ID: PMRREP2890| 187 Pages | 5 Aug 2025 | Format: PDF, Excel, PPT* | Food and Beverages

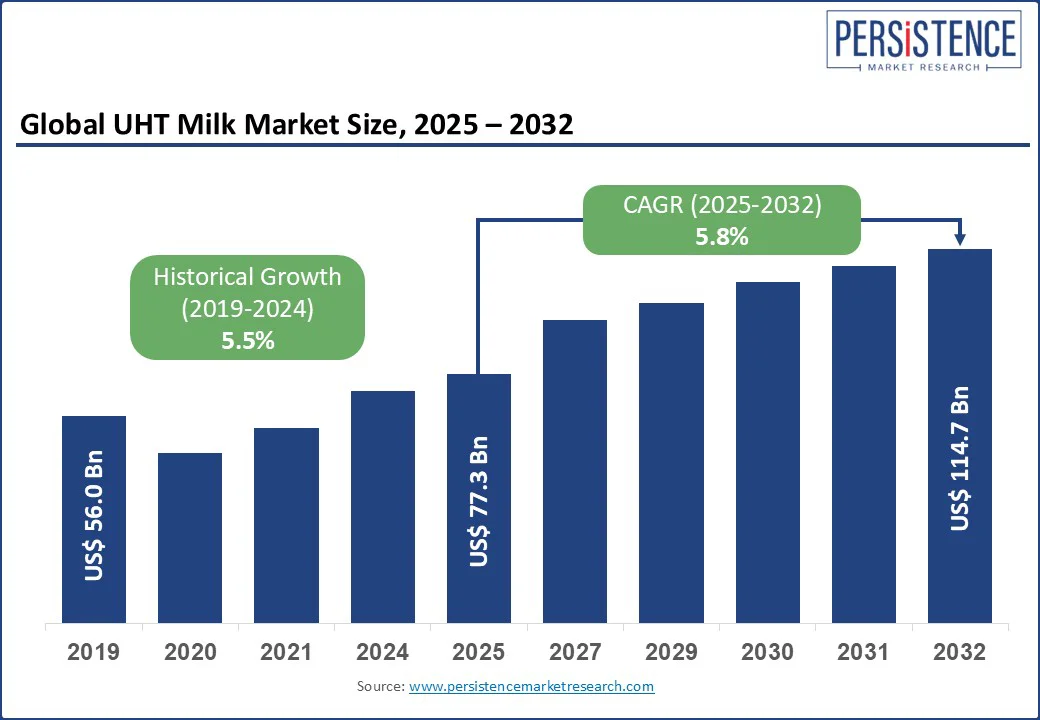

The UHT milk market size is likely to be valued at US$ 77.3 Bn in 2025 and is estimated to reach US$ 114.7 Bn in 2032, growing at a CAGR of 5.8% during the forecast period 2025-2032. Ultra-High Temperature (UHT) milk is changing dairy distribution by delivering a shelf-stable solution that puts an end to the reliance on cold chains. It provides extended shelf life without the requirement for refrigeration, thereby catering to evolving consumer lifestyles and supply-chain efficiencies. Its ability to remain stable for six to nine months makes it ideal for regions with underdeveloped cold chain infrastructure or where logistical flexibility is a priority. Leading dairy producers are hence using UHT processing to diversify portfolios, tap into export markets, and cater to the rising demand for convenient dairy solutions.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

UHT Milk Market Size (2025E) |

US$ 77.3 Bn |

|

Market Value Forecast (2032F) |

US$ 114.7 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.8% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.5% |

Increasing preference for premium-priced and long-life milk products is pushing the UHT milk market growth by changing consumer expectations around convenience, value, and quality. In the UAE and Singapore, high-income urban households often prioritize hygienic packaging and reliable sourcing. Hence, premium UHT milk, especially organic and fortified variants, is gaining momentum. Surging consumer demand for specialty lactose-free and high-protein products with extended shelf life is also spurring sales.

The shift is not just about convenience but also about reducing food waste and maximizing purchase efficiency. High-income households usually view long-life milk as a key pantry staple, primarily in the post-pandemic era where bulk buying and infrequent shopping trips have become normalized. In Europe, sales of premium UHT milk with added functional benefits, including calcium, vitamin-enriched, or immune-support formulas, have increased dramatically.

