ID: PMRREP33346| 200 Pages | 5 Aug 2025 | Format: PDF, Excel, PPT* | Healthcare

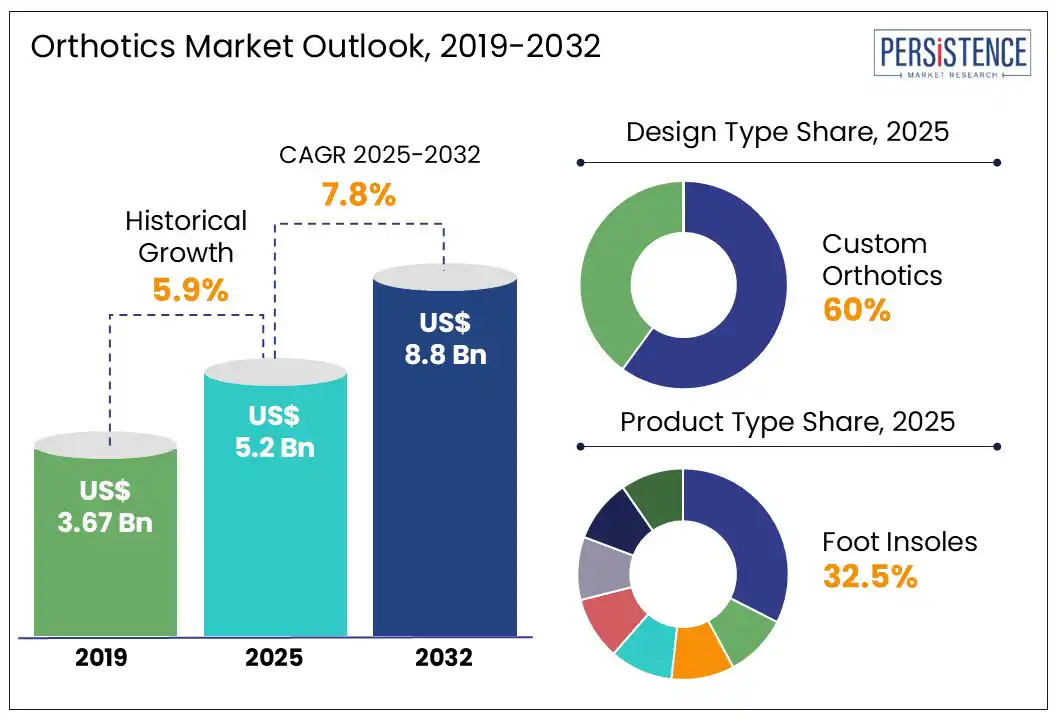

The global orthotics market size is likely to be valued at US$ 5.2 Bn in 2025 and is estimated to reach US$ 8.8 Bn in 2032, growing at a CAGR of 7.8% during the forecast period 2025 - 2032. The orthotics market growth is driven by the increasing recognition of orthotic devices as essential tools in managing and preventing musculoskeletal disorders. Orthoses are widely utilized to correct foot deformities, enhance mobility, support weakened joints, and mitigate the risk of further injury, making them a critical component in rehabilitation and preventive care.

The increasing adoption of orthotics by healthcare professionals is supported by a surge in foot and ankle-related conditions, particularly among high-risk populations such as athletes, military personnel, and aging individuals. As the demand for performance optimization, injury prevention, and post-operative rehabilitation grows, orthotic solutions are poised to play an increasingly central role in global healthcare strategies.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Orthotics Market Size (2025E) |

US$ 5.2 Bn |

|

Market Value Forecast (2032F) |

US$ 8.8 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

7.8% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.9% |

The market is witnessing significant growth due to various key factors. A leading contributor is the rising prevalence of orthopedic conditions that require orthotics for pain relief, enhanced mobility, and prevention of further complications.

The increasing incidence of sports injuries and accidents also plays a vital role in driving market growth. Furthermore, rising public awareness about the preventive and pain management benefits of orthotics is augmenting their adoption. For example, research from a tertiary care center in India reported that foot injuries accounted for 7.59% of all trauma cases.

Technological developments, including personalized fitting solutions, are driving the development of innovative and effective orthotics solutions that cater to diverse patient needs. Additionally, the growing affordability of orthotics and easier accessibility through e-commerce platforms are propelling market expansion.

Orthotic devices are commonly utilized to alleviate foot pain, ankle discomfort, and various lower extremity conditions. While they are intended to provide relief and improve biomechanical functions, certain concerns regarding potential adverse effects deter some individuals from adopting them. In some cases, orthotic support may inadvertently lead to increased strain on the feet. This can occur when the artificial support alters the natural mechanics of the foot, requiring the musculature to work harder to maintain balance and function. Similarly, insoles that provide insufficient or poorly designed support may disrupt normal posture and gait, potentially increasing the risk of musculoskeletal injuries elsewhere in the body.

