ID: PMRREP13117| 195 Pages | 27 Oct 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

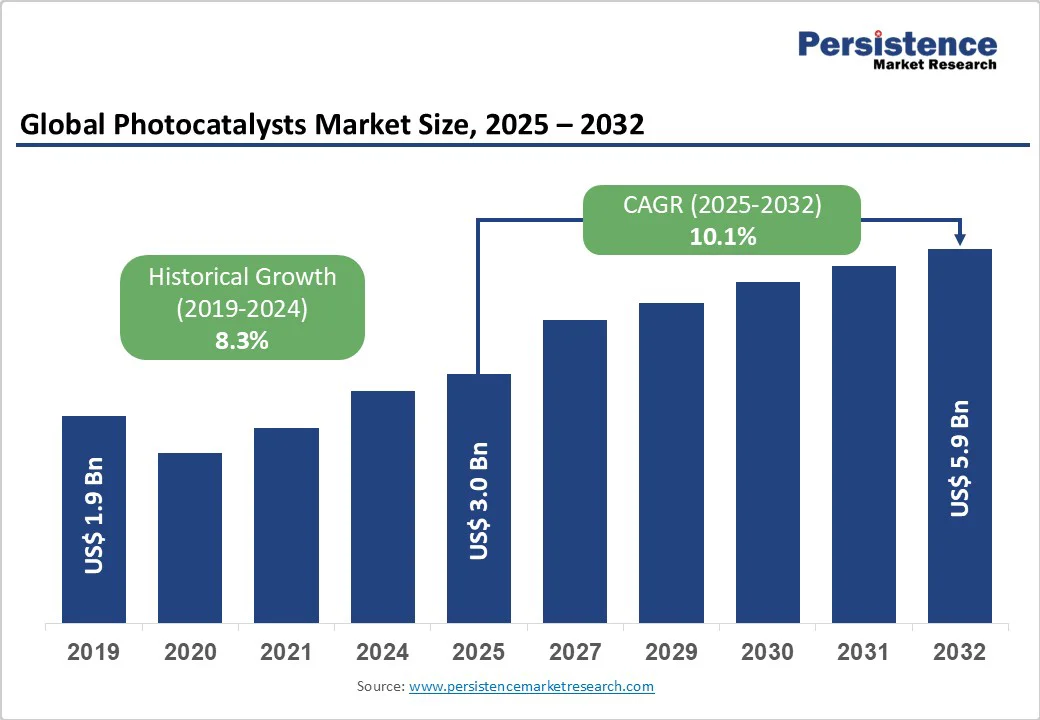

The global photocatalysts market size was valued at US$ 3.0 billion in 2025 and is projected to reach US$ 5.9 billion by 2032, growing at a CAGR of 10.1% between 2025 and 2032.

This robust growth is driven by increasing environmental consciousness, stringent regulations for air and water quality, and rising demand for sustainable solutions across industries.

The market expansion is further supported by technological advancements in visible light-activated photocatalysts, growing applications in building materials for self-cleaning surfaces, and the automotive sector’s adoption of air purification systems.

| Key Insights | Details |

|---|---|

| Photocatalysts Market Size (2025E) | US$ 3.0 billion |

| Market Value Forecast (2032F) | US$ 5.9 billion |

| Projected Growth CAGR(2025-2032) | 10.1% |

| Historical Market Growth (2019-2024) | 8.3% |

Global governments are implementing increasingly stringent environmental regulations to combat air and water pollution, creating substantial demand for photocatalytic solutions. The United States Environmental Protection Agency has introduced stricter emission standards, while the European Union’s Green Deal aims to achieve zero pollution by 2050, promoting adoption of clean technologies. These regulatory frameworks have resulted in 20% annual increases in clean technology investments globally, with photocatalysts playing a crucial role in meeting compliance requirements.

