ID: PMRREP32643| 196 Pages | 30 Dec 2025 | Format: PDF, Excel, PPT* | Healthcare

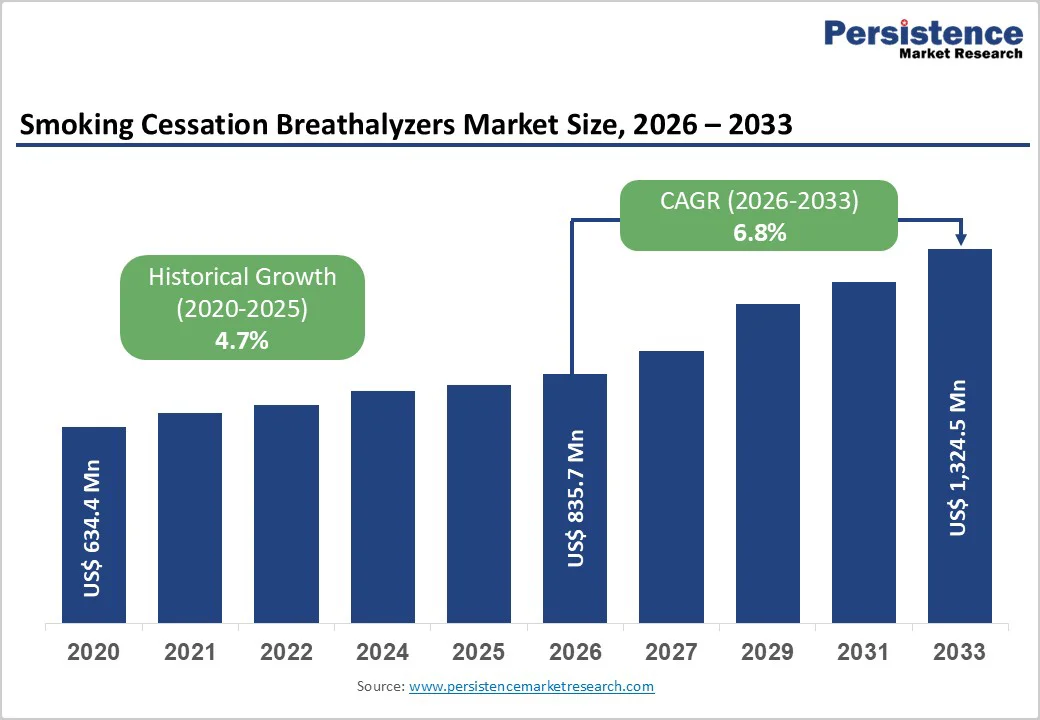

The global Smoking Cessation Breathalyzers Market size is expected to be valued at US$ 835.7 million in 2026 and projected to reach US$ 1,324.5 million by 2033, growing at a CAGR of 6.8% between 2026 and 2033.

Growth is driven by the large global smoking population, intensifying tobacco-control policies, and increasing use of breath carbon monoxide (CO) monitors as objective tools in smoking cessation programs. In 2023, an estimated 1.10 billion adults aged 15+ were current smokers worldwide, with smoking responsible for about 5.81 million deaths and 161.3 million disability adjusted life years (DALYs), underscoring the scale of the cessation challenge. Clinically validated devices such as the Smokerlyzer® range from Bedfont Scientific Ltd., and new mobile sensors like the Pivot Breath Sensor, provide real-time exhaled CO feedback that strengthens motivation, supports digital coaching, and enables objective verification of abstinence, making them increasingly integral to modern cessation strategies.

