ID: PMRREP33716| 199 Pages | 27 Jan 2026 | Format: PDF, Excel, PPT* | Food and Beverages

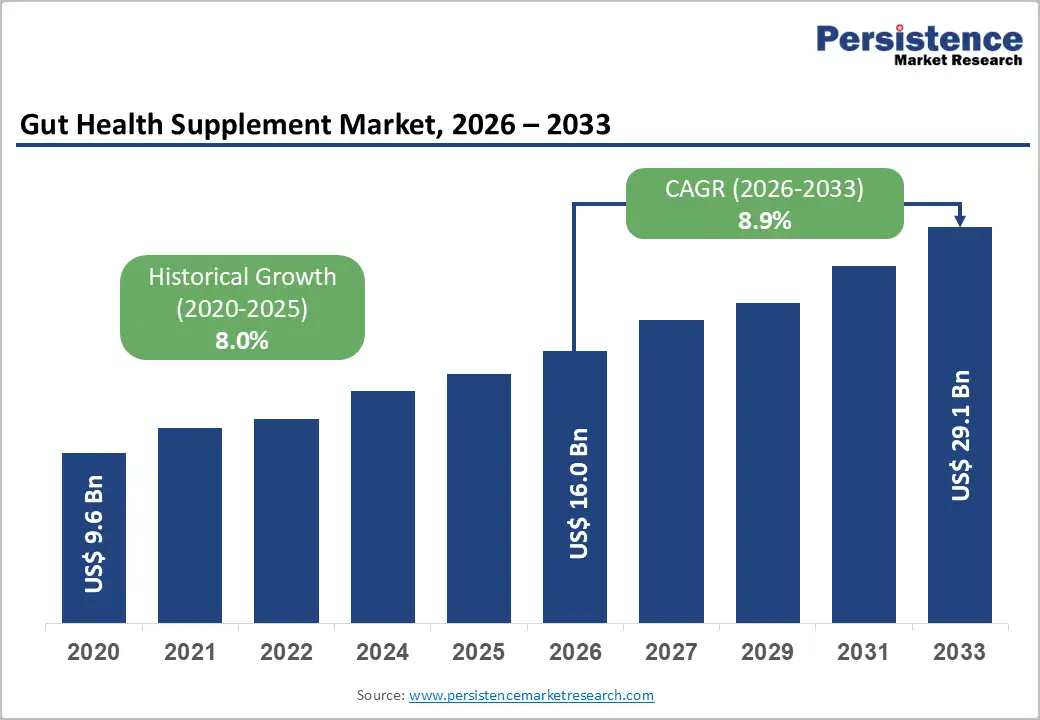

The global gut health supplement market size is estimated to grow from US$ 16.0 billion in 2026 to US$ 29.1 billion by 2033. The market is projected to grow at a CAGR of 8.9% from 2026 to 2033.

The gut health supplement market is growing steadily, driven by rising awareness of digestive health, the increasing prevalence of gut-related disorders, and the growing adoption of preventive healthcare. Asia-Pacific dominates the market and is also the fastest-growing region, supported by changing lifestyles, expanding nutraceutical retail and e-commerce channels, rising disposable incomes, and increasing consumer focus on probiotics, prebiotics, and overall gut wellness.

| Global Market Attributes | Key Insights |

|---|---|

| Global Gut Health Supplement Market Size (2026E) | US$ 16.0 Bn |

| Market Value Forecast (2033F) | US$ 29.1 Bn |

| Projected Growth (CAGR 2026 to 2033) | 8.9% |

| Historical Market Growth (CAGR 2020 to 2025) | 8.0% |

The prevalence of digestive disorders worldwide has been increasing significantly, underscoring the growing need for gut health support products. Functional gastrointestinal disorders (FGIDs), which include conditions like irritable bowel syndrome (IBS) and functional dyspepsia, affect large portions of the global population. Estimates indicate that IBS affects roughly 9-11% of people globally, while functional dyspepsia affects about 7%, with broad variations by region and diagnostic criteria. In comprehensive surveys, 33-50% of individuals meet criteria for at least one gut-related disorder, demonstrating a substantial burden on public health systems and quality of life.