The slightly altered taste of non-perishable milk, often described as cooked due to high-temperature processing, hinders its adoption in markets with rising preferences for fresh milk. In the U.S., for example, where cold chain logistics are well-established, several consumers still associate fresh milk with purity and quality. According to a 2023 consumer survey by Dairy Management Inc., 42% of respondents stated that they preferred the flavor of refrigerated pasteurized milk over shelf-stable options. They reported UHT milk’s taste as less natural or too processed.

The taste perception has become problematic in applications where milk is consumed directly such as in cold beverages or breakfast cereals. Coffee chains in North America are often reluctant to use UHT dairy products, fearing these can compromise flavor integrity in lattes or cappuccinos. Attempts to address this issue through reformulated UHT processes, including indirect heating methods, have been met with mixed success. These tend to raise production costs, making it difficult for producers to compete on price with conventional UHT lines.

The rise of plant-based UHT milk is creating new opportunities by extending the shelf-stable dairy segment beyond traditional animal-sourced options. This shift is evident in markets where lactose intolerance and vegan diets are on the rise. Retailers are capitalizing on this trend by dedicating more shelf space to plant-based UHT options, especially in Europe. According to a 2024 online survey, almond and oat milk sales in France and Germany now account for nearly 30% of all plant-based milk sales, up from 22% two years ago.

The growth is attributed to improvements in UHT processing that preserve the texture and flavor of plant-based milks better than earlier versions. These make them ideal for direct consumption and barista applications. In addition, plant-based UHT milks offer brands entry into export markets with limited cold chain infrastructure. The combination of extended shelf life, health positioning, and global portability is turning plant-based milk into a strategic growth element for both leading dairy firms and new entrants.

Based on product type, the market is divided into skimmed, whole, partly skimmed, and fat filled. Among these, the whole segment will likely account for around 48.2% of the UHT milk market share in 2025 due to its rich taste profile and high nutritional density, which appeal to both traditional and health-conscious consumers. Whole UHT milk retains its full fat content, which improves mouthfeel and is valued in culinary uses such as coffee preparation and baking. In China and the Middle East, full-fat UHT milk is often viewed as a premium and wholesome product ideal for children and the elderly.

Skimmed UHT milk is gaining popularity among health-conscious consumers as they demand low-fat options that deliver the convenience of long shelf life. The shift is evident in urban areas across Asia Pacific and Europe, where dietary preferences are moving toward reduced-calorie as well as heart-friendly alternatives. In Japan, for instance, Meiji has broadened its portfolio of low-fat UHT milk to cater to the rising demand from older adults managing cholesterol and blood pressure. In India, Nestlé’s Slim Milk has witnessed double-digit growth, propelled by demand from young consumers and fitness enthusiasts.

