ID: PMRREP12709| 189 Pages | 18 Jun 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

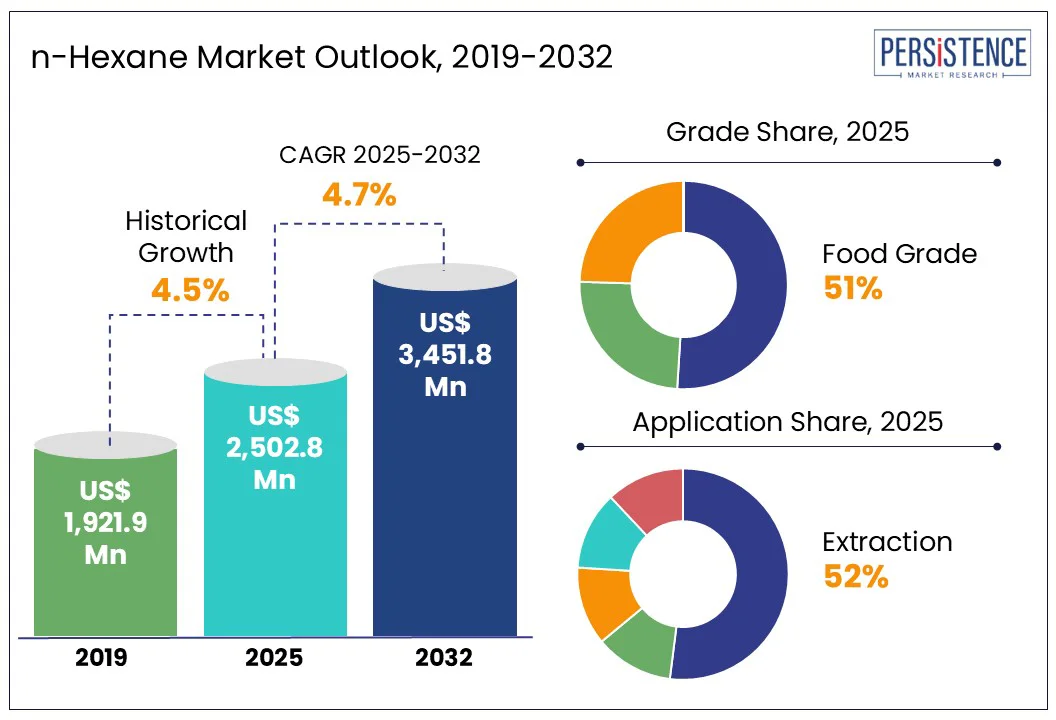

The global n-hexane market size is projected to rise from US$ 2,502.8 Mn in 2025 to US$ 3,451.8 Mn with a CAGR of 4.7% by 2032.

The gasoline is witnessing trends toward increased demand for high-purity grades in food and pharmaceutical applications, driven by regulatory compliance and safety standards. Concurrently, there is a growing shift toward sustainable and energy-efficient production methods, along with regional price adjustments to enhance competitiveness in emerging markets.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

n-hexane Market Size (2025E) |

US$ 2,502.8 Mn |

|

Projected Market Value (2032F) |

US$ 3,451.8 Mn |

|

Global Market Growth Rate (CAGR 2025 to 2032) |

4.7% |

|

Historical Market Growth Rate (CAGR 2019 to 2024) |

4.5% |

The growing demand for n-hexane in oil extraction is a key market driver, especially within the food processing industry. n-hexane’s superior solvent properties make it highly efficient in extracting edible oils from seeds such as soybeans and sunflower, contributing to high yield and cost-effective operations. This is particularly vital in emerging economies, where rising populations and changing dietary patterns are fueling the consumption of vegetable oils.

Focusing on the superior properties of hexane, manufacturers are expanding their market. For instance, ExxonMobil’s US$59.5 billion acquisition of Pioneer Natural Resources in May 2024 significantly strengthens its upstream operations and hydrocarbon resource base. This strategic expansion enhances ExxonMobil’s feedstock availability for downstream petrochemical production, including n-hexane.

The increased focus on production efficiency and output optimization in food-grade oil extraction continues to boost demand for high-purity n-hexane.

Health and environmental concerns significantly restrain the growth of the market. Prolonged exposure to n-hexane is associated with neurotoxic effects, particularly peripheral neuropathy, and contributes to air pollution due to its VOC nature. These health risks have led to increasing scrutiny by regulatory bodies and a gradual shift in industry preferences toward safer, eco-friendly alternatives.

A prominent regulatory development occurred in February 2025, when Slovenia proposed listing n-hexane as a Substance of Very High Concern under the European Union’s REACH regulation. The submission reflects escalating regulatory pressure in Europe. Such measures are likely to disrupt supply chains, increase compliance costs, and accelerate research into alternative solvents, thereby dampening the market’s near- to mid-term growth potential.

