ID: PMRREP35629| 191 Pages | 18 Sep 2025 | Format: PDF, Excel, PPT* | Healthcare

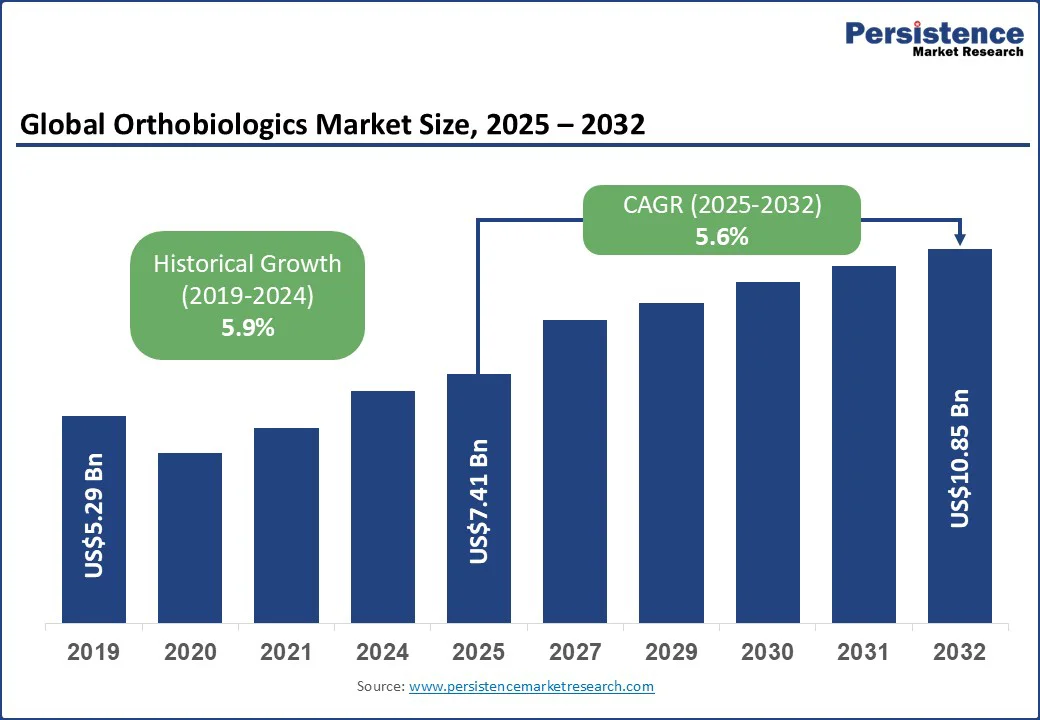

The global orthobiologics market size is likely to be valued at US$7.41 Bn in 2025 and is expected to reach US$10.85 Bn by 2032, growing at a CAGR of 5.6% during the forecast period from 2025 to 2032, driven by the rising prevalence of musculoskeletal disorders, sports injuries, and the growing adoption of minimally invasive procedures.

Key Industry Highlights

|

Key Insights |

Details |

|

Orthobiologics Market Size (2025E) |

US$7.41 Bn |

|

Market Value Forecast (2032F) |

US$10.85 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.6% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.9% |

Surgeons are shifting away from iliac crest autograft due to donor-site pain, complications, and added operating room time. This shift has accelerated the use of cellular bone matrix for spinal fusion, demineralized bone matrix putties, and synthetic bone void fillers in spine and trauma cases. Clinical studies highlight improved early fusion rates when graft substitutes are combined with autologous cell therapies, making biologics a preferred adjunct. Regulatory clarity is also strengthening adoption, with the FDA providing more defined pathways for HCT/P 361 products and granting PMA approvals for osteoinductive agents. The approval of rhPDGF-BB bone graft alternatives, such as Augment, for hindfoot and ankle arthrodesis is further validating biologic grafts in targeted orthopedic procedures.