In specific national contexts such as the United States, digestive diseases collectively impact 60-70 million people, with millions of physician visits and emergency room admissions each year for conditions like ulcers, IBS, and reflux. In addition, 20% of adults report gastroesophageal reflux disease (GERD) symptoms, and chronic constipation affects tens of millions more. These high prevalence rates have translated into increased consumer interest in preventive and supportive approaches, including probiotics, prebiotics, enzymes, and other gut health supplements. The growing incidence and public awareness of these digestive issues are key drivers behind the expanding demand for gut health supplement products worldwide.

The pricing of premium gut health supplements, especially those with specialized probiotic strains or clinically validated formulations, creates a significant barrier for many consumers. In markets like India, probiotic supplements can average around INR 1,500 per month, a price point that is high relative to many basic food items and beyond the reach of middle and lower-income consumers. Lack of insurance coverage or subsidies means individuals must pay the full cost out of pocket, which limits regular use of these products for preventive or ongoing gut health support. Price sensitivity particularly constrains accessibility in rural and semi-urban regions where discretionary health spending is lower.

In the United States, supplement users report median monthly expenditures of about US$48-50, with spending on premium formulations rising to US$75-100 among those buying through healthcare providers or specialty retailers. This reflects how higher costs for quality, branded, or clinically supported gut health products can deter broader adoption, particularly among cost-conscious consumers. With nearly three-quarters of American adults using supplements and a notable portion citing cost as a barrier, expense remains a restraint on market expansion, especially for high-end gut health supplements that require sophisticated production and clinical substantiation.

Consumer and clinical interest in synbiotics, combinations of probiotics and prebiotics that work synergistically to support beneficial gut bacteria, has increased notably as awareness of gut microbiome science grows. Data from the U.S. National Health and Nutrition Examination Survey (NHANES) show that use of non-food probiotic, prebiotic, and synbiotic supplements has increased up to three-fold in recent years, with synbiotic use identified across age groups and linked to maintenance of digestive health. Individuals most likely to consume these products include older adults and those with higher levels of education and income, indicating broader public recognition of gut health benefits.

Emerging science also highlights postbiotics, non-viable microbial products and metabolites, as desirable due to their stability and safety compared with live probiotics. Researchers note that postbiotics and synbiotics modulate the gut microbiota, support the intestinal barrier, and regulate the immune system, with growing clinical interest in their roles across conditions ranging from metabolic syndrome to immune-mediated disorders. Although not centralized in government databases, multiple peer-reviewed studies underscore that these biotics provide actionable health benefits by influencing gut microbial composition and its metabolic outputs, reinforcing consumer and clinical demand for advanced gut health supplements.

