ID: PMRREP33555| 179 Pages | 3 Sep 2025 | Format: PDF, Excel, PPT* | Consumer Goods

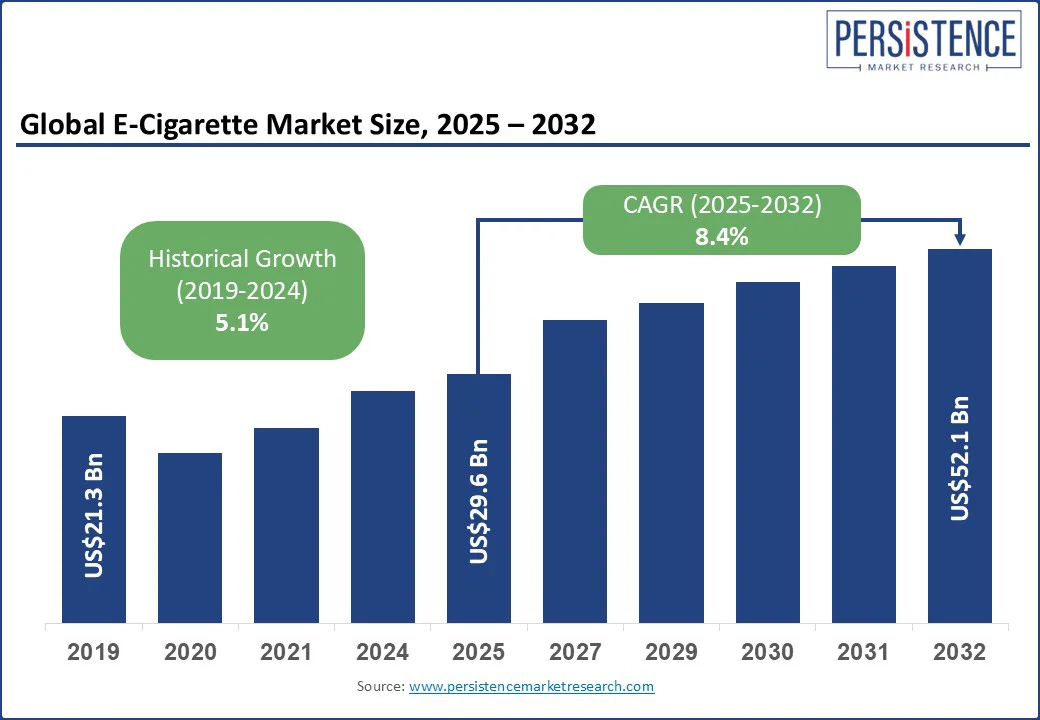

The global e-cigarette market size is likely to be valued at US$29.6 Bn in 2025 and is expected to reach US$52.1 Bn by 2032, growing at a CAGR of 8.4% during the forecast period from 2025 to 2032.

E-cigarettes are perceived as a lower-risk alternative to traditional tobacco smoking, supporting smokers reduce or quit combustible cigarettes.

Rising awareness of the health risks of smoking, along with changing lifestyle preferences and advancements in vaporizer technology that improve user experience and safety, is driving e-cigarette adoption.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

E-Cigarette Size (2025E) |

US$29.6 Bn |

|

Market Value Forecast (2032F) |

US$52.1 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

8.4% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.1% |

The rising demand among youth is significantly fueling the need for e-cigarettes, as these products are perceived as safer alternatives to traditional tobacco. Sleek device designs, vibrant packaging, and high-appeal flavors directly target adolescent and young adult preferences, making vaping more attractive.

Peer influence and the normalization of vaping through social media further amplify adoption, while youth-focused marketing strategies, such as event sponsorships and targeted digital campaigns, continue to drive market expansion, especially in North America and Europe.

The effect of these strategies is reflected in the 2024 National Youth Tobacco Survey (NYTS), which reported that approximately 1.63 million U.S. middle and high school students, representing about 5.9%, used e-cigarettes in the past 30 days.

