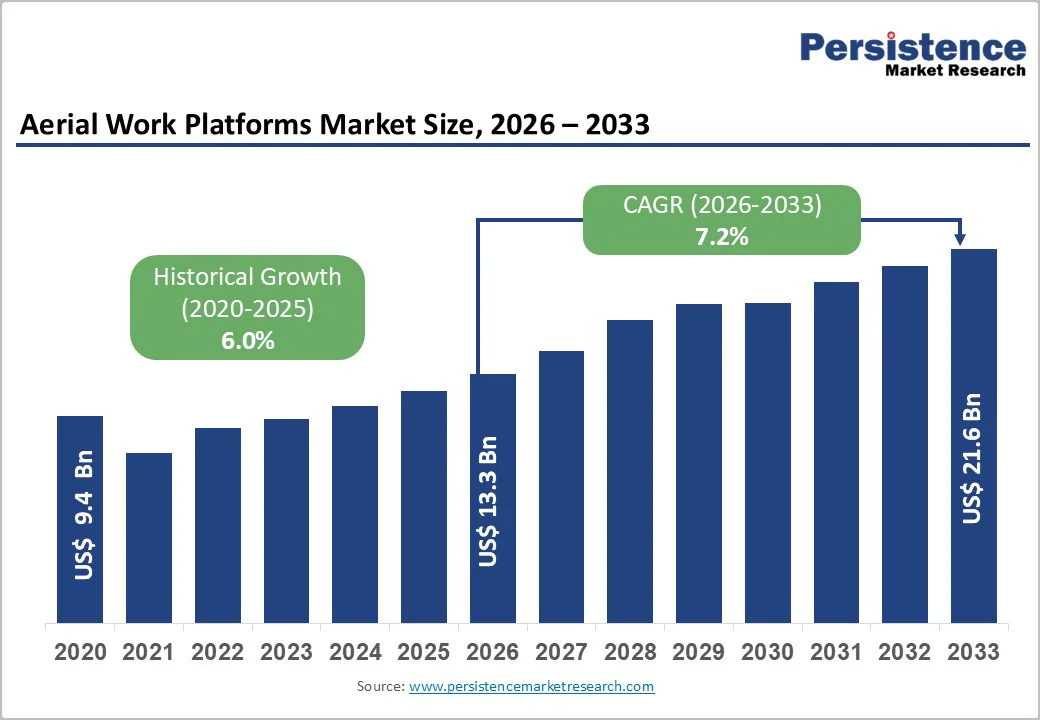

The global aerial work platforms market size is likely to be valued at US$ 13.3 billion in 2026 and is projected to reach US$ 21.6 billion by 2033, growing at a CAGR of 7.2% during the forecast period from 2026 to 2033.