A key opportunity lies in smartphone-connected and app-integrated breathalyzers that deliver real-time biofeedback, enable adaptive digital coaching, and provide objective outcome data, aligning with emerging personalized cessation models and value-based reimbursement frameworks.

| Key Insights | Details |

|---|---|

| Smoking Cessation Breathalyzers Market Size (2026E) | US$ 835.7 million |

| Market Value Forecast (2033F) | US$ 1,324.5 million |

| Projected Growth (CAGR 2026 to 2033) | 6.8% |

| Historical Market Growth (CAGR 2020 to 2025) | 4.7% |

Rising global burden of smoking and demand for effective cessation tools

A key growth driver for the smoking cessation breathalyzer market is the persistently high global burden of tobacco use and the corresponding need for effective cessation support. The Global Burden of Disease 2023 analysis estimated that 1.10 billion individuals were current smokers in 2023, and smoking was linked to about 5.81 million deaths and more than 160 million DALYs worldwide. Although smoking prevalence has declined in many regions, population growth means the absolute number of smokers has increased by roughly 120 million since 1990, sustaining a very large target population for cessation interventions. Breath CO analyzers give smokers immediate, visual feedback about exhaled CO levels, helping them associate smoking with measurable physiological harm and reinforcing motivation to quit; studies using the Smokerlyzer® have shown that reductions of 15 ppm in exhaled CO correlate with improved lung function and walking distance, demonstrating clinically meaningful benefits of quitting that can be communicated via these devices.

Integration of breath sensors into digital and community cessation programs

Integration of CO breath sensors into digital therapeutics and structured cessation services is another strong driver. Research on mobile cessation programs featuring the Pivot Breath Sensor, a personal CO monitor, found that providing real-time exhaled CO measurements via a smartphone-connected device positively influenced attitudes toward quitting and supported behavior change over 12 weeks of follow-up. A qualitative study evaluating the iCOquit Smokerlyzer® within the Quit Journey mobile app reported that users, particularly from low socioeconomic groups, perceived exhaled CO monitoring as acceptable and helpful because it offered frequent, objective feedback on progress and health impact. Health professionals in stop-smoking clinics, primary care, schools, and pharmacies increasingly adopt handheld CO monitors like piCO™ Smokerlyzer® as low-cost, easy?to?use tools to validate abstinence and motivate smokers during counseling sessions. As digital health platforms and remote coaching services expand globally, demand for smartphone-connected and portable breathalyzers that seamlessly integrate with apps and cloud-based patient management systems is accelerating.?

Market Restraints

Affordability constraints and limited access in low-resource settings

Affordability and access limitations in low And middle-income countries are restraining the widespread adoption of smoking-cessation breathalyzers. The WHO reports that more than 5.6 billion people (71% of the world’s population) are now covered by at least one MPOWER tobacco-control policy. However, many countries still face constrained health budgets and competing priorities when funding cessation tools. While devices like the piCO™ Smokerlyzer® are marketed as relatively low-cost, up-front procurement of handheld or smartphone-connected breathalyzers for nationwide cessation services, primary care, and community programs can be challenging in settings with limited financial and technical infrastructure. Without targeted financing, donor support, or local manufacturing partnerships, access to CO monitoring remains concentrated in high-income markets and specialized clinics, limiting the technologies' global penetration despite a strong clinical rationale.

Limited awareness and inconsistent incorporation into guidelines

Another restraint is limited awareness of breath CO monitoring among clinicians and policymakers, and inconsistent inclusion of such devices in national cessation guidelines or reimbursement frameworks. While numerous studies demonstrate that exhaled CO is a reliable biomarker for recent smoking and is widely used in clinical trials to verify abstinence, many routine cessation services still rely solely on self-report or occasional biochemical tests, without systematically incorporating breathalyzers into standard protocols. Some providers may perceive these devices as optional rather than essential, or may be unfamiliar with how to interpret ppm or %COHb values and integrate them into counseling workflows. This underutilization reduces repeat testing volumes and slows market uptake, particularly in regions where tobacco-control policies focus more on taxation and advertising bans than on expanding structured cessation support with objective monitoring tools.?

