ID: PMRREP35926| 188 Pages | 1 Dec 2025 | Format: PDF, Excel, PPT* | Industrial Automation

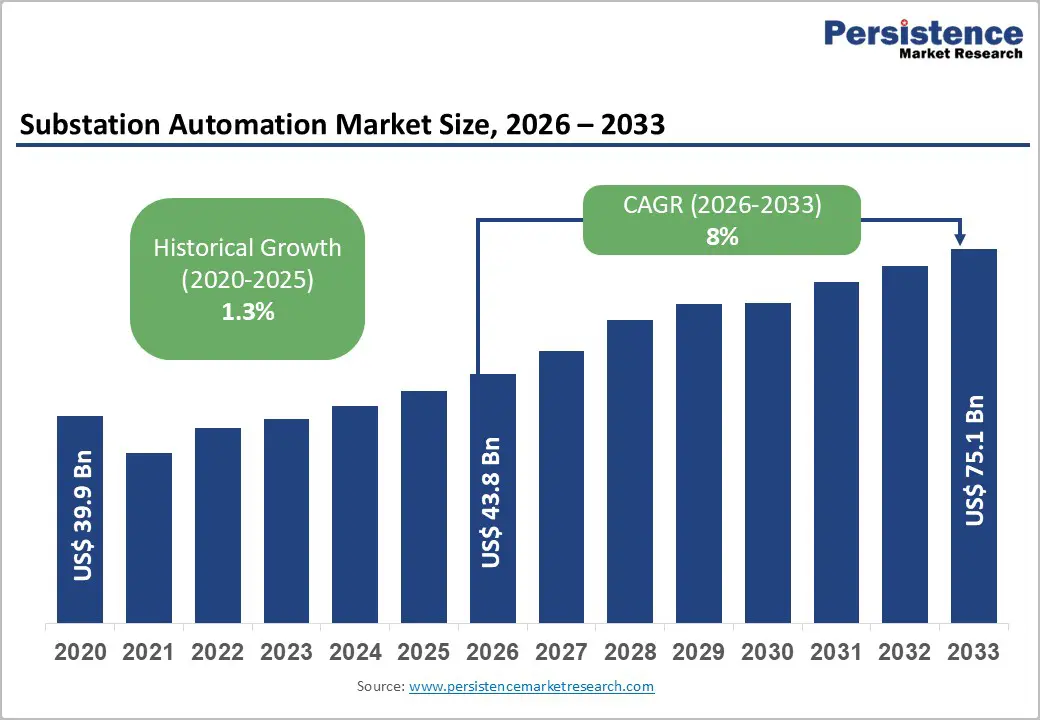

The global substation automation market size is likely to be valued at US$43.8 Billion in 2026, and is estimated to reach US$75.1 Billion by 2033, growing at a CAGR of 8% during the forecast period 2026 - 2033, driven by the growing intensity of grid modernization initiatives, substantial renewable energy integration requirements, and critical cybersecurity infrastructure investments across developed and emerging economies.

The market has seen modest growth due to delayed adoption cycles and implementation challenges, but is expected to accelerate significantly as utilities increasingly prioritize operational efficiency, grid resilience, and digital transformation in line with global decarbonization and energy security goals.

| Key Insights | Details |

|---|---|

| Substation Automation Market Size (2026E) | US$43.8 Bn |

| Market Value Forecast (2033F) | US$75.1 Bn |

| Projected Growth (CAGR 2026 to 2033) | 8% |

| Historical Market Growth (CAGR 2020 to 2025) | 1.3% |

Grid modernization is the primary driver of market growth, as utilities upgrade aging infrastructure and replace legacy systems with intelligent, interconnected automation platforms. Increasing grid complexity from expanding wind and solar integration, along with stricter reliability regulations, is accelerating adoption.

Government initiatives and major funding programs in the U.S., EU, and Asia Pacific further support investments by linking renewable energy targets to advanced automation for real-time monitoring and load balancing. Modernized substations reduce losses, improve fault detection and isolation, extend equipment life, and deliver substantial operational savings and strong long-term returns.

As countries continue to pursue net-zero electricity generation goals and face increasingly variable renewable generation sources, substation automation becomes essential for millisecond-response automation and dynamic grid control.

