ID: PMRREP35989| 199 Pages | 31 Dec 2025 | Format: PDF, Excel, PPT* | Food and Beverages

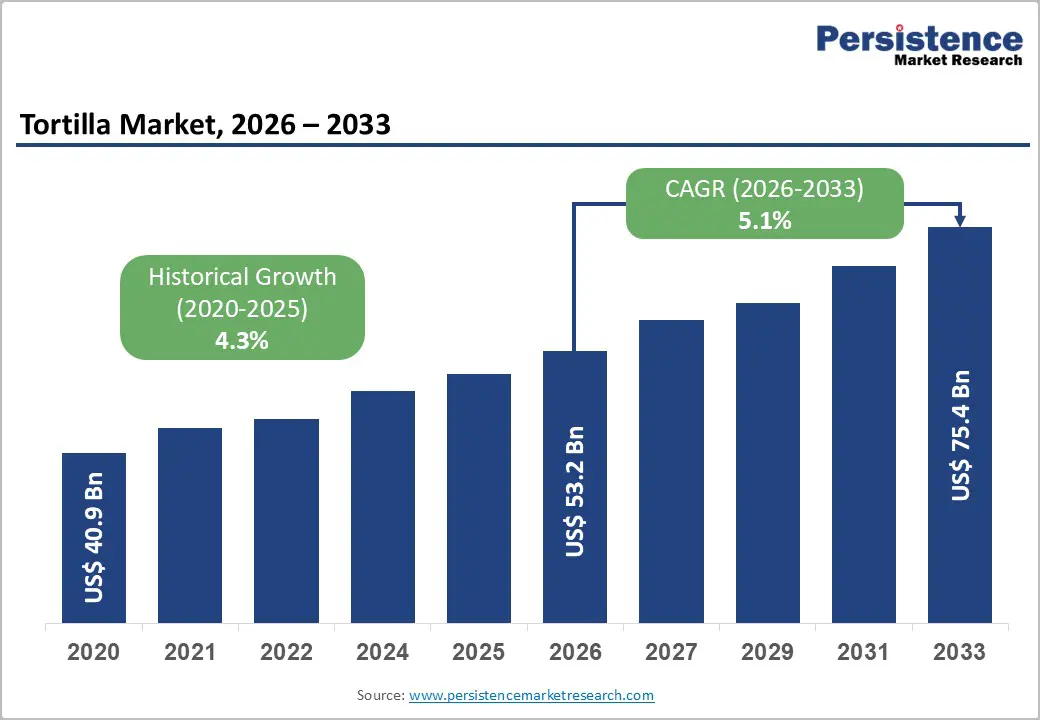

The global tortilla market size is estimated to grow from US$ 53.2 billion in 2026 to US$ 75.4 billion by 2033. The market is projected to record a CAGR of 5.1% during the forecast period from 2026 to 2033.

A fast-evolving global appetite for tortillas is reshaping food culture across regions, driven by fusion dining, modern retail expansion, and rising demand for convenient, versatile meal formats. The market is increasingly influenced by health-forward formulations, artisanal craftsmanship, and aggressive foodservice growth in emerging economies.

| Key Insights | Details |

|---|---|

| Global Tortilla Market Size (2026E) | US$ 53.2 Bn |

| Market Value Forecast (2033F) | US$ 75.4 Bn |

| Projected Growth (CAGR 2026 to 2033) | 5.1% |

| Historical Market Growth (CAGR 2020 to 2025) | 4.3% |

A rising global fascination with bold, authentic flavors is accelerating the spread of Mexican cuisine, pushing tortillas deeper into mainstream food cultures. Consumers across North America, Europe, and Asia are adopting Mexican dishes as everyday meals rather than occasional indulgences, driving steady demand for versatile tortilla formats. From quick-service chains to home kitchens, tortillas serve as a convenient base for wraps, tacos, quesadillas, and fusion recipes that appeal to health-conscious and flavor-seeking audiences. This broad culinary acceptance increases shelf rotation in retail and encourages foodservice operators to expand menu offerings featuring tortillas.

