- Executive Summary

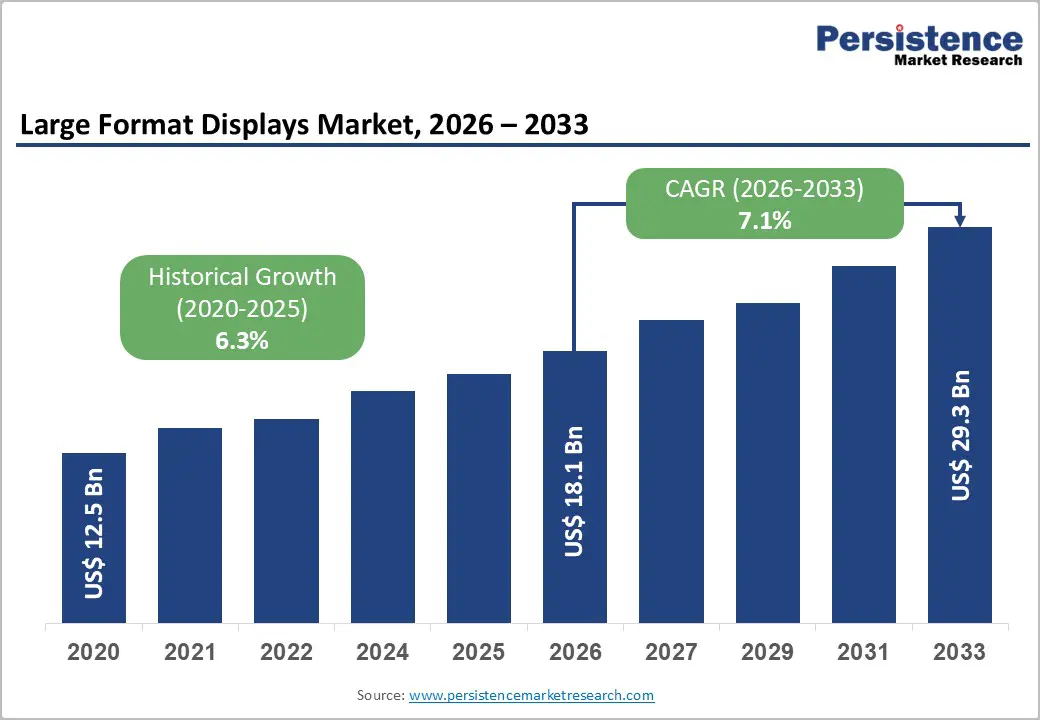

- Global Large Format Displays Market Snapshot 2026 and 2033

- Market Opportunity Assessment, 2026-2033, US$ Bn

- Key Market Trends

- Industry Developments and Key Market Events

- Demand Side and Supply Side Analysis

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definitions

- Value Chain Analysis

- Macro-Economic Factors

- Global GDP Outlook

- Global Infrastructure Development & Investment

- Growing Urbanization & Smart Cities Outlook

- Events & Entertainment Industry Growth Outlook

- Forecast Factors – Relevance and Impact

- COVID-19 Impact Assessment

- PESTLE Analysis

- Porter's Five Forces Analysis

- Geopolitical Tensions: Market Impact

- Regulatory and Technology Landscape

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Trends

- Price Trend Analysis, 2020 – 2033

- Region-wise Price Analysis

- Price by Segments

- Price Impact Factors

- Global Large Format Displays Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Global Large Format Displays Market Outlook: Screen Size

- Introduction/Key Findings

- Historical Market Size (US$ Bn) and Volume (Units) Analysis by Screen Size, 2020-2025

- Current Market Size (US$ Bn) and Volume (Units) Forecast, by Screen Size, 2026-2033

- 32” to 40”

- 41” to 80”

- Above 80”

- Market Attractiveness Analysis: Screen Size

- Global Large Format Displays Market Outlook: Product Type

- Introduction/Key Findings

- Historical Market Size (US$ Bn) and Volume (Units) Analysis by Product Type, 2020-2025

- Current Market Size (US$ Bn) and Volume (Units) Forecast, by Product Type, 2026-2033

- Standalone

- Video Wall

- Outdoor

- Touchscreen

- Market Attractiveness Analysis: Product Type

- Global Large Format Displays Market Outlook: Deployment Type

- Introduction/Key Findings

- Historical Market Size (US$ Bn) and Volume (Units) Analysis by Deployment Type, 2020-2025

- Current Market Size (US$ Bn) and Volume (Units) Forecast, by Deployment Type, 2026-2033