Market Opportunities

Smartphone-connected and app-integrated devices for personalized cessation

Smartphone-connected breathalyzers represent a major growth opportunity, particularly as personalized and adaptive smoking cessation interventions gain prominence. Recent analyses of digital cessation strategies emphasize the potential of handheld exhaled CO monitors to act as real-time digital diagnostics that feed individualized feedback loops within mobile apps, enabling adaptive nudges, coaching, and tailored quit plans. Devices such as the iCOquit Smokerlyzer® and Pivot Breath Sensor connect via Bluetooth to smartphones, allowing users to view trends in their CO levels, receive motivational messages when levels drop below 10 ppm (often used as an abstinence threshold), and share data with remote coaches. For manufacturers, integrating electrochemical CO sensors into compact, consumer-friendly form factors with app software development kits (SDKs) creates partnership opportunities with digital health firms, insurers, and employers running wellness programs. As payers increasingly value measurable outcomes and biovalidation, app-integrated breathalyzers are well-positioned to become core components of evidence-based digital cessation ecosystems.

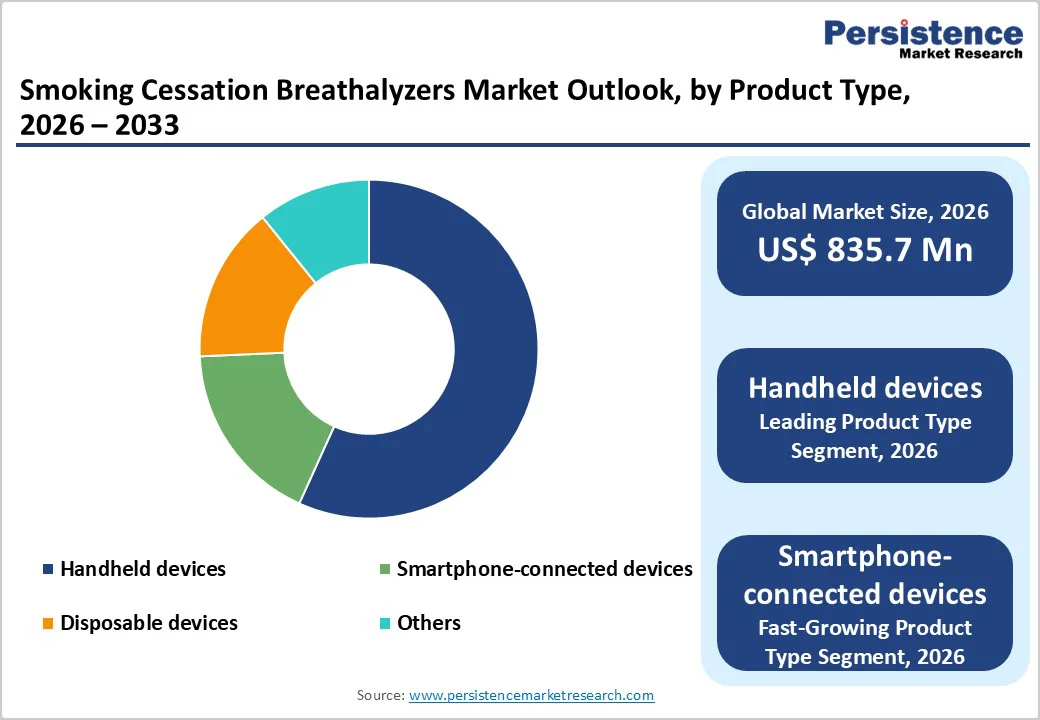

Within the product type, Handheld devices are the leading segment, accounting for an estimated 42% share of the Smoking Cessation Breathalyzers Market in 2025. Handheld CO monitors such as the piCO™ Smokerlyzer®, piCO+™ Smokerlyzer®, and other clinic-grade devices have become staple tools in stop-smoking services, primary care practices, and hospital-based cessation programs worldwide. These devices provide rapid, quantitative exhaled CO readings in parts per million (ppm) and estimated %COHb, with studies demonstrating a clear correlation between higher ppm values and active smoking and clinically meaningful reductions following cessation. Handheld units are valued for their robustness, multi-patient use with disposable mouthpieces, and features such as antimicrobial housings and patient-management software that support professional workflows. Their established clinical validation, ease of use by nurses, health visitors, and counselors, and frequent inclusion in procurement lists for public health cessation services underpin their dominant market share, even as newer smartphone-connected and disposable devices gain traction.

