ID: PMRREP36074| 200 Pages | 5 Feb 2026 | Format: PDF, Excel, PPT* | Food and Beverages

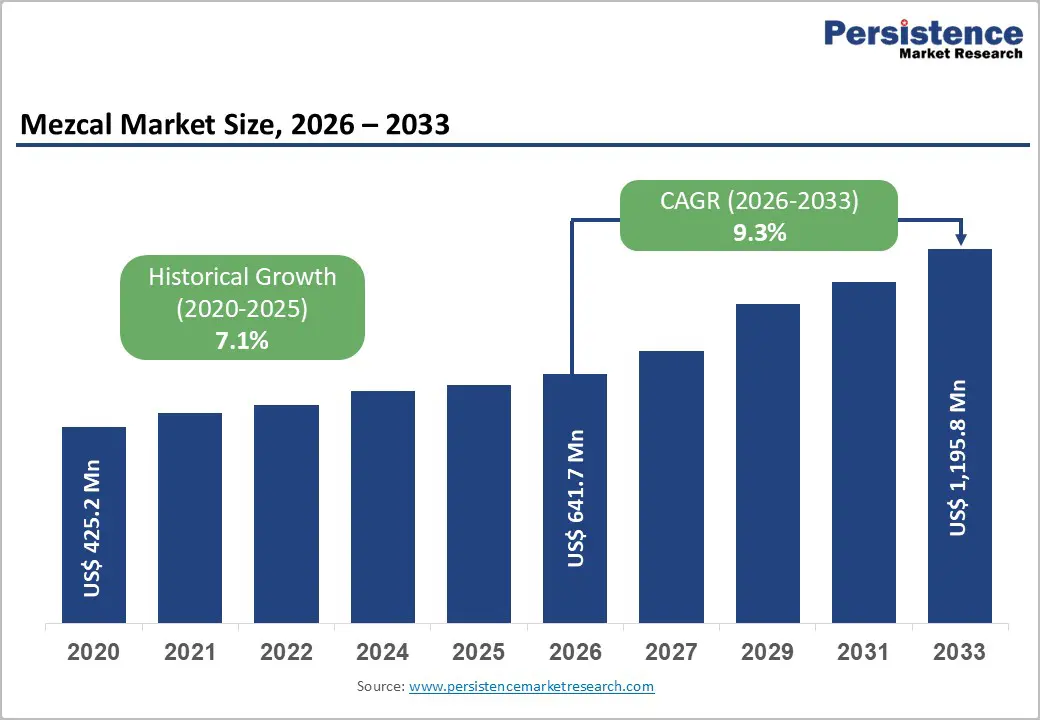

The global mezcal market size is expected to be valued at US$ 641.7 million in 2026 and projected to reach US$ 1,195.8 million by 2033, growing at a CAGR of 9.3% between 2026 and 2033.

The global market is currently undergoing a period of robust expansion driven by the escalating consumer demand for artisanal, heritage-driven spirits that offer distinct flavor profiles compared to mass-produced alternatives. This growth is predominantly anchored in the North American and European markets, where a sophisticated millennial demographic is trading up for premium agave-based products that emphasize traditional production methods and ethical sourcing. According to reports from the Distilled Spirits Council of the United States (DISCUS), the category has outperformed traditional spirits segments due to its strong association with cultural authenticity and the burgeoning craft cocktail movement in major urban centers.

