ID: PMRREP32474| 233 Pages | 5 Jan 2026 | Format: PDF, Excel, PPT* | Food and Beverages

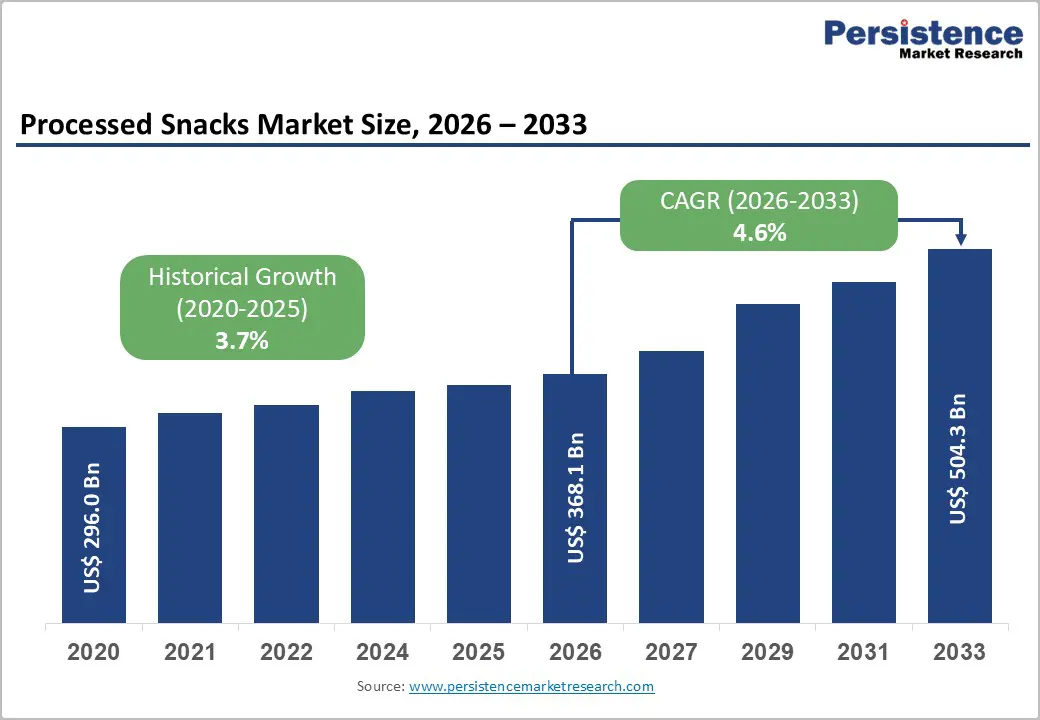

The global Processed Snacks Market size is expected to be valued at US$ 368.1 billion in 2026 and projected to reach US$ 504.3 billion by 2033, growing at a CAGR of 4.6% between 2026 and 2033.

The global processed snacks market is increasingly shaped by urban lifestyles, flavor-driven experimentation, and premiumization through health-forward reformulation. Convenience, taste intensity, and brand-led innovation are redefining how snacks fit into daily consumption across regions.

| Key Insights | Details |

|---|---|

| Global Processed Snacks Market Size (2026E) | US$ 368.1 Bn |

| Market Value Forecast (2033F) | US$ 504.3 Bn |

| Projected Growth (CAGR 2026 to 2033) | 4.6% |

| Historical Market Growth (CAGR 2020 to 2025) | 3.7% |

City life is rewriting eating behavior as time scarcity reshapes food priorities. Urban consumers increasingly favor snacks that fit commuting, desk-based work, and mobile lifestyles. Processed snacks answer this need through portability, extended shelf life, and instant consumption without preparation. Single-serve packs and resealable formats further strengthen their relevance in fast-paced daily routines.

Urbanization also drives exposure to modern retail formats, expanding access to diverse snack options. Working professionals and students rely on snacks as meal replacements or energy boosters. Growth in delivery platforms and convenience stores amplifies impulse purchases. As urban populations continue expanding globally, processed snacks evolve from occasional indulgence into habitual consumption items embedded within everyday eating patterns.

Ingredient cost instability poses persistent challenges for large-scale snack processors. Fluctuating prices of edible oils, grains, potatoes, corn, and spices directly affect production economics. External factors such as climate variability, energy costs, and supply disruptions amplify unpredictability. Maintaining price competitiveness becomes difficult when input costs shift rapidly.

Margin pressure intensifies for manufacturers operating on high-volume, low-margin models. Passing cost increases to consumers risks volume erosion in price-sensitive markets. Long-term sourcing contracts offer limited protection during sharp commodity swings. Smaller suppliers struggle with procurement leverage, while larger players face complex hedging decisions. Persistent volatility complicates forecasting, investment planning, and promotional strategies, ultimately restraining profitability across the processed snacks value chain.

