ID: PMRREP33684| 176 Pages | 29 Sep 2025 | Format: PDF, Excel, PPT* | Consumer Goods

The global furniture polish market size is likely to value at US$24.3 Bn in 2025 and is expected to reach US$39.3 Bn by 2032, growing at a CAGR of 7.1% during the forecast period from 2025 to 2032.

Rising consumer awareness of home maintenance and furniture durability drives growth. Higher disposable incomes and urbanization encourage investment in premium furniture, while households and commercial spaces increasingly adopt care products to preserve aesthetics, protect surfaces, and extend longevity.

| Key Insights | Details |

|---|---|

| Furniture Polish Market Size (2025E) | US$24.3 Bn |

| Market Value Forecast (2032F) | US$39.3 Bn |

| Projected Growth (CAGR 2025 to 2032) | 7.1% |

| Historical Market Growth (CAGR 2019 to 2024) | 5.6% |

Consumers are increasingly recognizing the importance of maintaining their homes and extending the lifespan of their furniture. Regular upkeep helps preserve aesthetics, prevents furniture damage, and reduces replacement costs. Higher disposable incomes and a growing preference for premium furniture have further fueled this trend.

Government initiatives promoting consumer rights and awareness have reinforced this behavior; for instance, the Department of Consumer Affairs, through its World Consumer Rights Day campaigns, highlights informed purchasing and responsible product use, demonstrating the benefits of proper home and furniture maintenance.

Additionally, programs such as the “Right to Repair” initiative encourage consumers to maintain and repair household items instead of replacing them, fostering a culture where furniture care is essential. Consequently, the demand for furniture polishes and maintenance products has risen, positioning them as practical tools for protecting investments and ensuring homes remain well-kept and durable.

The furniture polish market is facing restraints due to stringent environmental regulations and the increasing demand for eco-friendly alternatives. Many conventional polishes contain volatile organic compounds (VOCs) and chemicals that pose environmental and health risks, prompting governments to enforce strict guidelines on product composition and emissions. Compliance with these regulations adds to manufacturing costs and may limit the availability of certain chemical-based formulations.

Simultaneously, consumers are increasingly gravitating towards sustainable and non-toxic products, driving the industry toward natural or water-based furniture polishes. This shift challenges manufacturers to innovate and reformulate their offerings while maintaining performance standards. As a result, the sector faces pressure to balance regulatory compliance, consumer expectations, and profitability, which can slow growth in traditional polish segments.

The furniture polish market presents significant opportunities through expansion in commercial sectors and emerging markets. Rapid urbanization, growth in office spaces, hospitality infrastructure, and retail establishments is increasing the demand for furniture maintenance products to ensure durability and aesthetics. Commercial establishments, such as hotels, restaurants, and corporate offices, require regular upkeep of furniture, creating a steady demand for high-quality polishes and care solutions.

Emerging markets, particularly in the Asia Pacific, Latin America, and Africa, are witnessing a rise in disposable income and increased preference for premium furniture. This trend, combined with growing awareness about home maintenance, opens avenues for market penetration and product diversification.

Companies can leverage these opportunities by introducing region-specific formulations, affordable eco-friendly options, and strategic distribution channels, thereby driving growth and strengthening their presence in both commercial and residential segments.

In 2025, liquid furniture polishes hold the largest market share at around 50%, owing to their ease of application, affordability, and suitability for various furniture surfaces. They are favored for regular maintenance as they enhance shine, provide protective coatings, and ensure long-lasting results. The widespread availability of liquid polishes through both retail and online channels further reinforces their dominance among households and commercial users.

Aerosol furniture polishes are emerging as the fastest-growing segment. Their quick application, uniform coverage, and portability make them popular among urban consumers seeking convenience. Additionally, the introduction of eco-friendly and multi-surface aerosol formulations is accelerating adoption, driving rapid growth and creating new opportunities for manufacturers in the furniture polish market.