The momentum extends beyond traditional uses as global chefs incorporate tortillas into hybrid cuisines, elevating their relevance in contemporary food trends. This cross-cultural experimentation makes tortillas a staple in fast-casual dining, ready-to-eat meals, and premium snack segments. As culinary exploration widens across demographics, tortillas benefit from sustained visibility, reinforcing their position as a key driver of the expanding global Mexican food ecosystem.

Intense competition from local and artisanal tortilla makers is reshaping the dynamics of global tortilla sales, restricting the pricing flexibility of large manufacturers. Regional producers often offer fresher products with traditional preparation methods, giving them strong neighborhood-level loyalty and a clear edge in authenticity. These smaller competitors operate with lower overheads and can react quickly to shifting consumer tastes, creating a fragmented marketplace where premium pricing by major brands becomes harder to justify. Their presence keeps retail prices tightly constrained, especially in markets where freshness and tradition strongly influence purchase decisions.

Large manufacturers face additional pressure as artisanal producers expand through farmers’ markets, specialty stores, and online delivery channels. Their handcrafted positioning appeals to consumers seeking minimally processed or culturally rooted foods, intensifying the competitive landscape. This growing preference for local craftsmanship forces major brands to compete more on value, innovation, and convenience while absorbing tighter margins.

A rapid build-out of quick-service restaurants, cafés, and modern eateries across emerging markets is opening a sizeable window for bulk-pack tortillas and frozen formats. As foodservice operators scale, they demand consistent, high-volume tortilla supplies that align with standardized menus and centralized kitchens. Frozen tortillas, with their longer shelf life and reliable texture, are becoming essential for chains seeking operational efficiency across multiple locations. This structural growth encourages producers to invest in larger production lines, cold-chain capabilities, and region-specific formulations tailored to local palates.

For new startups and established players, expanding foodservice footprints translate into reliable, repeat-order partnerships and predictable demand cycles. Bulk formats in 10-50 count packs create room for value-driven offerings, while frozen variants enable broader geographic distribution without quality loss. Companies that align with foodservice distributors, cloud-kitchen networks, and fast-casual chains can secure long-term contracts and strong entry points into rapidly urbanizing regions.

