ID: PMRREP20992| 190 Pages | 20 Dec 2025 | Format: PDF, Excel, PPT* | Food and Beverages

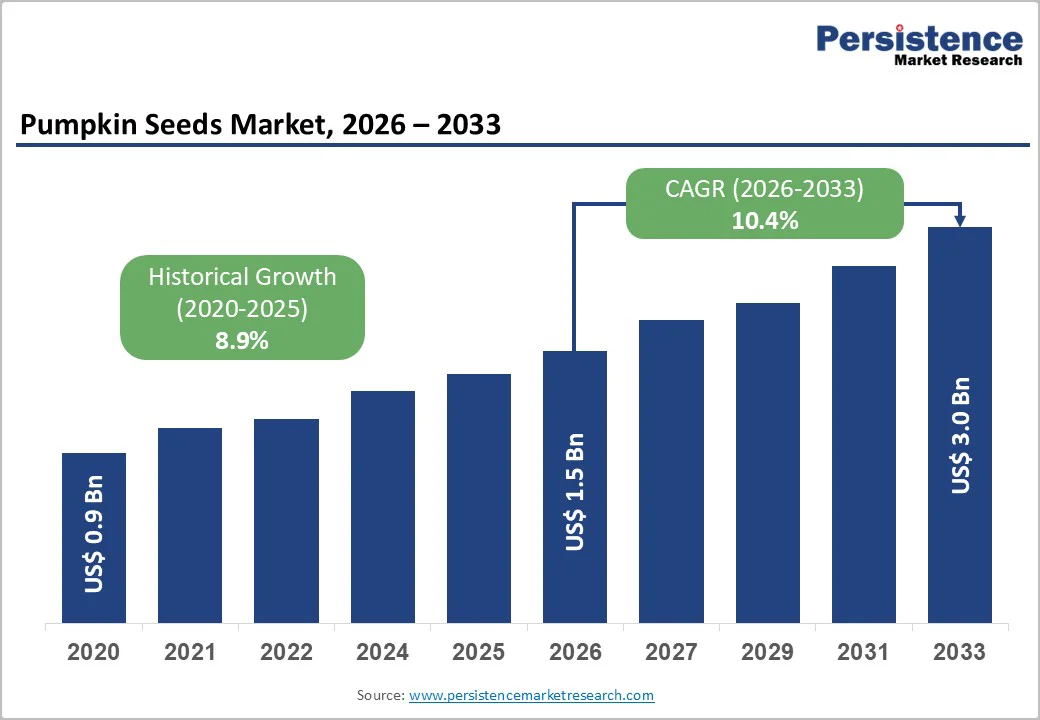

The global pumpkin seeds market size is likely to be valued at US$ 1.5 billion in 2026 and is estimated to reach US$ 3.0 billion by 2033, growing at a CAGR of 10.4% during the forecast period 2026−2033. Rising consumer health awareness, expanding functional food and plant?based dietary trends, and increased use of nutraceutical and cosmetic ingredients are driving significant growth in the market. High protein, healthy fats, fiber, and micronutrient content have boosted adoption in snacks, bakery, dietary supplements, and skincare, with many new launches focusing on value?added offerings such as flavored, roasted, and organic variants. Established demand in North America and Europe, rapid growth in Asia Pacific, supply chain improvements, e?commerce expansion, product innovation, and premiumization within the organic segment are shaping market trajectories.

| Key Insights | Details |

|---|---|

| Pumpkin Seeds Market Size (2026E) | US$ 1.5 Bn |

| Market Value Forecast (2033F) | US$ 3.0 Bn |

| Projected Growth (CAGR 2026 to 2033) | 10.4% |

| Historical Market Growth (CAGR 2020 to 2025) | 8.9% |

Growing consumer preference for plant-based proteins is a key driver of the pumpkin seeds market, as individuals increasingly prioritize health, sustainability, and ethical considerations in dietary choices. Pumpkin seeds are a rich source of complete plant protein, essential amino acids, and micronutrients, making them suitable for incorporation into snacks, bakery items, cereals, and fortified beverages. Awareness of cardiovascular health, muscle maintenance, and digestive wellness has fueled adoption in functional foods and dietary supplements. In 2024, global retail sales of plant-based protein products reached an estimated US$ 29 billion, reflecting significant consumer shift towards plant-derived nutrition, supporting growth for high-protein seeds in diverse applications.

Innovation in product formats further enhances market traction. Food manufacturers integrate pumpkin seeds into protein bars, seed blends, and ready-to-eat mixes, offering convenient solutions for health-conscious consumers. Expansion of e-commerce platforms and retail channels has improved accessibility across urban and semi-urban regions, while clean-label and traceable sourcing strengthens consumer trust. Sustainability narratives around plant-based nutrition appeal to environmentally conscious buyers, reinforcing long-term adoption.

