ID: PMRREP35403| 195 Pages | 9 Jun 2025 | Format: PDF, Excel, PPT* | Healthcare

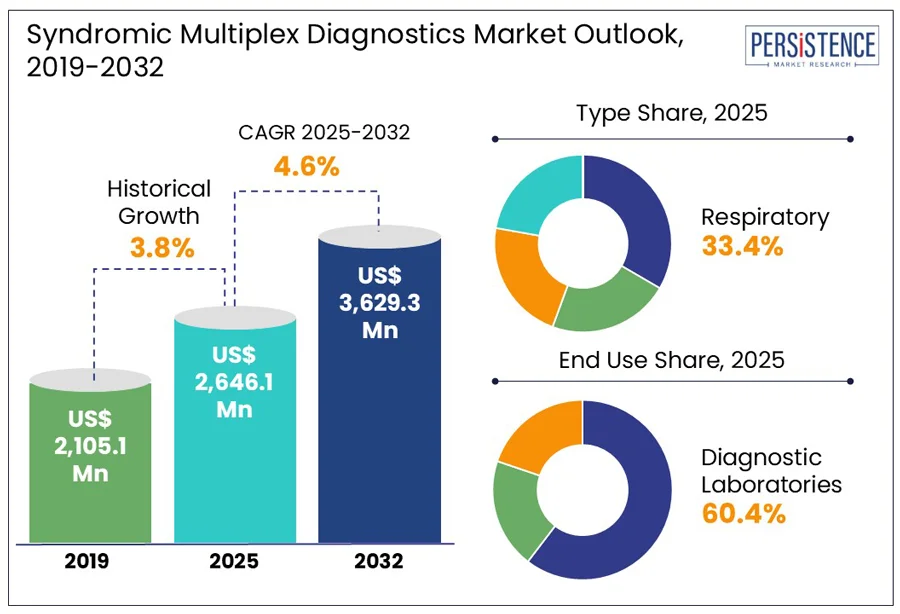

The global syndromic multiplex diagnostics market size is predicted to reach US$ 3,629.3 Mn in 2032 from US$ 2,646.1 Mn in 2025. It will likely witness a CAGR of around 4.6% in the forecast period between 2025 and 2032.

Syndromic multiplex diagnostics have transformed infectious disease testing by enabling simultaneous detection of multiple pathogens from a single patient sample, often through multiplex detection immunoassays. Increasing demand for accurate and fast diagnostics with emerging infectious threats and overlapping symptoms has positioned syndromic multiplex testing at the forefront of modern healthcare. Recent global health challenges, including recurrent influenza outbreaks and the COVID-19 pandemic, have propelled demand for rapid differentiation of pathogens to guide treatment and containment strategies.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Syndromic Multiplex Diagnostics Market Size (2025E) |

US$ 2,646.1 Mn |

|

Market Value Forecast (2032F) |

US$ 3,629.3 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

4.6% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.8% |

Public health benefits are anticipated to significantly propel the syndromic multiplex diagnostics market growth in the foreseeable future, reveals Persistence Market Research. These are expected to enable quick outbreak containment and enhance antimicrobial stewardship. During the surge of respiratory illnesses from 2022 to 2023, for example, several hospitals across Europe embraced syndromic multiplex panels to simultaneously test for SARS-CoV-2, Respiratory Syncytial Virus (RSV), and influenza. This integration of diagnostics into real-time surveillance efforts helps public health authorities track pathogen spread accurately, mainly during overlapping outbreaks or co-infections.

The ability of syndromic testing to address diagnostic gaps in under-resourced settings where differential diagnosis is challenging is another key driving factor. The World Health Organization (WHO) and Foundation for Innovative New Diagnostics (FIND) have backed initiatives to deploy multiplex platforms for febrile illnesses and meningitis in sub-Saharan Africa. These developments enable precise diagnosis even in the absence of specialist infrastructure, allowing for targeted intervention strategies. The U.S. Centers for Disease Control and Prevention (CDC), for example, highlighted the use of syndromic panels in hospital emergency departments in 2023 to lower admission rates by detecting viral causes of symptoms that mimic bacterial infections.

Contamination risks in syndromic multiplex diagnostics often arise from the high sensitivity of multiplex PCR platforms and the complexity of handling multiple targets in a single closed system. Even minor procedural lapses during reagent preparation or sample loading can result in cross-contamination, especially in non-laboratory or decentralized settings. A 2023 audit of point-of-care testing units in hospitals across the U.K., for instance, found high contamination rates when cartridges were not handled with strict aseptic technique. This led to unnecessary isolation measures and false-positive pathogen detection.

