ID: PMRREP35701| 196 Pages | 9 Oct 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

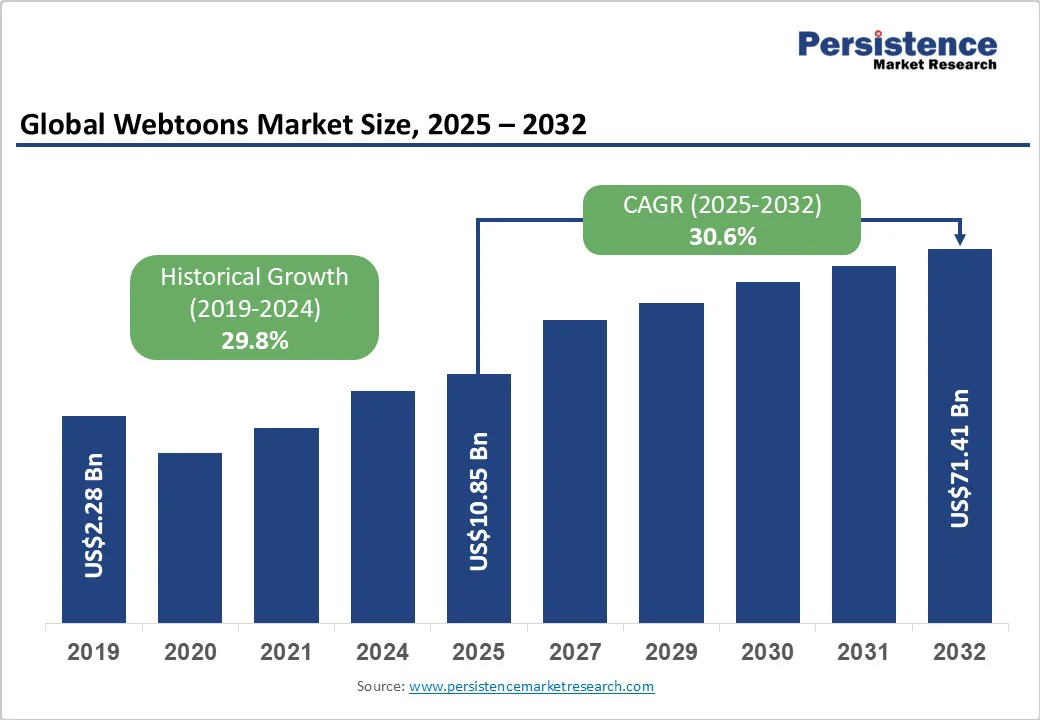

The global webtoons market size is likely to be valued at US$10.85 Billion in 2025. It is expected to reach US$71.41 billion by 2032, growing at a CAGR of 30.6% during the forecast period from 2025 to 2032, driven by the increasing adoption of smartphones and high-speed internet, which facilitates easy access to digital comics. This surge is further fueled by the growing popularity of Korean pop culture, including K-pop and K-dramas, which has enhanced the global appeal of webtoons.

A significant driver of this growth is the increasing demand for mobile entertainment, with platforms like Webtoon Entertainment attracting millions of active users worldwide. The adaptation of popular webtoons into short-form dramas and anime series has broadened their reach and appeal, further propelling market growth.

| Key Insights | Details |

|---|---|

| Webtoons Market Size (2025E) | US$10.85 Bn |

| Market Value Forecast (2032F) | US$71.41 Bn |

| Projected Growth (CAGR 2025 to 2032) | 30.6% |

| Historical Market Growth (CAGR 2019 to 2024) | 29.8% |

The webtoon market is experiencing rapid growth, driven by content adaptations, platform innovation, and evolving consumer preferences. The adaptation of popular webtoons such as The Villainess's Downfall and Sweet Home into short-form dramas has expanded reach, especially among Gen Z audiences, favoring vertical, mobile-first content. Collaborations with major entertainment firms, such as Webtoon Entertainment’s partnership with Disney to feature Marvel and Star Wars content, are further boosting global visibility and integrating webtoons into mainstream media.

Creator-led platforms, including Webtoon and Tapas, have democratized content creation, offering ad revenue sharing, crowdfunding, and global distribution that empower independent artists and encourage content diversity. The mobile optimization of webtoons aligns with modern on-the-go lifestyles, making them an accessible and preferred entertainment option for smartphone users.

Interactive storytelling innovations, such as multimedia enhancements, sound effects, and reader-driven plot choices, are reshaping user engagement. Webtoon Entertainment’s short-form video episodes for series such as The Mafia Nanny and Star Catcher cater to video-centric audiences, particularly Millennials and Gen Z, who seek immersive, personalized experiences. These technological and creative advancements are not only expanding the webtoon audience but also transforming how digital stories are consumed and monetized globally.