Snack aisles are undergoing a nutritional reset as consumers scrutinize ingredients more closely. Reformulating processed snacks with simpler labels, reduced additives, and recognizable ingredients unlocks premium growth potential. Clean-label positioning elevates perceived value while supporting higher price points. Reduced oil absorption, baked formats, and improved seasoning blends enhance nutritional appeal.

For key players and new startups, reformulation enables portfolio upgrading without abandoning familiar snack formats. Transparency around sourcing and processing builds trust with health-aware buyers. Better-for-you claims resonate strongly with urban professionals and younger consumers. As indulgence merges with wellness, clean-label snack innovation creates a strategic pathway toward margin expansion and long-term brand relevance.

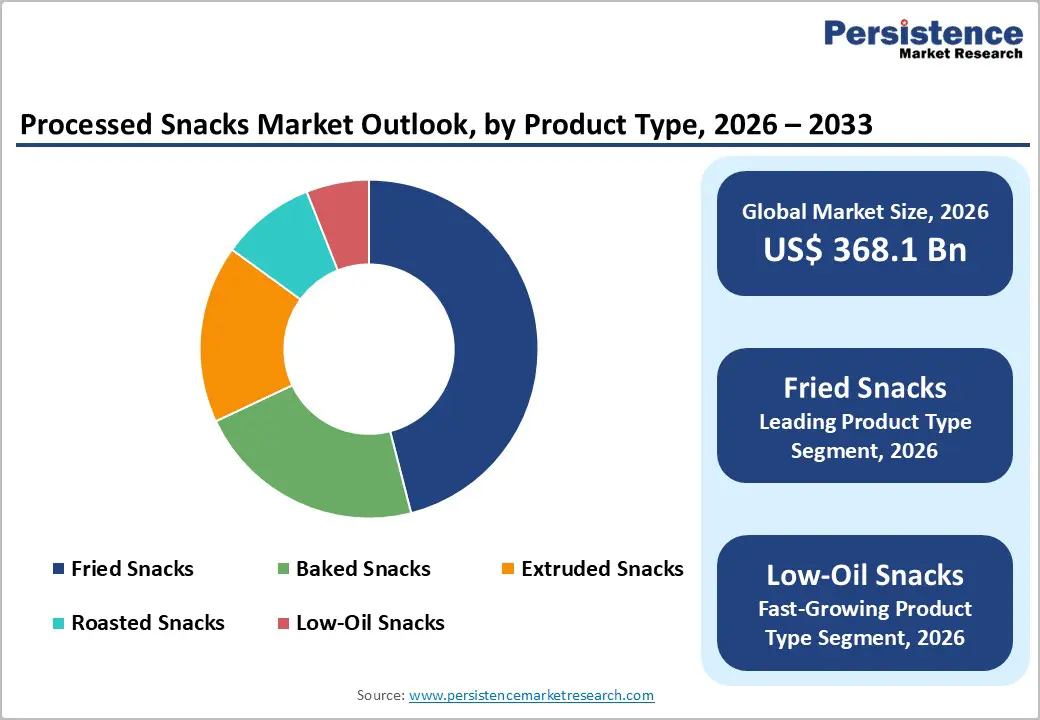

Fried Snacks holds approx. 47% market share as of 2025, reflecting deep-rooted consumer preference for bold taste and texture. Frying delivers distinctive crunch, mouthfeel, and flavor retention that other processing methods struggle to replicate. These sensory advantages sustain strong demand across chips, extruded snacks, and traditional fried formats.

Affordability and familiarity further reinforce dominance. Fried snacks adapt easily to regional seasoning profiles, supporting localized offerings at scale. Manufacturing infrastructure for frying remains widely established, enabling cost-efficient mass production. Despite rising health awareness, indulgence-driven consumption remains resilient. As long as taste remains a primary purchase driver, fried snacks continue to anchor the global processed snacks market.

Spicy & Hot flavored are projected to grow at a CAGR of 8.7% during the forecast period as consumers seek intense sensory experiences. Heat-forward profiles deliver excitement, novelty, and emotional engagement beyond basic flavors. Younger consumers actively experiment with chili, pepper, and fusion spice blends.

Global exposure to street food and regional cuisines fuels flavor crossover. Snack brands increasingly layer heat with tangy, smoky, or savory notes for complexity. Spicy snacks also encourage repeat purchases due to flavor addiction dynamics. As tolerance for bold flavors rises globally, spicy variants gain shelf visibility and pricing power across mass and premium snack categories.

