ID: PMRREP35806| 195 Pages | 31 Oct 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

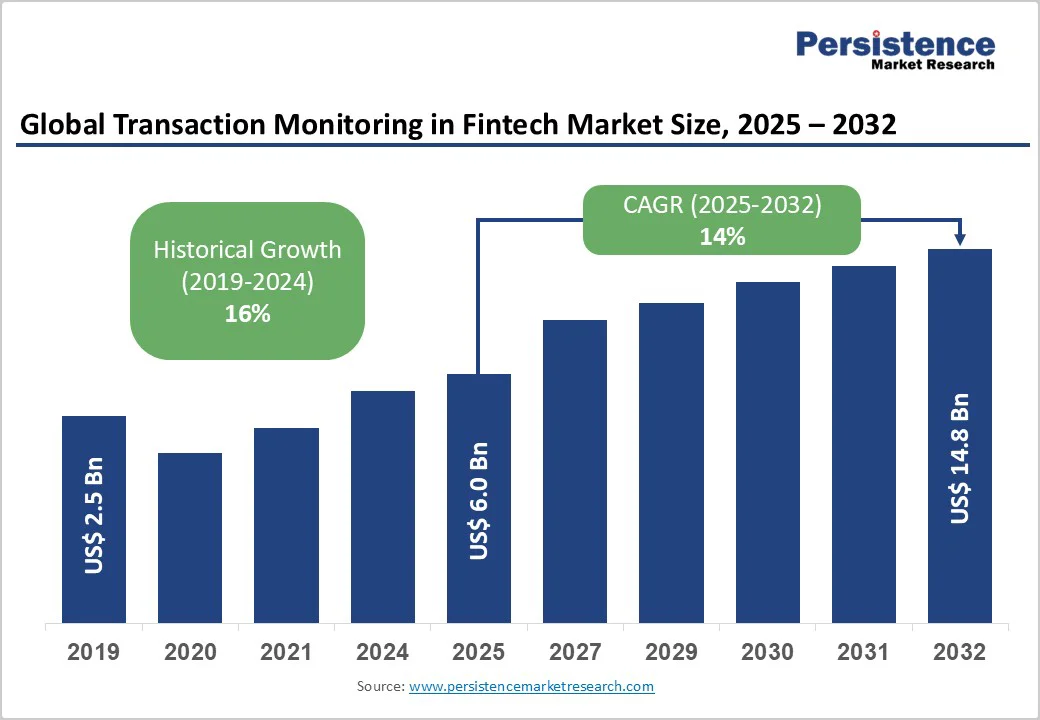

The global transaction monitoring in fintech market size is likely to be valued at US$6.0 Billion in 2025, and is estimated to reach US$14.8 Billion by 2032, growing at a CAGR of 14% during the forecast period 2025 - 2032.

The market is driven by rising demand for real-time fraud detection, AML compliance, and AI-powered analytics. The adoption of generative AI, cloud, and blockchain enhances transaction speed, security, and transparency, while regulatory mandates and growing transaction complexity further fuel the need for advanced monitoring solutions.

| Key Insights | Details |

|---|---|

| Transaction Monitoring in Fintech Market Size (2025E) | US$6.0 Bn |

| Market Value Forecast (2032F) | US$14.8 Bn |

| Projected Growth (CAGR 2025 to 2032) | 14% |

| Historical Market Growth (CAGR 2019 to 2024) | 16% |

The fintech sector is increasingly leveraging AI and machine learning (ML) to combat sophisticated financial crimes and comply with evolving AML regulations. AI/ML technologies enhance the detection of complex suspicious patterns by analyzing voluminous transaction data in real time, leading to more proactive risk management. This adoption accelerates operational efficiency by reducing false positives and enabling earlier intervention, minimizing financial losses and regulatory penalties. Globally, AML compliance expenditures are expected to rise due to intensifying regulatory scrutiny from bodies such as the Financial Action Task Force (FATF) and national regulators. The continuous refinement of AI models enhances anomaly recognition, supports predictive risk scoring, and automates regulatory reporting, thereby expanding market potential for fintech that integrates these tools into its transaction monitoring frameworks.

