ID: PMRREP19183| 199 Pages | 20 Nov 2025 | Format: PDF, Excel, PPT* | Consumer Goods

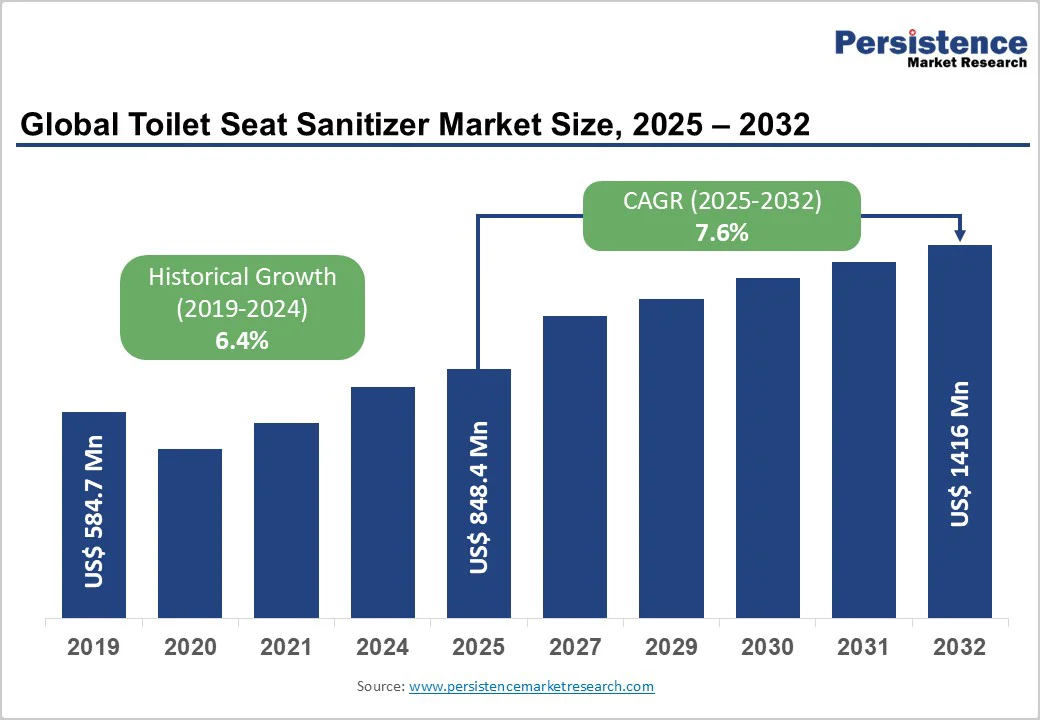

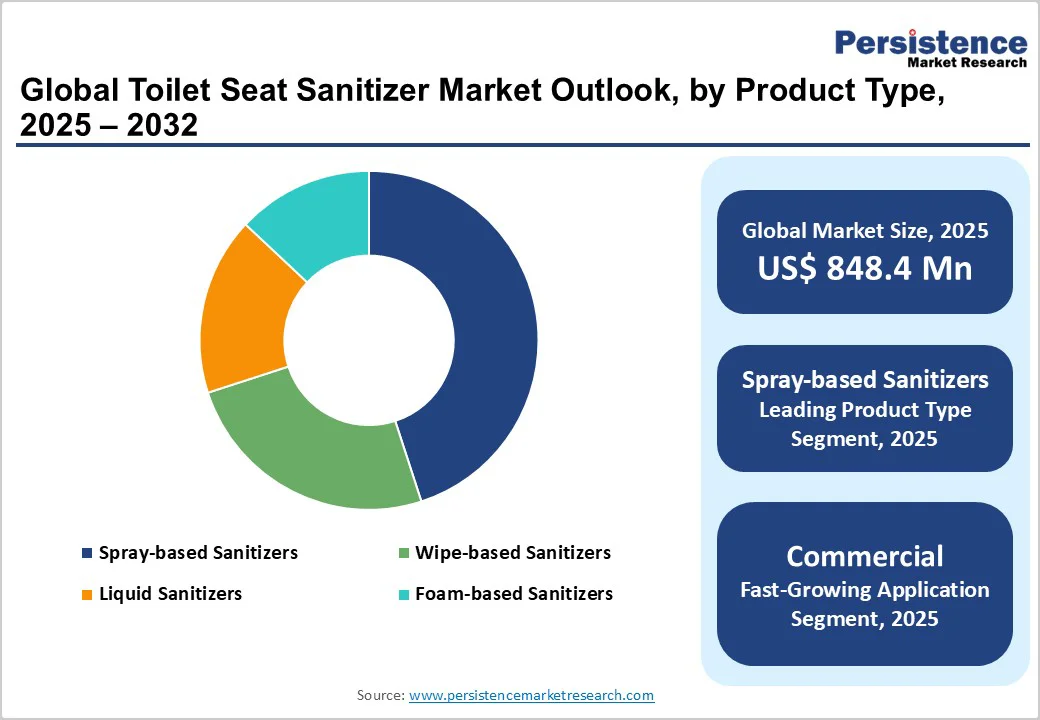

The global toilet seat sanitizer market size is projected to reach US$848.4 million in 2025 and is expected to reach US$1,416.7 million, registering a CAGR of 7.6% from 2025 to 2032.

