ID: PMRREP3889| 191 Pages | 11 Sep 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

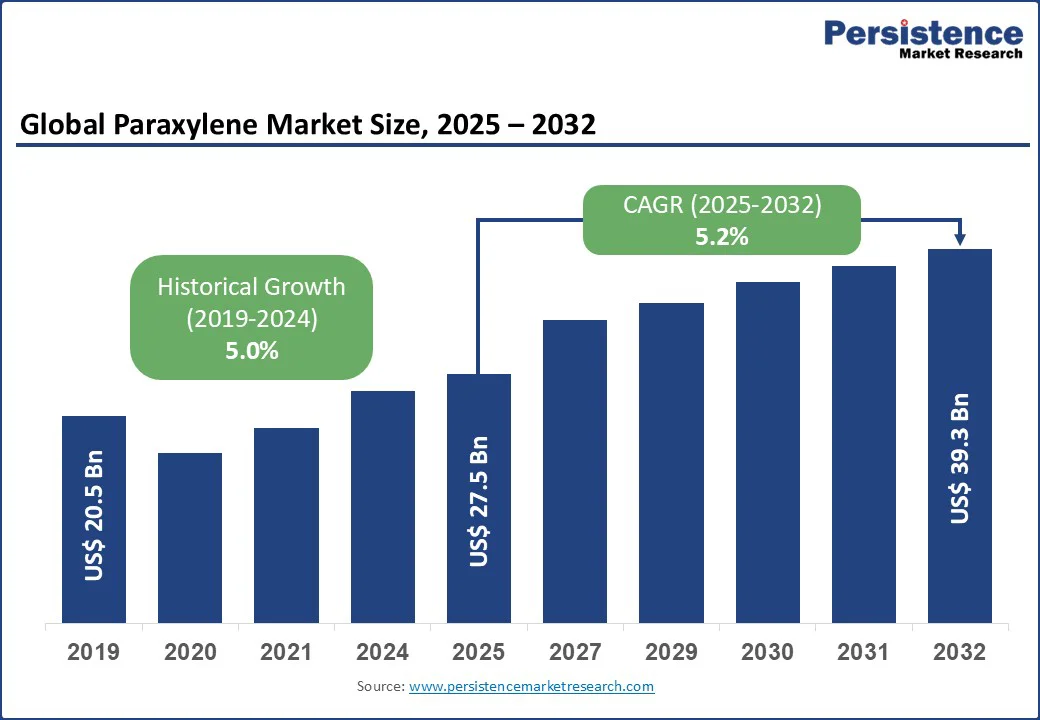

The global paraxylene market size is such likely to be valued at US$ 27.5 Bn in 2025 and is expected to reach US$ 39.3 Bn by 2032, growing at a CAGR of 5.2% during the forecast period from 2025 to 2032.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Paraxylene Market Size (2025E) |

US$ 27.5 Bn |

|

Market Value Forecast (2032F) |

US$ 39.3 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.0% |

The paraxylene market has experienced steady growth, driven by rising demand for polyester fibers and polyethylene terephthalate (PET) resins, which are critical for textiles, packaging, and bottling applications.

The paraxylene market is propelled by the rising demand for polyester fibers and PET resins, which are essential in textiles, packaging, and consumer goods. Polyester fibers, derived from purified terephthalic acid (PTA), are widely used in clothing, home furnishings, and industrial fabrics due to their durability, affordability, and ease of blending with natural fibers. With the growing global population, urbanization, and fast fashion trends, the demand for polyester-based textiles continues to surge, particularly in emerging economies such as China, India, and Southeast Asia. For instance, China alone accounts for more than 65% of global polyester fiber production, making it the largest consumer of paraxylene-derived PTA.

PET resins, also produced from paraxylene derivatives, play a crucial role in the packaging industry, especially for beverage bottles and food containers, owing to their lightweight, shatter-resistant, and recyclable properties. The rising consumption of bottled water, carbonated drinks, and ready-to-eat food products is driving PET demand across both developed and developing regions. For example, India’s bottled water industry is projected to grow at double-digit rates, significantly boosting PET resin consumption. Furthermore, the increasing focus on sustainability and circular economy practices has encouraged innovations in recyclable PET, further boosting market growth. Together, the dual demand from the textiles and PET packaging industries ensures strong, sustained growth for the paraxylene market in the coming years.