Among those who reported use in 2024, 87.6% consumed flavored e-cigarettes, with fruit (62.8%), candy (33.3%), and mint (25.1%) being the most popular choices. This highlights the strong appeal of non-tobacco flavors, and the continued influence of product design and marketing is driving youth engagement with e-cigarettes.

Most e-cigarettes contain nicotine, a highly addictive substance with well-documented harms, especially for adolescents and young adults. According to the U.S. Centers for Disease Control and Prevention (CDC), nicotine can negatively affect brain development by impairing attention, learning, mood, and impulse control.

Youth may become addicted rapidly, even before using the product daily, and face a higher risk of progressing to other drug use or conventional cigarette smoking. The CDC also reports that over 80% of U.S. poison control center calls involving children under age five are linked to exposure to e-cigarette liquids, highlighting the acute toxicity risks these products pose.

Beyond nicotine, there is growing concern about the chemical composition of vaping aerosols. The World Health Organization (WHO) notes that e-liquids often contain flavoring agents, additives, and carriers, such as propylene glycol and vegetable glycerol, which can produce harmful compounds when heated; some of these compounds are toxic or even carcinogenic.

Both the U.S. FDA and CDC confirm that e-cigarette aerosols may contain cancer-causing chemicals, ultrafine particles, heavy metals, and volatile organic compounds. Even if present in lower concentrations than in traditional tobacco smoke, these substances still pose serious long-term health risks to users.

Innovations such as temperature control, Bluetooth connectivity, customizable nicotine delivery, and leak-proof designs have significantly elevated the user experience and strengthened the appeal of e-cigarettes. Responding to increasing consumer demand for smarter and safer alternatives to traditional tobacco, manufacturers are further incorporating advanced features such as puff monitoring, child-lock mechanisms, and app integration, ensuring greater convenience, control, and safety for users.

For instance :

Many users seek a more enjoyable and less harsh experience than what is typically associated with traditional tobacco. Flavors such as menthol, fruit blends, desserts, candy, and beverages have significantly contributed to the appeal of vaping products, especially among younger adults and first-time users.

These flavor options provide an alternative to the traditional tobacco taste, making the transition from combustible cigarettes to vaping more palatable for many users. Companies are continuously expanding their flavor portfolios to meet diverse consumer preferences and regional tastes, which has helped increase product differentiation in an increasingly competitive market.

For instance :