Webtoons face significant challenges from digital piracy and the pressures of high-frequency content demands. Piracy through unauthorized apps and websites leads to substantial revenue loss, as pirated content diverts users from official platforms and undermines monetization. This issue impacts financial performance, evident in Webtoon Entertainment’s US$22 Million net loss in Q1 2025, and also discourages creators from producing content due to fears of uncompensated distribution.

The demand for weekly updates puts intense pressure on creators, often leading to burnout. This serialization model can compromise both the quality and consistency of storytelling and artwork. Platforms driven by engagement metrics may unintentionally favor quantity over creative integrity, further straining creators.

Such practices risk long-term audience disengagement if the quality of the content declines. Balancing frequent updates with sustainable working conditions is crucial to retaining talent and maintaining audience loyalty in the evolving webtoon ecosystem.

Webtoon platforms are actively forming strategic partnerships with global entertainment companies to expand their reach and diversify their content. Webtoon Entertainment’s collaboration with Ubisoft led to an original webcomic set in the *Assassin’s Creed* universe, leveraging the franchise's global fanbase to attract new readers.

Similar alliances with Discord and IDW Publishing have enabled the adaptation of well-known titles, such as *The Witcher* and *Avatar: The Last Airbender*, into vertical scrolling formats optimized for mobile, thereby increasing accessibility and appealing to established fandoms.

These collaborations have also fueled the adaptation of webtoons into anime and live-action formats, signaling significant growth potential. For example, *Yumi’s Cells* was adapted into an animated film, and multiple anime adaptations of webtoon originals are scheduled for 2025 - 2026. These cross-media ventures expand webtoons’ visibility and appeal to diverse audiences, including anime fans and live-action viewers.

Platforms are focusing on niche genres such as LGBTQ+, slice-of-life, and supernatural themes to meet evolving reader preferences. Titles such as the yuri webtoon *Not So Shoujo Love Story*, which has garnered over 73 million views, underscore the rising demand for inclusive, genre-specific narratives. This targeted approach helps build loyal fan communities and drives deeper engagement, supporting sustainable growth.

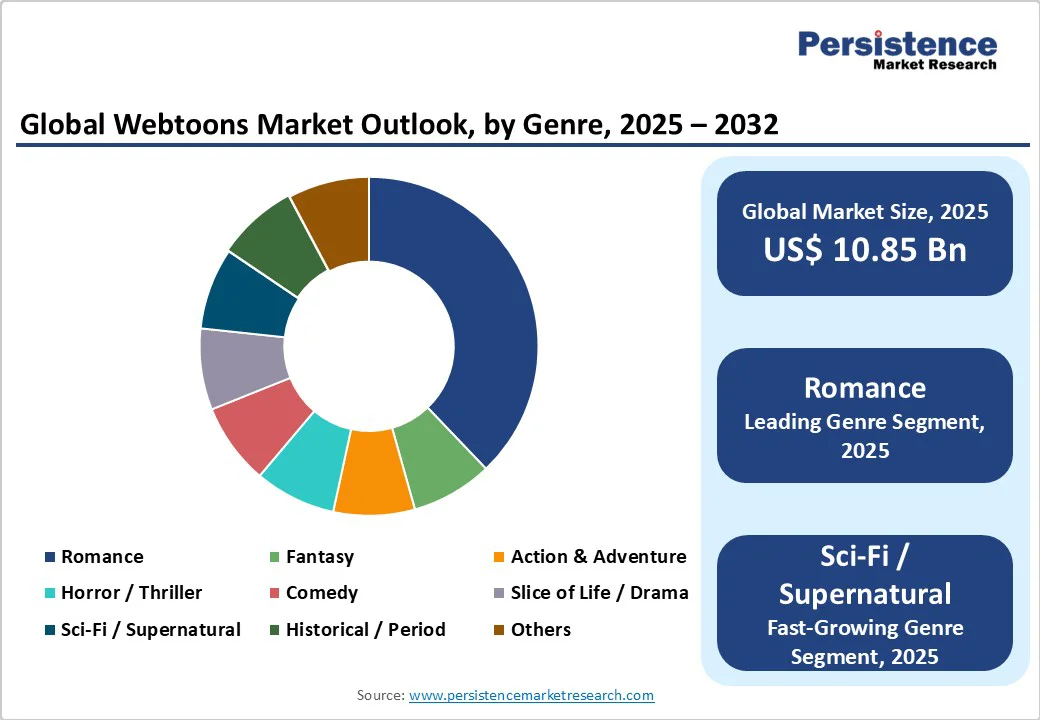

Romance remains the most dominant genre in the webtoon market, holding approximately 39.4% of the global market share in 2025. Its strong appeal among young adults and teenagers is driven by emotionally engaging narratives and relatable themes centered around relationships and personal growth.

