ID: PMRREP35549| 199 Pages | 5 Aug 2025 | Format: PDF, Excel, PPT* | Healthcare

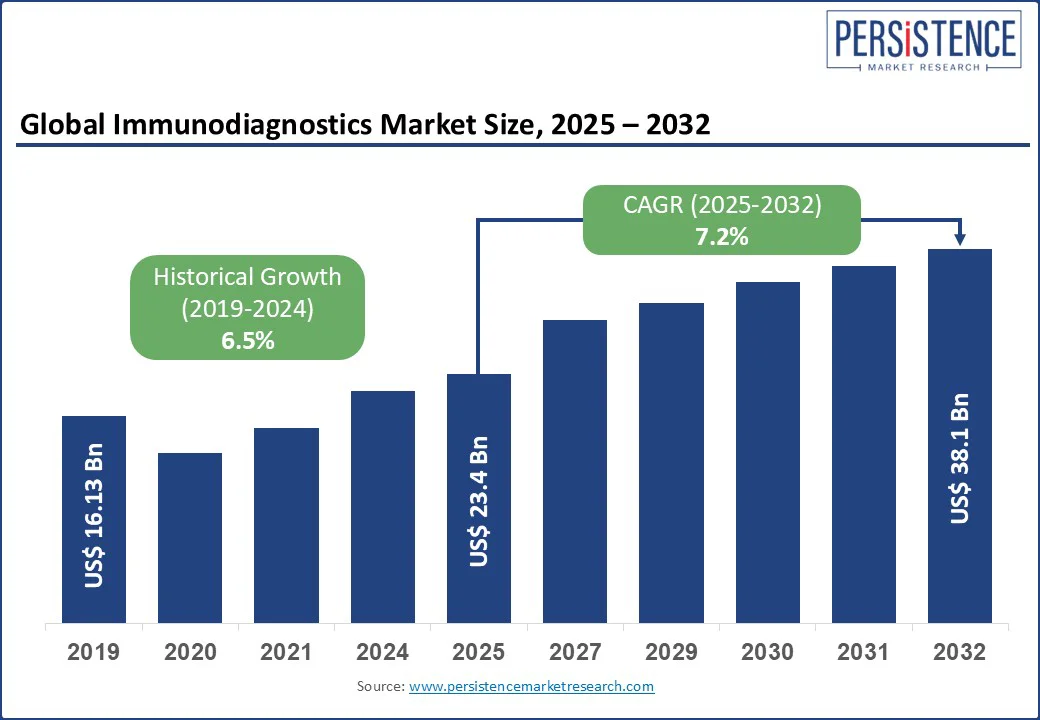

The immunodiagnostics market size is likely to be valued at US$ 23.4 Bn in 2025 and is estimated to reach US$ 38.1 Bn in 2032, growing at a CAGR of 7.2% during the forecast period 2025-2032. Immunodiagnostics has emerged as a key segment in the clinical diagnostics market, delivering high-sensitivity and quick detection of disease-specific biomarkers. The field is witnessing rising investments due to increasing demand for early disease identification, personalized treatment options, and decentralized testing models. Immunodiagnostic platforms are playing a key role in transforming diagnostic strategies for both public health systems and private healthcare networks. As global health priorities shift toward preventive care, immunodiagnostics is increasingly positioned as a core revenue stream for diagnostics firms.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Immunodiagnostics Market Size (2025E) |

US$ 23.4 Bn |

|

Market Value Forecast (2032F) |

US$ 38.1 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

7.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

6.5% |

Increasing prevalence of HIV, cancer, hepatitis, and respiratory infections is boosting the immunodiagnostics market growth. These diseases require early and accurate detection, which immunoassays are uniquely positioned to deliver. For example, immunoassays help detect low levels of HIV p24 antigen and HIV-1/2 antibodies during the early stages of infection. Cancer is a key market growth driver. As global cancer cases continue to rise, healthcare providers are turning to immunodiagnostics for tumor marker screening and therapy monitoring.