Key factors driving this growth include rising global emphasis on personal hygiene and sanitation, increased awareness of microbial transmission following global health crises, and a surge in travel and tourism. The robust expansion of public restrooms across commercial spaces is further boosting the toilet seat sanitizer market.

| Key Insights | Details |

|---|---|

| Toilet Seat Sanitizer Size (2025E) | US$848.4 million |

| Market Value Forecast (2032F) | US$ 1,416.7 million |

| Projected Growth CAGR (2025 - 2032) | 7.6% |

| Historical Market Growth (2019 - 2024) | 6.4% |

The surge in global hygiene consciousness following the COVID-19 pandemic has driven demand for toilet seat sanitizers, which are essentially preventive against germ transmission. According to the World Health Organization (WHO), poor sanitation continues to cause widespread disease, with diarrheal illnesses affecting millions each year.

In 2022, only 57% of the global population had access to safely managed sanitation services, underscoring the urgent need for specialized hygiene solutions.

This heightened awareness has encouraged widespread adoption of toilet seat sanitizers in public restrooms, transportation hubs, and workplaces, where users seek quick, reliable protection against bacteria such as E. coli and Staphylococcus aureus.

Educational initiatives by health authorities have further promoted daily usage, shifting public perception from reactive cleaning to proactive hygiene maintenance, ultimately transforming these sanitizers from niche products into everyday essentials in the post-pandemic lifestyle.

Rapid urbanization worldwide is significantly boosting demand for toilet seat sanitizers as urban populations increasingly rely on shared facilities in shopping malls, offices, schools, and transit centers. As urban density rises, public restrooms experience higher footfall, raising hygiene concerns among users.

The Centers for Disease Control and Prevention (CDC) notes that 80% of infections spread through touch, with restroom surfaces containing up to 10,000 bacteria per square inch, underscoring the necessity for personal sanitizing solutions.

In developing economies, where sanitation infrastructure often lags behind urban expansion, consumers turn to portable toilet seat sanitizers as an added safety measure. Moreover, innovations such as quick-drying, travel-sized sprays have made hygiene more accessible to fast-paced urban dwellers, supporting sustained market growth as consumers prioritize convenience and personal well-being in their daily routines.

The toilet seat sanitizer market is constrained by low consumer awareness and negative perceptions of these products. In many public places, sanitization practices are pursued on a low scale, with minimal hygiene measures and relying on traditional cleaning methods or basic disinfectants rather than specialized sanitizers.

This limited understanding of the product’s benefits and proper use discourages demand, especially in public facilities. Furthermore, misconceptions regarding product safety and chemical content hinder consumer confidence, making it difficult for manufacturers to drive consistent demand and expand market reach on a global scale.

The global toilet seat sanitizer market faces a significant restraint due to the growing availability and popularity of substitute products, such as disinfectant sprays, antibacterial wipes, and disposable toilet seat covers. These alternatives are widely accessible, cost-effective, and perceived to offer comparable hygiene protection, making them more attractive to a broader consumer base.

Many consumers find multipurpose disinfectant sprays and wipes more convenient because they can be used on a wider range of surfaces beyond toilet seats, thereby enhancing their perceived value. Additionally, disposable seat covers are gaining traction in public restrooms and travel environments for their simplicity and ease of disposal.

This wide range of affordable and versatile substitutes dilutes consumer attention and reduces the perceived necessity of dedicated toilet seat sanitizers. As a result, manufacturers in this market face challenges in differentiating their products, maintaining pricing competitiveness, and communicating the unique benefits of specialized sanitizers to sustain consistent demand and market growth.

The shift toward sustainable products has opened the door to innovation in alcohol-free, plant-based toilet seat sanitizers, appealing to environmentally conscious consumers amid rising demand for green hygiene solutions. The WHO notes that 44% of global wastewater remains untreated, heightening calls for biodegradable options that reduce ecological harm while effectively combating germs.