The consistent popularity of romance content is further supported by the growing demand for digital entertainment. Leading platforms have capitalized on this trend by promoting high-performing romance series that foster strong reader engagement and loyalty. Notable webtoons such as True Beauty and Lore Olympus have garnered massive followings, often leading to multimedia adaptations.

Sci-Fi and Supernatural genres represent the fastest-growing segment. Though still considered niche, these genres are expanding rapidly due to their imaginative storytelling and visually rich world-building. The vertical scrolling format of webtoons enhances the immersive experience, making it particularly effective for delivering complex narratives within sci-fi settings.

Increasing reader interest is also reflected in their willingness to invest in premium content. A key example of this momentum is the adaptation of Star Catcher into a vertical-scrolling episodic video series. Featuring voice actors and music, this format caters to Gen Z audiences who seek more immersive and multimedia-driven storytelling experiences.

Mobile applications remain the leading distribution channel for webtoons with a market share of 71%, with platforms such as Webtoon and Tapas driving the majority of user engagement. The convenience of accessing content via smartphones has made mobile apps the preferred platform for digital comic readers.

Features such as offline reading, personalized recommendations, and intuitive navigation have significantly enhanced the user experience, encouraging daily usage and long-term retention. The dominance of mobile apps is closely tied to shifting content consumption habits, particularly among younger demographics.

At the same time, OTT partnerships and streaming platforms represent the fastest-growing distribution channel for webtoons. This emerging segment is gaining traction as webtoon intellectual properties are increasingly adapted into short-form dramas, anime, and other video content formats.

These adaptations enable Webtoons to reach a broader audience beyond traditional comic readers, particularly among viewers who primarily consume content through video streaming services. Notable examples such as The Villainess's Downfall and Sweet Home highlight how studios are leveraging webtoon narratives to develop engaging, mobile-optimized content.

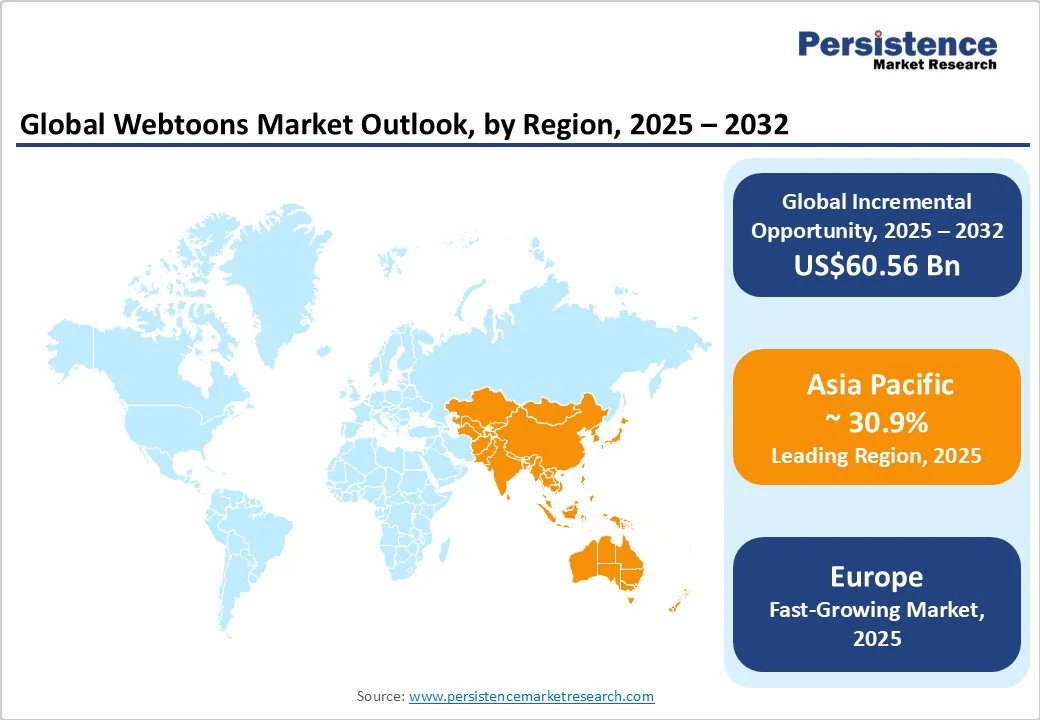

Asia Pacific dominates the market, accounting for over 30.9% of the market share in 2025, led by countries such as South Korea and Japan. The region's tech-savvy population, widespread mobile usage, and cultural affinity for visual storytelling have created a fertile environment for webtoon growth.

South Korea, in particular, remains at the forefront of the industry, both in terms of content creation and platform innovation. A major development in the region is the growing trend of adapting webtoons into live-action dramas and anime, which has amplified their international reach. Titles such as Sweet Home and All of Us Are Dead, originally webtoons, have been successfully adapted into high-profile Netflix series, attracting global audiences and boosting interest in the source material.