Premium pricing of organic and specialty pumpkin seed variants acts as a key restraint, primarily due to limited consumer affordability in certain segments. Organic farming, sustainable sourcing, and certifications entail higher production costs, which are reflected in retail pricing. For price-sensitive consumers, these products may appear less accessible compared to conventional seeds, leading to slower adoption in mainstream channels. High price points can also restrict distribution to premium retail stores and specialized health outlets, limiting overall penetration and volume growth, despite increasing awareness of nutritional and functional benefits.

Production complexities in specialty variants amplify cost structures, including smaller yields, manual harvesting, and adherence to strict quality standards. While the segment attracts health-conscious and premium buyers, scalability challenges and affordability constraints can impede broader adoption. Companies need to balance quality assurance and pricing strategies to sustain demand without alienating mainstream consumers, ensuring growth while maintaining the value proposition of specialty pumpkin seed products.

Rapid growth of healthy snack and seed-based formats represents a significant opportunity due to evolving consumer preferences toward nutrient-dense, convenient food options. Urban populations increasingly seek products that combine taste, portability, and functional benefits, with seeds offering natural protein, fiber, and micronutrients that align with these expectations. Innovation in snack formulations, including roasted, flavored, and mixed seed products, enhances appeal while supporting dietary trends such as plant-based and high-protein eating. Retail and e-commerce expansion enables faster access to these formats, extending reach across diverse consumer segments.

Seed-based snacks also support product differentiation for food manufacturers, allowing premium positioning through health-oriented branding and clean-label messaging. Incorporation of pumpkin seeds into bars, crisps, and ready-to-eat mixes creates opportunities for cross-category integration in both on-the-go and at-home consumption occasions. Strategic partnerships with ingredient suppliers and co-manufacturers accelerate product development and market entry, while rising awareness of natural and minimally processed foods strengthens adoption. The convergence of convenience, health benefits, and innovative formats positions pumpkin seeds as a versatile and high-growth ingredient in the evolving snack landscape.

The conventional segment is likely to lead with a projected 55% of the pumpkin seeds market revenue share in 2026. Its dominance is driven by widespread availability, competitive pricing, and integration into mainstream processed foods, snacks, and bakery products. Established agricultural supply chains provide reliable raw material sources, while predictable yield cycles support consistent production and distribution. Large-scale food processors and snack manufacturers leverage conventional seeds for cost efficiency, scalability, and formulation flexibility, ensuring steady adoption across retail and industrial channels. Market familiarity further reinforces its leading position.

The organic pumpkin seed segment is expected to witness the fastest growth between 2026 and 2033, due to increasing consumer preference for chemical-free and sustainably sourced ingredients. Rising health consciousness and premium retail demand encourage adoption in fortified snacks, bakery, and functional food applications. Certifications and traceability standards provide assurance, allowing producers to command price premiums and differentiate offerings. Strategic investments in organic farming, coupled with marketing emphasis on natural and sustainable positioning, are anticipated to sustain accelerated growth and broaden market penetration.

Raw seeds are poised to dominate with a forecasted market share of 35% in 2026, powered by versatility across snacks, bakery products, and ready-to-eat mixes. Wide consumer acceptance and simple processing support steady demand, while established supply chains ensure reliable availability. Growth is further fueled by innovations in flavoring, roasting, and packaging, enhancing appeal and convenience. Integration into health-focused and protein-enriched products, along with expanding modern retail and e-commerce channels, reinforces adoption across mainstream and specialty markets.

Pumpkin seed oil is anticipated to be the fastest-growing segment in 2026, propelled by increasing utilization in nutraceuticals and cosmetic applications, technological advancements in oil extraction, and rising consumer preference for plant-based oils in health and wellness products. Expansion of premium retail channels and integration into fortified foods further supports growth, positioning pumpkin seed oil as a high-potential segment in both industrial and consumer markets.