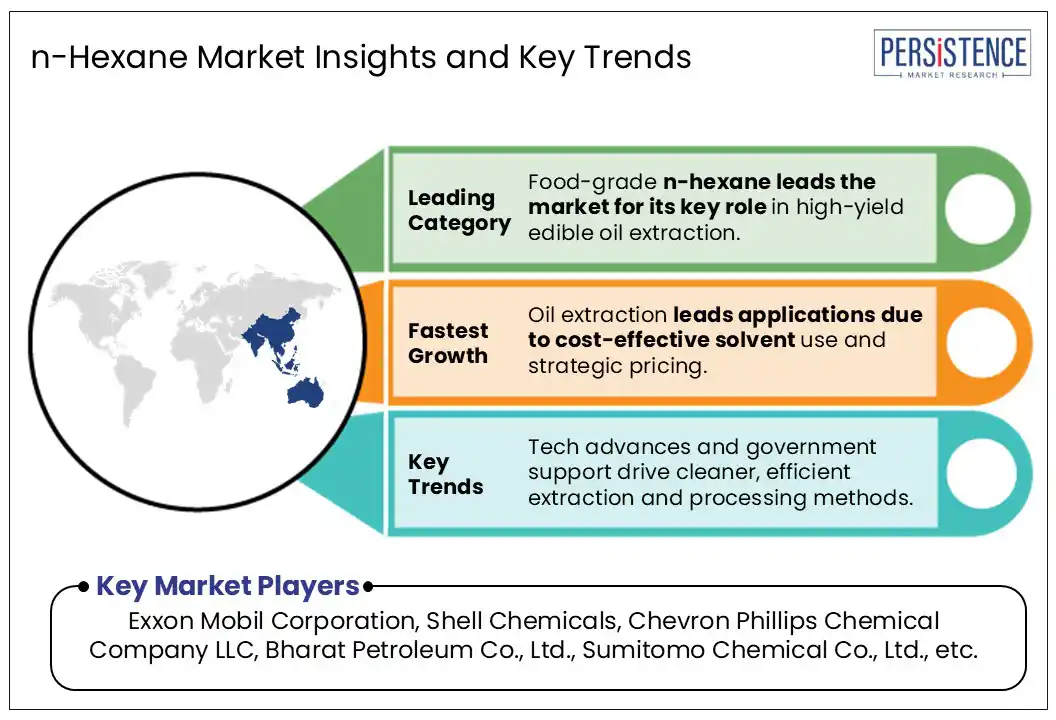

Advancements in extraction and processing technologies present a significant opportunity for market growth. Innovations in solvent recovery, purification systems, and catalytic efficiency are enhancing product quality and environmental compliance. These improvements support rising demand for food and pharmaceutical-grade n-hexane, where purity standards are stringent. Government initiatives such as India’s National Bio-Energy Mission and stringent pollution control norms by agencies such as the CPCB are pushing industries toward cleaner and more efficient solvent use.

In the same manner, the manufacturers are also investing in technological innovations. For instance, ExxonMobil’s April 2025 announcement of its R&D focus on advanced catalysts and performance materials, including efforts to improve energy efficiency and reduce emissions, demonstrates industry commitment to technological progress.

Such developments enhance the sustainability and competitiveness of n-hexane production, enabling its broader application across regulated sectors. The adoption of energy-efficient equipment also aligns with sustainability goals and regulatory pressure to minimize emissions and solvent residues.

Food-grade n-hexane commands a substantial share of the overall market, primarily due to its essential role in edible oil extraction. Its superior solvency, low boiling point, and ability to yield high oil output with minimal residue make it the solvent of choice for extracting oils from seeds such as soybean, canola, and sunflower.

Government policies are further bolstering this trend. In India, programs such as the Pradhan Mantri Kisan Sampada Yojana aim to modernize agro-processing infrastructure, enhancing the adoption of efficient extraction methods that often rely on food-grade solvents. Industry players are also playing a key role in shaping market dynamics. The growing global demand for vegetable oils, particularly in rapidly expanding markets across Asia Pacific and Africa, continues to drive the need for food-grade n-hexane.

The oil extraction application segment holds a significant share in the global n-hexane market, driven by the solvent’s high efficiency in extracting edible oils from oilseeds such as soybeans, sunflower, and rapeseed. In May 2025, Bharat Petroleum Co. Ltd. announced a strategic reduction in n-hexane prices within the Indian market, thereby improving affordability for domestic edible oil manufacturers and facilitating sector growth.

This pricing adjustment complements government initiatives such as the India’s National Edible Oil Mission, which aims to enhance local oilseed production and processing infrastructure to reduce import dependency. Regulatory bodies such as the US FDA and the FSSAI enforce stringent guidelines on permissible solvent residues in edible oils, ensuring consumer safety and product quality. These regulatory frameworks encourage the adoption of best extraction practices that maximize oil yield while maintaining compliance.