A significant restraint affecting the transaction monitoring in fintech market growth is the persistently high rate of false positives, where legitimate transactions are inaccurately flagged as suspicious. Studies indicate that false positives can constitute up to 95% of alerts in some systems, imposing substantial resource burdens on financial institutions tasked with manual investigations. This leads to increased operational costs and prolonged response times that can hinder real-time threat mitigation. For small and medium enterprises (SMEs), these costs can be prohibitive, hindering broader adoption of advanced transaction monitoring. Regulatory bodies mandate stringent compliance, but the complexity of evolving scams requires continual tuning of detection algorithms to balance sensitivity and specificity. Consequently, firms must allocate additional investments in skilled personnel, technology upgrades, and intelligent automation to optimize alert workflows.

Blockchain integration within fintech transaction monitoring presents a lucrative growth opportunity by enabling immutable audit trails and decentralized verification processes. This integration strengthens transparency, improves traceability of cross-border transactions, and minimizes reconciliation delays, which are pivotal in enhancing regulatory compliance and fraud prevention. Countries and blocs with strict regulatory frameworks, such as Singapore and the European Union (EU), are promoting blockchain adoption to augment fintech compliance infrastructures. Furthermore, combining blockchain with AI enables continuous transaction validation across distributed ledgers, offering an innovative approach to AML and fraud detection.

Cloud-based deployment is expected to command a dominant 65% of the transaction monitoring in fintech market revenue share by 2025. This lead is bolstered by the intrinsic advantages of cloud computing, including flexibility, scalability, and lower total cost of ownership, which enable fintech companies to rapidly adjust monitoring capabilities in response to fluctuating transaction volumes. Cloud platforms also provide enhanced disaster recovery, seamless integration with AI and blockchain technologies, and improved security postures adhering to standards like ISO/IEC 27001.

Web-based deployment is forecasted as the fastest-growing, with a robust CAGR of around 16% from 2025 to 2032. This growth is underpinned by the proliferation of mobile fintech applications and a demand for device-agnostic monitoring solutions that empower users to conduct real-time transaction reviews across platforms. The accessibility and user-friendly interfaces of web-based solutions particularly attract SMEs and digitally native fintech startups, who seek cost-effective, subscription-based tools without heavy IT overheads. Further spurring the growth of this segment are the evolving cloud-native architectures that facilitate hybrid deployments, blending web functionality with robust backend services.

The fraud detection and prevention segment is set to hold a commanding market share, estimated to stand at 40% in 2025, reflecting the fintech industry’s acute focus on combating increasingly sophisticated fraud schemes. This segment benefits from continuous innovation in AI-driven analytics that identify predictive markers of fraud in real time over massive datasets. For example, transaction pattern recognition and biometric verification have become standard features within these systems, reducing false positive rates and improving operational efficiency. As digital payment volumes soar due to e-commerce and mobile banking expansion, the demand for fraud detection is intensifying, making this segment a focal point for fintech investment.

Anti-money laundering is likely to be the fastest-growing segment through 2032, propelled by global regulatory intensification and stricter enforcement mandates by institutions such as the FATF. AML solutions have evolved beyond static rule-based systems to incorporate machine learning models that analyze multi-dimensional transaction data and customer behavior to detect complex laundering attempts involving layering, structuring, and integration. This dynamism increases market share as financial institutions seek to preempt regulatory fines and reputational damage by implementing advanced, automated AML compliance platforms.