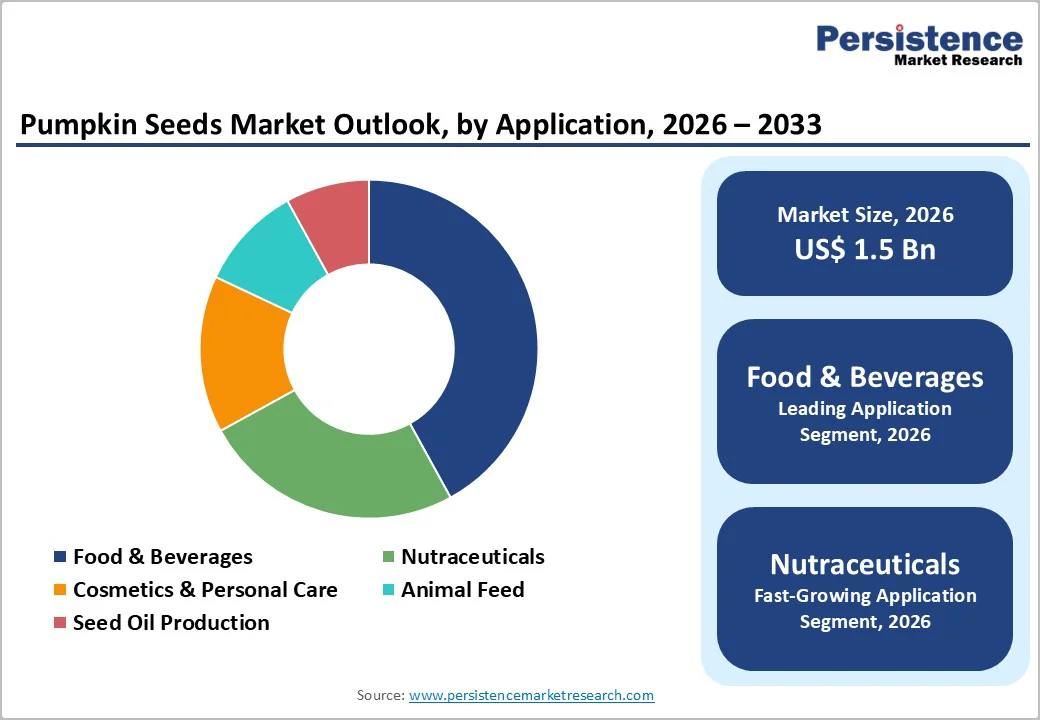

The food and beverages segment is expected to lead the pumpkin seeds market with a forecasted share of 42% in 2026, powered by widespread incorporation into snacks, cereals, bakery products, and nutritional foods. Its dominance reflects the adaptability of pumpkin seeds as a functional and nutrient-rich ingredient, supporting protein enrichment, fiber content, and flavor enhancement. Established food processors and snack manufacturers leverage raw and roasted seeds to meet growing consumer demand for convenient, health-oriented products. Distribution through modern retail and e-commerce channels further reinforces market penetration and consistent adoption.

The nutraceuticals segment is anticipated to be the fastest-growing category in 2026, propelled by increasing inclusion of pumpkin seed extracts in dietary supplements targeting metabolic, cardiovascular, and general wellness benefits. Rising consumer interest in preventive healthcare and natural functional ingredients drives demand. Product innovation, including capsules, powders, and fortified formulations, enhances applicability in wellness routines. Expansion of retail and online health supplement channels, coupled with strong emphasis on clean-label and traceable ingredients, positions the nutraceutical segment for sustained high growth.

North America remains a key market for pumpkin seeds, driven by high consumer awareness of health and wellness trends, rising demand for plant-based protein, and widespread adoption of functional snacks incorporating pumpkin seeds. Established food processors, ingredient suppliers, and branded snack companies leverage strong distribution networks and retail penetration to maintain consistent market presence. Urban populations increasingly prefer convenient, nutrient-dense snack options, positioning pumpkin seeds as a core ingredient in packaged snacks, bakery products, and health-focused formulations.

The North America pumpkin seeds market growth is further supported by innovation in product formats, including roasted seeds, flavored mixes, and fortified ingredients used in nutraceuticals and functional foods. Expansion of e-commerce platforms and private-label offerings enables rapid reach into both metropolitan and suburban areas. Regulatory support for labeling and health claims enhances consumer confidence, reinforcing pumpkin seeds as a versatile ingredient across diverse applications and sustaining long-term adoption and market expansion.

In Europe, the adoption of pumpkin seeds is strengthening, stimulated by growing consumer preference for plant-based and high-protein diets, particularly in Western and Northern countries. Food manufacturers are increasingly incorporating pumpkin seeds into bakery items, snack bars, and cereals, while functional ingredient producers utilize seed extracts for nutraceuticals and fortified foods. Sustainability considerations also play a significant role, with European consumers favoring organically sourced and traceable pumpkin seeds, encouraging producers to adopt eco-friendly farming and processing practices.

Innovation in flavors and product formats is driving market differentiation, with roasted, spiced, and blended seed mixes gaining traction. Distribution channels are expanding through both modern retail chains and specialized health stores, complemented by growing online sales. Regulatory frameworks in Europe support clean-label and health claims, enhancing consumer trust in pumpkin seed-based products. Strong collaboration between ingredient suppliers, food manufacturers, and research institutions is enabling product diversification, positioning Europe as a hub for premium and functional pumpkin seed offerings.