The 2022 Clean Air Act amendments and similar international policies mandate pollution control measures, driving industries to adopt photocatalytic air purification systems. According to the International Energy Agency, global investments in clean technologies are expected to rise by 20% annually, further supporting photocatalyst market growth as governments provide public funding initiatives to reduce environmental pollution.

Significant technological breakthroughs in photocatalyst materials have enhanced their efficiency and expanded their application scope, particularly through the development of visible light-activated photocatalysts. Research institutions and companies have successfully developed modified titanium dioxide formulations that can operate under fluorescent and natural lighting conditions, improving performance by up to 30% according to the Journal of Environmental Chemical Engineering.

Nanotechnology innovations, including the incorporation of materials such as graphene and nanoscale TiO2, have dramatically improved photocatalytic performance and enabled new applications in hydrogen production and energy conversion. Japanese companies like TOTO Ltd. and Ishihara Sangyo Kaisha have pioneered breakthrough technologies in visible light photocatalysts, with products like MPT-623 and STS-427 demonstrating significant antiviral and antibacterial activity under indoor lighting conditions, revolutionizing applications in healthcare facilities and public spaces.

The photocatalyst industry faces significant barriers from high initial investment requirements for commercial manufacturing and proprietary technology development. Manufacturing high-quality photocatalytic materials requires specialized equipment, controlled environments, and extensive quality control processes, resulting in substantial capital expenditures that can delay innovation cycles.

Companies must balance research and development costs with competitive pricing pressures, particularly challenging when raw material prices fluctuate. The complex manufacturing processes for advanced photocatalysts, especially those modified for visible light activation, require significant technical expertise and costly production facilities. These financial barriers are particularly pronounced for new market entrants seeking to compete with established players such as TOTO, Showa Denko, and BASF, who have already invested heavily in production infrastructure and hold numerous patents on key technologies.

The photocatalyst market faces intense competition from established alternative technologies that offer similar environmental benefits at potentially lower costs or with proven track records. Traditional air purification methods such as activated carbon filtration, HEPA systems, and chemical disinfectants provide immediate results without requiring light activation, making them attractive for applications with limited sunlight exposure.

In water treatment applications, conventional filtration systems, UV disinfection, and chemical treatments are often preferred due to their mature supply chains and regulatory approval history. The availability of these substitutes creates pricing pressure and limits market penetration, particularly in regions with well-established alternative technology infrastructures. Companies must continuously demonstrate superior long-term value propositions for end-users to switch from familiar technologies to photocatalytic solutions.