| Global Market Attributes | Key Insights |

|---|---|

| Global Mezcal Market Size (2026E) | US$ 641.7 Mn |

| Market Value Forecast (2033F) | US$ 1,195.8 Mn |

| Projected Growth (CAGR 2026 to 2033) | 9.3% |

| Historical Market Growth (CAGR 2020 to 2025) | 7.1% |

The structural shift in consumer behavior toward "drinking better, not more," a trend widely defined as premiumization, catalyzes the growth in the mezcal market. Unlike Tequila, which has witnessed a significant industrialization, Mezcal retains an image of handcrafted exclusivity, often produced in small batches by family-owned distilleries in Oaxaca and other protected regions. This artisanal appeal resonates strongly with high-net-worth individuals and young professionals who value the "farm-to-bottle" narrative. Data from the International Wine and Spirit Research (IWSR) indicates that super-premium Mezcal segments have witnessed a volume increase of nearly 30% in recent years. By focusing on traditional pit-roasting and tahona-milling techniques, brands are able to command higher price points, effectively boosting the overall market value while fostering deep brand loyalty among spirit connoisseurs.

A significant barrier to market expansion is the inherent biological limitation of the agave plant. While the most common variety, Espadín, takes approximately 6 to 8 years to reach maturity, wild varieties such as Tobalá and Tepeztate can require 15 to 25 years before they are suitable for harvest. The sudden surge in global demand has placed immense pressure on these wild populations, leading to localized shortages and rising procurement costs. According to the Consejo Regulador del Mezcal (CRM), over-harvesting threatens the genetic diversity and long-term sustainability of the industry. This scarcity forces producers to implement strict rationing or increase retail prices, which may alienate budget-conscious consumers and limit the market's ability to scale rapidly during periods of peak demand.

Sustainability and ethical production are becoming critical purchasing criteria for global consumers, offering a significant opportunity for market participants to differentiate their brands. Companies that invest in regenerative agave farming, water conservation, and fair-trade labor practices can appeal to the eco-conscious "Green Consumer" segment. For instance, the Tequila Regulatory Council (CRT) recently aimed for 100% deforestation-free production by 2027, a trend likely to follow in the Mezcal sector. Brands that implement Certified Organic or Biodynamic certifications and utilize sustainable packaging such as recycled glass bottles are seeing increased shelf velocity. This strategic focus not only mitigates supply chain risks related to agave depletion but also enhances brand equity, allowing companies to justify premium pricing while contributing to the preservation of Oaxacan biodiversity and local community welfare.

