ID: PMRREP35988| 210 Pages | 31 Dec 2025 | Format: PDF, Excel, PPT* | Food and Beverages

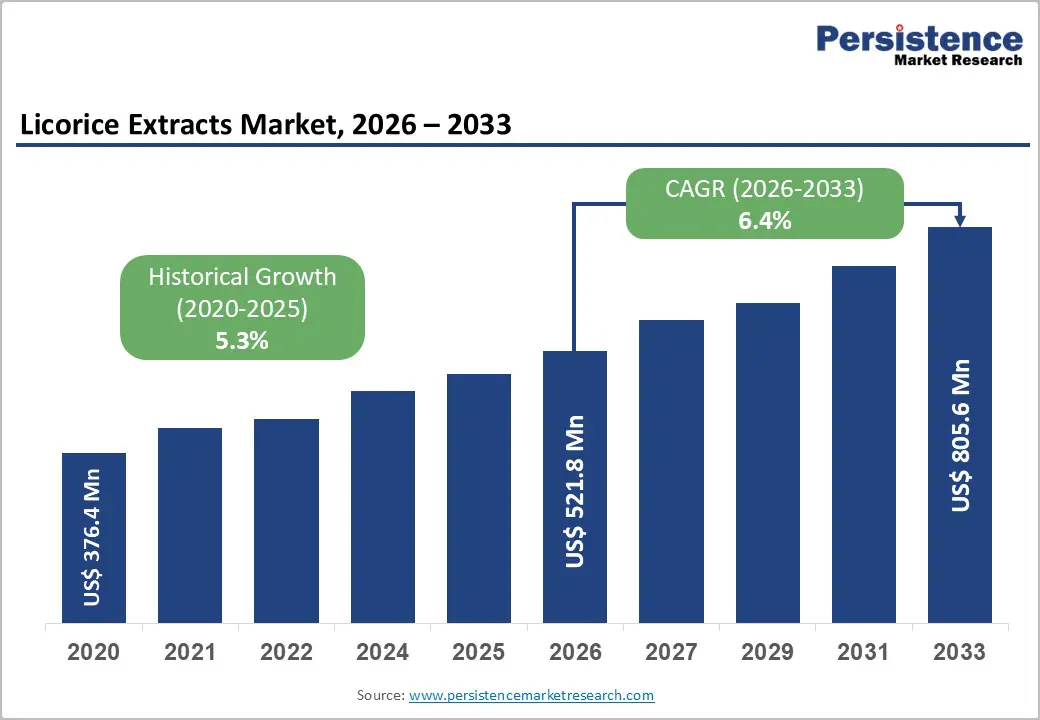

The global licorice extract market size is estimated to grow from US$ 521.8 million in 2026 to US$ 805.6 million by 2033. The market is projected to record a CAGR of 6.4% during the forecast period from 2026 to 2033.

The licorice extract industry is entering a phase of accelerated evolution, shaped by cleaner formulations, rising botanical innovation, and expanding cross-border supply chains. Growing applications in supplements, cosmetics, and natural confectionery are turning licorice into a high-value functional ingredient with global momentum.

| Key Insights | Details |

|---|---|

| Global Licorice Extract Market Size (2026E) | US$ 521.8 Mn |

| Market Value Forecast (2033F) | US$ 805.6 Mn |

| Projected Growth (CAGR 2026 to 2033) | 6.4% |

| Historical Market Growth (CAGR 2020 to 2025) | 5.3% |

A subtle but steady transformation is taking place across Western healthcare systems as practitioners increasingly explore herbal and plant-based therapies, giving licorice extract a strategic boost. Its traditional use in soothing digestive issues, respiratory support, and anti-inflammatory applications positions it as a credible adjunct to modern treatments. Physicians and wellness advisors are gradually integrating herbal solutions into patient care plans to meet growing consumer demand for natural alternatives that complement pharmaceuticals.

The growing awareness of preventive health, immunity enhancement, and holistic wellness reinforces this shift. Licorice extract is gaining traction in functional supplements, herbal teas, and digestive aids, while manufacturers innovate with standardized, high-purity formulations. As clinical interest expands and market acceptance strengthens, growth avenues open for both established suppliers and agile startups targeting health-conscious consumers.