South Korea's webtoon market is mature and highly developed, with platforms such as Naver Webtoon and Kakao Webtoon leading the global charge. The industry is supported by robust domestic demand and strong export performance.

Recent developments include the launch of original webtoon-to-OTT projects, such as Gyeongseong Creature, based on a webtoon and set to release globally through Netflix. South Korea continues to invest in creator ecosystems, providing grants and training to nurture emerging webtoon talent.

Japan is experiencing rapid growth in webtoon consumption, particularly among younger readers. Major Japanese publishers, such as Shueisha and Kodansha, have begun investing in vertical-scrolling digital comics to compete with Korean platforms.

A key development is the integration of webtoons into mobile gaming, with titles such as Tower of God and Noblesse appearing in game formats. Japanese platforms, including Piccoma, have also gained traction by offering translated Korean webtoons alongside domestic titles, fostering a hybrid content ecosystem.

Europe's webtoons market is the fastest-growing market, driven by increasing internet access, the popularity of digital comics, and the rising adoption of smartphones and tablets for content consumption. The region's linguistic and cultural diversity has led to the emergence of localized webtoon content tailored to regional audiences.

A key development across Europe is the partnerships between local publishers and global webtoon platforms, bringing European creators into the global spotlight and offering translated European webtoons to international readers. Platforms such as Webtoon Factory and Delitoon have also begun producing original European content, reflecting growing domestic demand.

Germany has seen rising engagement with webtoons, particularly among younger readers familiar with both traditional comics and digital content. The collaboration between German publisher Carlsen Verlag and webtoon platforms has led to the localization and distribution of both domestic and international titles. German artists are also gaining visibility through global platforms. The recent launch of The Boxer and other translated series has expanded German readership and contributed to a growing webtoon culture.

France, with its rich comic book tradition, has integrated webtoons into its digital culture seamlessly. Platforms such as Delitoon and Verytoon have localized content and attracted a strong user base. Recent initiatives include collaborations between French publishers and Korean platforms to co-produce webtoon content.

For example, the French webtoon Café Gourmand has gained popularity across Europe through syndication. Furthermore, French creators are increasingly participating in international contests hosted by global platforms, signaling a push toward greater global exposure.

North America has emerged as a significant hub for webtoons, particularly in the U.S., where a robust digital infrastructure and high internet penetration have supported rapid adoption across diverse audiences. Platforms such as Webtoon Entertainment have leveraged this environment by offering extensive libraries of webtoons accessible via smartphones and tablets.

The growth of the U.S. market is further fueled by the rising popularity of Korean cultural exports, including K-dramas, K-pop, and webtoons, which resonate with audiences seeking fresh and diverse storytelling formats. A key development in the U.S. market is the cross-media expansion of webtoon IP into traditional and visual media.

For instance, the webtoon Let’s Play was successfully adapted into a graphic novel published by Rocketship Entertainment, broadening its reach beyond digital platforms. Webtoon-based stories such as Lore Olympus have gained mainstream visibility, with adaptations reportedly in development for animated series. These initiatives underline the versatility of webtoons and their potential to evolve into multi-format entertainment properties.

The U.S. has witnessed a sharp rise in webtoon readership, driven by a growing preference for digital-first storytelling and mobile-friendly formats. Webtoon Entertainment's original U.S. series, such as Down to Earth and Midnight Poppy Land, have garnered millions of views and built strong fan communities. Partnerships between webtoon publishers and entertainment companies are also facilitating the development of animated and live-action adaptations targeted at Western audiences.

The global webtoons market is highly competitive yet concentrated, with major players such as Naver, Kakao, and Lezhin Entertainment dominating over half of the global revenue. These firms benefit from vast content libraries, advanced technologies, and large user bases, creating high entry barriers.

Despite this, innovation is strong, with AI, AR, and VR driving new user experiences. International expansion and localized content further fuel growth. Competition is also intensifying through hybrid revenue models, combining subscriptions and ads, to boost engagement and loyalty. While the market favors established players, rapid technological integration and genre diversification continue to shape its evolving dynamics.

The webtoons market is expected to reach US$10.85 Billion in 2025.

By 2032, the webtoons market is projected to grow to US$714.1 Billion.

The webtoons market is expected to grow at a CAGR of 30.6% from 2025 to 2032.

Key trends include mobile-first consumption, AI-driven personalization, media adaptations into TV and film, global expansion through translations, and growth in subscription and ad-based monetization models.

Romance is the leading genre with the highest market share. Mobile platforms dominate usage, and the subscription model leads in monetization.

Major players include Naver Webtoon, Lezhin Comics, Tapas Media, Tappytoon, and Kuaikan.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Genre

By Distribution Channel

By Monetization Model

By Adaptation Format

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author