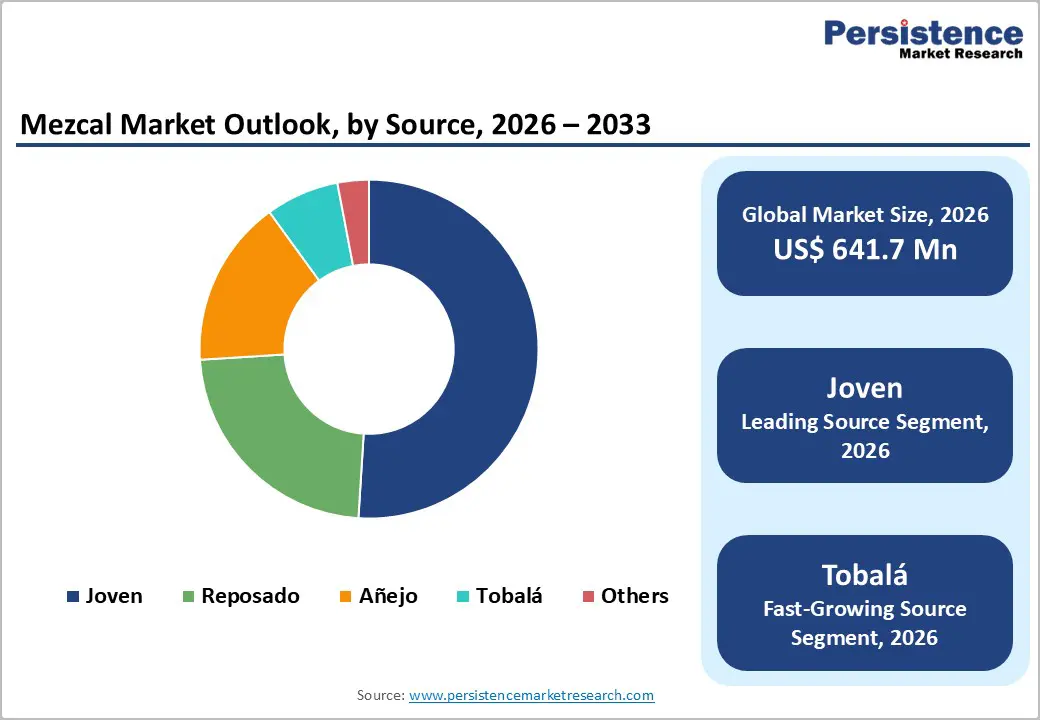

The joven segment held the leading position in the Mezcal Market in 2025, accounting for a dominant 48% market share. This segment’s leadership is attributed to its unaged, "blank" profile, which captures the purest expression of the agave plant and its terroir. Joven (or Blanco) Mezcal is the preferred choice for both traditional sippers and high-volume cocktail applications due to its brighter, more vibrant flavor profile and relative affordability compared to aged variants. Justification for its market dominance is also supported by the shorter production cycle, allowing distillers to bring products to market without the years of barrel-aging required for Reposado or Añejo. However, the Tobalá segment is identified as the fastest-growing product type, as affluent consumers increasingly seek out rare, small-batch wild agave expressions that offer unmatched complexity and "collector" status.

The on trade segment accounts for approximately 53% of the total revenue in 2025. The high concentration of sales in this channel is driven by the "education-heavy" nature of the spirit; most consumers first experience Mezcal through curated cocktail programs or guided tastings led by professional bartenders. Establishments such as those under the HORECA umbrella are vital for building brand awareness and justifying the high price points associated with artisanal production. Meanwhile, the Off Trade segment, particularly Online Retail, is the fastest-growing sales channel. The pandemic-led acceleration of e-commerce and the rise of specialized online spirits platforms like ReserveBar have made rare Mezcals more accessible to home enthusiasts, facilitating a surge in direct-to-consumer delivery and subscription-based "Mezcal Clubs."