A growing challenge for the licorice extract market is the competition from alternative natural sweeteners and plant extracts, which are increasingly favored by consumers seeking low-calorie, clean-label, or multifunctional ingredients. Stevia, monk fruit, and agave extracts are gaining popularity as sugar substitutes, while herbal extracts such as ginger, turmeric, and ginseng are expanding into functional food and beverage applications. This shift divides attention and budgets among manufacturers and formulators, making it harder for licorice extract to secure shelf space and product placement.

Food and beverage brands experimenting with flavor innovation often prioritize these alternatives due to versatile taste profiles and broader consumer familiarity. The fragmented market for plant-based extracts creates pricing pressures and necessitates stronger differentiation strategies for licorice extract producers to remain relevant and grow.

A fresh wave of ingredient innovation is positioning licorice extract as a high-value addition to functional cosmetics, creating a strong opportunity for both established players and new startups. Its naturally occurring glabridin is prized for anti-inflammatory and skin-brightening benefits, making it a preferred choice for brands developing sensitive-skin formulas, dark-spot correctors, and redness-reducing treatments. As consumers shift toward botanical actives with transparent sourcing, licorice extract fits seamlessly into clean beauty narratives, unlocking demand across serums, lotions, and sun-damage repair products.

Emerging brands are leveraging this momentum by formulating micro-encapsulated extracts to enhance skin penetration, while larger players are exploring standardized potency grades to strengthen efficacy claims. Growing uptake among K-beauty, J-beauty, and premium Western skincare creates a broad commercialization runway. With rising interest in hybrid beauty-wellness solutions, licorice extract presents a compelling opportunity for players aiming to scale in the functional skincare space.

Licorice Extract holds approx. 43% market share as of 2025, and powdered formats command the lead because they align with how global formulators actually work—fast, precise, and efficiency-driven. Powdered licorice extracts offer tight control over dosing, better stability, and seamless integration into supplements, functional foods, traditional remedies, and pharma-grade formulations. Their long shelf life and ease of global transport strengthen their dominance as manufacturers rationalize supply chains and optimize production economics. As clean-label herbal actives gain acceptance, powder remains the preferred input for scalable, high-purity licorice applications.

Granules continue to serve niche uses in traditional medicine and confectionery, where slow-release infusion is valued. Blocks and paste formats remain relevant in legacy herbal systems, brewing, specialized candies, and regional medicinal preparations, where texture and concentrated flavor are required.

Dietary Supplements are projected to grow at a CAGR of 9.4% during the forecast period, driven by consumers who are shifting toward targeted wellness routines that demand concentrated, reliable botanical actives. Licorice extract aligns well with supplement formulations seeking anti-inflammatory, digestive, and adaptogenic benefits, and its compatibility with capsules, tablets, and functional powders supports faster product development cycles. Supplement brands are increasingly prioritizing herbal efficacy backed by traditional use and emerging clinical validation, making licorice a dependable ingredient for premium, science-aligned SKUs.

Food & Beverage manufacturers integrate licorice for flavor modulation and natural sweetness. Pharmaceuticals leverage its soothing and anti-ulcer properties. Cosmetics & Personal Care categories utilize licorice for brightening and anti-irritation claims, especially in sensitive-skin products.