Investments in intelligent electronic devices, communication protocols, and advanced analytics, which integrate IoT, Artificial Intelligence, and machine learning (ML), foster real-time monitoring, predictive maintenance, and enhanced grid performance. This convergence of technological innovation, regulatory push, and infrastructural necessity ensures sustained growth in the market in the coming years.

Cybersecurity threats pose a major challenge to the market as attacks on power infrastructure continue to rise. Substation control systems are prime targets, and a single coordinated breach can trigger widespread outages, financial losses, and regulatory penalties. Many utilities hesitate to adopt advanced automation without strong cybersecurity, yet most lack the expertise to secure digital substations effectively.

Implementing protections such as network segmentation, intrusion detection, and continuous monitoring significantly increases project costs. Interoperability issues, legacy system limitations, and differing regional regulations further complicate deployments, leading to delays and overruns-especially for mid-sized utilities. These factors collectively slow adoption, underscoring the need for integrated security solutions and standardized industry practices.

Emerging economies are propelling the market by investing heavily in electrification and grid modernization projects. Middle- and low-income countries of Sub-Saharan Africa, South Asia, and Southeast Asia are focusing on expanding and modernizing their power infrastructure to meet rising electricity demand and achieve universal access goals.

These efforts are supported by international financial institutions such as the World Bank and regional development banks, which provide concessional financing and technical assistance. Unlike developed markets that prioritize retrofitting, emerging markets benefit from greenfield projects that allow deployment of standardized, modern substation automation systems, reducing complexity and costs.

India exemplifies this trend with initiatives such as the Saubhagya scheme and Smart Grid Mission targeting widespread automated substation deployment across rural areas. Similar electrification drives in Vietnam, Indonesia, and the Philippines are fueling pipeline growth.

The financial frameworks often blend public development funds, climate finance, and domestic budgets, enabling greater participation from emerging technology providers alongside established global vendors. Consequently, emerging markets are expected to increase their share of the market substantially, creating additional opportunities in training, localized manufacturing, and technology partnerships that foster ecosystem expansion and sustainable growth.