- Installed

- Rental

- Market Attractiveness Analysis: Deployment Type

- Global Large Format Displays Market Outlook: Backlight Technology

- Introduction/Key Findings

- Historical Market Size (US$ Bn) and Volume (Units) Analysis by Backlight Technology, 2020-2025

- Current Market Size (US$ Bn) and Volume (Units) Forecast, by Backlight Technology, 2026-2033

- LED Backlit

- CCFL

- Market Attractiveness Analysis: Backlight Technology

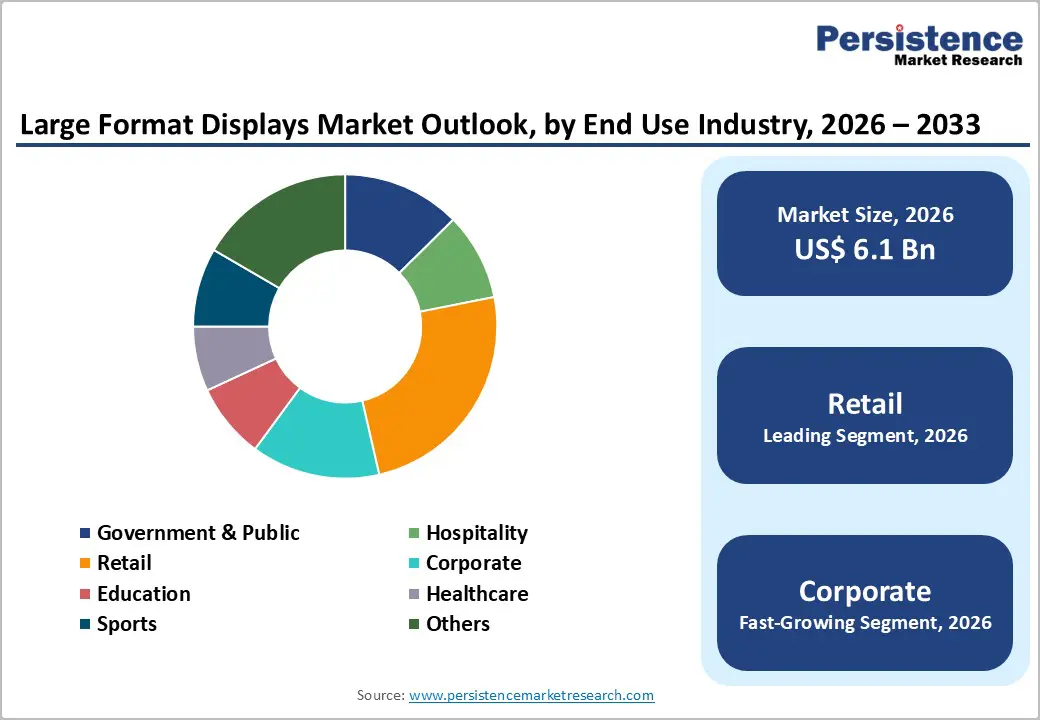

- Global Large Format Displays Market Outlook: End Use Industry

- Introduction/Key Findings

- Historical Market Size (US$ Bn) and Volume (Units) Analysis by End Use Industry, 2020-2025

- Current Market Size (US$ Bn) and Volume (Units) Forecast, by End Use Industry, 2026-2033