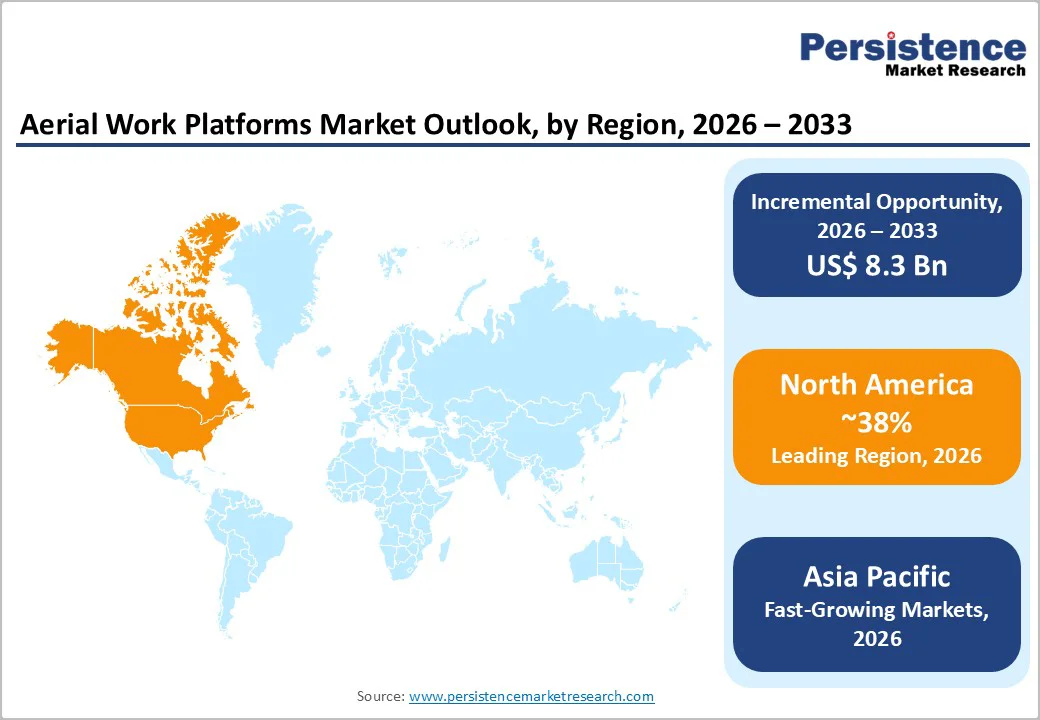

This growth trajectory reflects sustained expansion driven by robust construction activity, increased infrastructure investments across emerging economies, and the accelerating shift toward electric and hybrid platform solutions. The market's resilience demonstrates the critical role of aerial work platforms in modern industrial operations, with North America commanding 38% market share while the Asia Pacific emerges as the fastest-growing regional segment. Strategic opportunities exist in electrification adoption, rental service expansion, and applications in logistics and utilities sectors beyond traditional construction.

| Key Insights | Details |

|---|---|

| Aerial Work Platforms Market Size (2026E) | US$ 13.3 Bn |

| Market Value Forecast (2033F) | US$ 21.6 Bn |

| Projected Growth (CAGR 2026 to 2033) | 7.2% |

| Historical Market Growth (CAGR 2020 to 2025) | 6.0% |

The global construction output continues to expand, with the World Bank and regional development agencies identifying infrastructure development as a primary growth catalyst. Construction spending in developed markets (North America, Europe) remains robust despite economic uncertainties, while emerging economies particularly in Asia Pacific are experiencing unprecedented infrastructure modernization. The United Nations reports that Asia Pacific construction activity is expected to grow at 4.5-5.2% annually through 2033, directly correlating with aerial work platform demand. Governments worldwide are investing heavily in urban development, transportation infrastructure, and building renovation projects, necessitating efficient vertical access solutions. These platforms enable workers to safely access heights of 10 to 20 meters (the dominant segment, controlling >65% market share) efficiently, reducing project timelines and labor costs. The International Labour Organization's safety mandates further reinforce platform adoption, as traditional scaffolding faces increasing regulatory restrictions in developed markets.

Environmental regulations and carbon reduction initiatives are fundamentally reshaping the aerial work platforms market. The European Union's Euro 5 and Euro 6 emission standards, combined with California's Advanced Clean Off-Road (ACOR) regulations, are phasing out high-emission diesel equipment. Although gas/diesel platforms currently dominate with 55%+ revenue share, electric platforms represent the fastest-growing fuel type segment, driven by 25-30% annual growth rates in developed markets. Battery technology advancement, specifically lithium-ion innovation reducing costs from $150/kWh (2015) to approximately $70-80/kWh (2025), has improved electric platform economics significantly. Corporate sustainability commitments from major construction and logistics firms mandate fleet electrification, accelerating this transition. Rental service providers the fastest-growing sales channel are prioritizing electric platforms to differentiate services and reduce operational costs by 40-50% compared to fuel-based alternatives.

High capital intensity remains a major restraint in the aerial work platform (AWP) market, as premium boom lifts the fastest-growing category cost between $200,000 and $400,000 per unit. For SMEs, which make up 70-75% of construction companies in developing regions, such prices create significant financing hurdles. Borrowing has become more expensive due to 200-300 basis-point increases in interest rates, weakening ROI on equipment purchases and pushing smaller operators toward rental models. In many developing economies, limited access to structured equipment financing further restricts AWP adoption, impacting OEM profitability and slowing overall market penetration despite strong construction demand.