Hepatitis B and C are also pushing demand, especially in Asia Pacific where prevalence remains high. The World Health Organization’s (WHO) 2025 strategy emphasizes early detection through HBsAg and anti-HCV antibody testing. Vietnam followed this recommendation by launching a national hepatitis B screening campaign in 2024. It deployed more than 500,000 rapid immunoassay kits to test pregnant women within six months.

Cross-reactivity with similar antigens is a key challenge in immunodiagnostics, as it can lead to false-positive results and reduce diagnostic accuracy. The issue is hampering growth in regions where multiple pathogens with overlapping antigenic structures are prevalent. For example, in tropical countries, co-circulating viruses such as dengue, Zika, and chikungunya share structural similarities that often confuse antibody-based assays.

Such diagnostic ambiguity is not limited to infectious diseases. In autoimmune and allergy testing, antigens with partial homology can also trigger non-specific antibody binding. A 2025 study published in Clinical Chemistry and Laboratory Medicine revealed that thyroid peroxidase (TPO) antibody assays showed interference in patients with rheumatoid factors. These inaccuracies often delay correct treatment, specifically when immunoassays are used as standalone diagnostics without molecular confirmation.

The emergence of bead-based AlphaLISA technology is creating new possibilities in immunodiagnostics. It is enabling high-sensitivity and no-wash assays suitable for low-volume and high-throughput testing environments. AlphaLISA or Amplified Luminescent Proximity Homogeneous Assay allows for a single-step workflow with chemiluminescent signal generation. This feature drastically reduces assay time and improves automation compatibility, making it suitable for screening large sample sets.

One of the most significant advantages of AlphaLISA is its capacity to detect analytes at femtogram levels without interference from complex biological matrices. This makes it useful in applications such as autoimmune disease diagnostics, where signal noise often complicates results. AlphaLISA is also well-suited for multiplexing, allowing simultaneous measurement of several biomarkers from a small volume of sample. This is important in infectious disease testing, where multiple immune responses require quick assessment.