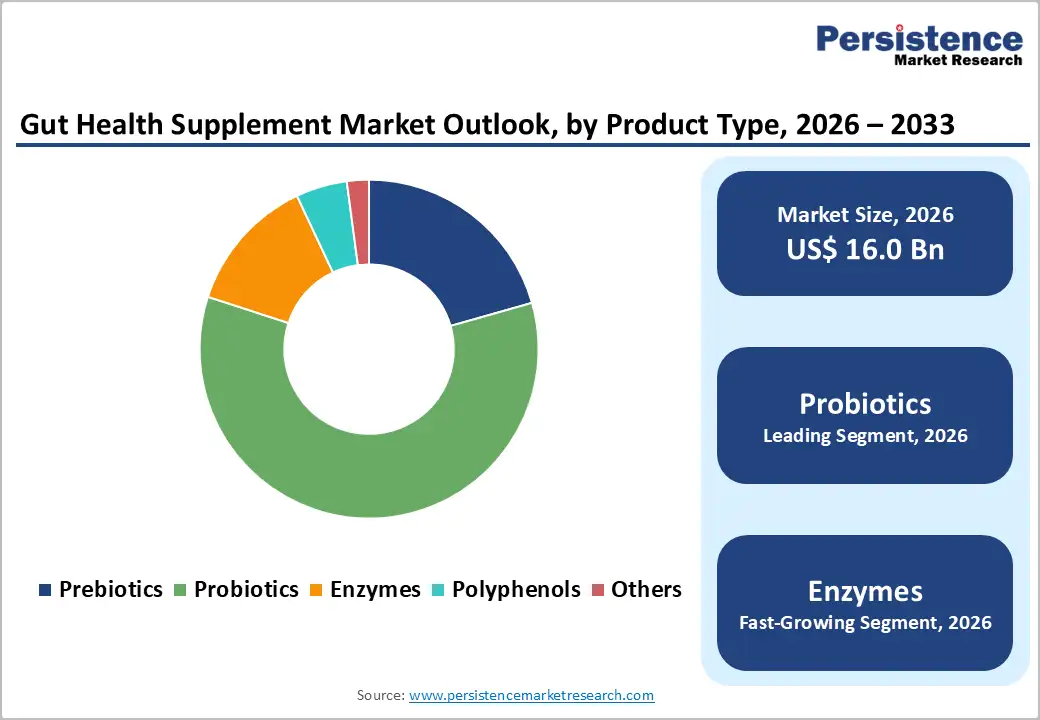

Probiotics products accounted for 59.4% of the global market in 2025, as they are the most widely recognized and commonly consumed category of gut-supporting products, backed by broad consumer familiarity and clinical relevance. Probiotic use has increased significantly over recent decades, with prevalence rising up to threefold for non-food probiotic products as consumers increasingly take them for digestive and general health support. Furthermore, surveys indicate that more than half of Americans incorporate probiotics into their diets specifically to support gut health and immunity, reflecting strong consumer belief in their benefits. With familiar strains like Lactobacillus and Bifidobacterium present in foods and supplements, probiotics have become the default supplement choice for individuals seeking natural digestive support.

Capsules dominate the gut health supplement market because they combine convenience, stability, and consumer familiarity, making them the preferred delivery format for probiotics, enzymes, and prebiotics. Capsules protect sensitive ingredients from degradation by stomach acid, improving viability and effectiveness, particularly for live microorganisms such as probiotic strains. Data from dietary supplement usage surveys show that pills and capsules are the most commonly consumed formats, with over 70% of adult supplement users reporting use of pill-based products for digestive health. Capsules also support controlled dosing and a longer shelf life than liquids, while being easier to transport and store. This aligns with consumer preference for simple, once-a-day dosing routines, reinforcing their dominant position in the gut health supplement market.