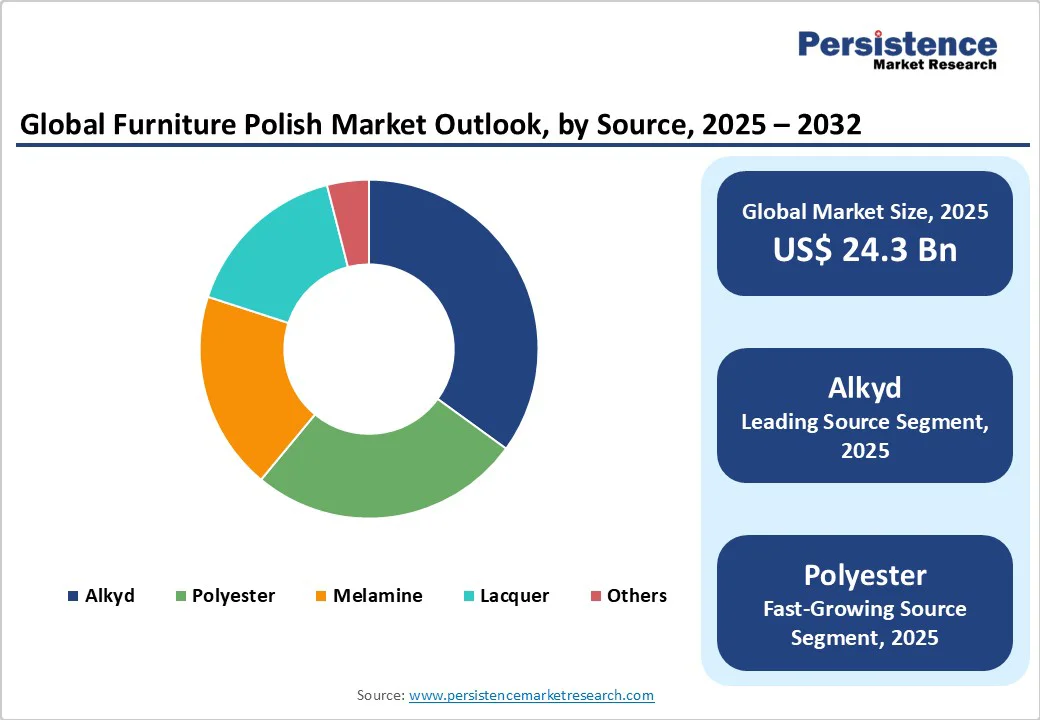

In 2025, alkyd-based furniture polishes lead with 35% market share. They are favored for their durability, smooth finish, and strong protective properties, making them a preferred choice for both residential and commercial furniture. Alkyd polishes provide long-lasting shine and resistance to scratches and stains, which sustains their demand across a wide range of consumers.

Polyester-based furniture polishes are the fastest-growing segment that are known for their high gloss, quick-drying capabilities, and superior wear resistance, polyester polishes are increasingly chosen by consumers seeking premium finishes. Manufacturers are also innovating with eco-friendly polyester formulations to meet rising consumer expectations. This combination of performance and sustainability is driving rapid adoption and expanding the segment in the furniture polish market.

In 2025, the household segment dominates the furniture polish market, accounting for nearly 45% share. Homeowners prefer furniture polishes for routine maintenance, protecting furniture from scratches, dust, and stains while enhancing its appearance. The accessibility of these products through retail stores and e-commerce platforms has reinforced their widespread adoption among domestic users, making households the largest end-use segment.

Furniture manufacturers represent the fastest-growing segment. Manufacturers are increasingly integrating polishes into their production and finishing processes to enhance product durability, appearance, and quality. Rising demand for premium and customized furniture, along with stringent quality standards, is driving the adoption of specialized polishes in commercial manufacturing. This trend offers significant growth potential for furniture polish producers targeting industrial clients.