The food processing industry is a crucial in the n-hexane market, largely due to the compound’s extensive application in edible oil extraction. Food-grade n-hexane is preferred for its excellent solvency, high oil recovery efficiency, and low boiling point, which enables effective separation and purification during processing.

The global increase in demand for processed and packaged food, driven by population growth, urbanization, and evolving dietary preferences, is significantly boosting the consumption of edible oils. This trend is particularly strong in Asia Pacific, leading to increased demand for cost-effective and efficient oil extraction solvents such as n-hexane.

The 2022 joint venture between CPCL and Indian Oil Corporation, which includes N-hexane in its product portfolio, is expected to bolster domestic supply. This supports stable pricing and availability, especially for the food processing industry. These factors collectively strengthen the role of N-hexane in ensuring high-efficiency operations within the food sector, making it a strategic chemical to meet the growing consumer and industry demands.

Asia Pacific n-hexane industry emerges as the fastest-growing in the global market, propelled by rapid industrialization and expanding food processing capacities. Countries such as China, India, Vietnam, and Indonesia are key contributors, driven by large population, urbanization, and rising consumption of processed foods and edible oils.

In China, the government implemented an action plan to standardize edible oil production and ensure quality and safety, focusing on inspections and regulatory compliance. This initiative aims to enhance the reliability of edible oil products, indirectly supporting the demand for high-purity solvents such as n-hexane used in oil extraction processes.

Furthermore, strategic industry investments are enhancing the region's chemical production capabilities. In May 2024, a joint venture between Chandra Asri Capital Pte. Ltd. and Glencore Asian Holdings Pte. Ltd. acquired Shell’s stake in the Energy and Chemicals Park in Singapore, strengthening the supply chain for n-hexane and related products in Southeast Asia. With supportive government policies, robust industrial growth, and increasing demand across various sectors, Asia Pacific is poised to remain a significant hub in the foreseeable future.

North America represents a mature yet steadily growing market, supported by its well-established food processing, pharmaceutical, and industrial sectors. The region’s strong demand for edible oils and processed foods fuels the consistent use of food-grade n-hexane in oil extraction.

The United States, in particular, has a significant share of the North American n-hexane market due to its advanced industrial infrastructure, stringent regulatory framework, and high-volume chemical manufacturing base.

In May 2021, Chevron Phillips Chemical expanded its alpha olefins business by commissioning a 266 KTA 1-hexene production unit in Texas, which uses proprietary technology to produce high-purity derivatives. This investment reflects broader capacity growth and technological leadership surrounding n-hexane and its derivatives.

Environmental regulations enforced by the U.S. EPA also drive producers to adopt cleaner and more efficient manufacturing practices, spurring advancements in solvent recovery and emissions control.

Europe accounts for a significant position in the global market, driven by its advanced food processing, pharmaceutical, and industrial manufacturing sectors. The demand for food-grade is particularly strong, fueled by stringent food safety standards and a well-established edible oil extraction industry across countries such as Germany, France, and Italy. Pharmaceutical and specialty chemical manufacturers in the region also rely on high-purity n-hexane for its solvency and extraction properties. However, Europe’s highly regulated chemical landscape influences market dynamics considerably.

The ECHA and REACH regulations impose strict controls on the use and handling of VOCs. These regulations are pushing manufacturers to invest in cleaner technologies and more sustainable production processes. With its emphasis on sustainability, regulatory compliance, and technological advancement, Europe remains a critical market, particularly in applications where purity and environmental standards are paramount.

The global n-hexane market is moderately consolidated, with a mix of multinational chemical corporations and regional players competing based on product purity, pricing strategies, supply reliability, and regulatory compliance. Key players dominate through integrated operations, technological innovation, and strategic expansions to strengthen their market presence.

Major companies such as ExxonMobil, Chevron Phillips Chemical, BPCL, Shell, and Indian Oil Corporation hold substantial market share. These companies benefit from large-scale production facilities, established distribution networks, and strong R&D capabilities. The market is also shaped by regulatory standards, especially in Europe and North America, where environmental and safety compliance encourages innovation in solvent recovery and emissions reduction.

The market is set to reach US$ 3,451.8 Mn by 2032.

The projected growth rate for n-hexane market is 4.7% CAGR by 2032.

The food processing sector is the major consumer of the n-hexane market.

India is estimated to witness a CAGR of 5.8% in the forecast period.

Exxon Mobil Corporation is one of the leading player in n-hexane market.

|

Report Attribute |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2024 |

|

Market Analysis |

US$ Million for Value Tons for Volume |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Grade

By Application

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author