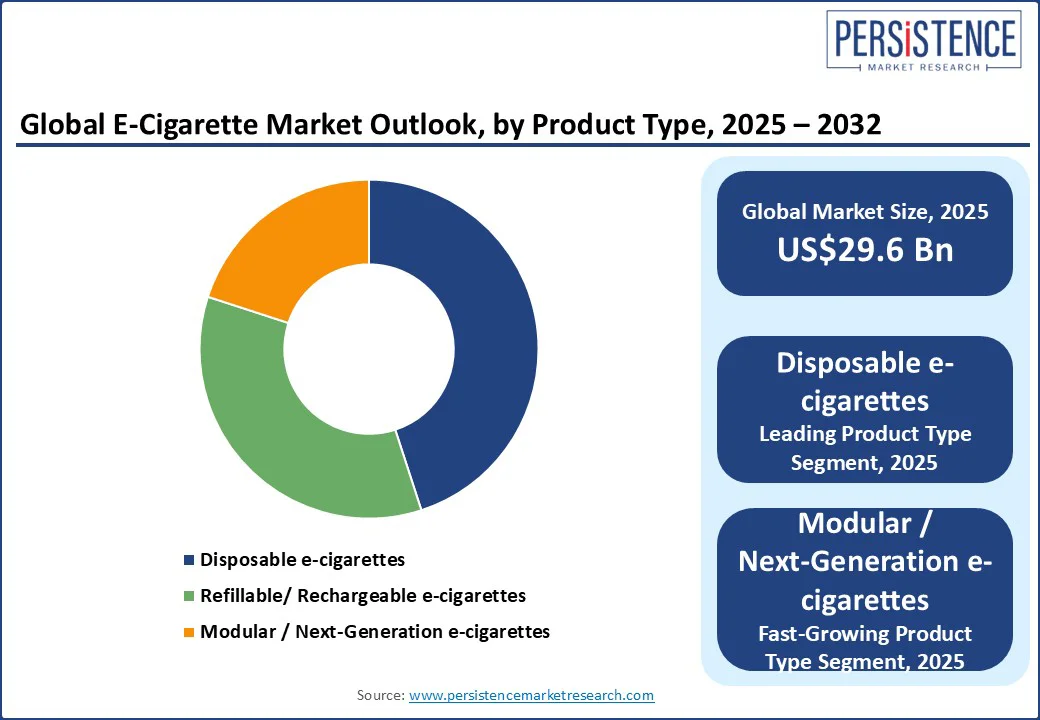

Based on product type, the market is segmented into disposable e-cigarettes, refillable/ rechargeable e-cigarettes, and modular/next?generation e-cigarettes. Among these, disposable e-cigarettes are expected to account for over 40% of the market by 2025.

This growth is driven by their affordability, ease of use, and wide availability across retail and online channels. They are particularly popular among first-time users and younger consumers who prefer hassle-free options that require no maintenance or refilling. The increasing variety of flavors and compact device designs further enhances their appeal.

For instance:

Next-generation (modular) e-cigarettes are projected to be the fastest-growing segment, due to rising demand for customizable and high-performance vaping experiences. With features such as refillable vape pods, adjustable settings, and extended battery life, they attract experienced users seeking greater control. Their long-term value and growing interest in personalization further accelerate global adoption.

Based on the distribution channel, the market is segmented into online and offline. Out of these, offline is expected to account for over 58% share in 2025 due to the personalized buying experience they provide. Consumers value the ability to physically inspect products, receive expert guidance, and access immediate after-sales support. Specialty e-cigarette stores, along with established retail networks and strong brand visibility, further strengthen offline sales by ensuring trust and convenience.

The online segment will grow at a significant rate due to consumer demand for convenience, wider product variety, and discreet purchasing. Brand websites and e-commerce platforms offer easy access, competitive pricing, and home delivery, while digital marketing and social media further enhance adoption, particularly among younger users.