False-negative results, on the other hand, are often a consequence of primer competition, mainly in high-multiplex panels where multiple targets interact or be suppressed due to suboptimal assay design. A study published in Clinical Infectious Diseases in late 2023 revealed how certain low-abundance pathogens, including mycoplasma pneumoniae, were occasionally missed in multiplex respiratory panels when co-infections with dominant viruses such as SARS-CoV-2 or RSV were present. This issue will likely become significant in clinical decision-making, where missed detection of atypical bacteria can delay appropriate treatment.

Simplified laboratory workflow is predicted to create new opportunities for syndromic multiplex diagnostics by enabling high-throughput testing with minimal technical expertise. Cartridge-based systems, including Cepheid’s GeneXpert and bioMérieux’s FilmArray, have changed diagnostic routines by automating multiple steps in a single enclosed unit. This has proven valuable in mid-sized hospitals and urgent care centers lacking dedicated molecular labs.

Various regional health systems in Spain, for instance, adopted the BioFire Respiratory 2.1 panel in 2023 to optimize testing during peak influenza season. This helped in reducing result times from more than six hours to under an hour without increasing staffing requirements. Laboratories are further capitalizing on multiplex diagnostics to consolidate multiple single-pathogen tests into one streamlined process. This not only frees up instrument time for other critical diagnostics but also reduces reagent and labor costs.

In terms of type, the market is trifurcated into respiratory, gastrointestinal, and central nervous system. Among these, the respiratory segment will likely generate a share of approximately 33.4% in 2025 due to the overlapping clinical presentations of a wide range of pathogens, which make conventional diagnosis both time-consuming and prone to error. Acute respiratory illnesses caused by viruses such as SARS-CoV-2, rhinovirus, and influenza are often present with indistinguishable symptoms. This makes respiratory panels particularly valuable for differential diagnosis.

Gastrointestinal syndromic multiplex diagnostics, on the other hand, have become increasingly important owing to the high prevalence of diarrheal diseases with overlapping symptoms. These panels offer simultaneous detection of multiple pathogens, allowing clinicians to quickly pinpoint the etiology and avoid unnecessary empirical treatment. A 2023 study from the University of Zurich, for example, showed that implementing multiplex gastrointestinal panels in emergency departments resulted in a 50% reduction in antibiotic prescriptions for viral gastroenteritis cases.

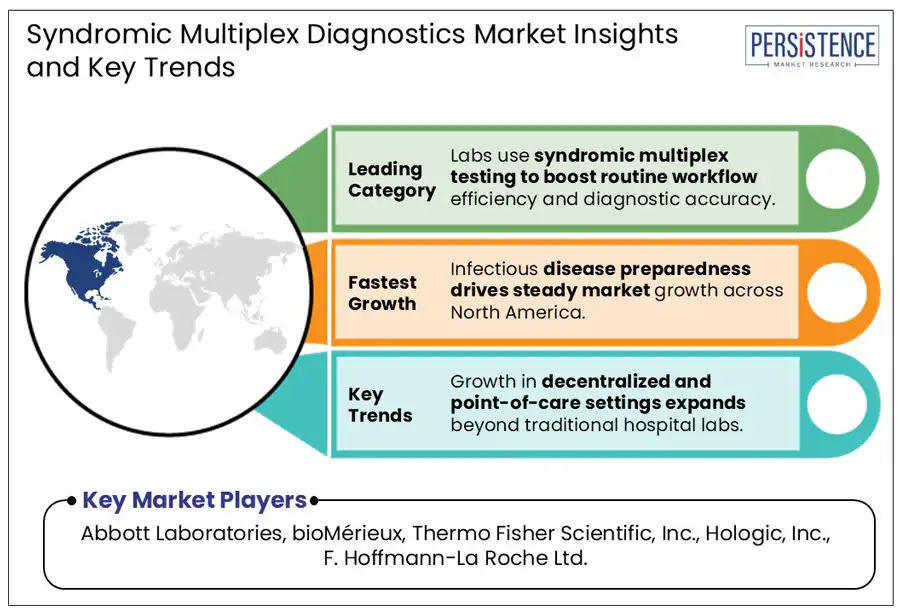

By end use, the market is bifurcated into hospitals and diagnostic laboratories. Out of these, diagnostic laboratories are predicted to lead with nearly 60.4% of the syndromic multiplex diagnostics market share in 2025, backed by their ability to manage high sample volumes, ensure regulatory compliance for complex molecular tests, and maintain quality control standards. These laboratories possess the infrastructure required to handle multiplex assays efficiently. In 2023, for instance, France’s Résapath network used BioFire and QIAstat-Dx platforms in regional labs to process up to 600 syndromic tests daily, which is otherwise unmanageable for small clinics.