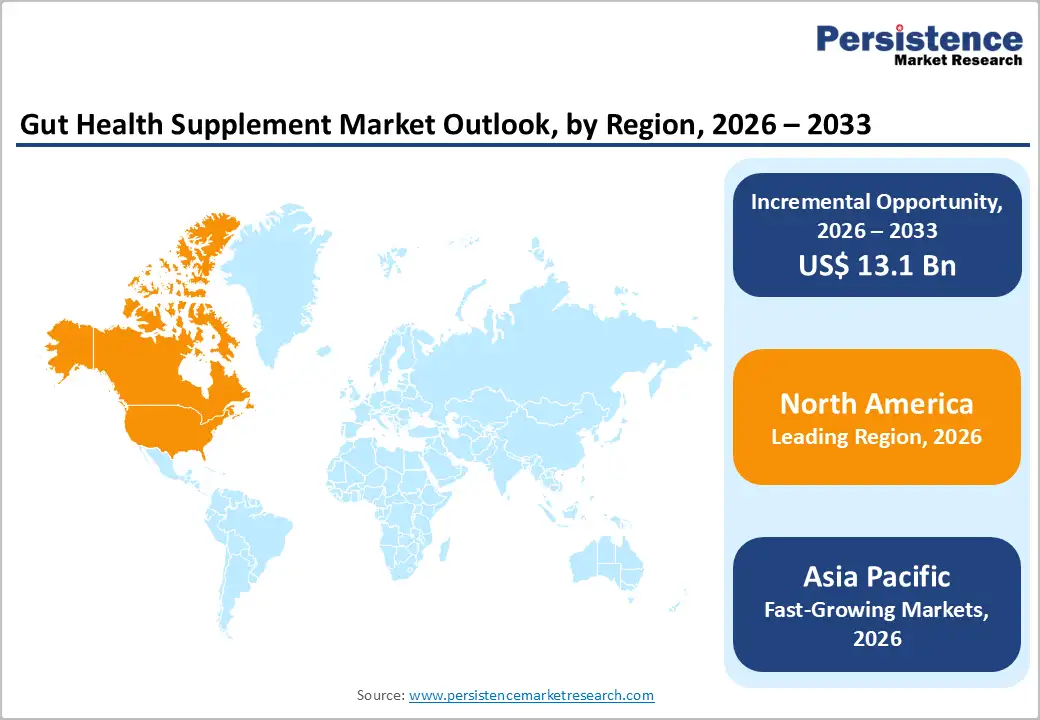

North America dominates the gut health supplement market with a 39.3% share in 2025, driven by high consumer health awareness, widespread supplement use, and strong preventive healthcare trends. In the United States, nearly 77% of adults reported taking dietary supplements in the past year, with digestive health products among the most common. Large portions of the population experience gastrointestinal issues, and an estimated 60-70 million Americans are affected by digestive diseases, driving proactive supplement consumption. Well-established retail and pharmacy networks, combined with robust e-commerce growth, ensure easy access to a diverse range of gut health products. Additionally, regulatory frameworks that enable clear labeling and health education campaigns increase consumer confidence in supplements, further reinforcing North America’s leadership in global demand for gut health supplements.

Europe is an important region in the gut health supplement market because of high consumer health awareness, an aging population, and strong regulatory support for nutraceutical products. Across the European Union, dietary supplements are widely used, with surveys showing that over 50% of adults in countries such as Germany, France, and the UK regularly take supplements, particularly for digestive and immune health. Functional gastrointestinal disorders are prevalent, with studies estimating that up to 40% of Europeans experience at least one chronic digestive symptom, which drives demand for probiotics, prebiotics, and enzyme supplements. Well-established healthcare systems, clear labeling regulations, and growing e-commerce channels further support market growth, positioning Europe as a key global region for gut health products.

Asia Pacific is the fastest-growing region in the gut health supplement market, driven by rising health awareness, expanding middle-class incomes, and increasing supplement adoption. In countries like China and India, rapid urbanization has shifted diets toward processed and low-fiber foods, contributing to gastrointestinal concerns; surveys indicate that up to 25-30% of urban adults in these markets report frequent digestive issues, prompting preventive supplement use. Growing internet penetration and e-commerce have made health products more accessible, with online retail sales expanding at double-digit annual rates. Additionally, public health campaigns and greater media focus on gut microbiome science are increasing consumer understanding of probiotics and prebiotics, further accelerating demand across the region’s large populations.

Leading companies in the gut health supplement market focus on high-quality, effective, and innovative products. Investments target ingredient quality, functional formulations, and product variety. R&D emphasizes efficacy, safety, and consumer-friendly formats, while collaborations with nutritionists and healthcare experts enhance trust and adoption. These strategies drive market growth, innovation, and wider global consumption of gut health supplements.

The global gut health supplement market is projected to be valued at US$ 16.0 Bn in 2026.

Rising digestive disorders, preventive healthcare awareness, aging population, and increasing demand for probiotics and prebiotics.

The global gut health supplement market is poised to witness a CAGR of 8.9% between 2026 and 2033.

Growth in synbiotics, postbiotics, personalized supplements, clean-label products, innovative formats, and emerging Asia-Pacific markets.

Alltech, International Flavors & Fragrances (IFF), Anovite, Nestle Health Science, Pfizer Inc., Bayer AG.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis |

|

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Form

By Sales Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author