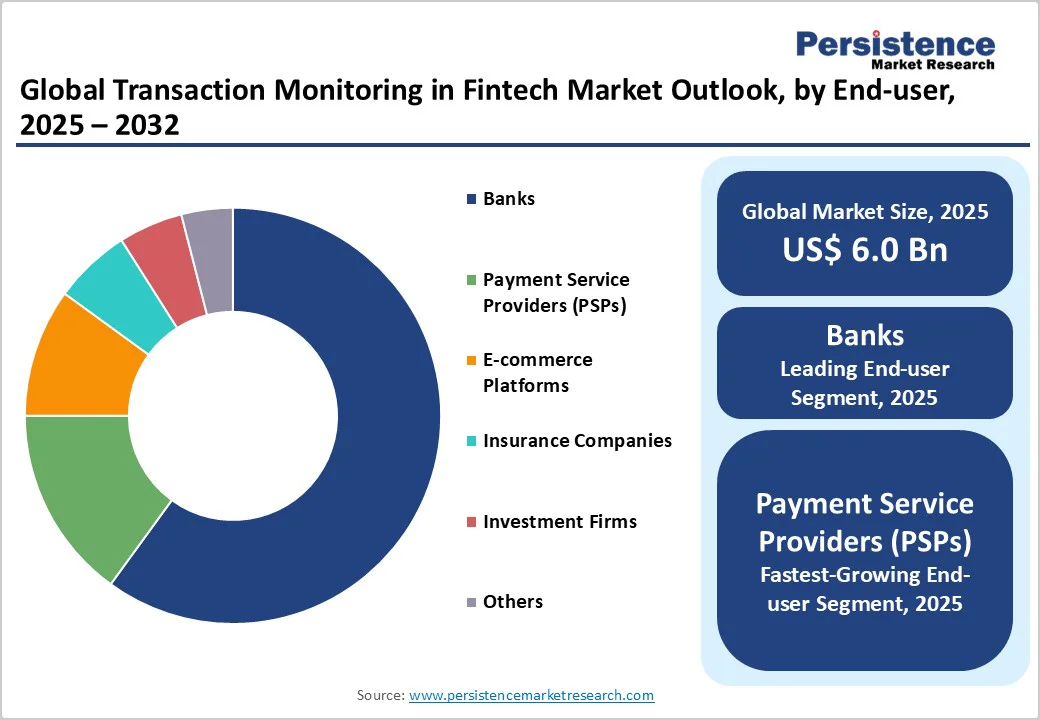

Among end-users, banks are poised to dominate with approximately 60% of the transaction monitoring in fintech market revenue in 2025. Their dominance stems from the vast scale of financial transactions processed daily, combined with stringent regulatory compliance requirements imposed by national and international authorities. Banks are heavily investing in advanced transaction monitoring systems that incorporate AI and machine learning to efficiently detect fraudulent and suspicious activities, reduce false positives, and ensure regulatory adherence. Their critical need for robust, scalable, and real-time monitoring solutions positions them as the primary growth engine within this segment.

Payment service providers are likely to experience the highest growth, with an anticipated CAGR of about 17% from 2025 to 2032. This rapid expansion is propelled by the explosive proliferation of digital payments globally, driven by mobile wallets, peer-to-peer platforms, and cross-border payment innovations. PSPs, often operating with slimmer margins and heightened exposure to fraud risks, are increasingly adopting automated, cloud-based transaction monitoring solutions to mitigate risk affordably and meet evolving AML requirements. The compelling growth trajectory of PSPs reflects broader industry digitalization trends and regulatory pressure, positioning them as pivotal drivers of market expansion alongside the established banking sector.