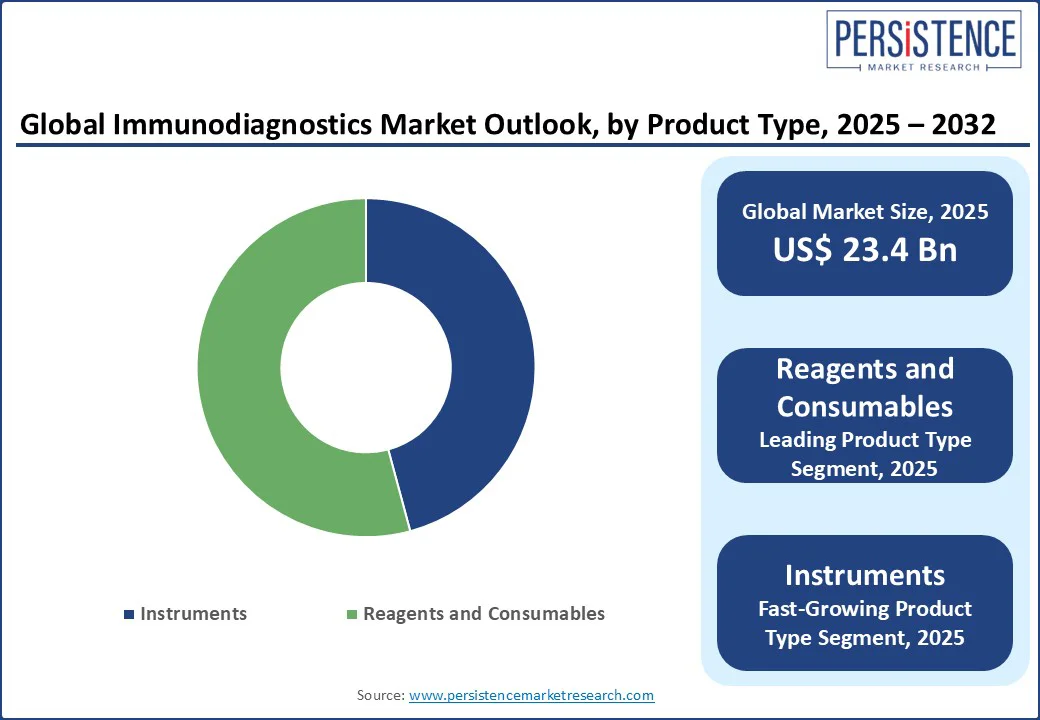

In terms of product type, the market is bifurcated into instruments and reagents and consumables. Out of these, reagents and consumables are estimated to hold about 54.2% of the immunodiagnostics market share in 2025 with their recurring use across a wide range of testing applications. This makes them the primary revenue driver for diagnostic companies. Dominance is also bolstered by the proprietary nature of several reagent formulations, which ties customers to specific platforms.

Instruments are gaining momentum because they serve as the technological backbone enabling assay automation, high-throughput processing, and integration with Laboratory Information Systems (LIS). These systems help in executing complex panels, tracking reagent usage, reducing contamination risk, and auto-validating results in real time. Increasing demand for integrated platforms that combine immunoassays with other diagnostic modalities is also pushing instrument sales.

Based on application, the market is divided into infectious diseases, oncology and endocrinology, bone and mineral diseases, autoimmunity disorders, cardiac biomarkers, drug monitoring, and others. Among these, the oncology and endocrinology segment is poised to account for nearly 29.5% of share in 2025 due to the clinical shift toward early detection of cancer biomarkers mainly in asymptomatic or high-risk populations. Immunoassays are ideal for this as they help detect minute concentrations of tumor-associated antigens such as prostate-specific antigen.

Infectious diseases are speculated to see considerable growth owing to the mutation of known pathogens. Additionally, the global rise in antimicrobial resistance and persistent gaps in early-stage detection are anticipated to bolster growth. Investments in immunodiagnostic infrastructure aimed at respiratory viruses, endemic, and emerging infections have increased following the COVID-19 pandemic. The World Health Organization's 2025 priority pathogen list has raised the focus on rapid diagnostics for TB, HIV, malaria, and viral hepatitis.