A strong push also comes from the rapid growth of ambulatory surgery centers specializing in orthobiologics. As CMS expands outpatient eligibility for procedures such as knee replacement and even outpatient shoulder arthroplasty in ASCs, more sports medicine and joint preservation cases are shifting away from hospitals. These centers prefer off-the-shelf biologics that avoid graft harvest, save operating time, and align with strict cost controls. Insurance coverage continues to support demand, with hyaluronic acid viscosupplementation and emerging evidence for platelet-rich plasma injections in knee osteoarthritis gaining traction. The rise in ACL injuries among younger populations continues to drive procedure volumes, reinforcing the role of biologics in outpatient orthopedic and sports medicine care.

Clinicians continue to report inconsistent outcomes with some widely used orthobiologic injections. Studies on hyaluronic acid viscosupplementation for knee osteoarthritis show only marginal pain relief and a higher rate of adverse events, which reduces physician confidence in its long-term use. Evidence for platelet-rich plasma in musculoskeletal conditions remains mixed due to variability in preparation protocols, making standardization difficult. Many insurers also enforce non-coverage policies for PRP injections, limiting patient access despite growing interest. This uneven clinical performance, combined with restricted reimbursement, slows down adoption in both orthopedic and sports medicine practices.

Trust and performance concerns also weigh heavily on allografts and cell-based biologics. A 2023 CDC investigation linked live-cell bone allografts to a multi-state tuberculosis outbreak, intensifying scrutiny around donor screening and tissue safety. Surgeons have also raised concerns about cellular bone matrix variability, with load differences affecting reliability in fusion procedures. Meanwhile, demineralized bone matrix osteoinductivity assays lack universal standardization, creating uncertainty over product consistency. Synthetic graft substitutes face mechanical drawbacks as well, with calcium phosphate cement proving brittle in load-bearing sites and calcium sulfate fillers resorbing too quickly, limiting their utility in long-term defect management. These limitations restrain broader integration of orthobiologics in high-demand orthopedic applications.

Clinics have a clear opportunity to expand biologic care through point-of-care bone marrow aspirate concentrate systems, which allow surgeons to concentrate autologous cells in the operating room and apply them on the same visit. Recent trials highlight the growing potential of microfragmented adipose tissue injections for knee osteoarthritis, showing comparable outcomes to PRP and creating new demand in cartilage treatment programs. As ambulatory surgical centers continue to take on more orthopedic cases, there is strong demand for biologics that fit streamlined, single-visit workflows. This shift opens growth potential for ASC-ready off-the-shelf orthobiologics and in-procedure cell concentration platforms.

On the materials side, innovation in 3D-printed biomimetic bone scaffolds presents a unique opportunity to integrate sustained-release growth factors into defect repair. These custom scaffolds allow precise control of porosity and osteoinductivity, improving performance in complex reconstructions. At the same time, exosome-based orthobiologics platforms are gaining traction as a promising cell-free alternative for tendon and cartilage repair. Advancing these next-generation therapies enables companies to move beyond traditional graft substitutes and position themselves in high-value niches, especially in specialty ASCs and revision spine centers where biologic innovation directly influences patient outcomes.