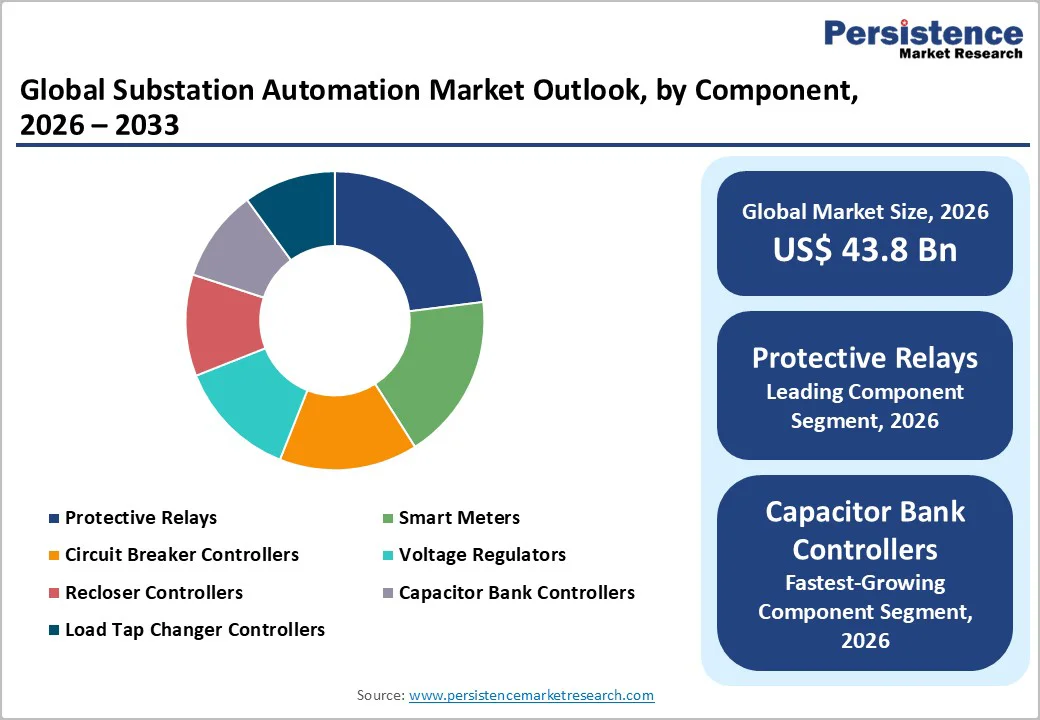

Protective relays are the leading component segment, expected to hold about 22.5% of the market revenue share in 2026. They serve as critical safety devices that detect electrical faults and trigger circuit isolation to prevent damage and injury. Although around 40% of substations still use legacy electromechanical relays, the transition toward advanced microprocessor-based relays offering better sensitivity, reliability, and integration is gaining traction.

These modern relays support advanced communication protocols, remote diagnostics, and predictive maintenance. Protective relays also offer a stable cost component in substation projects, largely driven by grid modernization and equipment lifecycle replacement cycles rather than discretionary spending.

Capacitor bank controllers are likely to grow the fastest through 2033. These devices manage reactive power compensation, ensuring voltage stability and power factor correction in distribution networks. Unlike traditional fixed capacitors, modern controllers feature real-time voltage sensing and automated switching, essential for handling fluctuations from increasing renewable energy sources.

Growing renewable integration, smart grid deployment, and the need to prevent voltage regulation failures that can cause outages are fueling the adoption of capacitor bank controllers. Advanced technologies, such as ML algorithms for optimized switching, boost efficiency gains, helping utilities improve grid stability and operational reliability.

Intelligent electronic devices (IEDs) dominate the module type segment, projected to capture about 28.3% of the revenue share in 2026. IEDs are integrated microprocessor-based control units can replace multiple discrete devices by combining functions such as protective relaying, metering, communication, and data storage.

Modern IEDs feature advanced connectivity, cybersecurity protocols, and cloud integration for remote diagnostics and firmware updates. IED replacement also aligns with typical substation maintenance cycles, providing stable and predictable demand. While incremental innovations continue, the segment remains resilient to disruption due to stringent regulatory and safety standards.

Cybersecurity solutions are the fastest-growing substation automation module segment from 2026 to 2033, driven by rising regulatory requirements and growing cyberattack risks. These solutions include intrusion detection and prevention systems, anomaly detection analytics, SIEM platforms, and ICS-specific endpoint protection.

They command premium pricing due to specialized ICS expertise, strict compliance certifications, and limited competition. Growth is further accelerated by NERC CIP revisions and increasing utility awareness of operational vulnerabilities. Emerging providers such as CyberX, Nozomi Networks, and Claroty are gaining share alongside traditional IED vendors expanding their cybersecurity portfolios.

Optical fiber communication is poised to lead with an estimated 35.7% share in 2026, favored for its immunity to electromagnetic interference, long-distance signal integrity, and inherent cybersecurity advantages. Utilities have invested decades in building extensive fiber infrastructure, supporting mature and stable market growth.

Components such as fiber transceivers are standardized and commodity-priced, limiting vendor differentiation. The segment is expected to grow steadily, driven mainly by broader substation automation expansion and technological upgrades such as higher bandwidth and improved reliability, rather than by shifts away from this established communication medium.

Wireless communication is the fastest-growing channel in substation automation, as it enables the quick deployment of connectivity without the need for expensive fiber optic infrastructure, especially in rural and remote substations where fiber installation costs are high. Advancements in 4G/LTE and 5G provide the necessary bandwidth and low latency for real-time automation needs.

Although cybersecurity risks exist, these are increasingly mitigated through strong encryption and authentication protocols. Wireless adoption is rising rapidly in cost-sensitive emerging markets, while more established regions show slower uptake. Leading technology providers such as Cisco, Ericsson, and Nokia are expanding wireless solutions, driving competition and market growth beyond traditional fiber-based systems.

In North America, the U.S. provides the regional growth anchor, driven by the Infrastructure Investment and Jobs Act (2021), allocating US$65 Billion for grid modernization and US$47 Billion specifically for grid resilience and cybersecurity improvements.

Federal matching requirement provisions incentivize state public utility commissions to approve rate base recovery mechanisms for substation automation investments, reducing utility capital allocation constraints. The aging U.S. electricity grid creates compelling replacement economics, with utilities recognizing that substation automation deployment extends asset operational lifespans 8-12 years and reduces catastrophic failure risks.