Regulatory complexity adds another layer of restraint. Manufacturers must navigate diverse and often inconsistent compliance regimes, including the EU Machinery Directive (2006/42/EC), ANSI/ASSE standards in North America, and fragmented safety rules across Asia Pacific. Emerging markets like China and India are still stabilizing their regulatory frameworks, creating uncertainty for new entrants. Compliance efforts raise manufacturing costs by 8-12%, disproportionately affecting smaller manufacturers. Variations in operator training strict OSHA-compliant certification in North America versus minimal standardization in emerging markets further complicate market expansion and delay global standard harmonization.

The market presents a significant multi-dimensional opportunity driven by rental channel expansion, rising boom lift adoption, and rapid technological integration. Rental service providers are becoming the fastest-growing sales channel, offering SMEs a capital-efficient alternative to equipment ownership and increasing platform accessibility in cost-sensitive regions.

With the global equipment rental market expected to reach $87 billion by 2030 (5.8% CAGR), and rental channels projected to capture 45-50% of platform deployments by 2033, early movers can secure dominant market positions, recurring revenue streams, and monetization through telematics, IoT maintenance, and subscription-based models. Simultaneously, boom lifts, growing at 8.5-9.2% CAGR, are witnessing rapid adoption across utilities, telecommunications, and industrial maintenance, supported by $2.5 trillion in clean energy infrastructure investment through 2030 and expanding 5G tower installations.

This diversification reduces construction dependency and creates a $2.8-3.2 billion opportunity by 2033. Additionally, technological advancements including AI, machine learning, autonomous navigation, and safety systems enable predictive maintenance, premium pricing, and entry into the fast-growing logistics sector, forming an additional $1.5-2.0 billion high-value opportunity concentrated in advanced markets.

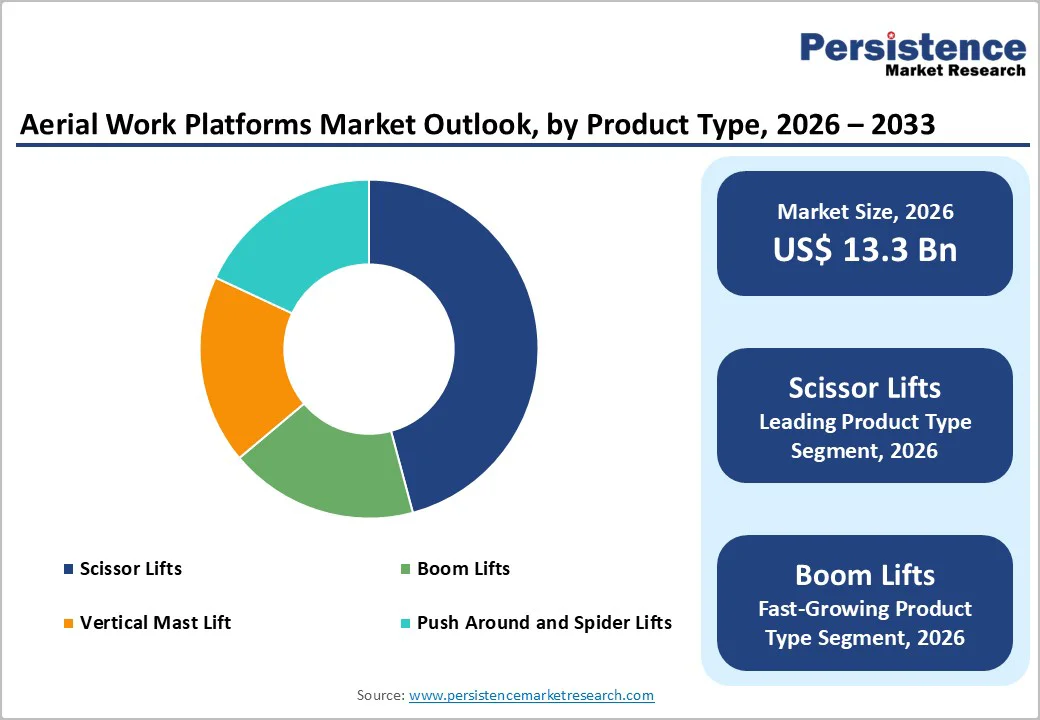

Scissor lifts remain the leading product type in the aerial work platforms market, holding over 45% revenue share, equivalent to $6.0-6.5 billion in 2026. Their dominance stems from strong suitability for compact and controlled environments such as warehouses, construction interiors, and maintenance operations. With vertical lifting heights of 10-20 meters, they align with the largest height-demand segment, which accounts for more than 65% of total deployments. Their ease of operation, lower training requirements, and established global rental availability further reinforce market leadership. Scissor lifts are expected to grow steadily at 6.5% CAGR, with North America exhibiting 6% growth and the Asia Pacific accelerating to 7-8% due to rapid construction and logistics expansion.