The market is constrained by high production costs coupled with stringent environmental regulations, which challenge both profitability and long-term sustainability. Paraxylene production is energy-intensive, requiring large volumes of crude oil or naphtha as feedstock, and the prices of these raw materials are highly volatile. Fluctuations in the crude oil market directly affect production costs, creating uncertainty for manufacturers and often compressing profit margins. Additionally, the capital investment required to establish and maintain advanced refining and petrochemical facilities adds to the overall cost burden, making it difficult for smaller or regional players to compete with large, integrated companies. For instance, volatility in Brent crude prices, rising from under USD 43 per barrel in 2020 to over USD 99 per barrel in 2022, significantly increased raw material costs for paraxylene producers worldwide.

Environmental regulations further complicate the landscape. Paraxylene production generates emissions, effluents, and other by-products that require strict monitoring and treatment. Governments across North America, Europe, and increasingly in Asia are implementing stringent policies to limit greenhouse gas emissions, enforce sustainable practices, and reduce dependency on fossil-fuel-derived chemicals. For example, the European Union’s Green Deal and stricter carbon emission standards have pushed petrochemical companies to invest heavily in energy-efficient technologies, further escalating costs. These regulatory pressures, combined with cost challenges, may limit capacity expansions and reduce overall competitiveness, restraining market growth despite strong downstream demand.

The paraxylene market lies in the advancements in bio-based paraxylene production, driven by the global shift toward sustainability and reduced dependency on fossil fuels. Traditional paraxylene production is heavily reliant on crude oil and naphtha, making it vulnerable to price volatility and environmental concerns. In contrast, bio-based paraxylene, derived from renewable feedstocks such as biomass, sugarcane, and agricultural residues, offers a greener alternative with a lower carbon footprint. Growing demand for eco-friendly products, coupled with stricter environmental regulations, is creating a favorable landscape for the commercialization of bio-based paraxylene.

Several leading companies and research organizations are investing in the development of innovative technologies to scale up production. For instance, Virent, supported by The Coca-Cola Company, has pioneered plant-based paraxylene for 100% bio-PET bottles. These advancements are not only addressing sustainability goals but also attracting significant investments from consumer goods and packaging companies committed to circular economy practices. Additionally, improvements in catalytic processes and biotechnology are enhancing yield efficiency, making bio-based paraxylene more commercially viable. As consumer and regulatory pressures grow, bio-based paraxylene represents a transformative opportunity, positioning the industry toward long-term sustainable growth.

Purified Terephthalic Acid (PTA) is a dominating segment expected to account for approximately 62% share in 2025. Its dominance stems from its widespread use in polyester production, particularly for textiles and PET bottles, due to its cost-effectiveness, high yield, and scalability in manufacturing. PTA-based production processes, such as those employed by Reliance Industries and Sinopec, enable high-volume output with minimal waste, making them a preferred choice for large-scale manufacturers. The ability to integrate PTA production with downstream polyester manufacturing further drives its adoption across industries such as textiles and beverage bottling.

The dimethyl terephthalate (DMT) segment is the fastest-growing, driven by its increasing use in specialty polyester applications, such as high-performance films and engineering plastics for electronics and construction. DMT offers greater flexibility in producing customized polyester products, appealing to industries with specific performance requirements. The growing focus on lightweight and durable materials, supported by initiatives such as the U.S. Department of Energy’s advanced manufacturing programs, is accelerating the adoption of DMT in regions such as North America and the Asia Pacific, with significant growth potential in high-value applications.