While over-the-counter or mass-produced orthotics may offer temporary relief from localized foot pain, they may also transfer mechanical stress to other joints, including the knees, hips, and lower back. This redistribution of pressure can lead to new or worsened symptoms in those areas.

Cost remains a significant barrier to wider adoption, particularly for custom-made orthotic solutions. In the U.S., for example, prescription custom orthotics typically range from US$ 400 to US$ 600, posing a financial challenge for many patients. This expense, combined with the potential for adverse biomechanical outcomes, contributes to hesitation among consumers considering orthotic intervention.

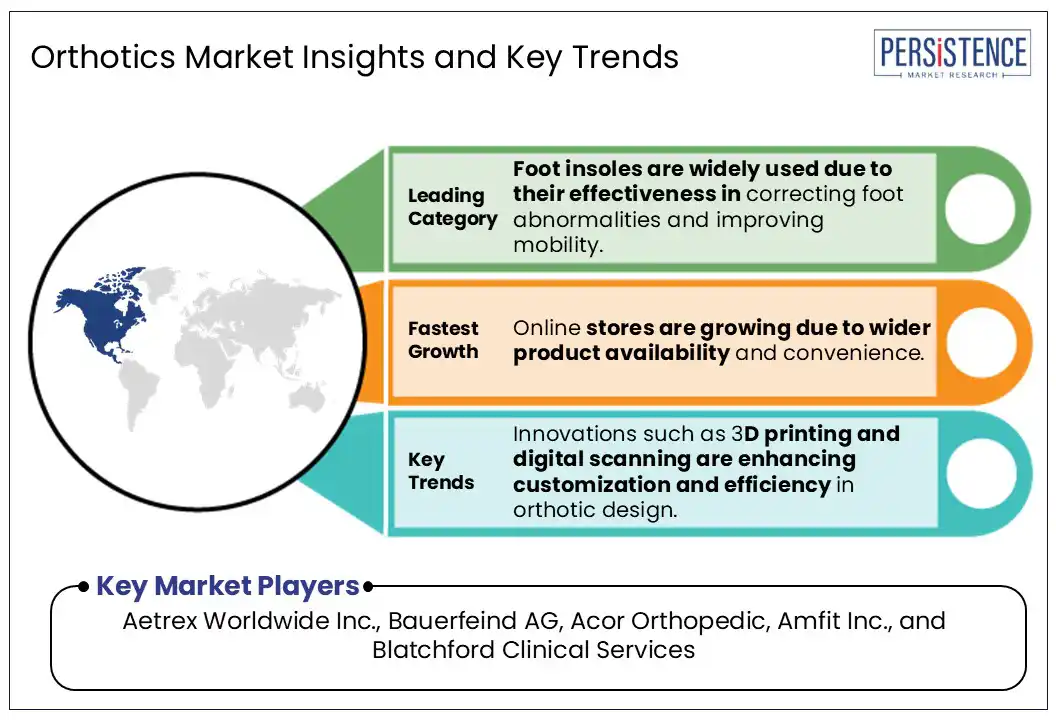

The orthotics market is poised for growth, driven by rising focus on personalized, patient-centric care, which paves the way for innovative custom orthotic solutions utilizing advancements such as 3D printing and digital technologies.

The trend toward customization addresses the high demand for orthotic devices that are not only comfortable and effective but also visually appealing. Additionally, the use of orthotics is surging beyond traditional rehabilitation, finding new applications in areas such as sports performance enhancement, preventive care, and chronic disease management.

Integration of novel technologies, including smart sensors, AI, and telehealth platforms, further enhances the functionality of orthotics. These enable improved monitoring and remote patient care while fostering better patient engagement and outcomes. A few companies also focus on collaborating with athletes and social media influencers to attract new customers. For example, Striv has developed smart insoles equipped with over 250 innovative sensors that provide real-time coaching, detailed gait analysis, and customized training plans. These insoles aim to optimize performance and reduce injury risk by delivering lab-quality biomechanics data directly to runners. Olympic marathoner Jake Riley has endorsed the technology, highlighting its potential to revolutionize training and injury prevention.

By design type, custom orthotics are estimated to hold a market share of 60% in 2025, due to their superior ability to meet individual patient needs. These devices are tailored based on precise foot measurements and medical conditions, offering enhanced comfort, support, and effectiveness compared to prefabricated options.

Growing demand for personalized healthcare solutions, developments in 3D printing, and digital scanning technologies are further augmenting the adoption of custom orthotics. These are particularly favored in managing complex orthopedic conditions, sports injuries, and chronic pain. As healthcare professionals prioritize individualized care, the custom orthotics segment continues to lead and shape market trends globally. For instance, clinics such as the Foot and Ankle Center of Lake City in Seattle have adopted 3D printing technology, providing patients with orthotics that support various activities, including sports and daily routines.

