ID: PMRREP34733| 199 Pages | 31 Jul 2025 | Format: PDF, Excel, PPT* | Consumer Goods

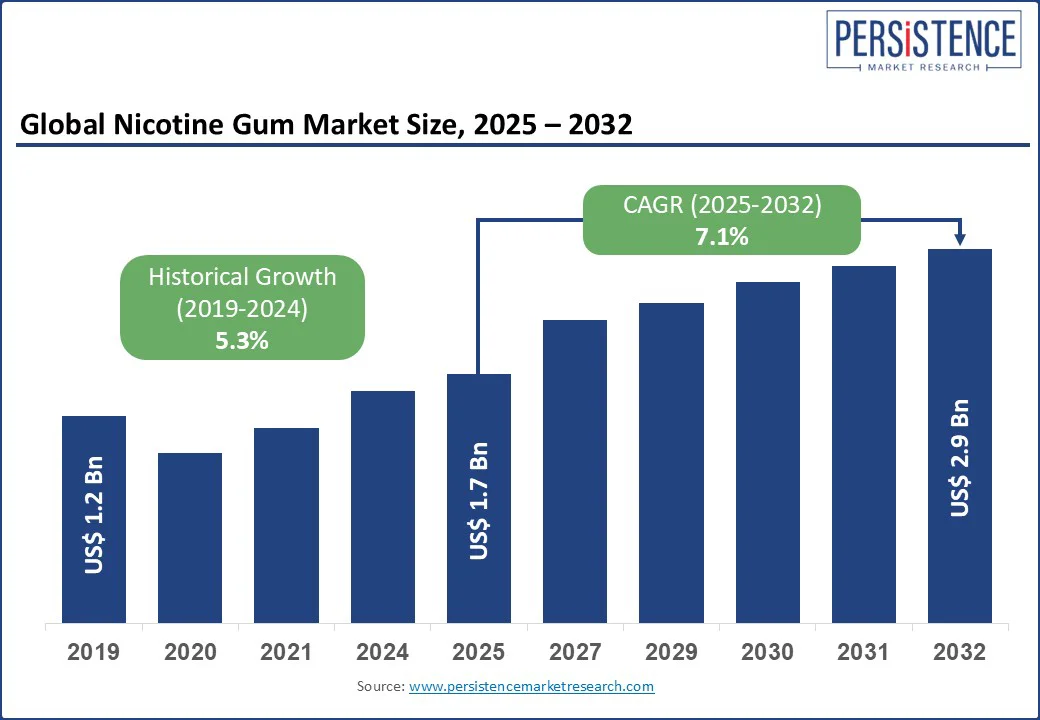

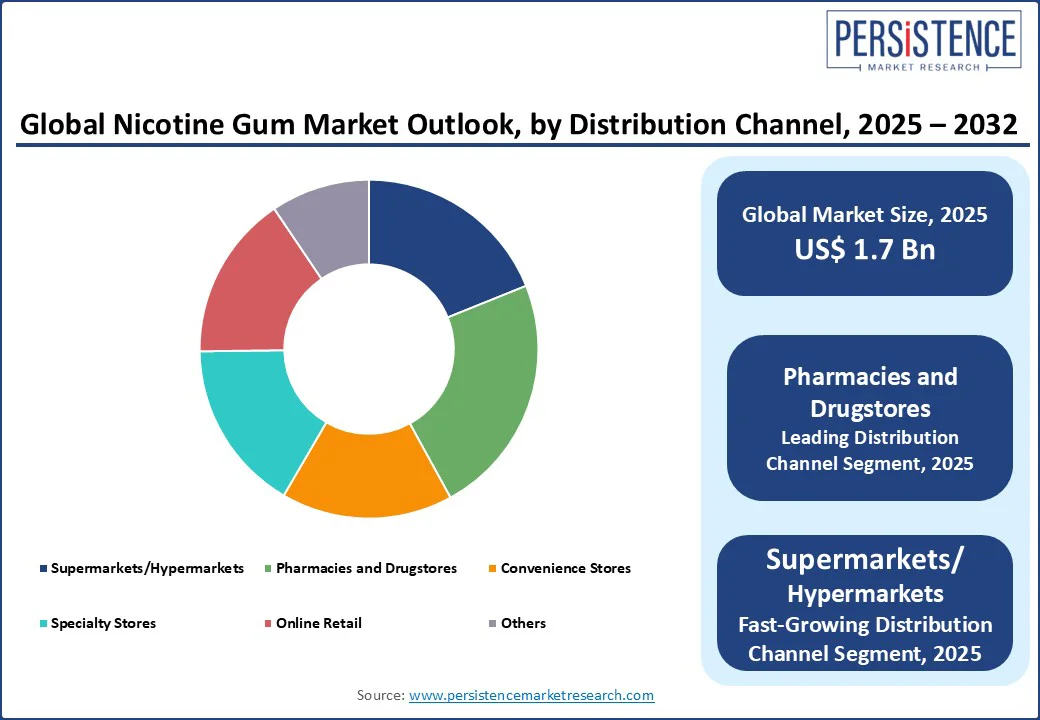

The global nicotine gum market size is likely to be valued at US$ 1.7 Bn in 2025 and is expected to reach US$ 2.9 Bn by 2032, growing at a CAGR of 7.1% from 2025 to 2032.

The nicotine gum market is witnessing a steady growth as health awareness and tobacco cessation initiatives drive consumer demand. Nicotine gum serves as a widely accessible and effective nicotine replacement therapy (NRT), helping individuals reduce or quit smoking. According to the World Health Organization (WHO) over seven million deaths annually are attributed primarily to combustible tobacco use (i.e., cigarettes), public health urgency is further propelling demand for safer alternatives. With evolving product formats, diverse flavor offerings, and expanding distribution channels, the market is increasingly catering to varied demographic and behavioral segments across regions.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Nicotine Gum Market Size (2025E) |

US$ 1.7 Bn |

|

Market Value Forecast (2032F) |

US$ 2.9 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

7.1% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.3% |

Nicotine gum is gaining traction as a safer and more accessible alternative to traditional tobacco products, particularly among individuals looking to quit smoking. Backed by major health authorities such as the WHO as part of approved NRT, it delivers a controlled dose of nicotine without exposing users to harmful combustion byproducts found in cigarettes. With over 1.3 billion tobacco users globally and more than 8 million deaths annually due to tobacco-related diseases, the demand for cessation tools is urgent and growing.