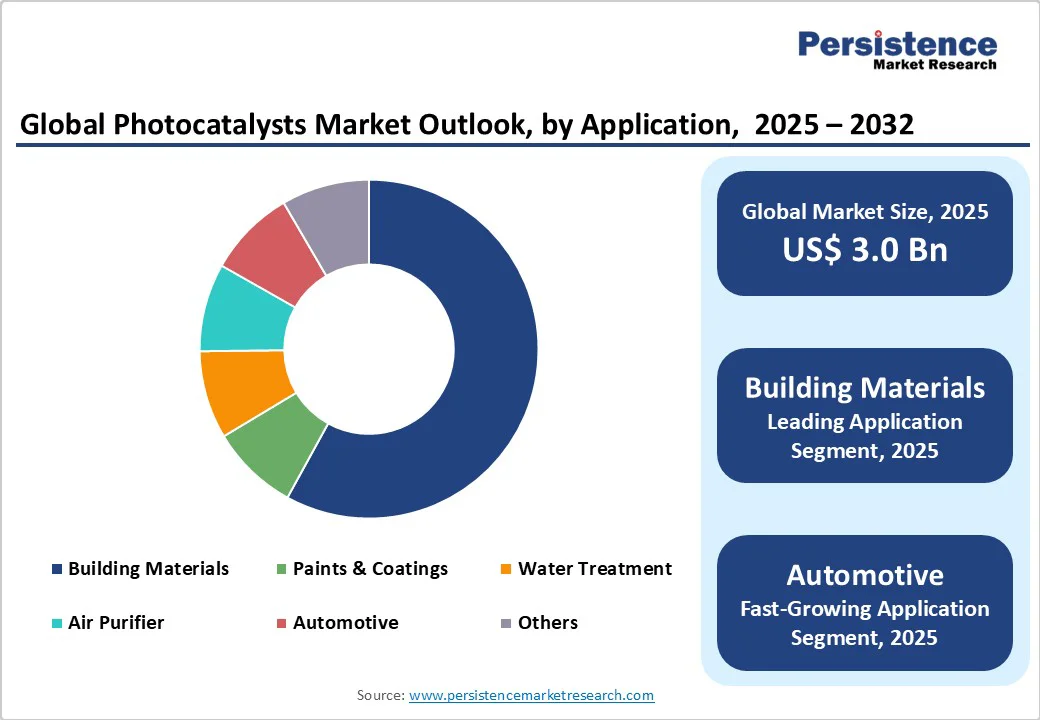

The building materials segment represents a significant growth opportunity, with the market share projected to reach 58% by 2025 as construction industries worldwide embrace sustainable and low-maintenance solutions. Photocatalytic coatings and materials offer self-cleaning properties that significantly reduce maintenance costs and enhance building aesthetics, particularly valuable in urban environments with high pollution levels. NASA research has validated photocatalytic solutions for creating self-cleaning surfaces that maintain high reflectance and act as air purifiers, leading to widespread adoption in commercial and residential construction.

The technology enables buildings to actively contribute to air quality improvement while reducing operational costs, making it attractive for green building certifications and smart city projects. Companies like TOTO have successfully commercialized photocatalytic building materials, with their HYDROTECT technology demonstrating six times more powerful air purification effects compared to conventional products, creating substantial market opportunities for expansion into infrastructure applications.

The automotive industry presents the fastest-growing application segment for photocatalysts, driven by increasing consumer awareness of air quality and regulatory requirements for emission reduction. Vehicle manufacturers are incorporating photocatalytic air purification systems to improve cabin air quality and meet environmental standards, with the automotive segment projected to experience the highest growth rates through 2032. JR Tokai and Seiwa Kankyo Engineering have successfully deployed photocatalytic ceramic filters in Shinkansen smoking rooms, demonstrating effective decomposition of volatile organic compounds and secondhand smoke.

The technological prowess to provide continuous air purification without filter replacement makes it particularly attractive for automotive applications. Rising urbanization and air pollution concerns in major automotive markets such as China and India are driving demand for advanced cabin air filtration systems, creating substantial opportunities for photocatalyst integration in both passenger and commercial vehicles.

Titanium dioxide dominates the photocatalysts market with more than 80% share in 2025, primarily due to its proven effectiveness, chemical stability, and cost-effectiveness compared to alternative photocatalytic materials. The widespread adoption of TiO2 stems from its excellent photocatalytic properties under UV light irradiation, non-toxic nature, and extensive research validation spanning over five decades since the discovery of the Honda-Fujishima effect in 1972. Ishihara Sangyo Kaisha has developed advanced TiO2 formulations like the ST/STS series that maximize photocatalytic activity while maintaining commercial viability.

The material’s versatility enables applications across air purification, water treatment, self-cleaning surfaces, and antimicrobial coatings, with TOTO’s HYDROTECT technology demonstrating superior performance in building materials. However, cerium oxide is emerging as the fastest-growing segment, driven by its unique oxygen storage capacity and superior catalytic properties in automotive applications, where it serves as an essential component in catalytic converters for emission control.

The building materials segment leads photocatalyst applications with a 58% share in 2025, reflecting the construction industry’s growing emphasis on sustainable and self-maintaining infrastructure solutions. This dominance results from photocatalytic materials’ ability to provide multiple benefits including self-cleaning surfaces, air purification, and antimicrobial properties that significantly reduce maintenance costs and enhance building performance.

