ID: PMRREP9104| 191 Pages | 11 Sep 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

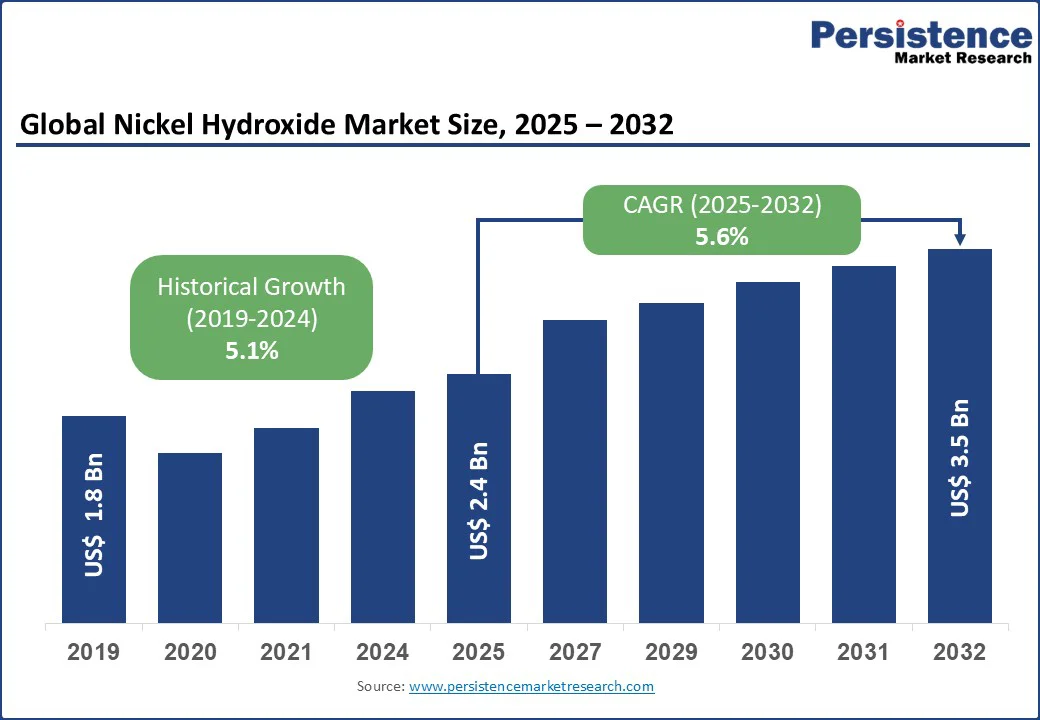

The global nickel hydroxide market size is likely to be valued at US$2.4 Bn in 2025 and expected to reach US$3.5 Bn by 2032, registering a CAGR of 5.6% during the forecast period 2025-2032.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Nickel Hydroxide Market Size (2025E) |

US$2.4 Bn |

|

Market Value Forecast (2032F) |

US$3.5 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.6% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.2% |

This growth is driven by the increasing demand for rechargeable batteries, particularly nickel-metal hydride (NiMH) and nickel-cadmium (Ni-Cd) batteries, used extensively in the battery industry, electric vehicles (EVs), and consumer electronics.

The nickel hydroxide market is driven by the surging demand for rechargeable batteries in electric vehicles and energy storage solutions, supported by global sustainability initiatives. The battery industry is a key driver, with NiMH batteries, which rely heavily on nickel hydroxide, witnessing a 30% increase in demand from 2019 to 2025. The global push for electric vehicles, particularly in Asia Pacific, has significantly boosted the industry, with China producing 3.54 Mn new energy vehicles (NEVs) in 2025, a 159.5% increase year-over-year, as reported by the China Association of Automobile Manufacturers.

Nickel hydroxide’s role as a positive electrode material in NiMH batteries enhances energy density and cycling performance, making it critical for EVs and hybrid electric vehicles (HEVs). For instance, Toyota’s Prius, a leading HEV, relies on NiMH batteries, with over one million units sold globally in 2025, driving nickel hydroxide demand. Government policies, such as China’s Healthy China 2030 and the EU’s Green Deal, promote clean energy, with 40% of new vehicle sales targeted to be electric by 2030 in Europe, increasing the need for energy storage solutions.

Additionally, advancements in battery technology, such as high-performance NiMH batteries from Sumitomo Metal Mining, improve efficiency by 20%, further fueling market growth. The rise in consumer electronics, with global smartphone sales reaching 1.4 Bn units in 2025, also drives demand for nickel hydroxide in portable device batteries, particularly in North America and Asia Pacific.