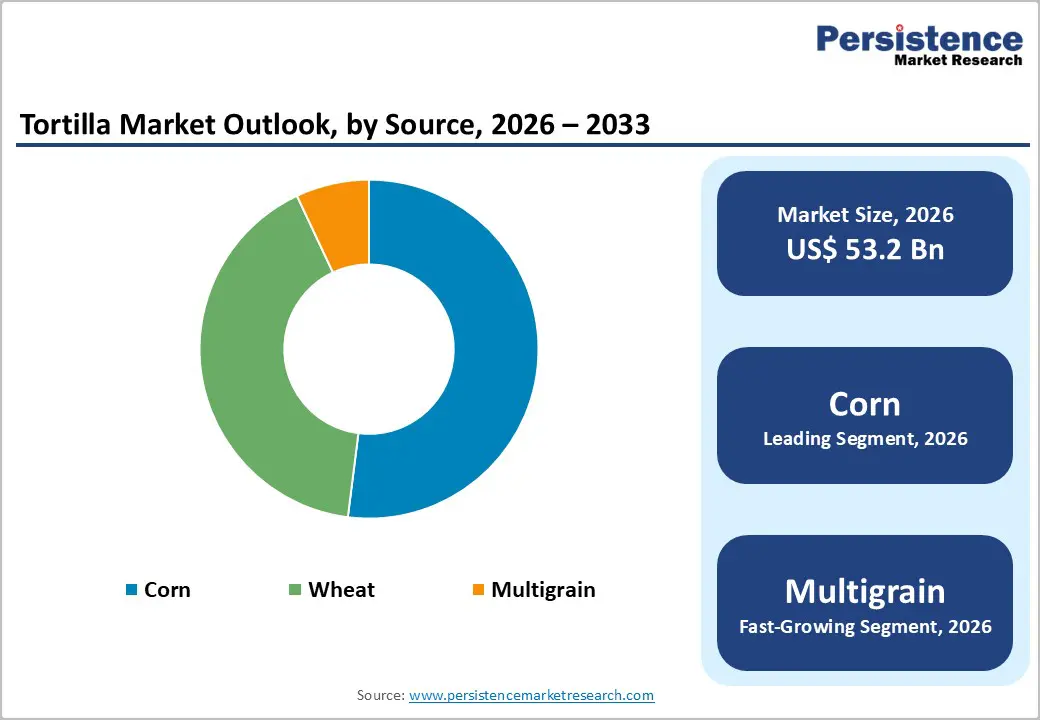

Corn-based tortillas hold approximately 53% market share as of 2025, driven by their deep cultural roots, authentic flavor, and strong acceptance across both traditional and modern food applications. Their naturally gluten-free profile aligns with rising dietary preferences, strengthening demand across global retail and foodservice channels. Corn tortillas also offer versatility for tacos, tostadas, chips, and ready-to-eat snacks, making them essential for manufacturers targeting mass consumption and high-volume formats. Their cost efficiency and wide ingredient availability further reinforce their dominance in large-scale production systems.

Wheat tortillas maintain steady demand in wrap-focused segments, particularly in Western markets where soft-texture formats support fusion menus. Multigrain tortillas continue gaining traction among health-driven consumers seeking fiber-rich, nutrient-forward alternatives.

Frozen tortillas are projected to grow at a CAGR of 7.5% in the global tortilla market during the forecast period, driven by rapid adoption across foodservice chains, cloud kitchens, and retail freezer aisles. Their long shelf life, consistent texture, and ease of storage make them a practical choice for operators scaling standardized menus across multiple locations. As urban consumers prioritize convenience, frozen tortillas fit seamlessly into ready-meal kits and time-saving home cooking routines, expanding their relevance in both developed and emerging markets. Rising cold-chain investments and improved freezing technologies further enhance product quality and distribution reach.

Fresh tortillas continue to hold strong demand in regions where daily preparation and traditional consumption shape buying behavior. They remain preferred in households and specialty shops that prioritize aroma, softness, and immediate use.

