ID: PMRREP15259| 178 Pages | 1 Oct 2025 | Format: PDF, Excel, PPT* | Healthcare

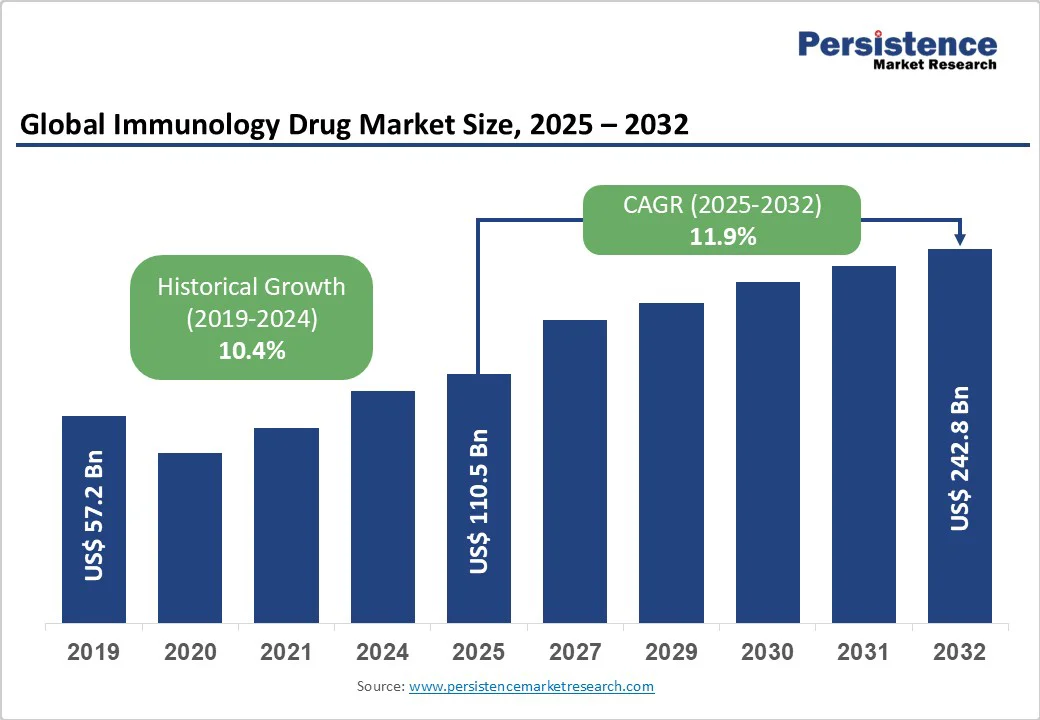

The global immunology drug market size is likely to value at US$110.5 Bn in 2025 and reach US$242.8 Bn by 2032, growing at a CAGR of 11.9% during the forecast period from 2025 to 2032.

The immunology drug market is witnessing robust growth, driven by increasing demand from key therapeutic areas such as autoimmune disorders and organ transplantation, where targeted therapies and immunosuppressants play a pivotal role.

Immunology drugs, renowned for their precision in modulating immune responses, efficacy in chronic conditions, and ability to reduce inflammation, are indispensable for treating diseases such as rheumatoid arthritis, psoriasis, and inflammatory bowel disease.

The escalation in global prevalence of autoimmune diseases, coupled with breakthroughs in biologic therapies, propels market expansion.