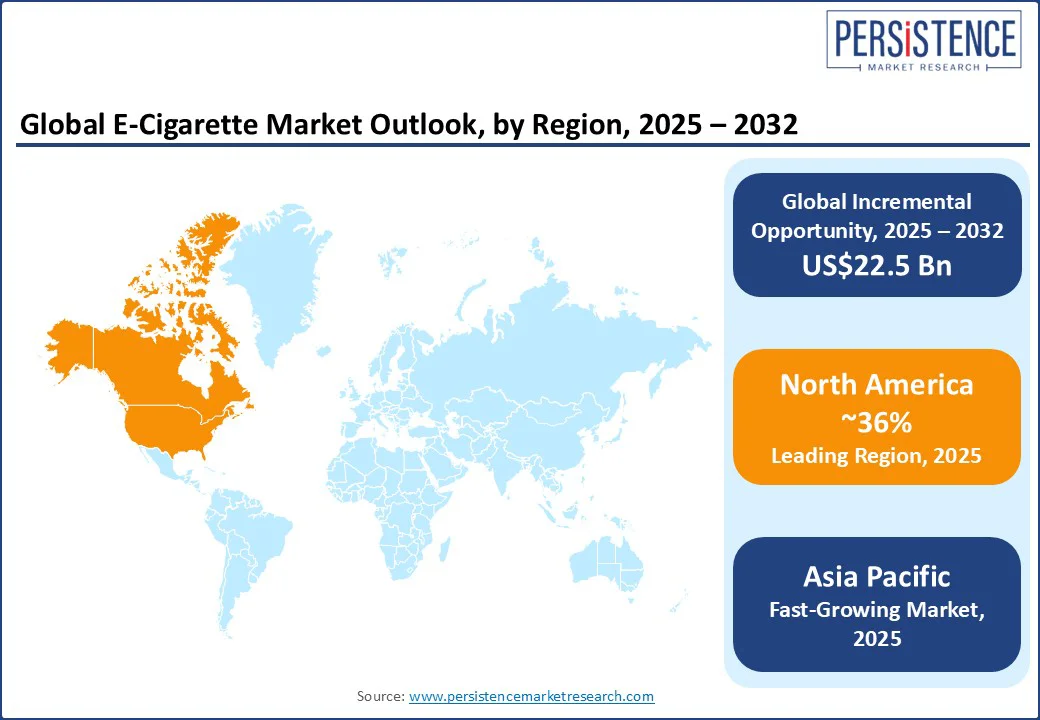

North America dominates the market with an estimated share of over 36%, primarily due to strong consumer adoption, favorable regulations, and the presence of leading international and domestic brands. According to the CDC, adult e-cigarette usage in the U.S. increased from 4.5% in 2019 to 6.5% in 2023, reflecting a steady upward trend.

Although youth usage has declined, falling from 7.7% of middle and high school students in 2023 to 5.9% in 2024, it still represents a significant portion of the market, especially driven by flavored products such as fruit, candy, mint, and menthol. More than 80% of e-cigarette unit sales during this period were linked to these flavors.

The U.S. regulatory framework has played a critical role in shaping the market. The Food and Drug Administration (FDA) has authorized only 34 e-cigarette products under its Premarket Tobacco Application (PMTA) process as of late 2024, reflecting efforts to balance product safety with market access. Enforcement efforts have intensified, including the formation of a multi-agency task force targeting illegal and unauthorized vaping products.

Asia Pacific is expected to grow at the highest rate, driven by a massive smokeless tobacco user base of nearly 280 million people, representing about 77% of global users. This creates significant potential for e-cigarette adoption as consumers seek alternatives to traditional tobacco. Rising urbanization, higher disposable incomes, and a tech-savvy population are boosting adoption, while flavored products, innovative devices, and expanding online sales channels increase appeal and accessibility.

Countries, including India and Nepal, targeting a 30% reduction in tobacco use by 2025, highlight the region’s shift away from traditional tobacco. Despite regulatory hurdles, such as bans or restrictions in India and Thailand, declining tobacco consumption and evolving regulations are expected to drive strong demand.

Europe is a key region in the e-cigarette market, driven by strict smoking regulations and public smoking bans that encourage vaping adoption. According to the ASH Smokefree GB Youth Survey 2025, 20% of 11- to 17-year-olds have tried vaping, approximately 1.1 million youths, with 7% currently using e-cigarettes. This shows that e-cigarettes have penetrated deeply across demographics, reaching both adults and young users.

Youth smoking rates have risen from 14% in 2023 to 21% in 2025, highlighting the complex dynamics of tobacco and nicotine product use in Europe. These factors, combined with the region’s established consumer base and regulatory frameworks, make Europe not only the largest market by volume but also strategically critical for global e-cigarette manufacturers navigating evolving public health policies.

The market is currently fragmented, with a diverse range of players. The ongoing regulatory developments and strategic initiatives by major companies indicate a potential shift toward consolidation in the future. Companies are focusing on product innovation, such as pod-based systems and new flavor variants, geographic expansion, and strategic partnerships to enhance distribution.

The global e-cigarette market is projected to be valued at US$29.6 Bn in 2025.

The growing shift from traditional tobacco to less harmful alternatives, along with rising health awareness and demand for convenience, is driving the need for e-cigarettes.

The e-cigarette market is poised to witness a CAGR of 8.4% from 2025 to 2032.

Advancements in vaping technology, combined with growing consumer demand for personalized flavors and sleek, customizable devices, are creating significant opportunities for product innovation and market expansion.

Imperial Brands PLC, Eleaf Group, British American Tobacco PLC, ELFBAR, Altria Group Inc., Philip Morris International Inc., and Japan Tobacco Group are among the leading key players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Mode of Operation

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author