- Government & Public

- Hospitality

- Retail

- Corporate

- Education

- Healthcare

- Sports

- Others

- Market Attractiveness Analysis: End Use Industry

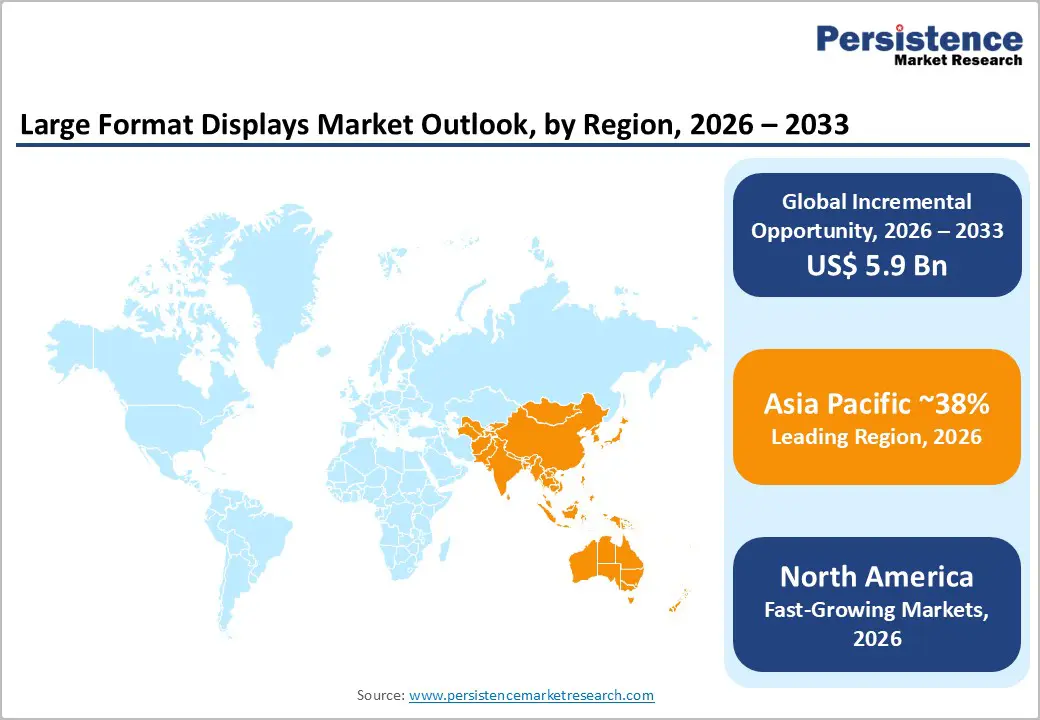

- Global Large Format Displays Market Outlook: Region

- Key Highlights

- Historical Market Size (US$ Bn) and Volume (Units) Analysis by Region, 2020-2025

- Current Market Size (US$ Bn) and Volume (Units) Forecast, by Region, 2026-2033

- North America

- Europe

- East Asia

- South Asia & Oceania

- Latin America

- Middle East & Africa

- Market Attractiveness Analysis: Region

- North America Large Format Displays Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Pricing Analysis

- North America Market Size (US$ Bn) and Volume (Units) Forecast, by Country, 2026-2033

- U.S.

- Canada

- North America Market Size (US$ Bn) and Volume (Units) Forecast, by Screen Size, 2026-2033

- 32” to 40”

- 41” to 80”

- Above 80”

- North America Market Size (US$ Bn) and Volume (Units) Forecast, by Product Type, 2026-2033

- Standalone

- Video Wall

- Outdoor

- Touchscreen

- North America Market Size (US$ Bn) and Volume (Units) Forecast, by Deployment Type, 2026-2033

- Installed

- Rental

- North America Market Size (US$ Bn) and Volume (Units) Forecast, by Backlight Technology, 2026-2033

- LED Backlit

- CCFL

- North America Market Size (US$ Bn) and Volume (Units) Forecast, by End Use Industry, 2026-2033

- Government & Public

- Hospitality

- Retail

- Corporate

- Education

- Healthcare

- Sports

- Others

- Europe Large Format Displays Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Pricing Analysis

- Europe Market Size (US$ Bn) and Volume (Units) Forecast, by Country, 2026-2033

- Germany

- Italy

- France

- U.K.

- Spain

- Russia

- Rest of Europe

- Europe Market Size (US$ Bn) and Volume (Units) Forecast, by Screen Size, 2026-2033

- 32” to 40”

- 41” to 80”

- Above 80”

- Europe Market Size (US$ Bn) and Volume (Units) Forecast, by Product Type, 2026-2033

- Standalone

- Video Wall

- Outdoor

- Touchscreen

- Europe Market Size (US$ Bn) and Volume (Units) Forecast, by Deployment Type, 2026-2033

- Installed

- Rental

- Europe Market Size (US$ Bn) and Volume (Units) Forecast, by Backlight Technology, 2026-2033

- LED Backlit

- CCFL

- Europe Market Size (US$ Bn) and Volume (Units) Forecast, by End Use Industry, 2026-2033

- Government & Public

- Hospitality

- Retail

- Corporate

- Education

- Healthcare

- Sports

- Others

- East Asia Large Format Displays Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Pricing Analysis

- East Asia Market Size (US$ Bn) and Volume (Units) Forecast, by Country, 2026-2033

- China

- Japan

- South Korea

- East Asia Market Size (US$ Bn) and Volume (Units) Forecast, by Screen Size, 2026-2033

- 32” to 40”

- 41” to 80”

- Above 80”

- East Asia Market Size (US$ Bn) and Volume (Units) Forecast, by Product Type, 2026-2033

- Standalone

- Video Wall

- Outdoor

- Touchscreen

- East Asia Market Size (US$ Bn) and Volume (Units) Forecast, by Deployment Type, 2026-2033

- Installed

- Rental

- East Asia Market Size (US$ Bn) and Volume (Units) Forecast, by Backlight Technology, 2026-2033