| Key Insights | Details |

|---|---|

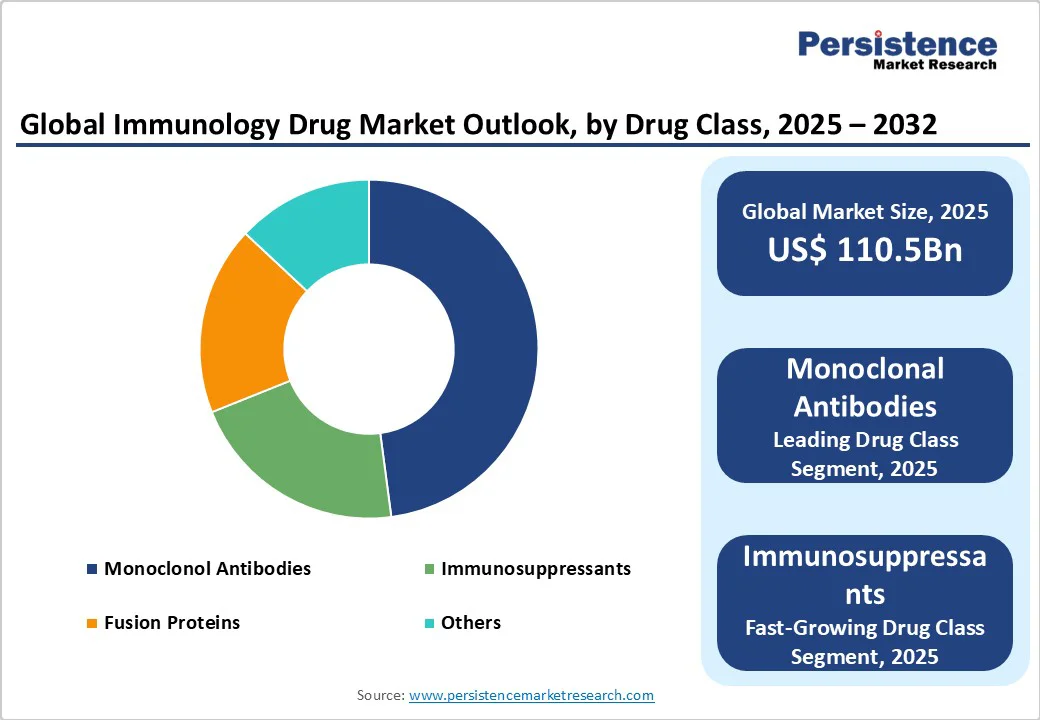

| Immunology Drug Market Size (2025E) | US$ 110.5Bn |

| Market Value Forecast (2032F) | US$242.8Bn |

| Projected Growth (CAGR 2025 to 2032) | 11.9% |

| Historical Market Growth (CAGR 2019 to 2024) | 10.4% |

The global immunology drug market is experiencing substantial growth due to the rising incidence of autoimmune diseases and chronic inflammatory conditions worldwide. Immunology drugs are vital for managing these disorders by suppressing overactive immune responses, alleviating symptoms, and preventing long-term organ damage.

According to the Global Autoimmune Institute, over 50 million Americans suffer from autoimmune diseases, with rheumatoid arthritis alone affecting 1.3 million adults, while the World Health Organization estimates that inflammatory bowel disease impacts 6.8 million people globally as of 2023.

This surge is attributed to genetic predispositions, environmental factors such as pollution, and lifestyle changes, particularly in urbanizing regions. Companies such as AbbVie reported revenue uptick in immunology portfolios in 2024, fueled by drugs such as Humira biosimilars.

Government initiatives, including India's National Programme for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases, and Stroke, integrate immunology treatments into public health frameworks, ensuring broader access.

The aging global population, projected to reach 1.5 billion over 60 by 2050 per the United Nations, further amplifies need for long-term therapies, positioning autoimmune management as a cornerstone driver for sustained market growth through 2032. This dynamic underscores the immunology drug market's resilience, with projections indicating a compounded demand surge aligned with epidemiological trends and therapeutic advancements.

The immunology drug market is significantly restrained by high development costs and stringent regulatory requirements. Developing biologics, such as monoclonal antibodies and fusion proteins, involves extensive preclinical and clinical trials, often costing billions and taking years to complete.

Regulatory agencies enforce rigorous safety and efficacy standards, further prolonging timelines and increasing expenses. In emerging markets, these challenges are compounded by limited reimbursement frameworks and pricing pressures.

For example, Brazil’s 2024 health budget cuts have restricted access to costly biologic therapies, limiting patient availability and market growth. Such constraints hinder the adoption of innovative treatments, particularly novel fusion proteins and cutting-edge immunotherapies.

Consequently, pharmaceutical companies face difficulties recouping investments, slowing innovation, and reducing market penetration. These factors collectively dampen growth prospects, especially in cost-sensitive regions with strict regulatory oversight, challenging the immunology sector’s expansion globally.

The rapid advancements in personalized medicine and biosimilars are transforming the immunology drug market, presenting significant growth opportunities. Personalized medicine enables tailored treatments based on individual genetic profiles, enhancing efficacy and minimizing side effects. Concurrently, biosimilars offer more affordable alternatives to expensive biologics, increasing patient access and driving market expansion.

The European Union’s Horizon Europe program, with its €1 billion investment in precision immunology research, is a catalyst for innovation and cross-border collaborations. This funding accelerates the development of novel therapies, including fusion proteins aimed at preventing organ rejection, a critical need in transplant medicine.

These innovations promise to diversify revenue streams for pharmaceutical companies while promoting market inclusivity by broadening treatment availability. By 2032, this synergy of personalized approaches and biosimilar adoption is expected to reshape immunology therapeutics, making treatments more effective, accessible, and economically viable on a global scale.