Companies can capitalize by launching herbal variants, such as those using peppermint extracts, which align with trends in the toilet care market where natural ingredients are gaining traction for their skin-friendly properties and lower toxicity. This opportunity is bolstered by policy incentives in regions such as Europe, where eco-labeling boosts sales by 25%, promising significant revenue for firms investing in R&D for recyclable packaging and non-toxic formulas.

E-commerce platforms present untapped potential for penetrating fast-growing regions such as the Asia Pacific, where urbanization drives hygiene product demand but traditional retail lags. With online sales projected to rise by 30% in developing economies, digital channels enable affordable distribution of portable sanitizers to underserved areas, tying into the Toilet Seat Market dynamics of improved accessibility.

Government-backed digital health initiatives support this by enhancing consumer education on germ risks, as 73 million people still lack safe sanitation, according to WHO data. Manufacturers adopting targeted online marketing can capture this growth by leveraging user reviews and demos to build trust and achieve up to 40% market share in high-potential segments, such as commercial end users.

Spray-based sanitizers lead the product type category with approximately 45% market share, attributed to their superior convenience and broad coverage in quick-application scenarios. Their portability makes them ideal for public restrooms, where users value rapid evaporation and no-residue formulas that ensure hygiene without mess.

Sprays effectively reduce surface bacteria by 99.99% in seconds, outperforming wipes in high-traffic environments by penetrating crevices more thoroughly. This dominance is reinforced by consumer preferences for travel-friendly options, as seen in rising sales of compact bottles, aligning with broader trends in the Toilet Care Market for efficient, on-the-go solutions.

Alcohol-based formulations hold the top position in the formulation category, commanding about 55% of the market due to their proven rapid-kill efficacy against a wide spectrum of pathogens. These products align with CDC recommendations for quick disinfection, eliminating 99% of viruses and bacteria on contact, which is crucial in preventing restroom-transmitted illnesses like urinary tract infections.

Their fast-drying nature and strong antimicrobial properties make them preferred in commercial settings, where time efficiency is paramount. This leadership is supported by widespread availability and consumer trust in alcohol's disinfecting power, though balanced by emerging non-alcohol alternatives for sensitive users.

Offline sales dominate the distribution channel segment with roughly 60% market share, driven by immediate accessibility in supermarkets and pharmacies where impulse purchases occur. Physical retail allows consumers to assess product scents and sizes firsthand, fostering trust in hygiene essentials amid high restroom usage.

Statistics show that offline channels account for 70% of hygiene product transactions in urban areas, bolstered by in-store promotions that educate consumers about germ risks. This edge persists despite online growth, as traditional outlets better serve older demographics less inclined toward digital shopping.

The commercial end-user segment leads with approximately 40% share, fueled by stringent hygiene mandates in hotels, offices, and healthcare facilities where shared restrooms heighten infection risks.

WHO data shows that inadequate sanitation in public spaces leaves 1.5 billion people without basic services, prompting businesses to invest in bulk sanitizers to comply and ensure customer safety. Commercial adoption is enhanced by bulk packaging and dispenser integrations, reducing operational costs while addressing high-touch surface concerns, as evidenced by increased deployments post-pandemic.