To meet evolving consumer needs, manufacturers are offering nicotine gums in a variety of flavors, sugar-free formats, and higher nicotine strengths to suit different levels of dependency. In 2024, Cipla launched a fast-dissolving variant of its Nicotex gum in India, aimed at providing quicker nicotine absorption and more immediate craving relief. Such innovations, coupled with expanding online and pharmacy distribution, rising tobacco taxes, and government-backed cessation programs, are making nicotine gum more accessible and appealing to a broader consumer base. As a result, it continues to gain momentum as a vital tool in global smoking cessation efforts.

Despite growing adoption, the nicotine gum market faces challenges due to its limited long-term success in ensuring complete smoking cessation. Many users relapse within weeks or months of quitting, often due to psychological dependence or improper usage of the gum. While it helps manage withdrawal symptoms initially, it may not address the behavioral and emotional aspects of addiction.

Inconsistent dosage adherence and improper use reduce the gum’s therapeutic effectiveness, making it less reliable as a standalone solution. These limitations can lead to user frustration and diminished trust in nicotine gum as a quitting method. Without integration into comprehensive cessation programs that combine behavioral counseling and follow-up support, the efficacy of nicotine gum remains suboptimal. These factors continue to restrain market expansion, particularly in regions where access to professional cessation services is limited or where consumer education around proper use is lacking.

Consumers, particularly younger demographics, are increasingly inclined toward options that align with their taste and wellness preferences. To meet this demand, manufacturers are expanding flavor portfolios to include fruit, cinnamon, and mint variants, alongside sugar-free formulations that appeal to health-conscious users and those with dietary restrictions. These innovations not only improve user satisfaction but also enhance compliance, helping brands strengthen consumer loyalty in a competitive space.