TOTO’s photocatalytic coating technology has been successfully implemented in major infrastructure projects, including Moto-Sumiyoshi Station on the Tokyu Toyoko Line, where titanium dioxide-coated membrane roofs provide both self-cleaning functionality and environmental purification by decomposing NOx compounds.

The segment benefits from increasing adoption of green building standards and smart city initiatives that prioritize environmental sustainability. However, the automotive segment represents the fastest-growing application area, driven by stringent emission regulations and consumer demand for improved cabin air quality, with photocatalytic systems offering maintenance-free air purification solutions that complement traditional filtration methods.

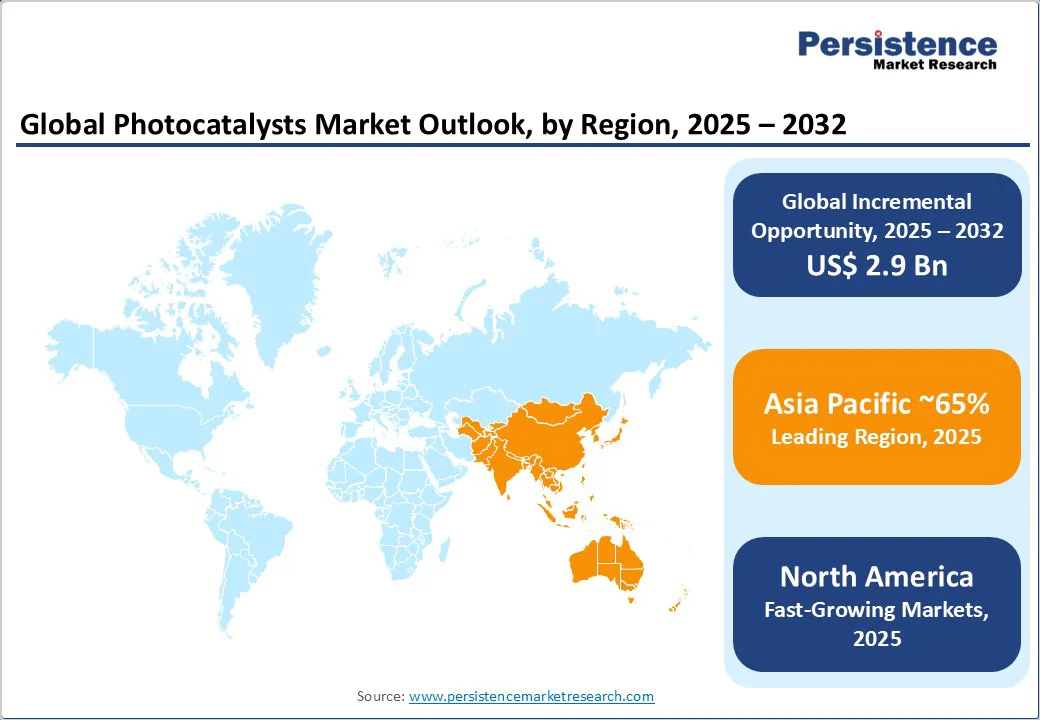

North America represents the fastest-growing regional market for photocatalysts, supported by robust regulatory frameworks, significant clean energy investments, and advanced innovation ecosystems. The United States accounts for over 84% of regional market share, driven by record US$ 71 billion investments in clean energy and transportation during 2024’s third quarter, reflecting 12% year-over-year growth according to Rhodium Group. The region benefits from stringent environmental regulations including Clean Air Act amendments and state-level emission standards that mandate adoption of advanced pollution control technologies.

Innovation leadership in photocatalytic research is concentrated in major metropolitan areas with strong university-industry partnerships, particularly around MIT, Stanford, and University of California systems that drive technological advancement. Post-COVID-19 emphasis on indoor air quality has accelerated adoption of photocatalytic coatings in healthcare facilities, commercial buildings, and residential applications, with the EPA promoting clean indoor air initiatives that favor photocatalytic solutions over traditional chemical-based systems.