By product type, the foot insoles segment is projected to hold a market share of 32.5% in 2025. There is a growing recognition of the importance of foot health and the role insoles play in preventing and alleviating discomfort. Individuals are becoming more proactive in seeking solutions to maintain foot comfort and prevent injuries. A significant portion of the population experiences foot pain or related conditions. Studies indicate that over 50% of individuals suffering from foot pain utilize foot orthotic insoles, with usage rates increasing with age 76% among those aged 55 to 64 and 88% among those aged 85 to 94.

Innovations in materials and design have led to more effective and comfortable insoles. For example, the integration of 3D printing technology allows for the creation of custom orthotic insoles tailored to individual foot structures, enhancing comfort and support.

North America is projected to lead, capturing a market share of approximately 40% in 2025. It is driven by a well-established healthcare infrastructure, high healthcare expenditure, and a strong focus on technological developments.

The region's leadership is further fueled by the increasing prevalence of musculoskeletal disorders, diabetes, and arthritis, which significantly propel the demand for orthotic solutions. The rising adoption of custom and innovative orthotics, supported by developments such as digital scanning, also contributes to market growth.

The U.S., being a key contributor, benefits from a large base of leading market players, robust insurance coverage for orthotic devices, and growing public awareness of the benefits of orthotics in preventive and therapeutic care. For example, Medicare Part B covers orthotic devices deemed medically necessary when prescribed by a physician. Beneficiaries are responsible for 20% of the Medicare-approved amount after meeting the annual Part B deductible. For those with insurance, out-of-pocket costs for custom orthotics can range from 10% to 15% of the total device price, depending on the specific insurance plan and medical necessity.

Europe is estimated to hold a share of 28.2% in 2025. One prominent contributor to growth is the increasing participation in sports and athletic activities across the continent.

As more individuals engage in physical exercise, there is a corresponding rise in sports-related injuries and a surging focus on performance optimization, leading to greater utilization of orthotic solutions. This trend is supported by data indicating a high demand from the sports and athletics sector for foot orthotic insoles. For example, around 6.2 million individuals in the European Union (EU) seek hospital treatment for sports-related injuries each year. Of these cases, 7% (around 402,000 individuals) necessitate hospital admission for further care. A study on adult Germans found that 3.1% sustained a sports injury in the preceding year. Among these injuries, dislocations, sprains, and torn ligaments accounted for 60%, while fractures comprised 18%.

A significant contributor to Asia Pacific market growth is the region's rapidly aging population. With aging, there is an increased prevalence of musculoskeletal disorders and mobility challenges, leading to a high demand for orthotic solutions to enhance mobility and quality of life.

Orthotic devices are increasingly adopted to address conditions such as osteoarthritis, spinal deformities, and plantar fasciitis, offering non-invasive support that can delay or prevent the need for surgical interventions. Moreover, the region’s growing incidence of diabetes, a major contributor to foot deformities and neuropathic complications, is further fueling demand for custom foot orthoses and diabetic shoe inserts.

In Japan, where nearly 30% of the population is over 65, public health policies actively promote the use of mobility aids and orthotic devices to reduce fall-related injuries and healthcare burden. Similarly, in China, investments in community health centers and rural outreach programs are improving access to orthopedic and podiatric care. Technological advancements such as 3D-printed orthotic insoles, pressure-mapping systems, and smart orthoses with embedded sensors are gaining traction, especially in urban medical centers and rehabilitation clinics.

The global orthotics market is multifaceted, featuring a blend of established leaders, innovative start-ups, and technology-driven entities all vying for prominence. Leading companies boast expansive product portfolios, global reach, and brand equity.

Concurrently, a wave of emerging players and start-ups is making a difference by specializing in niche segments, leveraging disruptive technologies such as 3D printing and wearable sensors to introduce personalized and smart orthotic solutions. Strategic partnerships and collaborations are increasingly prevalent, enabling knowledge exchange, research endeavors, and market growth.

The orthotics market is set to reach US$ 5.2 Bn in 2025.

By the end of the forecast period (2032), the market is projected to grow to USD 8.8 Bn, reflecting a steady expansion.

Growing awareness of orthotics for performance enhancement and injury prevention in sports is set to create opportunities.

By design type, custom orthotics are estimated to hold a market share of 60% in 2025, due to their superior ability to meet individual patient needs.

The orthotics market is estimated to rise at a CAGR of 7.8% through 2032.

Aetrex Worldwide Inc., Acor Orthopedic, Amfit Inc., Blatchford Clinical Services, and The Foot Lab are a few leading players.

|

Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization & Pricing |

Available upon request |

By Product Type

By Application

By Design Type

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author