Fertin Pharma launched RYZE Fruit Blast in 2025, a sugar-free, fruit-flavored 2 mg nicotine gum in India. Designed with a soft chew format for easier consumption, the product specifically targets younger smokers seeking more palatable alternatives. Such launches reflect the market’s strategic shift toward flavor and health-focused offerings, creating strong commercial potential for brands looking to attract new user segments and drive sustained engagement.

The 2 mg dosage segment dominates global demand in the nicotine gum market, primarily due to its suitability for first-time users and light smokers. This lower-strength variant provides a mild yet effective nicotine dose that helps manage cravings without causing significant side effects, making it an ideal starting point for those smoking fewer than 20 cigarettes per day. It is widely recommended in clinical settings and supported by public health guidelines as a part of nicotine replacement therapy.

Cipla launched Nicotex Begin in May 2025 integrated smoking cessation platform in India that combines its 2 mg Nicotex gum with behavioral therapy and WHO-aligned NRT protocols. The app-based support system offers a structured quitting journey for light smokers, enhancing both accessibility and long-term success. Such innovations reflect the growing focus on coupling low-dosage gum with digital support, further cementing the leadership of the 2 mg segment in global cessation efforts.

Mint-flavored nicotine gums hold the prominent share in the global market, driven by their wide consumer appeal and perceived freshness. This flavor is favored across all age groups due to its familiar taste, refreshing sensation, and ability to mask the bitter aftertaste of nicotine. Mint variants are commonly recommended by healthcare providers and are often the default option offered in smoking cessation programs. Their widespread availability across pharmacies, online platforms, and retail stores further strengthens their market position.

In Canada, Kenvue (Nicorette) updated its Canadian gum portfolio in early 2025, featuring Ultra Fresh Mint, Extreme Chill Mint, Spearmint, and Fresh Fruit flavors available in both 2 mg and 4 mg dosages. The addition of sugar-free mint variants has enhanced its appeal to health-conscious consumers and reinforced mint’s dominance in taste-based product innovation.

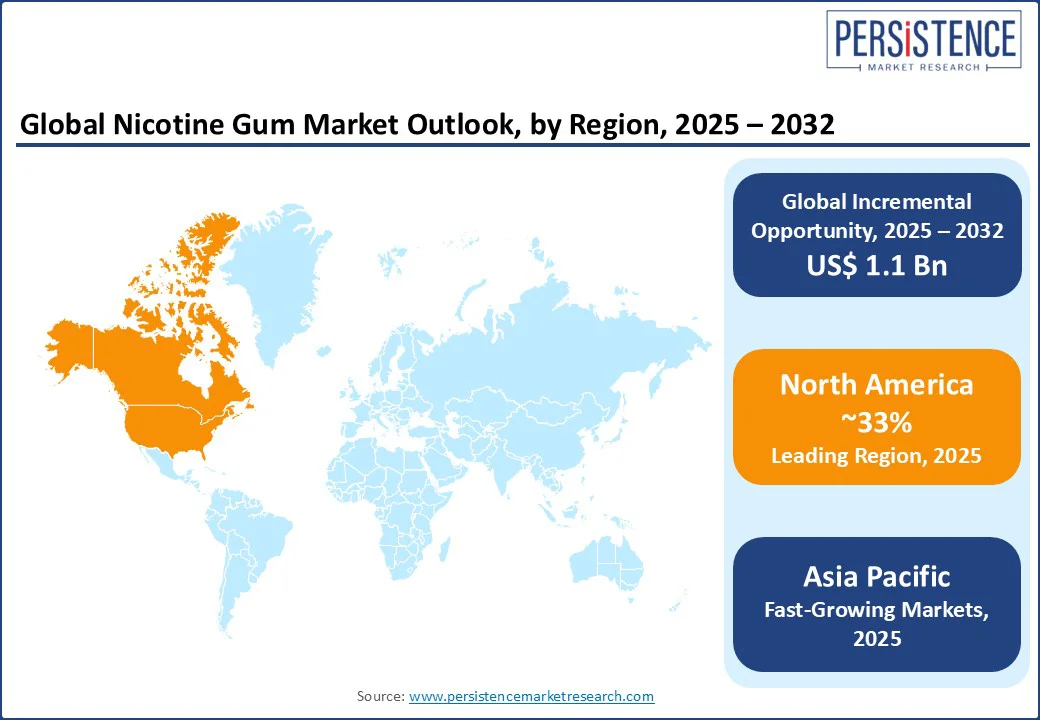

North America remains a key revenue contributor to the global nicotine gum market, driven by high smoking prevalence, robust tobacco cessation infrastructure, and supportive regulatory frameworks. In the U.S. alone, smoking remains the leading cause of preventable death, accounting for over 480,000 deaths annually, according to the CDC. This public health crisis has accelerated the adoption of NRTs, including gum, especially through workplace wellness programs and corporate health initiatives that include NRT as part of insured employee wellness benefits.