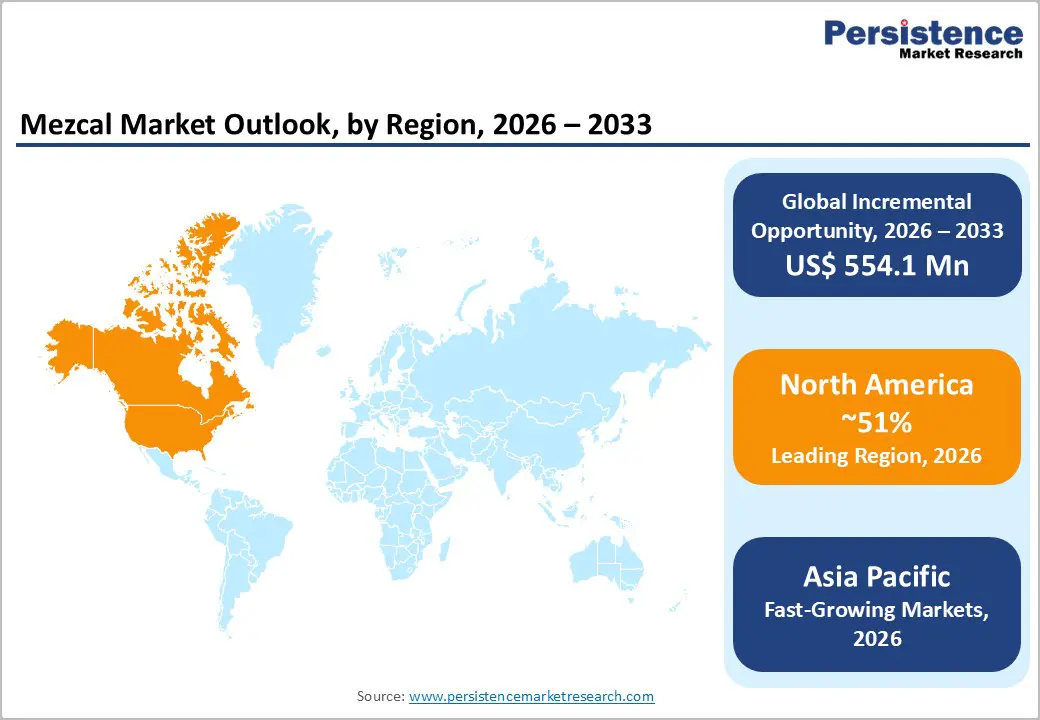

North America is the preeminent region in the global landscape, commanding 51% share in 2025. The market leadership is almost entirely driven by the United States, which has become the largest consumer of Mezcal outside of Mexico. High disposable income and a mature cocktail culture have turned Mezcal into a staple spirit in metropolitan areas. Regulatory frameworks in the U.S. have evolved to support the category, with increased TBB labeling approvals for artisanal classifications.

Innovation in the U.S. market is focused on celebrity-backed brands and "craft-premium" positioning. Major companies like Constellation Brands Inc. and Diageo plc have heavily invested in Oaxacan distilleries to secure their supply chains. Furthermore, the region is seeing a surge in "Agave Tourism" and tasting festivals, which foster deeper consumer connection. The presence of a massive Mexican-American population also provides a robust cultural foundation for continued category growth.

Asia Pacific is the fastest-growing market for Mezcal globally, with a projected high CAGR of 10.6% between 2025 and 2032. This rapid expansion is driven by the surging nightlife and bar culture in China, Japan, and India. As urban centers like Shanghai and Mumbai see a rise in high-end specialty bars, the demand for "exotic" premium spirits has skyrocketed. The region also benefits from a manufacturing advantage in terms of high-speed glass production and competitive logistics for the regional distribution of bottled goods.

China, in particular, represents a massive frontier; the rising middle class views premium agave spirits as status symbols similar to high-end Cognac. In Japan, the appreciation for craftsmanship and artisanal production resonates deeply with the local "quality-first" consumer mindset. Government investments in tourism and hospitality infrastructure across Southeast Asia are further facilitating the entry of global Mezcal brands into 5-star hotel bars. The proliferation of e-commerce platforms in the region is also making boutique artisanal brands more accessible to a geographically diverse consumer base.

The mezcal market is currently characterized by a "fragmented-consolidated" structure. At the production level, the market remains highly fragmented with thousands of small-scale artisanal "Palenqueros" (distillers) in rural Mexico. However, the distribution and branding landscape is increasingly consolidated among a few global beverage giants. Companies like Diageo plc, Pernod Ricard, and Bacardi Limited have aggressively pursued an acquisition-led growth strategy, buying majority stakes in popular artisanal brands to leverage their massive global distribution networks. Key differentiators employed by market leaders include the ability to secure long-term agave supply contracts and achieving "Ancestral" production certifications. Emerging business models are focusing on "Direct-to-Distillery" partnerships that ensure more revenue reaches the local producers while maintaining the high quality and authenticity that global consumers demand.

The global mezcal market is expected to be valued at approximately US$ 641.7 million in 2026, growing steadily at a CAGR of 9.3%.

The primary driver is the rising consumer demand for Artisanal and Premium spirits, fueled by millennials seeking authenticity and a complex smoky flavor profile in craft cocktails.

The global Mezcal market is poised to witness a CAGR of 9.3% between 2026 and 2033.

Significant opportunities lie in the expansion into Asia Pacific emerging markets and the development of Sustainable/Ethical production portfolios to meet green consumer trends.

The industry features global giants such as Diageo plc, Pernod Ricard, Constellation Brands Inc., and Campari Group, alongside prominent artisanal brands like Mezcal Vago and Amarás.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Source

By Sales Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author