Boom lifts represent the fastest-growing segment, expanding at 8.5% CAGR through 2033 and currently capturing 25-28% of the market, valued at $3.3-3.7 billion. Their height flexibility, horizontal outreach, and suitability for complex environments make them essential for utilities, telecom tower work, and industrial maintenance segments growing 10-12% annually. Boom lifts also command a 20-25% price premium and are benefiting from hybrid and electric model adoption.

The construction segment remains the dominant application for aerial work platforms, accounting for an estimated 50-55% of total global demand. This leadership is driven by extensive use in building construction, large-scale infrastructure development, renovation projects, and routine site maintenance. With global construction output expanding at 3.5-4.2% annually, and Asia Pacific advancing at nearly 6% CAGR, demand continues to rise in line with rapid urbanization and infrastructure modernization. Increasing safety regulations that favor mechanical access solutions over manual scaffolding further reinforce adoption. Additionally, the construction sector’s high fragmentation, where 70-75% of contractors in developing economies are SMEs, fuels sustained rental market growth, as these firms often prefer capital-efficient access to equipment. Overall, construction applications are projected to grow steadily at around 6.8% CAGR, matching global building and infrastructure investment patterns.

In contrast, the logistics and transportation sector represents the fastest-growing application, expanding at 9.5-11.0% CAGR through 2033. Currently contributing 15-18% of total demand, this segment is driven by rapid e-commerce expansion, warehouse automation, and last-mile logistics capacity-building. Global e-commerce spending is expected to reach $6.3 trillion by 2030, pushing warehouse construction and modernization at 6.8% annually. Logistics environments require platforms for inventory handling, order picking, maintenance, and equipment installation applications well-suited to scissor lifts and vertical mast lifts. With Asia Pacific logistics expanding 10-12% CAGR, the segment is projected to capture 22-25% of total market demand by 2033, surpassing utilities and smaller niche applications.

Gas and diesel dominate the market with over 55% revenue share, valued at $7.3-7.8 billion in 2026, supported by mature infrastructure, proven reliability, and operator familiarity. Their strong performance in outdoor and heavy-duty construction applications reinforces their continued preference, particularly in developing regions. Growth, however, is moderating at 6.0% CAGR as stricter emission regulations including Euro 5/6 and CARB Phase III push operators toward cleaner alternatives. Regional variation remains significant: North America, holding 35% share, is expanding at 5.2%, while Asia Pacific, with 30% share, grows faster at 6.5-7.0%, aided by cost-sensitive demand and less stringent regulatory pressure. Diesel’s 15-20% pricing advantage over electric platforms continues to sustain adoption in emerging markets.

In contrast, electric fuel represents the fastest-growing fuel type, achieving 18-22% global growth and 25-28% growth in developed markets. With 20-23% current revenue share ($2.7-3.0 billion), they are projected to reach 35-38% share by 2033, creating a $7.5-8.5 billion segment. Declining lithium-ion battery costs ($70-80/kWh), 40-50% lower energy expenses, minimal maintenance, and zero emissions are driving widespread adoption, especially within rental fleets and sustainability-focused markets across North America, Europe, and Tier-1 Asian cities.

The platform working height market presents strong opportunities across both dominant and fast-growing height segments. The 10-20 meter category leads the market with over 65% revenue share, valued at $8.7-9.2 billion, driven by its suitability for multi-story construction, commercial building maintenance, and warehouse operations. This range aligns with the height requirements of typical 3-5 story buildings in developed economies and 6-8 storey structures in emerging regions. Standard scissor and boom lifts operating in this class benefit from operator familiarity, proven designs, and competitive cost structures, supporting a stable 7% CAGR. High rental penetration further strengthens long-term demand as SMEs prefer cost-efficient access over ownership.

