ID: PMRREP33113| 191 Pages | 20 Jan 2026 | Format: PDF, Excel, PPT* | Healthcare

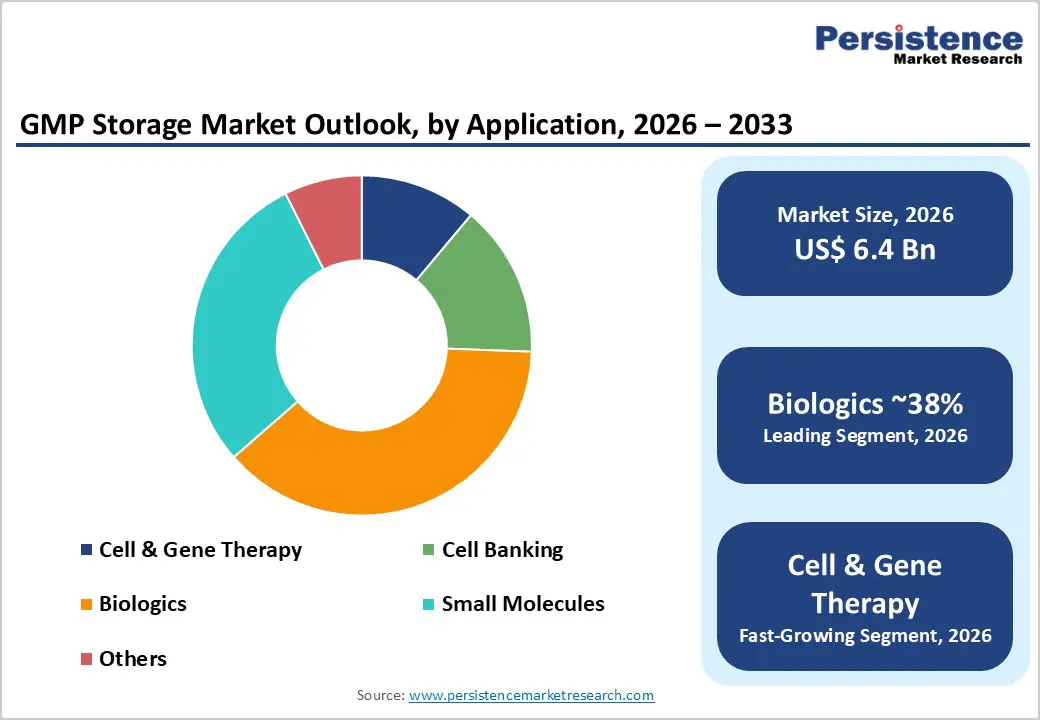

The global GMP storage market size is estimated to grow from US$ 6.4 billion in 2026 to US$ 9.4 billion by 2033. The market is projected to record a CAGR of 5.6% during the forecast period from 2026 to 2033.

Good Manufacturing Practice (GMP) storage plays a critical role in supporting research and development activities across the pharmaceutical and biopharmaceutical industries. It ensures that temperature-sensitive biological materials, including cell therapies, vaccines, blood derivatives, and research reagents, are stored under controlled and validated conditions. By minimizing risks related to contamination, degradation, and product mix-ups, GMP storage safeguards product quality and supports regulatory compliance throughout early-stage and advanced R&D processes.

With increasing outsourcing of drug development and manufacturing to CDMOs, demand for flexible and scalable GMP storage solutions is rising. Both GMP storage products, such as biomedical refrigerators and ultra-low freezers, and GMP storage services offering multi-temperature environments are essential to maintain material integrity. These solutions help prevent costly losses, support uninterrupted R&D workflows, and enable efficient progression from research to commercialization.

| Key Insights | Details |

|---|---|

| GMP Storage Market Size (2026E) | US$ 6.4 Bn |

| Market Value Forecast (2033F) | US$ 9.4 Bn |

| Projected Growth (CAGR 2026 to 2033) | 5.6% |

| Historical Market Growth (CAGR 2020 to 2025) | 4.8% |

Technological advancements are reshaping the biomedical cold storage landscape, driving a shift from traditional equipment to cutting-edge, energy-efficient systems that deliver superior performance and stability. Modern biomedical refrigerators and freezers now feature smart technologies such as IoT-enabled monitoring, remote diagnostics, and advanced digital controls, which significantly reduce energy consumption and minimize temperature fluctuations that can compromise sensitive biological materials. As of 2024-2025, innovations in ultra-low temperature freezers and eco-friendly refrigeration solutions are widely adopted across pharmaceutical, research, and clinical settings, reflecting strong industry demand for precision and sustainability in cold storage infrastructure. These innovations support stringent regulatory compliance and help maintain sample integrity, which is critical for biologics, cell therapies, and vaccines.