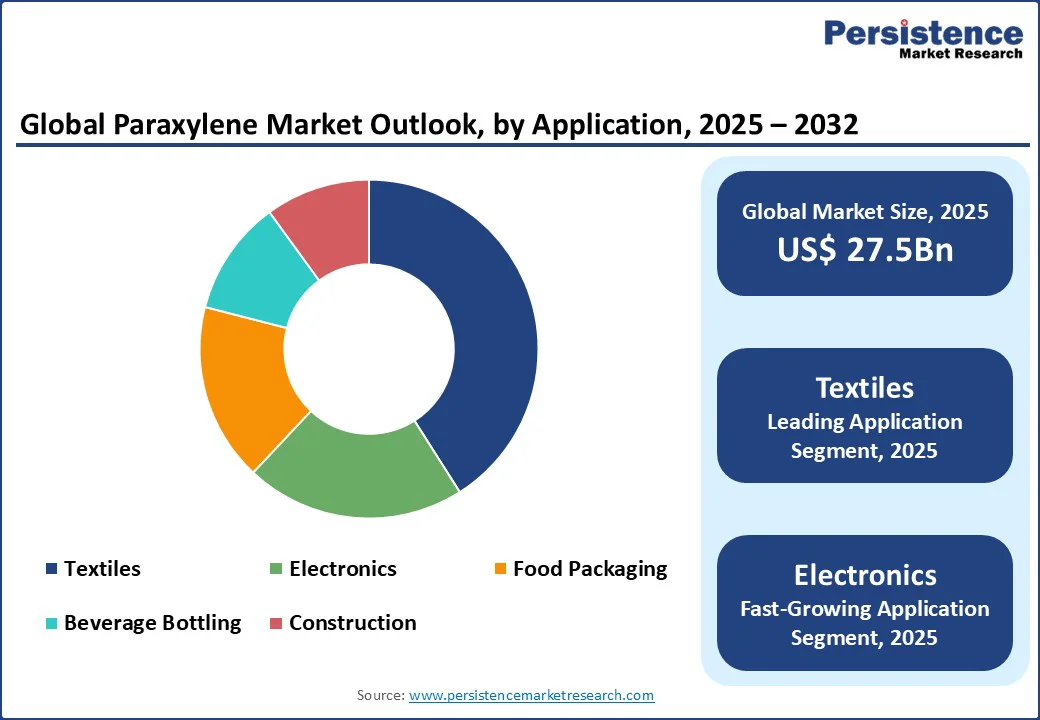

Textiles lead the paraxylene market, holding a 41% share in 2025. The segment’s dominance is driven by the global demand for polyester fibers in clothing, home furnishings, and industrial textiles, particularly in emerging markets. The rapid growth of the textile industry in the Asia Pacific, where China and India account for polyester fiber production, has spurred the adoption of paraxylene-based PTA for cost-effective and scalable manufacturing. Paraxylene-derived polyester fibers offer durability, affordability, and versatility, making them critical for manufacturers such as Reliance Industries and Formosa Plastics.

The electronics segment is the fastest-growing, fueled by the increasing demand for polyester-based films and resins in electronic components, such as circuit boards and display screens. The rise in consumer electronics, particularly in the Asia Pacific, where smartphone penetration is driving demand for lightweight and high-performance materials. The integration of paraxylene-derived products in advanced manufacturing processes, supported by government initiatives in countries such as Japan and South Korea, is accelerating adoption in this segment.