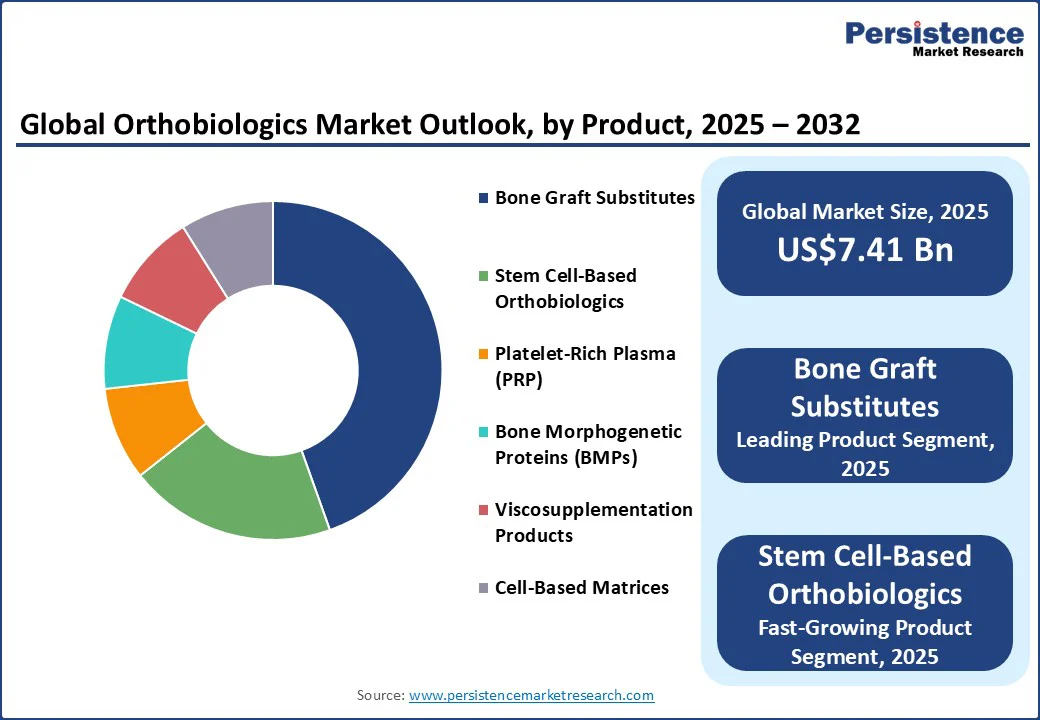

Bone graft substitutes hold the largest share of the orthobiologics market, accounting for approximately 45% of total product revenue. This dominance stems from their wide use in spinal fusion, trauma repair, and reconstructive surgeries, where large graft volumes are required. Surgeons increasingly prefer allografts, demineralized bone matrix (DBM), and synthetic bone void fillers because they eliminate the complications of autograft harvesting and are available in off-the-shelf forms. Their ease of use, broad clinical acceptance, and expanding FDA-approved formulations continue to reinforce their leadership. The consistent demand across high-volume procedures ensures that this category remains the backbone of the market.

Stem cell-based therapies are the fastest-growing product group in the market. These include bone marrow aspirate concentrates and autologous or allogeneic cell-based platforms, which are increasingly being adopted in cartilage, tendon, and complex bone repair. Their rapid growth is fueled by technological innovation, clinical trials demonstrating regenerative benefits, and the rise of point-of-care concentration systems that allow same-visit applications in ambulatory surgical centers. As evidence builds and workflows become more efficient, stem cell-based orthobiologics are expected to post the highest CAGR among all product categories.

Spinal fusion dominates the market, contributing about 64% of total application revenue. Fusion procedures require substantial volumes of graft material, making them a key driver of demand for bone graft substitutes, DBM, and bone morphogenetic proteins (BMPs). The rising prevalence of degenerative disc disease, an aging patient base, and steady growth in both elective and revision spine surgeries further support this segment’s leading position. Spine surgeons have also been early adopters of biologic adjuncts to improve fusion success, which reinforces spinal fusion as the largest and most lucrative application area.

Soft tissue injuries, including ligament and tendon repair, represent the fastest-growing application area. Rising sports-related injuries, especially ACL and rotator cuff tears, are driving higher case volumes in younger and more active populations. The increased use of PRP injections, microfragmented adipose tissue therapies, and exosome platforms in tendon and cartilage repair supports this trend. Reconstructive surgery is also gaining momentum as demand grows for biologic-scaffold combinations in complex trauma and oncology-related defects. The strong growth in these applications is closely tied to the expansion of ambulatory surgical centers, where single-visit biologic interventions align well with outpatient orthopedic workflows.