Major industry players including Thermo Fisher Scientific, Eppendorf AG, BioLife Solutions, and others are intensifying R&D investment to enhance product portfolios with advanced cooling technologies and intelligent control systems. For example, Thermo Fisher launched new ultra-low temperature freezers with enhanced energy efficiency and smart monitoring capabilities in 2024, while PHC Corporation released energy-efficient ultra-low temperature units in early 2025. These developments are boosting adoption rates of advanced cold-chain storage equipment, expanding market growth, and enabling scalable solutions for CDMOs and biopharma companies facing temperature-sensitive supply chain challenges. As cold storage requirements grow with increasing biologics production, the integration of sophisticated technologies will continue to be a key driver of market expansion.

The pharmaceutical industry is growing exponentially based on the launch of user-friendly products. The demand is surging for good storage practices for product integrity. The mandate is to follow specific storage conditions underscoring supply efficiency. Additionally, to meet the production rate for biopharmaceutical products, setting up an advanced infrastructure adds latency in the process. Compliance with the standards of the storage conditions requires heavy capital. The amount of energy consumed by such a vast build-up is also expensive.

The advanced technologies implemented to make it a growing market sector, such as real-time monitoring of products, multiple inspections, and cloud-based solutions, are pricey. The maintenance of such facilities and the continuous requirement of power supply add up to the cost of the service for manufacturers. Some Australian cold storage businesses have stated that, with increasing electricity network charges, energy costs account for up to 30% of their earnings before interest, taxes, depreciation, and amortization. Maintaining the quality of the products after manufacturing until the end-user receives them is expensive. Thus, a reduction in the cost of the products by manufacturers is a major challenge.

A significant growth opportunity exists in the adoption of digitalized, energy-efficient, and automated GMP storage solutions as biopharmaceutical companies increasingly prioritize operational efficiency and regulatory compliance. Advanced storage systems equipped with real-time temperature monitoring, automated alarms, and remote data access help reduce human intervention, lower energy consumption, and ensure consistent storage conditions. These solutions are particularly attractive for CDMOs and research facilities managing high volumes of temperature-sensitive materials, as they minimize product loss, improve audit readiness, and support uninterrupted manufacturing and clinical development activities.

Another major opportunity stems from the rapid expansion of cell and gene therapy manufacturing and regional biomanufacturing hubs, especially in the Asia Pacific region. Countries such as China, Japan, India, and Singapore are making substantial investments in GMP-compliant facilities, innovation parks, and clinical research centers focused on regenerative and personalized medicine. This expansion is driving demand for cryogenic storage, ultra-low temperature freezers, and validated biobanking infrastructure. As these facilities increasingly support multinational clinical trials and global supply chains, demand for standardized GMP storage products and services aligned with international regulatory expectations is expected to rise steadily.

Among the GMP storage market, products remain the dominant category, accounting for nearly 83% of total revenue in 2025. This segment comprises biomedical refrigerators, standard and ultra-low temperature freezers, and cryogenic storage systems that form the core infrastructure for GMP-compliant storage. These products are critical for maintaining validated temperature conditions for biologics, vaccines, cell therapies, plasma derivatives, and reference samples across manufacturing and quality control operations. Demand is reinforced by frequent facility upgrades driven by tightening GMP and GDP requirements, as well as the expansion of specialized applications such as tissue banking, plasma fractionation, and advanced therapy medicinal product (ATMP) handling. Although GMP storage services are gaining traction due to outsourcing and capacity flexibility needs, capital expenditure on high-performance refrigeration and cryogenic equipment remains essential. As a result, products continue to generate the largest revenue share and are expected to anchor GMP storage infrastructure throughout the forecast period.

By application, biologic storage represents the largest segment of the global GMP storage market, holding an estimated 38% share in 2025. Biologics, including monoclonal antibodies, recombinant proteins, and complex vaccines, dominate pharmaceutical development pipelines and commercial sales worldwide. These products typically require strict refrigerated or frozen storage throughout manufacturing, packaging, and distribution to preserve stability and efficacy. The growing adoption of long-acting formulations, subcutaneous biologics, and combination therapies has increased the volume and complexity of biologic inventories, intensifying the need for GMP-validated cold rooms, freezers, and continuous monitoring systems. In parallel, the rapid expansion of biosimilars, particularly in Europe and the Asia Pacific, is placing additional pressure on manufacturers and distributors to scale biologic-dedicated storage capacity. Meanwhile, cell and gene therapy applications represent the fastest growing segment, driven by rising clinical activity and commercialization, although biologics continue to lead in overall market share.