The nickel hydroxide market faces challenges due to fluctuating nickel prices and stringent environmental regulations. Nickel, a key raw material, constitutes over 55% of nickel hydroxide production costs, and its price volatility is driven by market deficits and declining London Metal Exchange (LME) stockpiles. This impacts affordability, particularly for smaller manufacturers in the battery industry. Additionally, environmental regulations associated with nickel mining, such as the EU’s Battery Regulation, impose strict sustainability standards, raising production costs by 10–15% for companies such as Umicore and Norilsk Nickel. These regulations limit mining output in regions such as Australia and Canada, where nickel production is projected to rise from 170,000 tonnes in 2020–21 to 251,000 tonnes by 2025–26, yet face environmental constraints. The high cost of advanced manufacturing processes, such as chemical precipitation, further restricts market growth, particularly in price-sensitive markets such as Latin America and parts of Asia Pacific.

The nickel hydroxide market is poised for growth due to expanding applications in renewable energy storage and technological advancements in battery production. The global shift toward renewable energy, with solar and wind energy installations growing by 25% in 2025, drives demand for NiMH batteries in grid-scale energy storage solutions.

For example, Tesla’s Megapack, used in renewable energy storage, incorporates NiMH batteries, with 10,000 units deployed globally in 2025, boosting nickel hydroxide demand. Government incentives, such as the U.S. Inflation Reduction Act, provide tax credits of up to 30% for renewable energy projects, encouraging investment in energy storage solutions.

Additionally, innovations in high-temperature spherical nickel hydroxide, which offers 9.2% higher electrochemical performance, are creating opportunities in electric vehicles and consumer electronics. Partnerships between key players such as Tanaka Chemical Corporation and EV manufacturers, such as BYD in China, enhance market penetration, offering scalable production solutions for rechargeable batteries.

The batteries segment dominates with a 70% share in 2025, driven by the widespread use of nickel hydroxide in NiMH and Ni-Cd batteries for electric vehicles, consumer electronics, and energy storage solutions. NiMH batteries, which account for 60% of the battery segment revenue, are favored for their high energy density and long cycle life. Companies such as Sumitomo Metal Mining and Tanaka Chemical Corporation lead this segment, with innovations such as spherical nickel hydroxide improving battery performance by 15%.

The catalyst is the fastest-growing segment driven by nickel hydroxide’s use in electrochemical processes, such as electrocatalysis and photocatalysis, in the chemical industry. The segment is gaining traction in North America, where 40% of chemical manufacturing relies on catalysts for sustainable production. Applications in wastewater treatment and hydrogen production, supported by U.S. Department of Energy initiatives, are expected to drive growth with catalyst demand projected to increase by 20% by 2032.