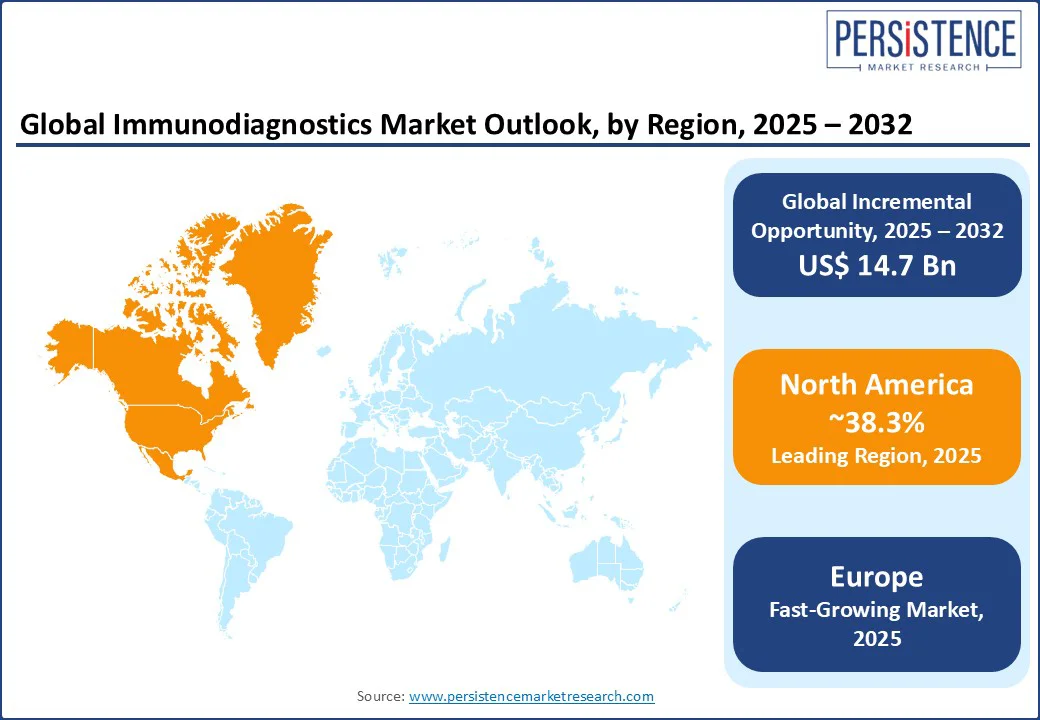

In 2025, North America is projected to account for approximately 38.3% of share due to the ongoing shift toward automation, multi-disease panels, and precision-based applications. The U.S. immunodiagnostics market is expected to dominate through 2032 with increasing investment by domestic players in high-throughput chemiluminescence and immunoassay platforms made for hospital labs. In 2024, for example, Abbott received FDA clearance for an upgraded version of its Alinity i immunoassay analyzer. It is capable of processing over 170 tests per hour with integrated quality controls.

There is also a surge in the use of immunodiagnostics in decentralized care models. It is supported by increasing adoption of point-of-care (POC) and home-based diagnostics. Expanded insurance coverage for infectious disease and cardiac marker tests is another prominent factor boosting growth. The U.S. is further experiencing increasing research and development activities in the field of multiplexed testing. Researchers at Emory University, for instance, recently developed a portable paper-based immunoassay capable of simultaneously detecting HIV, syphilis, and hepatitis B from a single finger-prick.

Europe’s market is mainly propelled by a move toward value-based diagnostics, population screening programs, and region-specific disease detection. Germany, France, and the U.K. are emphasizing early diagnosis of chronic and infectious diseases through nationwide screening initiatives. The U.K. National Health Service (NHS), for example, recently expanded its use of immunoassays for early cancer detection and cardiovascular biomarkers under its Genomic Medicine Service. It utilizes novel protein-based assays in routine screening.

Regulatory harmonization across the EU under the In Vitro Diagnostic Regulation (IVDR) has also changed the commercial landscape. Companies must now present powerful clinical evidence for their immunoassay kits, leading to the withdrawal of several CE-marked legacy tests. Hence, companies such as Siemens Healthineers and DiaSorin are launching IVDR-compliant assays. Poland and Romania are experiencing steady growth due to increased public health investments post-COVID.

In Asia Pacific, the market is witnessing considerable growth augmented by increasing public health initiatives, rising non-communicable disease prevalence, and local manufacturing capacity expansion. China remains at the forefront, with companies such as Mindray and Snibe launching Chemiluminescence Immunoassay (CLIA) analyzers across secondary and tertiary hospitals. In early 2025, for example, Snibe introduced its MAGLUMI X9 platform, a high-throughput, fully automated CLIA system capable of processing up to 720 tests per hour.

India is emerging as a prominent hub for both production and consumption. The National Health Authority's rollout of diagnostics under Ayushman Bharat is spurring demand for cost-effective immunoassays for hepatitis, tuberculosis, and HIV. In 2024, Agappe Diagnostics collaborated with Japan’s Fujirebio to launch CLEIA platforms catering to labs in India. In addition, local players are benefiting from the government’s Production Linked Incentive (PLI) scheme. It has boosted investment in diagnostic manufacturing parks in states such as Telangana and Gujarat.

The immunodiagnostics market houses several large-scale diagnostic firms and emerging biotech companies, each striving to innovate in terms of assay sensitivity, speed, and automation. Key players are dominating through extensive test portfolios and integrated laboratory platforms. They are also investing huge sums in research and development activities. They are often first to market with high-throughput immunoassay systems that combine immunodiagnostics with AI-based result interpretation. There is increasing activity from mid-sized players and start-ups targeting niche applications such as autoimmune disorders and point-of-care (POC) diagnostics.

The immunodiagnostics market is projected to reach US$ 23.4 Bn in 2025.

Rising demand for home-based immunodiagnostic kits and increasing number of diagnostic labs globally are the key market drivers.

The immunodiagnostics market is poised to witness a CAGR of 7.2% from 2025 to 2032.

Licensing of proprietary reagents and custom immunoassay development services for pharma clinical trials are the key market opportunities.

Abbott, Roche Diagnostics, and DiaSorin are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Technology

By Application

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author