Meanwhile, platforms below 10 meters represent the fastest-growing height segment, expanding at 8.5-9.5% CAGR and currently contributing 12-14% market share. Growth is propelled by the rapid expansion of the logistics and e-commerce sectors, where fulfillment centers require safe, efficient, low-height access for inventory handling and facility maintenance. Vertical mast and push-around lifts lead adoption due to low investment needs and ease of operation. With strong demand across Asia Pacific and North America, this segment is expected to reach 16-18% share by 2033, unlocking a $3.5-4.2 billion opportunity.

North America remains the leading aerial work platform market, generating over 38% of global revenue in 2026. The United States drives the majority of regional demand, supported by a large and mature construction base, extensive infrastructure maintenance needs, and a highly developed logistics sector. Market growth is steady at 6.0% CAGR through 2033, driven largely by equipment replacement cycles and rental fleet expansions rather than new large-scale infrastructure development. Regulatory frameworks such as OSHA and ANSI, although fragmented across states, enforce strict safety and operator certification requirements, favoring established OEMs with strong compliance capabilities.

The U.S. construction industry, valued at $1.7 trillion, remains the primary driver of platform demand, while Canada adds stable mid-single-digit growth through infrastructure renewal and housing activity. Canada shows 6.5% CAGR, with rental channels enabling access in a price-sensitive market. Infrastructure modernization supported by the $110 billion U.S. IIJA investment and rapid warehouse expansion, growing 6-7% annually, significantly strengthens demand. The logistics segment is the fastest-growing application, expanding at 8-10% CAGR. Therefore, major OEMs and consolidating rental companies are dominant. Scissor lift pricing remains competitive, while specialized boom lifts retain healthier margins.

Asia Pacific has become the strongest growth engine for the global aerial work platforms market, contributing 22-25% of global revenue and expanding rapidly at 8.0-9.2% CAGR, far exceeding growth rates in North America and Europe. By 2033, the region is positioned to capture 30-35% of global market value, supported by large-scale construction activity, rapid urbanization, industrial upgrades, and the expansion of modern logistics networks. China and India dominate regional demand, while ASEAN economies emerge as the next wave of high-growth markets.

China generates 40-45% of regional demand, driven by urban development, metro expansion, and factory modernization, while also shaping global pricing dynamics through competitive domestic manufacturers such as Sinoboom and XCMG. It leads the shift toward electric platforms, with 35-40% of new units already electric. India contributes 12-15% of regional demand, supported by its expanding construction sector and developing rental ecosystem, though financing constraints still moderate adoption.

Japan provides steady demand, backed by advanced technology adoption, whereas ASEAN countries, collectively growing at a 9-11% CAGR, benefit from foreign manufacturing investment and rising logistics activity. As rental penetration deepens across emerging markets, the Asia Pacific will reinforce its role as the industry’s fastest-growing and most influential region.

The aerial work platforms market exhibits moderate consolidation, with competitive dynamics varying by segment and geography. The global market features 15-20 significant OEM manufacturers and 40-60 regional/national rental service providers. The top 5 manufacturers (JLG, Genie, Snorkel, Niftylift, Boom Lifts) collectively command 55-65% of global OEM market share, with JLG and Genie alone representing 35-40% combined share.

Market concentration is higher in developed markets where brand recognition, safety certification, and service infrastructure create high barriers to entry. Emerging markets display lower concentration, reflecting domestic manufacturer presence and lower regulatory barriers. The rental service provider market is highly fragmented; the top 10 regional rental platforms command only 35-40% of deployment volume, suggesting a significant consolidation opportunity through acquisition and regional player consolidation.

The Aerial Work Platforms market is estimated to be valued at US$ 13.3 Bn in 2026.

Growing construction, infrastructure modernization, and maintenance activities worldwide are driving increased adoption of aerial work platforms for safe, efficient elevated operations.

In 2026, the North America is likely to dominate with an exceeding 38% revenue share in the global Aerial Work Platforms market.

Among applications, construction has the highest preference, capturing beyond 38% of the market revenue share in 2026, surpassing other applications.

Terex Corporation, JLG Industries, Inc, Haulotte Group, OSHKOSH CORPORATION Linamar Corporation, Tadano Limited, and Aichi Corporation are a few leading players in the Aerial Work Platforms market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Mn, Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Fuel Type

By Platform Working Height

By Sales Channel

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author