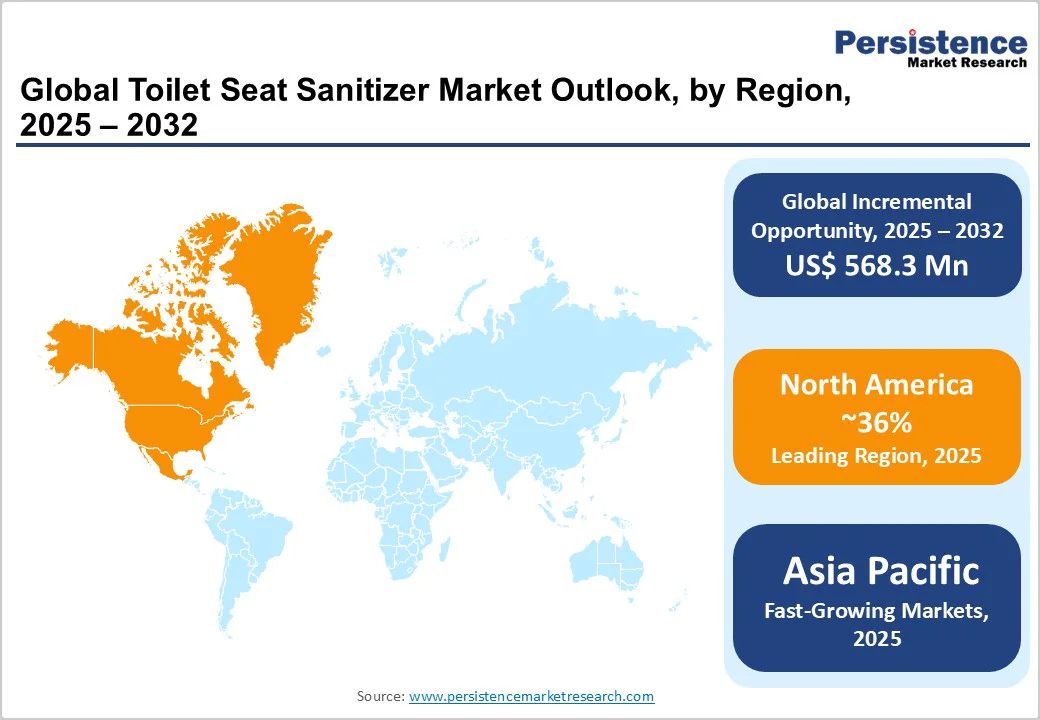

North America leads the global toilet seat sanitizer market, with the U.S. at the forefront due to stringent hygiene regulations and robust awareness campaigns led by organizations such as the CDC and EPA. Emphasis on minimizing touch-based transmission in public facilities such as airports, schools, and offices has driven increased demand for products.

The growing culture of health-consciousness, coupled with high disposable incomes, supports the adoption of premium and automatic dispenser-based sanitizers.

Technological innovations such as sensor-activated and alcohol-free variants are gaining traction, particularly in urban and institutional settings. Recent public health data reveal that nearly 80% of infections are transmitted via contaminated surfaces, which has intensified sanitation practices.

Additionally, the region’s commitment to sustainability and green chemistry continues to drive R&D investments, leading to eco-friendly product launches that prioritize consumer safety and environmental stewardship.

Europe’s toilet seat sanitizer market is performing strongly, led by Germany, the U.K., France, and Spain, countries that uphold rigorous EU hygiene standards and regulatory consistency. Harmonized European regulations, such as REACH and Biocidal Products Regulation (BPR), ensure sanitizer formulations meet safety and efficacy benchmarks, boosting consumer confidence and adoption across public facilities.

The growing tourism sector and the rise in hospitality renovations have further amplified demand, particularly in hotels, airports, and retail complexes. With WHO reporting that nearly 30% of the population still lacks access to safe sanitation, local governments have prioritized hygiene initiatives to close this gap.

Innovation in natural and alcohol-free formulations, along with recyclable packaging, has positioned Europe as a leader in sustainable hygiene solutions. This regulatory coherence and eco-conscious consumer behavior sustain market resilience and long-term growth potential across the region.

Asia Pacific exhibits the fastest-growing market for toilet seat sanitizers, driven by rapid urbanization, industrialization, and increasing public health awareness. Key countries including China, Japan, India, and ASEAN nations are witnessing heightened adoption, propelled by infrastructure expansion and government-led sanitation initiatives such as India’s Swachh Bharat Mission.

Local manufacturing strengths and cost efficiencies enable wide product availability, supporting exports and competitive pricing. The rise of the middle class, growing tourism, and changing hygiene habits are fueling the adoption of compact and travel-friendly sanitizers. Furthermore, increasing investments in eco-friendly production and biodegradable formulations are establishing Asia Pacific as both a manufacturing and innovation hub for the global market.

The global toilet seat sanitizer market remains fragmented, with numerous players vying for share through differentiated strategies like R&D in eco-friendly formulas and expansion into e-commerce. Key leaders employ partnerships for distribution in commercial sectors, while emerging firms focus on regional customization to counter consolidation trends.

This structure fosters innovation, such as smart dispensers, but intense competition pressures pricing and sustainability efforts. Overall, a mix of global giants and local innovators drives growth, emphasizing portable and natural variants to capture diverse end-users.

The global toilet seat sanitizer market is expected to reach US$ 1,416.7 million by 2032, growing from US$ 848.4 million in 2025 at a 7.6% CAGR, driven by hygiene demands.

Heightened hygiene awareness post-pandemic drives demand, with WHO reporting 1.5 billion lacking basic sanitation, prompting adoption of quick sanitization solutions in public spaces.

Spray-based sanitizers lead with 45% share, favored for portability and 99.99% germ-kill efficiency, ideal for on-the-go use per hygiene guidelines.

North America leads, supported by U.S. regulatory focus from the CDC on touch-transmission risks, fostering innovation in commercial applications.

Eco-friendly natural formulations offer growth, aligning with sustainability trends and EU incentives, potentially boosting sales by 25% in green-conscious markets.

Key players include Reckitt Benckiser, Cleenol Group Ltd., and Pee Safe, focusing on innovations like eco-variants and dispensers for commercial dominance.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn, Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Formulation

By Distribution Channel

By End-User

By Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author