Canada's electricity sector is deploying comparable modernization initiatives, with provincial utilities in Ontario, British Columbia, and Alberta committing substantial capital to distribution automation and substation intelligence technologies aligned with renewable energy integration targets. Mexico offers exciting emerging market opportunities, with private utilities such as Grupo México and government-sponsored rural electrification initiatives generating substation automation demand.

The North America market is characterized by intense competitive dynamics, with established vendors such as ABB and Siemens competing aggressively alongside emerging software-centric providers offering cloud-based monitoring and analytics platforms.

In Europe, the EU's climate and energy policy architecture provides uniquely powerful market drivers, with the Green Deal mandating climate neutrality by 2050 and the Renewable Energy Directive establishing 80% renewable penetration targets for 2032. Germany, leading European grid modernization efforts, has been extensively deploying distribution substations with integrated automation capabilities as part of the Energiewende initiative.

German utilities are leveraging EU standardization initiatives to procure interoperable automation solutions, reducing vendor lock-in risks and accelerating technology adoption. France is also modernizing its distribution substations under the Électricité de France plan, emphasizing enabling demand-response coordination for achieving renewable integration targets.

The Europe market is characterized by strong cybersecurity compliance with the NIS2 Directive, growing emphasis on grid resilience amid energy security concerns, and a competitive vendor landscape where European-headquartered companies gain advantages compared to non-European entities due to regulatory familiarity and established utility relationships.

The Eastern Europe market of Poland, the Czech Republic, and Romania represents emerging opportunity zones, with EU infrastructure funding mechanisms and renewable energy obligations driving grid modernization initiatives.

Asia Pacific is anticipated to capture the largest share of the substation automation market, commanding an estimated 32.5% in 2026, and is projected to grow at the highest CAGR through 2033. China provides the dominant regional growth engine, with the State Grid Corporation implementing the largest substation automation deployment globally as part of the XII Five-Year Plan.

The country's smart grid modernization objectives explicitly identify substation automation as critical infrastructure enabling renewable energy integration and cross-regional transmission optimization. Government-directed technology mandates favor domestic equipment vendors such as NARI Technology and Guodian Electric, creating protectionist market dynamics that limit multinational vendor market share.

India is expected to offer the most dynamic growth opportunities, with the Smart Grid Mission targeting 120+ pilot cities and cumulative substation automation deployments estimated to be in billions through 2033.

Government policies, including the PM-KUSUM scheme, mandating rooftop solar integration across distribution networks, and the Integrated Power Development Scheme (IPDS), earmarking dedicated substation automation budgets, are driving market expansion.

The India substation automation market is attracting aggressive vendor competition from both multinational corporations and emerging Indian technology providers. Southeast Asia is also experiencing an accelerated deployment of substation automation driven by electrification initiatives, industrial manufacturing growth, and renewable energy integration mandates.

The global substation automation market is moderately consolidated, with ABB, Siemens, Schneider Electric, and Eaton accounting for over half of revenue, supported by strong utility relationships, regulatory expertise, and integrated hardware-software platforms. These players invest heavily in advanced analytics, AI-driven maintenance, and cybersecurity.

Regional specialists such as Hitachi Energy and Mitsubishi Electric focus on niche segments, while regulatory complexity and integration challenges limit new entrants. However, digitalization is enabling software-focused firms to enter through cloud-based solutions. Market consolidation is expected to rise as major vendors acquire smaller firms and expand integration partnerships.

The global substation automation market is projected to reach US$43.8 Billion in 2026.

Growing intensity of grid modernization initiatives, substantial renewable energy integration requirements, and critical cybersecurity infrastructure investments across developed and emerging economies are driving the substation automation market.

The substation automation market is poised to witness a CAGR of 8% from 2026 to 2033.

Prioritization of operational efficiency and grid resilience by utilities and digital transformation investments aligned with global decarbonization targets and energy security mandates are key market opportunities.

ABB Ltd., Siemens AG, Alstom Grid, and Eaton Corporation are some of the key players in the substation automation market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Component

By Module Type

By Communication Channel

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author