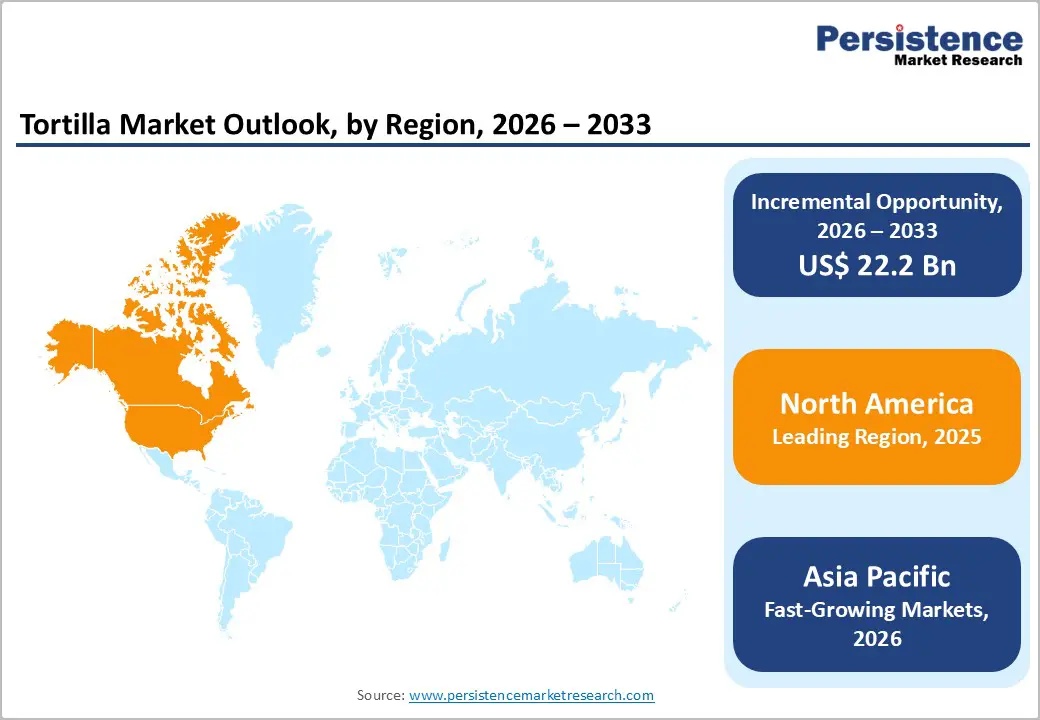

North America holds approximately 39% market share in the global tortilla market, driven by strong consumer adoption and a rapidly evolving food culture. The U.S. continues to integrate tortillas into mainstream eating habits, with rising demand for clean-label, low-carb, grain-free, and flavored variants. Canada is witnessing growth in artisanal tortilla production and expanding retail shelf space for organic and non-GMO options as multicultural populations influence purchasing behavior. Foodservice operators across both countries are increasingly using tortillas in fusion menus, breakfast wraps, protein-packed snacks, and ready-to-eat meal formats.

Leading brands such as Mission Foods, Guerrero, La Banderita, TortillaLand, and La Tortillería are shaping innovation through improved formulations, healthier ingredient profiles, and expanded plant-based offerings, reinforcing tortillas as a staple across North American diets.

Asia Pacific tortilla market is expected to grow at a CAGR of 8.2%, driven by rapid urbanization, shifting meal habits, and rising experimentation with global cuisines. India is seeing increased adoption of tortillas across QSR chains and home kitchens, as consumers embrace convenient wrap-style meals. China’s growing interest in fusion snacks and Westernized fast-casual dining is pushing tortillas into bakery shelves and ready-meal offerings. Japan is seeing demand for premium soft tortillas used in gourmet wraps and bento-style applications, supported by a preference for clean, minimally processed formats. South Korea’s active café culture is integrating tortillas into brunch menus, protein wraps, and on-the-go snack lines. Expanding retail distribution, modern trade growth, and strong foodservice uptake continue to shape a dynamic, fast-growing market across the region.

The global tortilla market remains moderately fragmented, with a mix of dominant multinational brands and agile regional producers shaping competition. Leading companies are strengthening portfolios through clean-label lines, gluten-free formulations, and certifications that appeal to health-driven consumers. Many are expanding manufacturing footprints in Asia, the Middle East, and Europe to capture rising demand linked to tourism growth and the spread of globalized foodservice formats. Startups are gaining visibility through artisanal production, niche flavors, and e-commerce-driven direct sales, targeting younger buyers seeking convenience and authenticity. QSR investments and cloud-kitchen expansion continue to accelerate large-volume tortilla consumption, while busy lifestyles push retailers to stock more ready-to-heat wraps and multipack formats. Continuous innovation in texture, shelf life, and plant-based variants keeps competition active across regions.

The global tortilla market is projected to be valued at US$ 53.2 Bn in 2026.

Global enthusiasm for Mexican cuisine is steadily embedding tortillas into everyday eating habits worldwide, accelerating the growth of the global Tortilla market.

The global Tortilla market is poised to witness a CAGR of 5.1% between 2026 and 2033.

Expanding foodservice networks across emerging markets is creating strong demand for bulk-pack and frozen tortilla formats, unlocking a substantial growth window for companies in the Tortilla industry.

Major players in the global Tortilla market include Gruma Corporation, General Mills, Olé Mexican Foods, La Tortilla Factory, Maria & Ricardo's Tortilla, Siete Foods, Signature Flatbreads (UK) Ltd, and Catallia Mexican Foods, and others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn, Volume: Tons |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Source

By Form

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author