European photocatalyst markets demonstrate strong growth supported by comprehensive regulatory harmonization and substantial government investments in sustainable technologies. The European Commission’s EUR 180 million investment in cutting-edge digital technologies and research underscores the region’s commitment to environmental innovation, creating significant opportunities for photocatalytic applications across multiple sectors. Germany, France, and the United Kingdom lead regional adoption through green building initiatives and urban air quality improvement programs that favor photocatalytic solutions.

The region’s automotive industry, particularly German manufacturers, increasingly incorporates photocatalytic air purification systems to meet stringent Euro 7 emission standards and consumer demands for premium cabin environments.

REACH regulatory compliance requirements ensure high safety standards for photocatalytic materials, while the European Green Deal’s zero pollution targets by 2050 drive continued investment in advanced environmental technologies. Strong emphasis on circular economy principles encourages development of recyclable and sustainable photocatalytic materials that align with EU environmental objectives.

Asia Pacific dominates global photocatalyst consumption with approximately 65% share in 2025, driven by rapid industrialization, urbanization, and strong government support for environmental technologies. Japan leads technological innovation through companies like TOTO, Showa Denko, and Ishihara Sangyo Kaisha, which have pioneered commercial photocatalytic applications and hold numerous international patents. The Japan Photocatalysis Industry Association established in 2006 provides standardization and certification frameworks that ensure high-quality products and facilitate global technology transfer.

China and India represent the largest growth markets, with urbanization rates exceeding 64% and 36% respectively, creating substantial demand for air and water purification solutions. Chinese investments in smart city projects and green infrastructure initiatives have accelerated photocatalyst adoption in building materials and urban pollution control systems. ASEAN countries demonstrate growing interest in photocatalytic technologies for addressing air quality challenges in rapidly developing urban centers, supported by government policies promoting sustainable development and environmental protection technologies.

The global photocatalysts market exhibits a moderately consolidated structure with several established players dominating key technology segments, particularly in titanium dioxide-based formulations. Japanese companies maintain technological leadership, with TOTO Ltd. pioneering commercial applications through their HYDROTECT technology and Ishihara Sangyo Kaisha developing advanced photocatalytic materials.

Market concentration is driven by significant research and development requirements, patent portfolios, and manufacturing expertise needed for high-quality photocatalyst production. Companies pursue growth through strategic partnerships with construction firms, automotive manufacturers, and environmental technology integrators to expand application reach.

Innovation focuses on visible light activation, enhanced durability, and cost reduction strategies, with emerging business models emphasizing licensing agreements and joint ventures to accelerate market penetration across diverse geographic regions and industry verticals.

The global photocatalysts market was valued at US$ 3.0 billion in 2025 and is projected to reach US$ 5.9 billion by 2032, representing a compound annual growth rate of 10.1% during the forecast period.

Key growth drivers include rising environmental regulations and pollution control requirements, technological advancements in visible light activation, increasing demand for self-cleaning building materials, and automotive sector adoption of air purification systems.

Titanium dioxide dominates the global photocatalysts market with more than 80% market share in 2025, driven by its proven effectiveness, chemical stability, cost-effectiveness, and extensive commercial validation across multiple applications.

Asia Pacific leads the global photocatalysts market with approximately 65% market share in 2025, primarily driven by rapid industrialization, urbanization, and strong government support for environmental technologies in countries like Japan, China, and India.

Building materials applications represent a significant growth opportunity with 58% market share, as construction industries worldwide embrace sustainable and low-maintenance solutions that provide self-cleaning properties and air purification capabilities.

Major market players include TOTO Ltd., Ishihara Sangyo Kaisha Ltd, Showa Denko K.K., Daicel Corporation, The Chemours Company, Tronox Limited, BASF SE, Tayca Corporation, and Nanoptek Corporation, among others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn/Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author