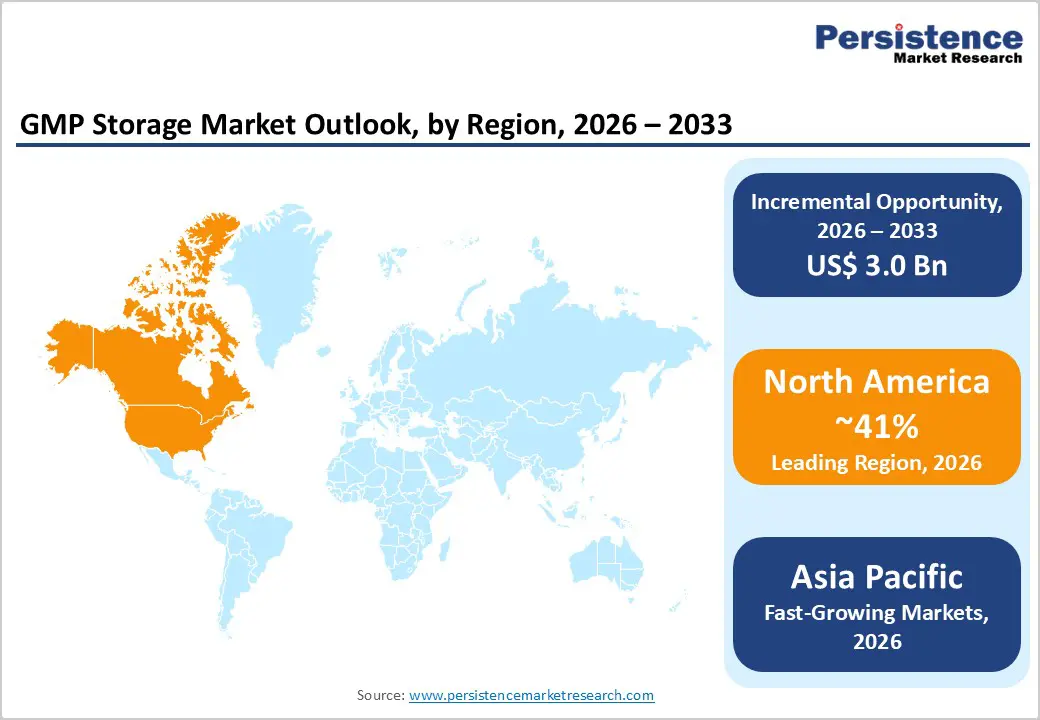

North America leads the global GMP storage market, with the U.S. as the primary driver due to its dense network of biologics manufacturers, advanced therapy companies, CDMOs, and GMP-compliant cell banking facilities. The region benefits from a strong innovation ecosystem, high R&D expenditure, and rapid regulatory approvals of cell and gene therapies under frameworks such as the FDA’s regenerative medicine and breakthrough therapy designations. These factors intensify the demand for robust cryogenic and refrigerated storage solutions that maintain product integrity. Strict enforcement of GMP, GDP, and 21 CFR Part 11 regulations further accelerates the adoption of validated storage systems equipped with continuous temperature monitoring, electronic record keeping, and comprehensive qualification documentation.

Outsourcing of biologics production and cell banking to North American CDMOs has significantly increased cryogenic storage requirements, with some expansions involving capital investments exceeding US$1 billion. Additionally, the growth of specialized logistics providers offering integrated cryogenic shipping, temporary storage, and chain-of-identity tracking near clinical hubs is boosting demand for modular GMP storage units. These factors, combined with technological leadership and a large pipeline of high-value biologic and ATMP products, ensure North America maintains a dominant share of the global GMP storage market.

The Asia Pacific region is emerging as the fastest growing market for GMP storage, driven by rapid expansion in biomanufacturing across China, Japan, India, and ASEAN economies. Government initiatives promoting local production of vaccines, biologics, and cell therapies through financial incentives, innovation parks, and regulatory reforms are encouraging the establishment of GMP-compliant facilities and technology transfers from multinational companies. Large-scale plasma and biologics production facilities in China and Singapore have increased freezer capacity by approximately 30% in recent years to support exports and regional supply chains. Additionally, the development of BSL-3 laboratories and clinical research centers is driving demand for ultra-low temperature and rapid-shock freezer units.

The region is also experiencing growth in cell banking outsourcing, including master and working cell banks and long-term storage for stem cells and cell therapy materials. Regulatory frameworks are increasingly aligning with U.S. and European GMP standards, including requirements for data governance and quality management in storage infrastructure. Lower manufacturing costs, participation in global clinical trials, and rising investment in cryogenic and automated storage solutions make Asia Pacific a key destination for new GMP storage deployments, ensuring strong market growth in the coming years.

The global GMP storage market is moderately fragmented, comprising major equipment manufacturers, specialized cryogenic technology providers, and regional storage and logistics service firms. Key players like Thermo Fisher Scientific, Sartorius, Danaher (Cytiva), and Eppendorf compete on product reliability, energy efficiency, temperature consistency, and digital monitoring features, while niche vendors offer high-performance cryogenic systems and customized validation services. Service providers differentiate through geographic reach, regulatory expertise, and integrated solutions covering storage, distribution, and quality testing. Common strategies include capacity expansion, acquisitions, partnerships with cell and gene therapy developers, and investment in connected smart storage platforms.

The global GMP storage market is projected to be valued at US$ 6.4 Bn in 2026.

Rising biologics production, stricter regulatory compliance, temperature-sensitive therapies, CDMO expansion, and growing cold-chain reliability requirements worldwide.

The global GMP storage market is poised to witness a CAGR of 5.6% between 2026 and 2033.

Digitalized storage systems, Asia Pacific biomanufacturing growth, cell and gene therapy scaling, automated monitoring, and energy-efficient infrastructure adoption.

North America is the leading region in the global GMP storage market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn and Volume (if Available) |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author