Among distribution channels, Pharmacies & distributors are expected to be the leading segment, capturing the largest share of the Smoking Cessation Breathalyzers Market in 2025. Community pharmacies are increasingly recognized as accessible hubs for smoking cessation advice, nicotine replacement therapy, and behavioral support, particularly in countries such as the U.K., where pharmacy-led stop-smoking services are widespread. CO breathalyzers like the piCO™ Smokerlyzer® are commonly stocked or supplied through pharmacy distributors, enabling pharmacists and pharmacy-based advisors to perform point-of-care CO testing during counseling sessions and follow-ups. In parallel, medical equipment distributors serve hospital respiratory departments, occupational health providers, and public health agencies, bundling breathalyzers with spirometers and other diagnostic devices from brands such as Vitalograph Ltd., MD Diagnostics Ltd., and Micro Direct, Inc. As pharmacies expand their preventive and wellness offerings and as distributors consolidate regional coverage, this channel will likely maintain its leadership, even as online stores and direct-to-consumer e-commerce models grow rapidly for personal and smartphone-connected breathalyzers.

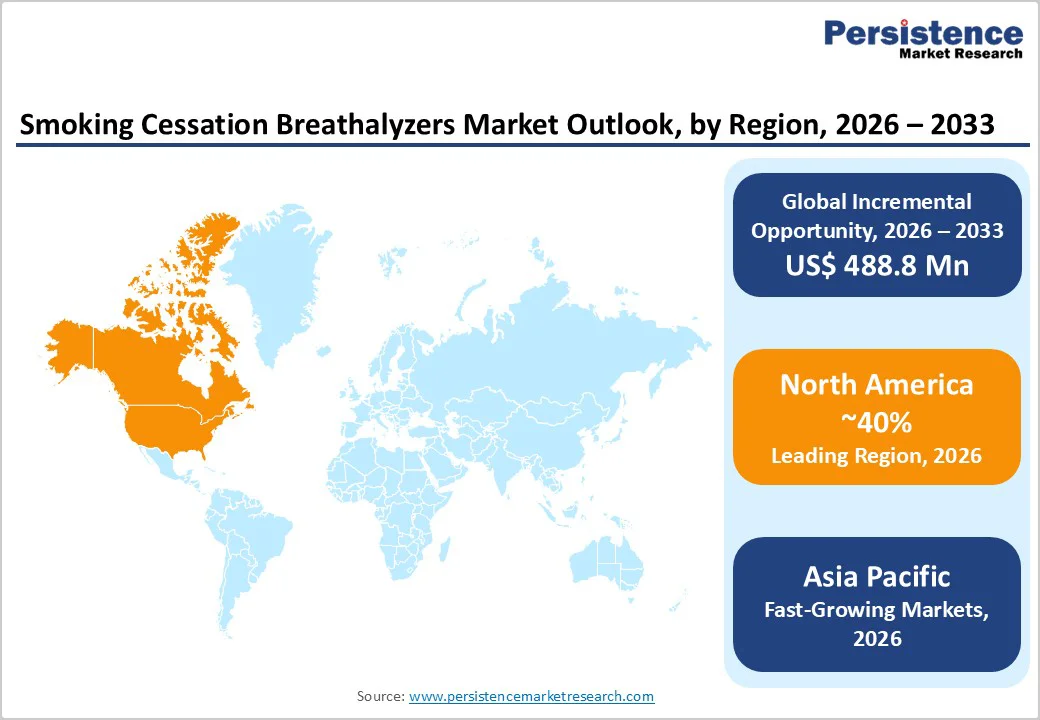

North America holds the leading regional share, estimated at around 40% of the Smoking Cessation Breathalyzers Market in 2025, driven by strong tobacco-control frameworks, high smoking-related disease burden, and robust adoption of technology-enabled cessation tools. In the United States, tobacco smoking remains one of the top preventable causes of death, with Our World in Data and WHO estimating more than 8 million deaths globally each year from tobacco use and a substantial share linked to North American populations. Federal agencies such as the U.S. Centers for Disease Control and Prevention (CDC) and U.S. Food and Drug Administration (FDA) support comprehensive strategies including taxation, smoke-free laws, and cessation support, creating favorable conditions for the adoption of validated biofeedback devices.