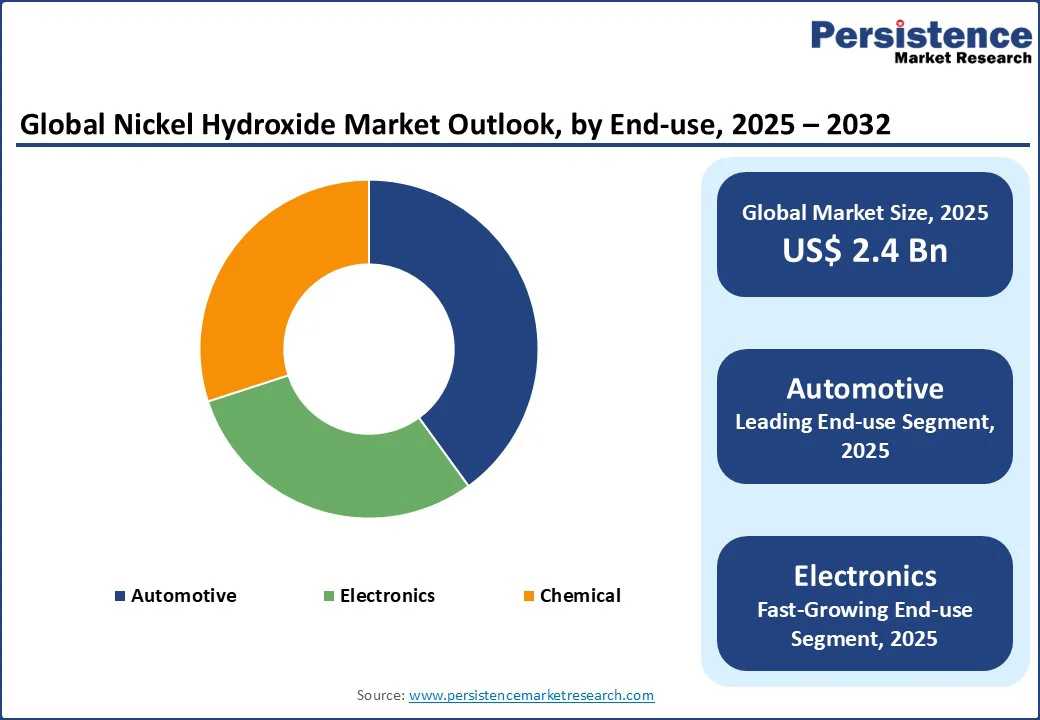

The automotive holds a 40% share in 2025, driven by the adoption of NiMH batteries in electric vehicles and HEVs. The global EV market, relies heavily on nickel hydroxide for battery production, with China leading at 3.5 Mn EV units produced annually. Companies such as Toyota and BYD drive demand, with NiMH batteries powering 60% of HEVs globally. The segment benefits from government policies, such as India’s FAME II scheme, offering subsidies of up to 40% for EV adoption.

The electronics segment is the fastest-growing, fueled by demand for rechargeable batteries in smartphones, laptops, and wearable devices. Global consumer electronics sales, drive nickel hydroxide demand, particularly in Asia Pacific, where South Korea and Japan account for 30% of global electronics production. Innovations such as Umicore’s high-purity nickel hydroxide for lithium-ion battery applications enhance performance by 10%, boosting adoption in consumer electronics.

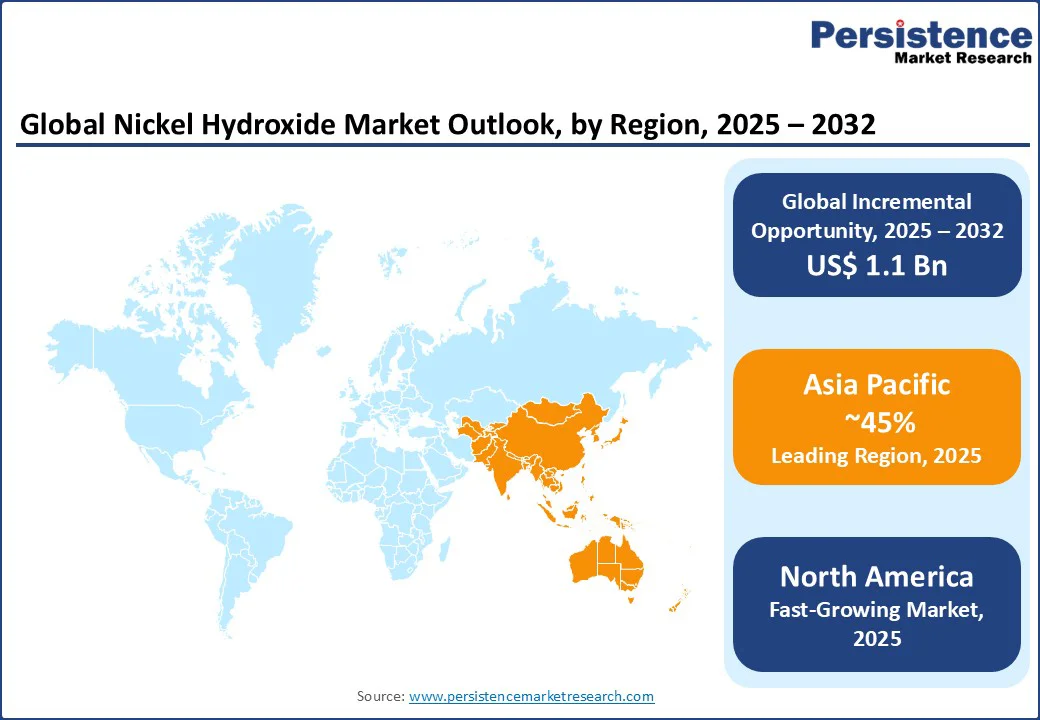

Asia Pacific is the leading region, with a 45% share in 2025, led by China, Japan, and India. China is dominant majorly driven by its battery industry and EV production, with 3.5 Mn NEVs produced. The Healthy China 2030 initiative promotes clean energy, boosting demand for energy storage solutions such as NiMH batteries. Japan contributes significantly, with Sumitomo Metal Mining investing US$200 Mn in a new nickel hydroxide facility in 2025, supporting electronics and automotive applications. Japan’s electronics industry, producing 25% of global consumer electronics, drives demand for rechargeable batteries, with Sony and Panasonic leading adoption.