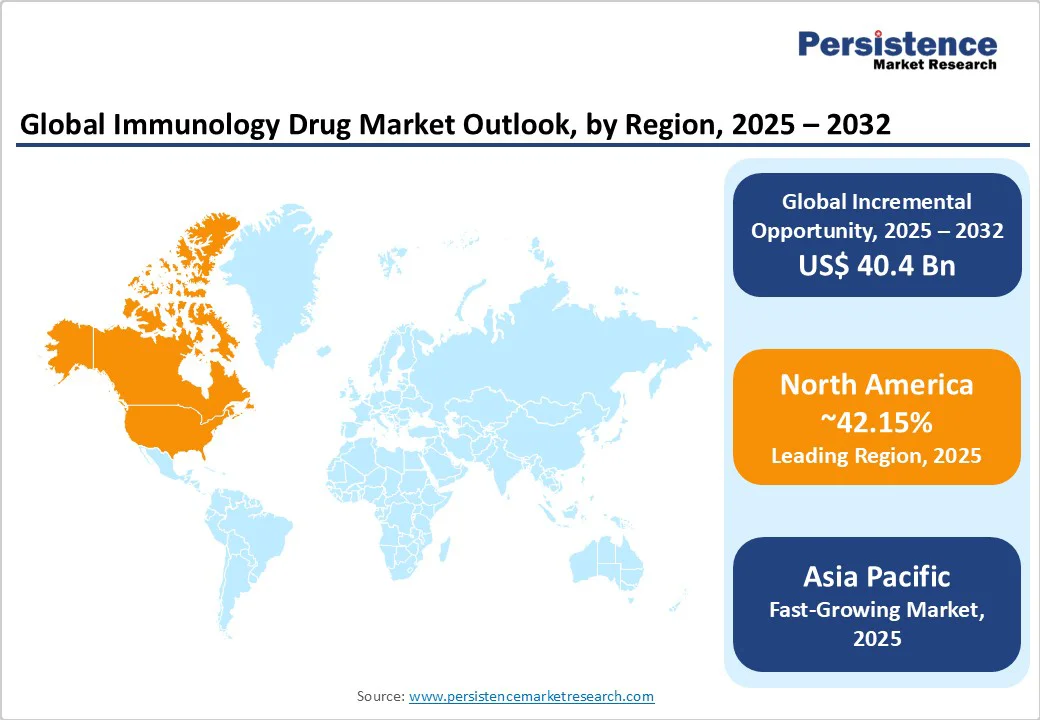

North America dominates the immunology drug market, projected to capture a 42.15% share in 2025. This dominance is fueled by several key factors. Foremost is the region’s robust investment in cutting-edge research and development, driven by leading pharmaceutical companies and academic institutions focused on innovative immunology therapies.

Additionally, favorable reimbursement policies in the U.S. and Canada facilitate patient access to advanced treatments, boosting market growth. The high prevalence of autoimmune and inflammatory diseases-exacerbated by aging populations and lifestyle factors such as diet and stress-creates sustained demand for immunology drugs.

Moreover, stringent regulatory oversight by the FDA ensures that therapies meet rigorous safety and efficacy standards, fostering patient trust and encouraging industry innovation. This combination of scientific advancement, supportive healthcare infrastructure, and a significant disease burden firmly positions North America as the global hub for breakthroughs in immunology drug development.

The Asia Pacific region is the fastest-growing region in the immunology drug market, driven by several dynamic factors. Although it currently lags behind North America in market share, rapid urbanization and expanding healthcare infrastructure in countries such as China and India are rapidly reshaping the landscape.

The region’s large and growing patient base, compounded by high rates of diabetes-related inflammation and genetic susceptibility to autoimmune conditions, intensifies demand for immunology therapies. Local pharmaceutical giants such as Biocon are capitalizing on this opportunity by producing affordable biosimilars, enhancing accessibility.

Meanwhile, global leaders such as Novartis and Roche are strategically entering the immunology drug market through joint ventures and collaborations, aiming to tap into regional growth. Rising disposable incomes and an expanding middle class are fueling increased spending on premium and innovative therapies.

Additionally, the proliferation of digital pharmacies and the establishment of clinical trial hubs further accelerate market development. Together, these trends position Asia Pacific for sustained, inclusive growth in immunology drugs through 2032.

Europe is emerging as the second fastest-growing region in the immunology drug market, driven by several strategic factors. A unified regulatory framework across the European Union streamlines drug approvals, accelerating access to innovative immunology therapies.

Strong public health systems, particularly in Germany and France, are fueling rising demand for treatments targeting autoimmune diseases. Significant investment through the EU’s €95 billion Horizon Europe program specifically supports immunosuppressant research and development, focusing on preventing organ rejection. Leading pharmaceutical companies such as Janssen and Roche spearhead clinical trials, pushing the frontier of new therapies.

Sustainability mandates encourage the development and adoption of eco-friendly biosimilars, aligning market growth with environmental goals. Moreover, increasing population mobility and pollution-related health issues have prompted enhanced cross-border collaborations to address rising disease prevalence.

This collaborative approach, combined with advanced patient registries and value-based pricing models, fosters more efficient, patient-centered care and underpins steady market expansion across Europe’s immunology sector.

The global immunology drug market is intensely competitive, led by diversified portfolios and strategic alliances among biopharma giants. Characterized as an oligopolistic landscape, it features dominant players with global footprints alongside niche innovators focusing on rare indications.

Key competitors invest heavily in biosimilar development and AI-optimized trials to capture shares in high-growth segments such as personalized immunosuppressants. Mergers, such as Pfizer's 2024 acquisition of a fusion protein startup, underscore consolidation trends, while regional expansions target Asia Pacific's untapped potential.

The Immunology Drug market is projected to reach US$110.5 Bn in 2025.

Escalating prevalence of autoimmune diseases and advancements in biologic therapies are the key market drivers.

The Immunology Drug market is poised to witness a CAGR of 11.9% from 2025 to 2032.

Advancements in personalized medicine and biosimilars represent the key market opportunity.

AbbVie, Inc., Janssen Global Services, Novartis AG, Pfizer Inc., and Eli Lilly and Company are key market players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn/Mn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Drug Class

By Disease Indication

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author