The region is also a hub for digital innovation in smoking cessation. Clinical studies of the Pivot Breath Sensor, a portable personal CO monitor integrated with a mobile cessation program, demonstrated that regular breath testing and app feedback improved motivation to quit and supported biovalidation of abstinence over a 12-week follow-up. Partnerships between breathalyzer manufacturers and digital-health players, insurers, and employer wellness programs are expanding, embedding smartphone-connected sensors into multi-channel behavior-change interventions. Established medical device companies such as Honeywell International Inc., Masimo Corporation, and Drägerwerk AG & Co. KGaA also contribute sensor technology and respiratory-monitoring expertise that can be leveraged in CO breathalyzers, further strengthening the regional ecosystem.

Asia Pacific is forecast to be the fastest-growing region in the Smoking Cessation Breathalyzers Market between 2025 and 2032, driven by very high smoking prevalence, rapid implementation of tobacco-control policies, and expanding healthcare and digital infrastructure. The Global Burden of Disease 2023 analysis found that 43.3% of all current smokers live in East/South Asia and Oceania, with large concentrations in China, India, Indonesia, and other ASEAN countries. Although prevalence percentages are beginning to decline, population growth means absolute numbers of smokers remain high, and smoking-attributable deaths and DALYs are substantial. The WHO notes particularly high tobacco use in the South-East Asia Region, at 26.5% of the population in 2022, underscoring the need for scalable cessation interventions.?

Governments in China, India, and several ASEAN states are strengthening tobacco-control regulations, introducing quitlines, and promoting cessation through primary care and workplace programs. Cross-sectional studies using devices such as the Smokerlyzer® in cancer hospital outreach screening demonstrate the feasibility of exhaled CO testing at the community level and highlight its potential to support both screening and cessation counseling. Regional device makers such as Sunvou Medical Electronics, E?LinkCare Meditech, and distribution partners for Bedfont and other international brands are expanding availability of handheld and smartphone-connected CO monitors across hospitals, occupational health services, and pharmacies. As mobile health usage grows rapidly in countries like India and China, integration of CO sensors with local smoking cessation apps presents a strong avenue for accelerated adoption and market growth.

Market Structure Analysis

The Smoking Cessation Breathalyzers Market is moderately fragmented, with a mix of specialized breath-analysis companies and broader medical device manufacturers competing on technology, usability, and clinical validation. Competition increasingly centers on miniaturization, smartphone connectivity, cloud-based data management, cost-effective disposable components, and partnerships with digital cessation programs, insurers, and public health agencies.

The global Smoking Cessation Breathalyzers Market is projected to reach approximately US$ 835.7 million in 2026.

Demand is driven by a large global smoker base of about 1.10 billion people, strong tobacco control policies, and proven effectiveness of exhaled carbon monoxide biofeedback in supporting quitting.

North America leads the market due to advanced healthcare infrastructure, strict tobacco control measures, and early adoption of digital and handheld CO monitoring devices

A key opportunity is the development of smartphone-connected, app-integrated breathalyzers that enable personalized cessation programs and digital health integration.

Key players include Bedfont Scientific, Vitalograph, MD Diagnostics, COVita, E-LinkCare Meditech, Sunvou Medical Electronics, Honeywell, Drägerwerk, Masimo, and other regional respiratory diagnostics manufacturers.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

Product Type

Sensor

Distribution Channel

Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author