The inclusion of nicotine gum in U.S. smoking cessation programs under the Affordable Care Act further enhances its accessibility. The rising popularity of sugar-free and flavored formulations caters to younger, health-conscious demographics seeking effective and safer smoking cessation alternatives. Altogether, these factors establish North America as both a mature and progressive region for nicotine gum adoption.

Europe’s nicotine gum market is undergoing a noticeable transformation as consumer preferences shift toward sugar-free, naturally flavored, and low-risk alternatives to tobacco. Rising health consciousness, particularly among younger and middle-aged adults, is fueling demand for gums that offer both effective nicotine delivery and a cleaner ingredient profile. Flavors like mint, fruit, and cinnamon are increasingly popular, aligning with consumer desire for palatable options during smoking cessation.

Simultaneously, strict tobacco regulations are reshaping the competitive landscape. Countries like Belgium are leading the charge by banning disposable vapes, in-store tobacco displays, and even smoking in outdoor public spaces used by children, as announced in 2025. These measures, combined with WHO’s call for bans on flavors and sweeteners in nicotine products, are pushing consumers toward regulated cessation aids such as gums. Moreover, premium-positioned brands are tapping into this regulatory momentum; Sweden’s Vont launched a new EU-compliant nicotine gum line across Germany, Poland, and the UK in 2024, reflecting growing product innovation.

Asia Pacific is emerging as a high-potential market for nicotine gum, propelled by a massive tobacco burden and improving access to cessation resources. Despite a decline in global smoking prevalence from 22.7% in 2007 to 17% in 2021, the absolute number of smokers remains high, exceeding 940 million adults in 2019, with a significant concentration in countries such as India, China, and Indonesia.

Southeast Asia alone suffers around 3.1 million annual deaths from tobacco use, underscoring the urgent need for effective harm-reduction tools. Governments across the region are strengthening tobacco control programs and encouraging smoking cessation through public health initiatives, which is enhancing consumer openness to nicotine gum. Cipla released Mint Plus sugar-free 2 mg Nicotex gum in January 2025, packaged in convenient flip-top tins for easy, discreet use. The mint-flavored variant is designed to support on-the-go craving management. Combined with growing e-commerce penetration in tier 2 and 3 cities and native-language marketing, such product-linked support ecosystems are driving wider adoption of nicotine gum in Asia Pacific’s urban and rural areas alike.

The global nicotine gum market is moderately consolidated, with competition intensifying due to growing demand for smoking cessation aids and consumer preference for low-risk alternatives. Players are differentiating through dosage innovation, flavor variety, sugar-free formulations, and integrated behavioral support platforms to boost quit rates and user engagement.

New entrants and established firms are focusing on digital outreach, especially via e-commerce and mobile health apps, to capture health-conscious, tech-savvy consumers. Regulatory approvals, WHO prequalification, and alignment with public health initiatives are becoming crucial for long-term market positioning, especially in countries with national tobacco control mandates and expanding cessation programs.

The global nicotine gum market is projected to value at 1.7 bn in 2025.

The nicotine gum market is driven by the increasing awareness of smoking-related health risks.

The nicotine gum market is poised to witness a CAGR of 7.1% between 2025 and 2032

Expansion of flavored and sugar-free nicotine gums offers strong appeal to younger, health-conscious quitters.

Major players in the nicotine gum market include Johnson & Johnson Services, Inc., Perrigo Company plc, Fertin Pharma A/S, Alkalon, Cipla Inc., and others.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Units |

Value: US$ Bn/Mn, Volume: As applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Dosage

By Category

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author