- LED Backlit

- CCFL

- East Asia Market Size (US$ Bn) and Volume (Units) Forecast, by End Use Industry, 2026-2033

- Government & Public

- Hospitality

- Retail

- Corporate

- Education

- Healthcare

- Sports

- Others

- South Asia & Oceania Large Format Displays Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Pricing Analysis

- South Asia & Oceania Market Size (US$ Bn) and Volume (Units) Forecast, by Country, 2026-2033

- India

- Southeast Asia

- ANZ

- Rest of SAO

- South Asia & Oceania Market Size (US$ Bn) and Volume (Units) Forecast, by Screen Size, 2026-2033

- 32” to 40”

- 41” to 80”

- Above 80”

- South Asia & Oceania Market Size (US$ Bn) and Volume (Units) Forecast, by Product Type, 2026-2033

- Standalone

- Video Wall

- Outdoor

- Touchscreen

- South Asia & Oceania Market Size (US$ Bn) and Volume (Units) Forecast, by Deployment Type, 2026-2033

- Installed

- Rental

- South Asia & Oceania Market Size (US$ Bn) and Volume (Units) Forecast, by Backlight Technology, 2026-2033

- LED Backlit

- CCFL

- South Asia & Oceania Market Size (US$ Bn) and Volume (Units) Forecast, by End Use Industry, 2026-2033

- Government & Public

- Hospitality

- Retail

- Corporate

- Education

- Healthcare

- Sports

- Others

- Latin America Large Format Displays Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Pricing Analysis

- Latin America Market Size (US$ Bn) and Volume (Units) Forecast, by Country, 2026-2033

- Brazil

- Mexico

- Rest of LATAM

- Latin America Market Size (US$ Bn) and Volume (Units) Forecast, by Screen Size, 2026-2033

- 32” to 40”

- 41” to 80”

- Above 80”

- Latin America Market Size (US$ Bn) and Volume (Units) Forecast, by Product Type, 2026-2033

- Standalone

- Video Wall

- Outdoor

- Touchscreen

- Latin America Market Size (US$ Bn) and Volume (Units) Forecast, by Deployment Type, 2026-2033

- Installed

- Rental

- Latin America Market Size (US$ Bn) and Volume (Units) Forecast, by Backlight Technology, 2026-2033

- LED Backlit

- CCFL

- Latin America Market Size (US$ Bn) and Volume (Units) Forecast, by End Use Industry, 2026-2033

- Government & Public

- Hospitality

- Retail

- Corporate

- Education

- Healthcare

- Sports

- Others

- Middle East & Africa Large Format Displays Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Pricing Analysis

- Middle East & Africa Market Size (US$ Bn) and Volume (Units) Forecast, by Country, 2026-2033

- GCC Countries

- South Africa

- Northern Africa

- Rest of MEA

- Middle East & Africa Market Size (US$ Bn) and Volume (Units) Forecast, by Screen Size, 2026-2033

- 32” to 40”

- 41” to 80”

- Above 80”

- Middle East & Africa Market Size (US$ Bn) and Volume (Units) Forecast, by Product Type, 2026-2033

- Standalone

- Video Wall

- Outdoor

- Touchscreen

- Middle East & Africa Market Size (US$ Bn) and Volume (Units) Forecast, by Deployment Type, 2026-2033

- Installed

- Rental

- Middle East & Africa Market Size (US$ Bn) and Volume (Units) Forecast, by Backlight Technology, 2026-2033

- LED Backlit

- CCFL

- Middle East & Africa Market Size (US$ Bn) and Volume (Units) Forecast, by End Use Industry, 2026-2033

- Government & Public

- Hospitality

- Retail

- Corporate

- Education

- Healthcare

- Sports

- Others

- Competition Landscape

- Market Share Analysis, 2025

- Market Structure

- Competition Intensity Mapping

- Competition Dashboard

- Company Profiles

- Samsung Electronics Co., Ltd.

- Company Overview

- Product Portfolio/Offerings

- Key Financials

- SWOT Analysis

- Company Strategy and Key Developments

- LG Electronics Inc.

- Sony Corporation

- Sharp NEC Display Solutions

- Panasonic Corporation

- Barco NV

- Planar Systems, Inc.

- ViewSonic Corporation

- Leyard Optoelectronic Co., Ltd.

- Daktronics, Inc.

- Christie Digital Systems

- Elo Touch Solutions

- BenQ Corporation

- AU Optronics Corp.

- BOE Technology Group

- Samsung Electronics Co., Ltd.

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations

Loading page data

Please wait a moment