India is the fastest-growing market fueled by the FAME II scheme, offering US$1.4 Bn in EV subsidies, and a growing chemical industry, with 15% of manufacturing using nickel hydroxide catalysts. Rapid urbanization, with 60% of Asia’s population in urban areas, and increasing disposable incomes drive consumer electronics demand, with smartphone sales reaching 800 Mn units in 2025. The region’s focus on sustainability, with China’s carbon neutrality goal by 2060, supports eco-friendly production, positioning the Asia Pacific as the epicenter of the nickel hydroxide market.

North America is the fastest-growing market, holding a 25% share in 2025, with the United States as the primary contributor, driven by a robust battery industry and increasing EV adoption. The U.S. market benefits from high demand for rechargeable batteries, with 1.5 Mn EVs sold, a 25% increase from 2023, according to the U.S. Department of Energy. Nickel hydroxide is critical for NiMH batteries used in HEVs such as the Ford Escape Hybrid, with 200,000 units sold. The chemical industry, contributing 4% to U.S. GDP, drives demand for nickel hydroxide as a catalyst in sustainable production processes, with 40% of chemical manufacturers adopting nickel-based catalysts.

Government initiatives, such as the Inflation Reduction Act, provide US$500 Bn in clean energy incentives, boosting energy storage solutions. The U.S.’s advanced manufacturing infrastructure, with companies such as American Elements investing US$50 Mn in battery-grade nickel hydroxide production, supports market growth. Trends include sustainable production methods, with Umicore launching eco-friendly nickel hydroxide in 2025, reducing emissions by 15%. The rise of e-commerce platforms such as Amazon enhances distribution, while Canada’s nickel mining, projected to reach 200,000 tonnes by 2026, supports raw material supply, driving the nickel hydroxide market in North America.

Europe accounts for a leading share in 2025, with Germany, France, and the UK as leading countries, driven by stringent environmental regulations and EV growth. Germany holds a 12% regional market share, fueled by its automotive industry, with 1 Mn EVs sold in 2025, supported by the EU’s Green Deal targeting 30% EV sales by 2030. Nickel hydroxide is used in NiMH batteries for vehicles such as the BMW i3, with 50,000 units sold in 2025. France is the fastest-growing country, driven by government subsidies covering 40% of EV costs, boosting demand for rechargeable batteries.

The UK emphasizes energy storage solutions, with 20% of renewable energy projects using NiMH batteries. Europe’s focus on sustainability, with EU Battery Regulation mandating 50% recycled content in batteries by 2030, drives demand for eco-friendly nickel hydroxide from companies such as Sumitomo Metal Mining. The chemical industry in Germany and France, contributing 15% to Europe’s GDP, uses nickel hydroxide as a catalyst, with 30% of chemical processes adopting nickel-based solutions. Partnerships with e-commerce platforms and R&D investments, such as Umicore’s US$100 Mn facility in Germany, enhance market growth, positioning Europe as a key hub for the nickel hydroxide market.

The global nickel hydroxide market is highly competitive, with key players focusing on innovation, sustainability, and strategic partnerships to capture market share. Companies leverage advancements in rechargeable batteries and energy storage solutions to meet growing demand in electric vehicles and consumer electronics. Mergers, acquisitions, and collaborations with EV manufacturers and chemical industry players enhance market presence, while R&D investments drive product innovation.

The nickel hydroxide market is projected to reach US$ 2.4 Bn in 2025, driven by demand for rechargeable batteries in electric vehicles and consumer electronics.

Rising demand for electric vehicles, advancements in energy storage solutions, and government policies promoting clean energy fuel market growth.

The nickel hydroxide market is expected to grow at a CAGR of 5.6% from 2025 to 2032, driven by battery industry expansion.

Expansion of renewable energy storage and innovations in high-performance rechargeable batteries offer significant growth potential.

Leading players include Sumitomo Metal Mining, Tanaka Chemical, Umicore, Norilsk Nickel, and American Elements, focusing on innovation and sustainability.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Application

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author