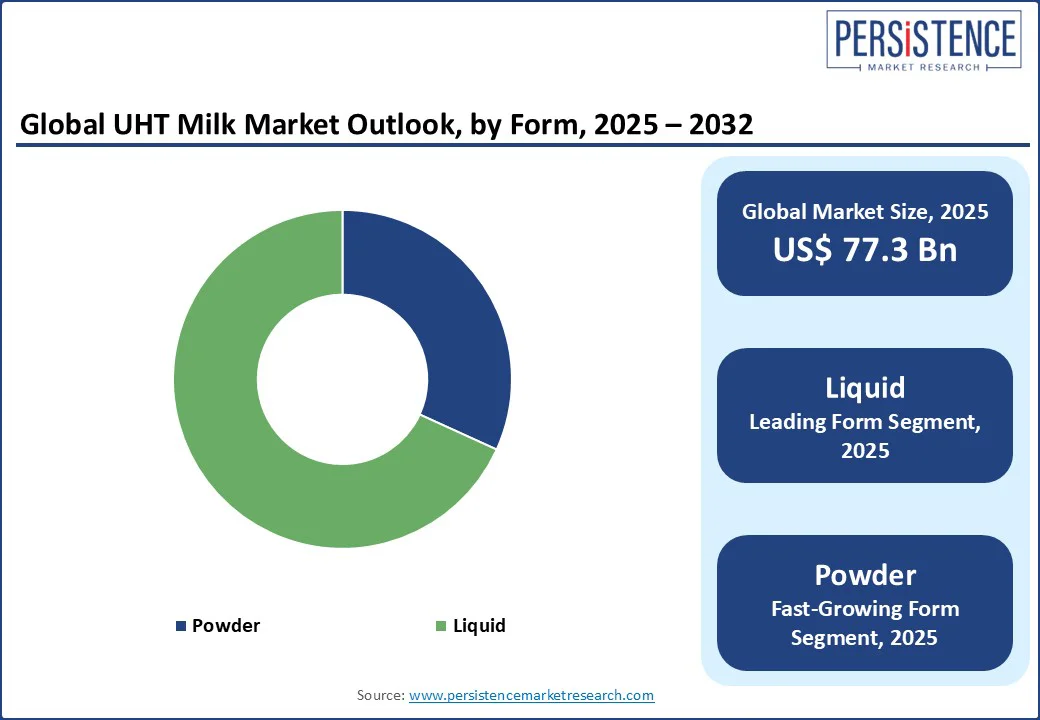

By form, the market is bifurcated into powder and liquid. Out of these, the liquid segment is predicted to hold approximately 68.2% of share in 2025 with its immediate usability and compatibility with fast-paced, urban lifestyles. Liquid UHT milk can be consumed straight from the pack or used instantly in cooking, which appeals to working professionals and nuclear families. The surge in single-serve packaging formats is also fueling demand. Thailand’s Dutch Mill and Australia’s Devondale have launched portable UHT packs in 180ml and 250ml sizes to cater to schoolchildren and commuters.

Powdered UHT milk is seeing decent growth due to its logistical advantages, specifically in regions with inconsistent supply chains and limited refrigeration. In rural parts of Africa and South Asia, powdered milk serves as a dependable alternative to fresh or liquid UHT milk. The format is also gaining popularity among food manufacturers and the HoReCa sector. Industrial bakeries and tea shops in the Philippines often prefer milk powder for its consistency, low cost per unit, and ease of bulk use.