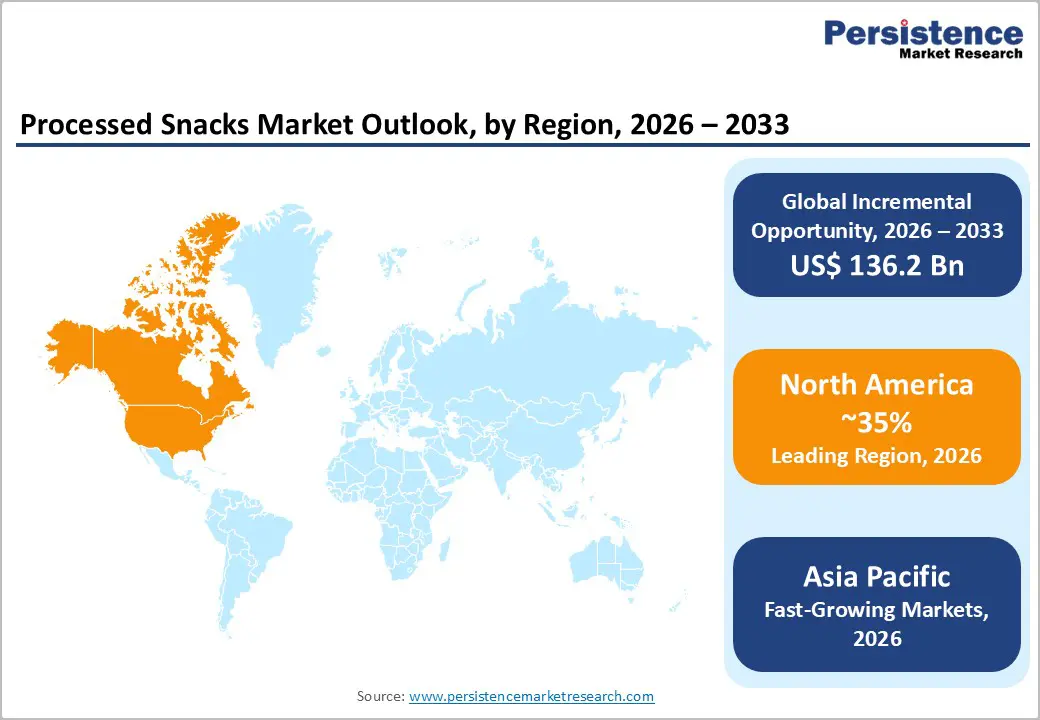

North America holds approximately. 35% market share in the global Processed Snacks Market, driven by high snack frequency and innovation-led consumption. In the United States, demand shifts toward portion-controlled packs, protein-enriched snacks, and flavor experimentation. Convenience remains central as snacking replaces structured meals.

Canada reflects similar trends with rising demand for clean-label and responsibly packaged snacks. Retailers emphasize private labels alongside branded offerings. Digital marketing and data-driven promotions shape purchasing behavior. Sustainability messaging and nutritional transparency influence brand loyalty. As snacking becomes deeply embedded in daily routines, North America continues shaping global snack innovation benchmarks.

Asia Pacific Processed Snacks Market is expected to grow at a CAGR of 8.4% as consumption accelerates across urban populations. In India, growth is driven by affordable snack packs and localized flavors. China shows rapid expansion in premium and western-style snacks through modern retail.

Japan focuses on portion control, texture innovation, and seasonal launches. South Korea emphasizes bold flavors and visually appealing packaging. E-commerce and convenience stores accelerate penetration. Regional players blend domestic taste profiles with global formats. As disposable incomes rise, processed snacks transition from occasional treats into everyday consumption staples across Asia Pacific markets.

The global Processed Snacks Market remains highly fragmented, featuring multinational brands and strong regional players. Leading companies invest heavily in flavor innovation, health-focused variants, and eye-catching packaging. Marketing emphasizes lifestyle alignment and emotional appeal. Certifications related to quality and sourcing support trust.

Sustainability initiatives address packaging waste and responsible ingredient sourcing. Strategic sales partnerships with retailers and foodservice operators expand reach. Domestic flavor adaptation strengthens regional relevance. Regulatory pressure around labeling and nutrition influences formulation strategies. As competition intensifies, differentiation increasingly depends on innovation speed, brand storytelling, and operational efficiency.

What is the projected size of the global Processed Snacks market in 2026?

Rising urbanization and on-the-go consumption habits is key demand driver in the Processed Snacks market.

North America leads the Processed Snacks market with about 35% share in 2025.

Reformulating snacks with better-for-you and clean-label claims unlocks premium growth is the key opportunity for key players in the market.

Key players include PepsiCo, Inc., Mondelez International, Inc., The Kraft Heinz Company, General Mills, Inc., Mars, Incorporated, Nestlé S.A., Conagra Brands, Inc., and others

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Flavor

By Sales Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author