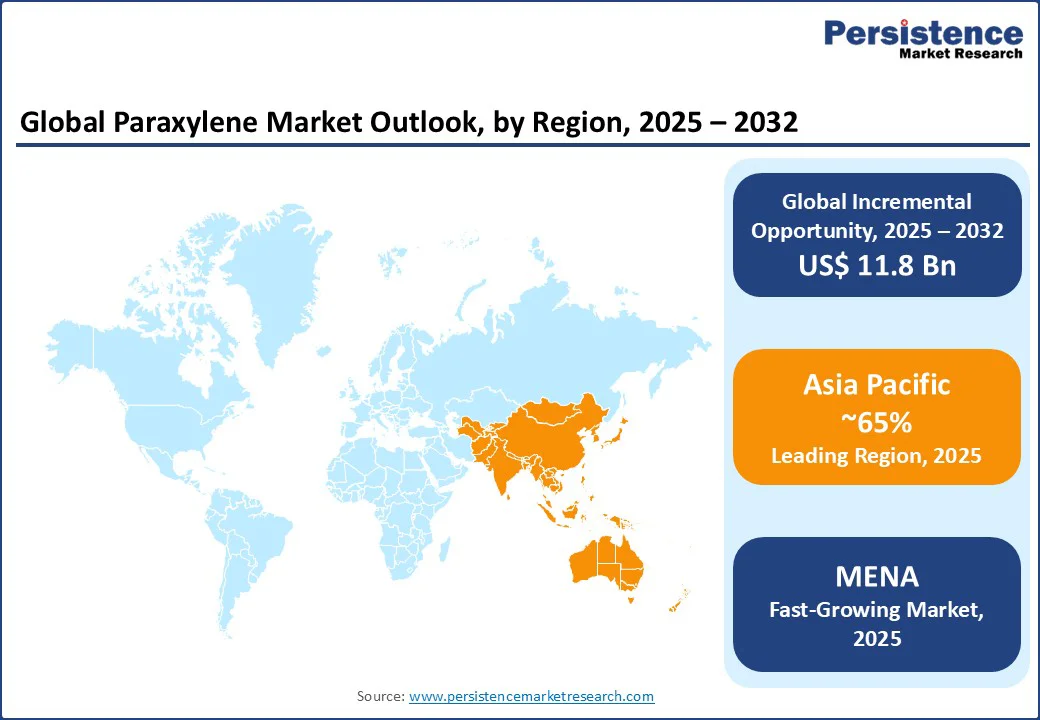

The Middle East and North Africa (MENA) region is emerging as the fastest-growing market for paraxylene, driven by abundant hydrocarbon resources, strategic investments in petrochemical infrastructure, and increasing downstream polyester and PET production capacities. Countries such as Saudi Arabia, the United Arab Emirates, and Qatar are leveraging their vast crude oil and natural gas reserves to expand integrated chemical complexes, enabling local production of paraxylene and its derivatives, including purified terephthalic acid (PTA) and polyethylene terephthalate (PET) resins. These developments reduce dependency on imports and position MENA as a key exporter of paraxylene to Asia, Europe, and Africa.

Rising demand from the textile and packaging industries is a major growth driver. The proliferation of polyester fibers in clothing, home furnishings, and industrial fabrics, combined with increasing consumption of PET bottles for beverages and packaged foods, is creating a strong downstream market for paraxylene. Additionally, governments in the region are implementing policies to diversify economies beyond crude oil, encouraging investments in chemicals and petrochemicals. Strategic collaborations with global players, advanced refining technologies, and energy-efficient production processes are further accelerating market growth. As a result, the MENA region is poised to witness robust paraxylene demand growth, making it a critical emerging market within the global paraxylene landscape over the coming years.

Europe paraxylene market is driven by established demand in the textile and packaging sectors, where PTA and PET resins are widely used. Key production and consumption hubs include Germany, France, and Italy, supported by advanced petrochemical infrastructure. A major trend is the shift toward bio-based and recycled paraxylene, fueled by strict environmental regulations, carbon-neutrality targets, and growing consumer preference for sustainable products. Companies are investing in energy-efficient and low-emission processes, promoting eco-friendly PET packaging and textiles. Strategic partnerships, capacity expansions, and digital supply chain optimization are also shaping the sector. Overall, European market emphasizes sustainability, technological advancement, and high-value applications, maintaining its competitive edge in the global paraxylene industry.

Asia Pacific is likely to dominate the global paraxylene market in 2025, holding an estimated 65% market share, driven by robust manufacturing hubs, strong industrial growth, and rising demand for polyester fibers. Countries such as China and India are the largest consumers and producers of paraxylene, largely due to their rapidly expanding textile and packaging industries. China, in particular, continues to lead in polyester production, with hundreds of integrated petrochemical and textile complexes that convert paraxylene into purified terephthalic acid (PTA) and further into polyester fibers and PET resins. Similarly, India’s growing textile sector and increasing production of PET bottles are fueling demand for paraxylene derivatives.

The region benefits from established infrastructure, competitive labor costs, and favorable government policies supporting chemical manufacturing, which encourage both domestic production and foreign investments. In addition, urbanization, rising disposable incomes, and the proliferation of fast fashion are boosting the consumption of polyester-based clothing and home furnishings, further enhancing paraxylene demand. The packaging sector, particularly PET bottles for beverages and food containers, is also experiencing strong growth, driven by lifestyle changes and increased consumption of packaged goods. Together, these factors position Asia Pacific as the leading and fastest-growing market for paraxylene, accounting for a substantial share of global demand in 2025.

The global paraxylene market is highly competitive, shaped by regional strengths and a mix of global and niche players. In North America and Europe, major companies such as ExxonMobil, BP, and Chevron Phillips Chemical dominate through scale, advanced R&D, and strong partnerships with downstream manufacturers. In the Asia Pacific, rapid industrial expansion and rising demand are drawing significant investments from international leaders such as Reliance Industries, Sinopec, and Formosa Plastics, alongside regional vendors. Companies are emphasizing innovation, energy-efficient refining, and strategic alliances to strengthen market presence. The emergence of bio-based paraxylene and advanced technologies serves as a key differentiator, driving adoption across textiles, packaging, and electronics. Consolidation among global leaders contrasts with fragmentation across regional and niche participants.

The global paraxylene market is projected to reach US$ 27.5 Bn in 2025.

The increasing demand for polyester fibers and PET resins is a key driver.

The paraxylene market is poised to witness a CAGR of 5.2% from 2025 to 2032.

Advancements in bio-based paraxylene production are a key opportunity.

ExxonMobil, Reliance Industries, BP, Chevron Phillips Chemical, Sinopec, and Formosa Plastics are key players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author