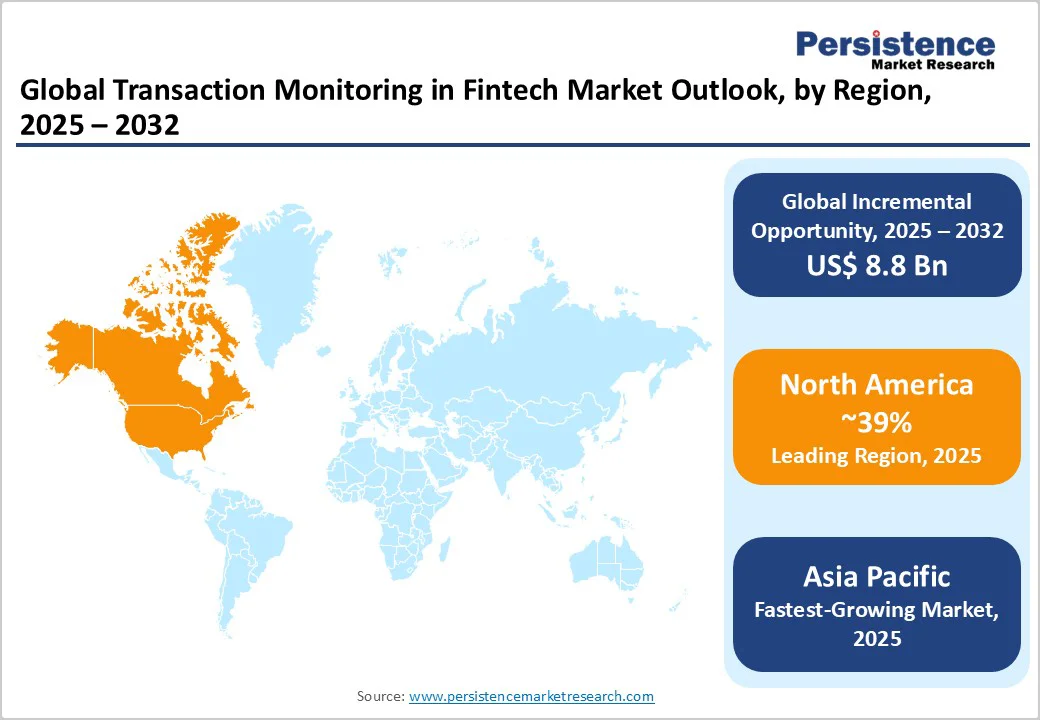

North America is anticipated to secure an estimated 39% of the transaction monitoring in fintech market share in 2025. The United States leads this dominance, driven by its advanced fintech sector, pervasive AI integrations, and comprehensive regulatory frameworks, including the Bank Secrecy Act (BSA), anti-money laundering laws, and regulatory oversight by agencies such as the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). Investment ecosystems in Silicon Valley and other fintech hubs foster innovation in AI-powered monitoring tools, ensuring rapid product development and deployment cycles.

Regional market growth is stimulated by increasing digital transaction volumes and the necessity for automated compliance workflows amid growing regulatory penalties. The regulatory environment drives large-scale investments in technologies that enhance compliance accuracy, reduce manual intervention, and improve audit readiness. Moreover, prominent competitive dynamics encourage vendors to develop integrated AI-ML-cloud solutions with predictive analytics to reduce operational costs and improve monitoring effectiveness.

Europe is predicted to command approximately 25% of the market share in 2025, with Germany, the U.K., France, and Spain as principal contributors. The harmonization of AML regulations via the EU’s AML directives, coupled with GDPR compliance mandates, creates a uniform regulatory environment demanding cutting-edge transaction monitoring capabilities. The fintech hubs across Europe, notably London, Berlin, and Paris, are also driving the adoption of advanced analytics and regulatory technology (RegTech).

Investment trends emphasize blockchain deployment to ensure data integrity and transparency across multi-jurisdictional transactions, with companies accelerating cross-border compliance solutions. Regulatory initiatives are progressively increasing AML penalties, incentivizing firms to integrate sophisticated machine learning-driven monitoring to stay compliant. The region’s competitive landscape is characterized by strong collaborations between financial institutions, RegTech firms, and government-backed innovation centers promoting financial security.

Asia Pacific is anticipated to exhibit the fastest growth trajectory at around 19% CAGR over 2025 - 2032, capturing nearly 20% of the global market by 2025. This surge is primarily driven by burgeoning fintech adoption in China, India, and ASEAN economies, where rapid digitization of financial services and evolving AML regulations compel the deployment of scalable transaction monitoring solutions. The regional market also benefits from robust IT infrastructure and government incentives supporting fintech innovation, particularly in cloud services and AI integration.

The competitive landscape is expanding rapidly with local and global players establishing presence to capture untapped SME markets and growing urban consumer bases. Investment flows are robust, particularly in AI-enhanced transaction analytics and blockchain-based compliance tools, creating opportunities for fintech providers aiming to leverage regional economic growth and technological advancement.

The global transaction monitoring in fintech market structure displays moderate concentration, marked by a few leading multinational players alongside a vibrant ecosystem of specialized and regional fintech vendors. Oracle Corporation, NICE Actimize, FICO, and SAS Institute dominate, maintaining their competitive advantages through integrated AI and cloud offerings, comprehensive compliance toolkits, and extensive customer engagements across financial enterprises worldwide.

Increasing demand for agile, niche, and cost-efficient solutions fosters competition from emerging fintech startups and specialized RegTech firms. This dynamic results in a semi-consolidated market landscape where large incumbents continuously innovate and pursue acquisitions to broaden capabilities, while newcomers focus on disruptive niche applications, especially SME segment targeting and blockchain-enhanced services. The competitive positioning increasingly emphasizes technological sophistication, scalability, regulatory adaptability, and partnership ecosystems to capture new growth opportunities.

The transaction monitoring in fintech market size is projected to reach US$6.0 Billion in 2025.

The soaring demand for real-time fraud detection and compliance with anti-money laundering (AML) regulations is driving the market.

The transaction monitoring in fintech market is poised to witness a CAGR of 14% from 2025 to 2032.

The increasing adoption of AI-powered analytics in banking and the widening integration of generative AI, cloud computing, and blockchain technologies in financial transactions are key market opportunities.

Oracle Corporation, NICE Actimize, and FICO are some of the key players in the transaction monitoring in fintech market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Deployment Mode

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author