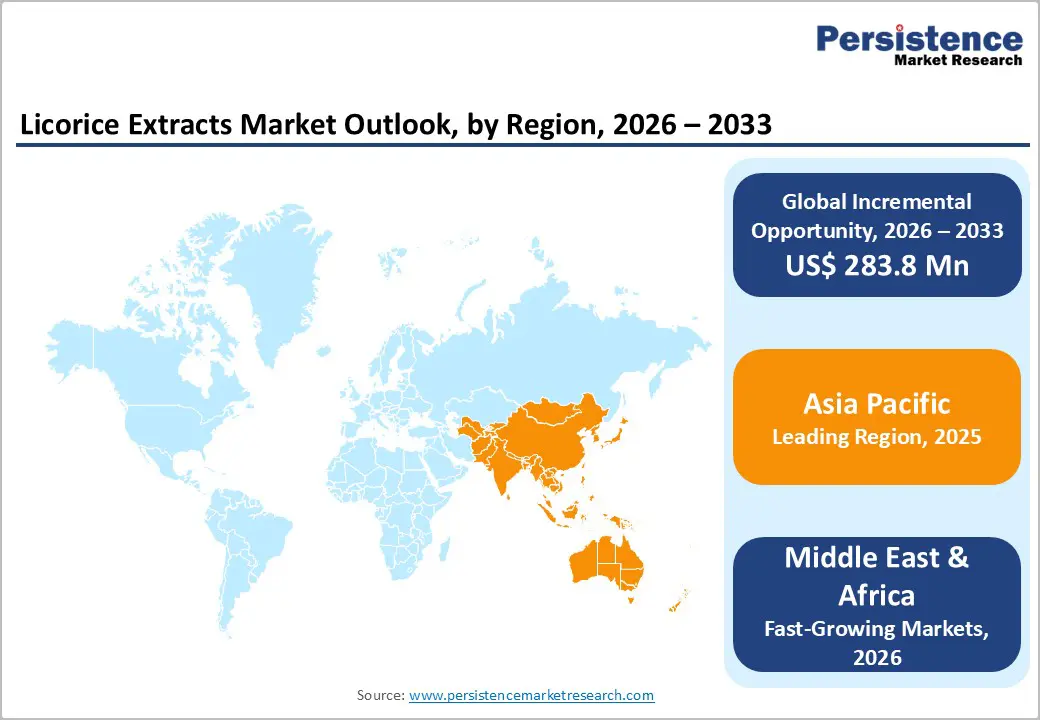

Asia Pacific licorice extract market holds approximately 48% market share in the global Licorice Extract Market, reflecting the region’s deep-rooted use of herbal therapeutics and accelerating demand for natural bioactive ingredients. China is shaping the market through large-scale extraction facilities and the rising use of licorice in traditional medicine modernization programs. India is driving momentum through the surge in Ayurvedic supplement brands and the push for plant-based sweeteners in food formulations. Japan continues to influence premium segments with its preference for high-purity extracts used in derma-focused skincare.

Growing investments in clean-label herbal ingredients, cross-border supply chain integration, and regional standardization efforts are reinforcing the Asia Pacific’s leadership. Innovation in process optimization, solvent-free extraction, and pharma-grade licorice derivatives is expanding opportunities for domestic producers and emerging players.

Middle East & Africa licorice extract market is expected to grow at a CAGR of 9.8%, driven by an accelerating preference for herbal formulations across food, pharma, and wellness sectors. GCC countries are expanding their reliance on licorice derivatives in traditional remedies and sugar-reduction initiatives, supported by local processing upgrades and increased imports of high-grade roots. Egypt is strengthening demand through its pharmaceutical manufacturing base, where licorice extract is used in cough syrups, digestive formulations, and soothing herbal blends. South Africa is seeing rising adoption in functional teas, natural confectionery, and niche skincare products as consumers shift toward clean botanical ingredients.

Investments in quality certification, improved extraction standards, and diversification into specialty extracts are reshaping market dynamics. Growing awareness of licorice’s anti-inflammatory, antimicrobial, and flavor-enhancement properties is encouraging product developers to integrate the ingredient into newer applications. Local distributors are expanding cross-border partnerships to secure consistent supply, while startups are exploring value-added formats such as high-purity glycyrrhizin concentrates and low-glycyrrhizin cosmetic-grade variants.

The global licorice extract market presents a moderately fragmented competitive landscape shaped by a mix of long-established processors and agile new entrants expanding niche applications. Leading companies are upgrading extraction systems toward high-purity, low-glycyrrhizin grades to meet stricter regulations, while startups are experimenting with solvent-free processing and controlled-environment drying. Cultivation partnerships in Central Asia and the Middle East are expanding as firms secure traceable, pesticide-compliant roots. Rising confectionery demand and the shift toward clean-label sweeteners are pushing brands to educate consumers on functional benefits. R&D is accelerating around skin-brightening actives, gut-health blends, and low-bitterness profiles. Online retail is becoming a critical distribution channel, giving smaller producers global visibility as governments tighten standards on purity and labeling.

The global licorice extract market is projected to be valued at US$ 521.8 Mn in 2026.

The global licorice extract market is gaining momentum as Western healthcare increasingly integrates herbal and plant-based therapeutic approaches.

The global licorice extract market is poised to witness a CAGR of 6.4% between 2026 and 2033.

Increased use of licorice extract in functional skincare and cosmetic formulations especially for anti-inflammatory and brightening benefits is emerging as a major growth opportunity for industry participants.

Major players in the global Licorice Extract market include Now Foods, Cokey Co.,Ltd., Chemcopia, FC Licorice, Norevo GmbH, Mafco Worldwide LLC., Nutragreenlife Biotechnology Co.,Ltd, and others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Form

By Nature

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author