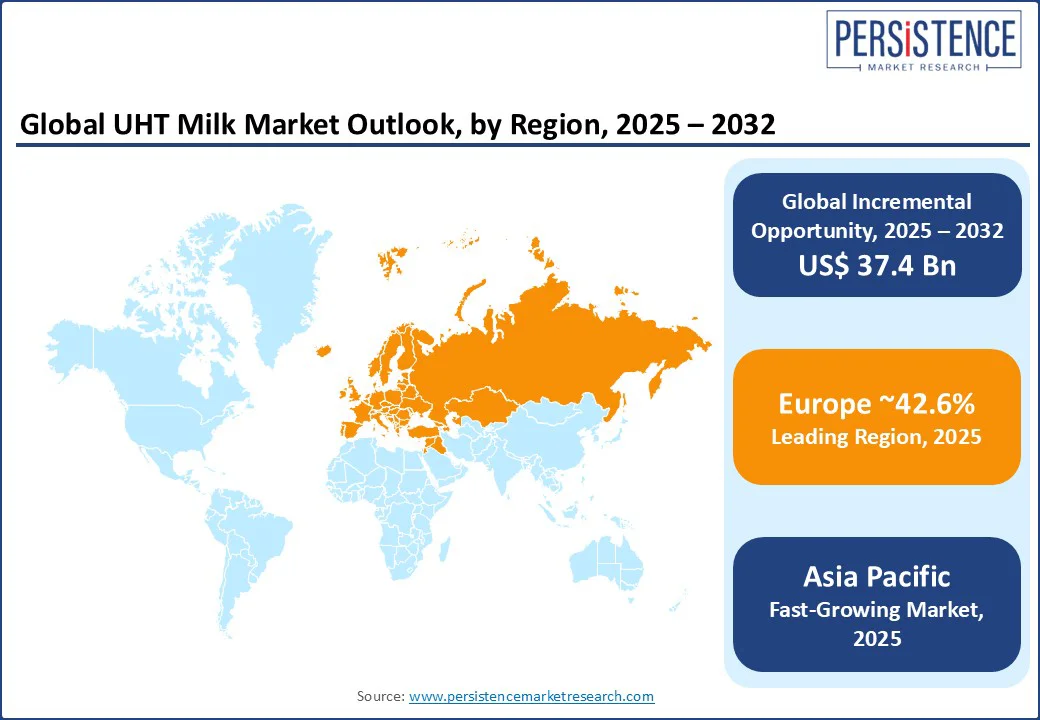

In 2025, Europe is projected to account for nearly 42.6% of the share owing to increased consumption of UHT-treated milk across France, Spain, and Italy. According to Eurostat, over 70% of drinking milk sold in these countries is UHT-treated. This is attributed to its longer shelf life and lower dependence on refrigeration compared to fresh milk. Markets in Southern and Central Europe favor UHT milk primarily because of warm climates. In addition, small urban dwellings with limited fridge space are spurring demand.

Germany presents a contrasting dynamic, with refrigerated fresh milk still preferred by a large portion of consumers. Poland and Romania, on the other hand, are witnessing a shift toward UHT milk, backed by rising rural demand and distribution efficiencies. In 2023, Poland-based dairy giant Mlekovita reported a 12% year-on-year surge in UHT milk exports. It targeted neighboring EU markets where supply chain disruptions made long-life products more desirable.

In Asia Pacific, UHT milk is experiencing skyrocketing demand, especially in countries where cold chain infrastructure is limited. China has witnessed a steady rise in demand, with companies such as Yili and Mengniu dominating the shelf-stable category. The preference for UHT milk in the country is associated with safety concerns and trust in sterilized products over fresh alternatives among parents and the elderly. India presents a different scenario, where UHT milk is creating a large consumer base alongside the dominant fresh milk segment.

Brands such as Amul and Nestlé India have been extending their UHT lines to cater to metro cities and working professionals who prioritize convenience and portability. From 2022 to 2023, Amul’s Tetra Pak milk segment grew by over 20%, accelerated by increasing e-commerce penetration and changing consumption patterns post-pandemic. The lack of refrigeration in parts of the country has also made UHT milk a suitable option in semi-urban and rural markets. Vietnam, Thailand, and Indonesia are further experiencing considerable growth due to increasing school milk programs and government nutrition campaigns.

In North America, UHT milk remains a niche segment compared to fresh milk, attributed to long-standing consumer preferences for refrigerated dairy. However, the market is gradually shifting. According to the U.S. Department of Agriculture (USDA), shelf-stable milk, including UHT, accounts for less than 10% of total milk sales in the U.S. However, it is gaining popularity in specific consumer segments such as emergency preparedness buyers, college students, and households with limited refrigeration access.

The U.S. UHT milk market is speculated to see decent growth with rising demand for meal kits and online grocery platforms, including Amazon Fresh and Instacart. These have given UHT milk new visibility. Brands such as Parmalat and Organic Valley are hence broadening their shelf-stable portfolios and distribution in both retail and digital channels. The surge of food inflation has also made UHT milk an attractive option due to reduced spoilage and waste, especially in foodservice settings. Canada has shown a slightly more receptive market, boosted by rural demand and supply chain logistics across remote areas.

The UHT milk market houses various multinational dairy corporations, regional players, and private label brands. They are focusing on long shelf life as a core value proposition. Leading companies are competing through extensive distribution networks and diverse product portfolios catering to different fat contents and packaging formats. They often focus on value-added offerings, including fortified UHT milk or organic variants, to target health-conscious and premium consumers. In emerging markets, local and regional players play a key role by addressing price sensitivity and cultural preferences. In India and Brazil, for example, domestic brands such as Amul and Italac, respectively, have built trust by delivering affordable options in small pack sizes.

The UHT milk market is projected to reach US$ 77.3 Bn in 2025.

Changing dietary habits post-pandemic and expansion of modern retail in emerging countries are the key market drivers.

The UHT milk market is poised to witness a CAGR of 5.8% from 2025 to 2032.

Development of smart packaging with freshness indicators and launch of co-branded UHT milk products are the key market opportunities.

Nestlé S.A., Danone SA, and Fonterra Co-operative Group Limited are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Form

By Source

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author