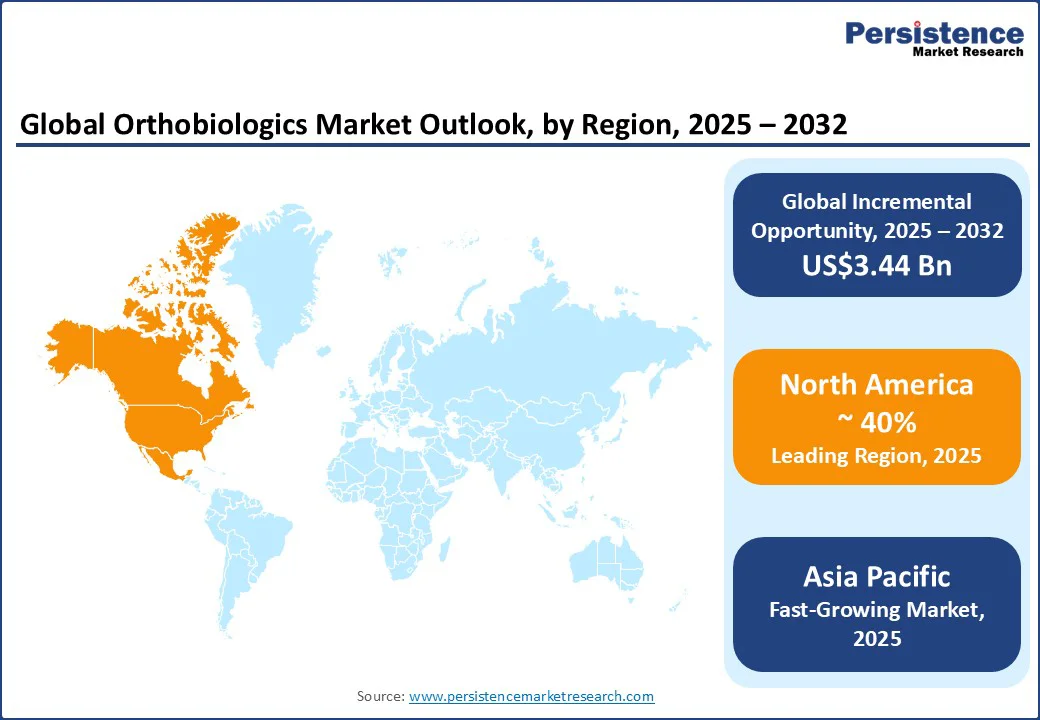

North America is expected to dominate, accounting for around 40% of total revenue in 2025, underpinned by its mature healthcare infrastructure and payer-driven adoption patterns. The U.S. is the largest contributor with recent Medicare policy changes that expanded the list of covered procedures at Ambulatory Surgical Centers (ASCs), such as the inclusion of total shoulder arthroplasty, which has boosted outpatient procedural volumes and driven demand for ASC-ready biologics and point-of-care cell systems. This shift toward single-visit outpatient care has concentrated buying power in high-quantity centers, favoring nimble, off-the-shelf orthobiologic solutions.

The U.S. leads the region, with Centers for Medicare & Medicaid Services (CMS) payment rules and payer policies dictating which injectables and biologics scale in ASCs versus hospitals. Companies, including Stryker, are consolidating the market through M&A and portfolio integration, aligning biologics with implants and digital surgical ecosystems.

Asia Pacific is the fastest-growing, driven by rising surgical volumes, expanding hospital networks, and a surge in private-pay orthopedics. Asia Pacific has a high-growing CAGR compared to other mature regions, with rapid adoption of bone graft substitutes, PRP, and point-of-care stem cell systems. Local manufacturers and cross-border partnerships are expanding capacity, helping meet the rising demand for affordable and accessible biologics.