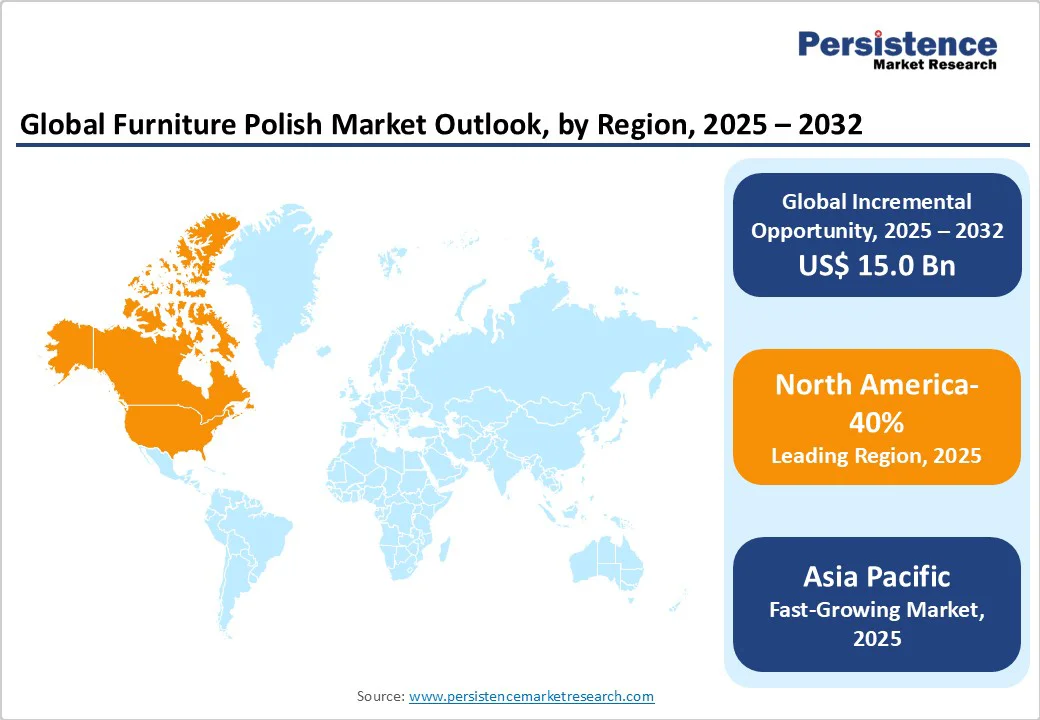

North America dominates the furniture polish market, accounting for approximately 40% share in 2025. This leadership is driven by high consumer awareness regarding home maintenance, widespread adoption of premium furniture, and a strong preference for quality care products. The presence of established manufacturers, advanced retail networks, and easy availability of both conventional and eco-friendly furniture polishes further support market growth.

Additionally, stringent quality standards and rising disposable incomes encourage consumers to invest in products that enhance durability and aesthetics. The combination of mature infrastructure, consumer spending power, and awareness about furniture care solidifies North America’s position as the leading regional market.

Europe accounts for a significant portion of the furniture polish market, supported by growing consumer awareness of home maintenance and a preference for high-quality furniture care products. The region’s emphasis on environmentally friendly and non-toxic formulations has encouraged the use of safer, innovative polishes.

Strong retail networks and easy availability of liquid and aerosol formats further drive adoption. Rising disposable incomes, urbanization, and the desire to maintain durable furniture also contribute to market growth. Overall, Europe’s focus on sustainability, quality standards, and consumer spending ensures it remains a key region in the global market.

Asia Pacific is the fastest-growing region in the furniture polish market, driven by rapid urbanization, rising disposable incomes, and increasing awareness of home maintenance. The growing middle-class population is investing in premium furniture, which has boosted demand for products that enhance durability and aesthetics.

The expansion of retail networks and the rise of e-commerce platforms have made furniture polish more accessible to consumers across urban and semi-urban areas. Additionally, manufacturers are introducing region-specific formulations and eco-friendly alternatives to cater to the evolving preferences of consumers. These factors, combined with the expansion of commercial sectors such as hospitality and offices, position the Asia Pacific as a high-growth market with significant potential for furniture polish manufacturers.

The global furniture polish market is highly competitive, characterized by continuous innovation, product differentiation, and strategic expansion. Companies focus on developing eco-friendly formulations, enhancing performance, and expanding distribution channels to strengthen market presence. Frequent product launches, partnerships, and marketing initiatives help firms capture consumer attention and maintain brand loyalty.

The industry is also witnessing competitive pricing strategies and regional customization to address diverse consumer preferences, driving overall growth while encouraging manufacturers to adopt sustainable practices and innovative solutions in both residential and commercial segments.

The furniture polish market is projected to reach US$24.3 Bn in 2025, driven by home maintenance and furniture durability needs.

Rising consumer awareness, urbanization, and demand for protective wood care products fuel market growth.

The furniture polish market will grow from US$24.3 bn in 2025 to US$39.3 bn by 2032, with a CAGR of 7.1%.

Expansion in commercial sectors and emerging markets drive opportunities for eco-friendly formulations.

Leading players include Liberon Limited, Reckitt Benckiser (Old English), S.C. Johnson (Pledge), Sherwin-Williams, PPG Industries, Akzo Nobel, Axalta, Masco Cabinetry, Chestnut Products, and Bona US.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Source

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author