Hospitals are likely to witness a considerable growth rate through 2032 as they face urgent clinical decision-making requirements, mainly in infectious disease wards, ICUs, and emergency departments. These settings require rapid pathogen identification to initiate targeted therapy and prevent complications. The Cleveland Clinic recently deployed multiplex respiratory panels in its emergency department during the flu season. This lowered the average time to initiate appropriate antibiotic or antiviral treatment from 12 hours to under 2 hours.

In 2025, North America is projected to account for a share of around 42.7% due to the post-COVID emphasis on rapid, differential diagnostics. The U.S. syndromic multiplex diagnostics market is poised to remain at the forefront of growth through 2032, amid the integration of respiratory and gastrointestinal panels into routine diagnostics by Mayo Clinic and Kaiser Permanente. The U.S. Centers for Medicare & Medicaid Services (CMS) also started piloting bundled reimbursement models for syndromic panels in 2024. This supported increasing use in hospital settings by reducing billing fragmentation.

Canada, on the other hand, is focusing on leveraging syndromic diagnostics for pediatric and rural healthcare settings. Alberta Health Services, for example, started deploying BioFire panels in regional labs servicing remote communities back in 2024. This resulted in the reduction of test turnaround times from days to under three hours. It was specifically impactful during a surge of pediatric RSV and enterovirus infections, where early pathogen identification allowed quick resource allocation in understaffed hospitals.

In Europe, syndromic multiplex diagnostics are gaining momentum as governments push for quick outbreak response and precise clinical decision-making. The Netherlands, France, and Germany have incorporated multiplex testing into national surveillance systems to track respiratory and gastrointestinal pathogens. Germany’s Robert Koch Institute, for example, started using data from syndromic panels in regional hospitals to monitor coinfections involving SARS-CoV-2 and influenza in 2023. This real-time data was instrumental in shaping public health advisories and managing hospital capacity during winter surges.

France has also scaled up adoption in public hospitals through centralized procurement programs. The Assistance Publique–Hôpitaux de Paris (AP-HP) network deployed QIAstat-Dx respiratory and gastrointestinal panels across multiple hospitals in 2023 to improve diagnostics. A follow-up evaluation showed a 28% improvement in bed turnover rates due to quick pathogen identification and targeted patient placement.

In Asia Pacific, Australia, India, China, and Japan are considered the leading adopters of syndromic multiplex diagnostics, propelled by government initiatives to strengthen infectious disease surveillance. China’s CDC used syndromic multiplex panels into its national pneumonia surveillance program in 2023. This enabled fast differentiation of viral and bacterial pathogens in over 50 provincial labs, which enhanced targeted treatment protocols during seasonal outbreaks.

India recently witnessed steady growth with private hospitals and diagnostic chains investing heavily in multiplex platforms. A significant example is the Apollo Hospitals network, which integrated BioFire and QIAstat-Dx respiratory panels in 2024 across various metro city hospitals to manage high patient inflow during the monsoon respiratory infection surge. This helped lower empirical antibiotic use by 40%, as per internal data shared at the 2024 Indian Association of Medical Microbiology conference.

The syndromic multiplex diagnostics market houses various renowned molecular diagnostics firms and niche players focused on syndromic panels. The market is heavily influenced by constant innovation in cartridge-based automation and assay design. Key players are striving to balance comprehensive pathogen detection with ease of use and speed. Regional companies, especially in China, are developing localized multiplex diagnostics for infectious disease panels. In Europe, firms are focusing on developing portable multiplex PCR platforms for decentralized testing in low-resource settings.

The market is projected to reach US$ 2,646.1 Mn in 2025.

Increasing government initiatives to control infections and rising demand for fast diagnostics are the key market drivers.

The market is poised to witness a CAGR of 4.6% from 2025 to 2032.

Development of cartridge-based systems and surging cases of overlapping symptoms are the key market opportunities.

Abbott Laboratories, bioMérieux, and Thermo Fisher Scientific, Inc. are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Type

By End Use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author