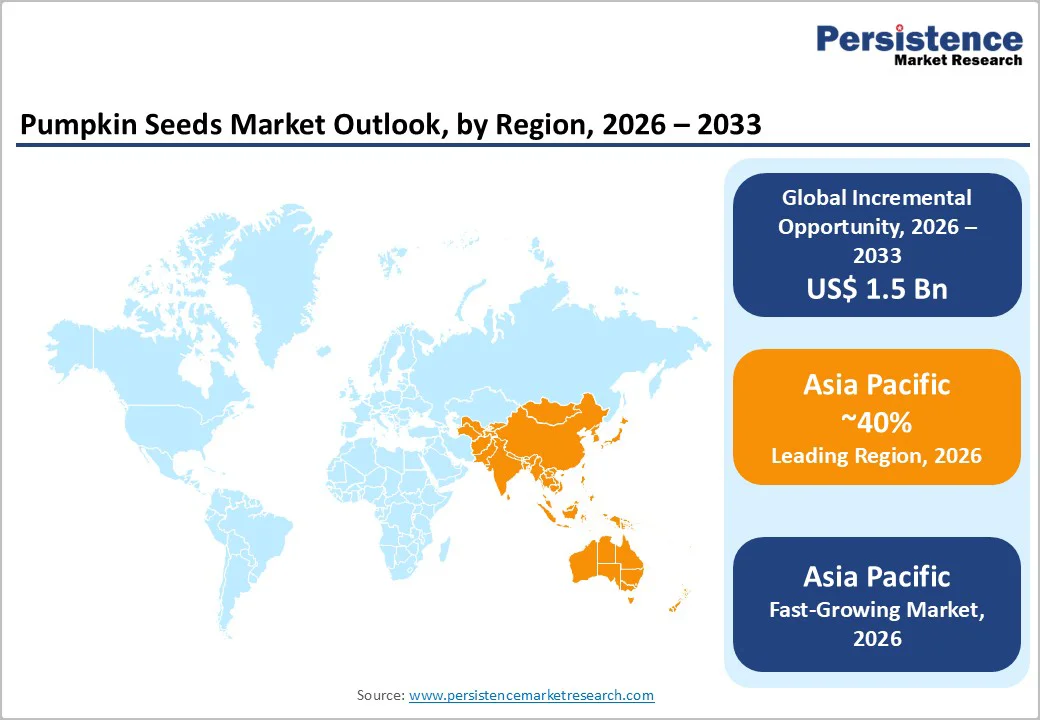

Asia Pacific is projected to be the dominant and fastest-growing pumpkin seed market, anticipated to hold an estimated share of around 40% in 2026. This leadership is supported by scale advantages across agriculture, processing, and consumption. Large-volume pumpkin cultivation in China and India ensures steady raw material availability, while vertically integrated processing clusters reduce cost per unit and improve supply continuity. Demand strength reflects a shift in urban diets toward nutrient-dense foods, where pumpkin seeds function as affordable protein and micronutrient sources suited to mass consumption rather than premium specialized segments.

Growth momentum in Asia Pacific is further reinforced by commercialization across food manufacturing and ingredient applications. Snack producers increasingly integrate pumpkin seeds into blended seed mixes, fortified snacks, and bakery formulations aligned with value pricing strategies. Expansion of nutraceutical manufacturing hubs in China, Japan, and India accelerates usage of pumpkin seed derivatives in capsules, powders, and functional blends. Distribution efficiency improves through rapid expansion of e-commerce grocery platforms and private-label penetration, enabling faster product scaling across metropolitan and tier-two cities.

The global pumpkin seeds market structure remains moderately fragmented, with leading players collectively accounting for approximately 45% of global revenues. Key companies include Conagra Foodservice, Inc., Qiaqia Food Co., Ltd., Natural World Inc., and Braga Organic Farms, which operate across branded foods, bulk seed supply, and value-added processing. Their scale enables consistent quality, broad distribution reach, and competitive pricing across retail and industrial channels.

These companies strengthen market positions through ingredient divisions, supported by strong sourcing networks and diversified portfolios spanning raw seeds, roasted snacks, and functional ingredients. Alongside global players, regional producers and organic specialists continue to expand presence by focusing on traceability, clean-label positioning, and specialized consumer demand, contributing to sustained competition and a balanced market structure.

The global pumpkin seeds market is projected to reach US$ 1.5 billion in 2026.

Rising health awareness, demand for protein‑rich and nutrient‑dense foods, growth of functional and plant‑based diets, expanding use in snacks, bakery, nutraceuticals, and cosmetics are driving the market.

The market is poised to witness a CAGR of 10.4% from 2026 to 2033.

Growing health‑conscious consumer demand, expansion of functional and plant‑based foods, increasing use in nutraceuticals and cosmetics, and rising organic product preferences are key opportunities in the market.

Some of the key market players include Conagra Foodservice, Inc., Qiaqia Food Co., Ltd., Natural World Inc., and Braga Organic Farms.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author