China has accelerated regulatory reforms, with recent guidance updates streamlining the approval of medical devices and biologics. These reforms reduce time-to-market for domestic cell-concentration systems and synthetic scaffolds, encouraging local innovation. Coupled with a growing hospital infrastructure in tier-1 and tier-2 cities, these policies are fostering increased adoption of allograft alternatives and autologous biologic therapies.

In India, private orthopedic centers and ASC-like outpatient facilities are fueling demand for regenerative care options, particularly PRP, bone marrow aspirate concentrates, and adipose-derived tissue therapies. While clinics and startups rapidly scale point-of-care offerings, regulators and professional societies are tightening oversight on stem-cell interventions. This has created a dual landscape where commercial uptake is rapid, but clinical practices are still adapting to evolving standards.

Europe’s market reflects a balance between North America’s commercial maturity and APAC’s rapid expansion. Adoption is strongly evidence-driven, with reimbursement frameworks favoring biologics backed by randomized clinical data and regulatory approvals. As a result, bone graft substitutes and viscosupplementation products account for a large share of market use, while stem cell therapies and advanced scaffold platforms represent the fastest-growing categories. Clinical trials and academic research programs across Europe continue to expand, strengthening the pipeline of next-generation biologics.

In the U.K., evidence and value assessments play a critical role. NICE and NHS remain cautious on routine use of PRP and viscosupplementation, limiting their reimbursement in knee osteoarthritis. Despite these constraints, private-pay practices and specialist research centers continue to adopt these injectables. Moreover, active guidance updates from clinical societies such as the British Orthopaedic Association (BOA) and ESSKA highlight ongoing clinical debate, pushing suppliers to adopt evidence-led commercialization strategies tailored to NHS standards.

The global orthobiologics market is moderately consolidated, with leading players such as Stryker, Medtronic, Zimmer Biomet, Johnson & Johnson (DePuy Synthes), and Smith & Nephew holding significant market shares. These companies leverage integrated portfolios that combine biologics with implants, digital surgical platforms, and ASC-focused solutions, giving them a commercial edge in high-volume orthopedic centers.

Strategic acquisitions and partnerships have been central, Stryker’s biologics portfolio reshaping, and Medtronic’s continued investments in bone morphogenetic proteins (BMPs) exemplify the move toward combining proven osteoinductive agents with scalable distribution models. The industry is becoming competitive with mid-tier and emerging companies such as Orthofix, Bioventus, Kuros Biosciences, and Anika Therapeutics advancing in niches such as demineralized bone matrices, regenerative scaffolds, and viscosupplementation.

Startups in the Asia Pacific and Europe are also gaining traction by developing cost-effective synthetic grafts and point-of-care systems, benefiting from regulatory support and hospital demand for affordable solutions. This dual structure, dominance by global OEMs, and innovation from specialized regional players, ensures an active pipeline of new technologies, while heightened regulatory scrutiny on tissue products continues to favor synthetic, terminally sterilized, and evidence-backed offerings.

The orthobiologics market size in 2025 is estimated at US$7.41 Bn.

By 2032, the orthobiologics market is projected to reach US$10.85 Bn, reflecting sustained demand growth.

Key trends include the rise of ASC-based biologic procedures, growing demand for synthetic and cell-based scaffolds, increased adoption of point-of-care regenerative therapies, and tightened safety and traceability standards following regulatory and public health events.

Bone graft substitutes represent the largest product segment, accounting for about 35% of global revenue in 2025, while stem cell–based orthobiologics are the fastest-growing category due to increasing adoption in spine and trauma applications.

The orthobiologics market is expected to grow at a CAGR of 5.6% from 2025 to 2032, driven by expanding surgical volumes, ASC penetration, and demand for advanced regenerative solutions.

Leading players include Stryker, Medtronic, Zimmer Biomet, DePuy Synthes (Johnson & Johnson), and Smith+Nephew.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author