ID: PMRREP32926| 192 Pages | 15 Dec 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

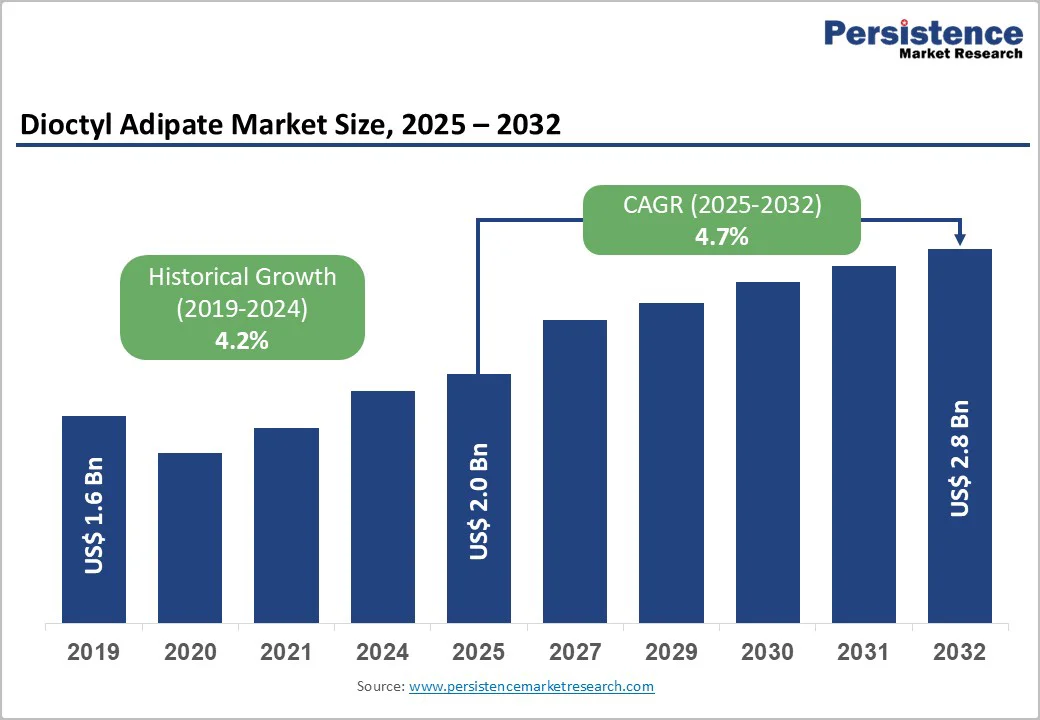

The global dioctyl adipate market size is valued at US$ 2.0 billion in 2025 and is projected to reach US$ 2.8 billion by 2032, growing at a CAGR of 4.7% between 2025 and 2032.

Market growth is primarily driven by shifting demand toward non-phthalate plasticizers due to stringent regulatory restrictions on traditional phthalate-based alternatives, coupled with increasing awareness of health and environmental concerns.

The expansion of the plasticizers market, coupled with rising demand from automotive, construction, and food packaging industries, continues to strengthen the market position of Dioctyl Adipate as a preferred safer alternative to restricted plasticizers.

| Key Insights | Details |

|---|---|

| Dioctyl Adipate Market Size (2025E) | US$ 2.0 Bn |

| Market Value Forecast (2032F) | US$ 2.8 Bn |

| Projected Growth CAGR (2025 - 2032) | 4.7% |

| Historical Market Growth (2019 - 2024) | 4.2% |

Increasing Demand for Non-Phthalate Plasticizers and Regulatory Compliance

The global transition toward non-phthalate plasticizers mark a major transformation in the chemical industry, fueled by strict regulatory policies such as EU REACH and FDA restrictions on phthalate-based compounds.

Governments across regions have imposed bans on conventional phthalates like DEHP, DBP, BBP, and DIBP in consumer goods, food-contact materials, and medical devices, limiting their concentration to 0.1% by weight. This shift has accelerated demand for Dioctyl Adipate, a safer, high-performance alternative that ensures compliance with global standards.

The non-phthalate plasticizers market is expanding rapidly, supported by rising awareness of environmental and health concerns. Within this growing landscape, adipate plasticizers, including Dioctyl Adipate, account for nearly 42% of the non-phthalate market share, establishing their dominance as the preferred eco-friendly and regulatory-compliant solution for a wide range of industrial applications.

Exceptional Low-Temperature Performance and Automotive Industry Expansion

Dioctyl Adipate possesses distinctive physical properties that render it indispensable for demanding applications requiring superior low-temperature flexibility. The material maintains its functional characteristics at temperatures as low as -76°C, significantly outperforming conventional plasticizers and enabling consistent performance in extreme environmental conditions.

This exceptional cold-resistance capability has established DOA as the preferred plasticizer for automotive applications, where reliability under diverse climate conditions is paramount. Additionally, the automotive cables and wiring supplies is experiencing robust growth driven by electrification trends and the proliferation of advanced vehicle systems requiring sophisticated cable insulation solutions.

Competitive Pressure from Alternative Plasticizers and Bio-Based Substitutes

The Dioctyl Adipate market faces intensifying competition from emerging bio-based and specialty plasticizers, as well as established alternatives such as Dioctyl Terephthalate (DOTP) and Diisononyl Cyclohexane-1,2-Dicarboxylate (DINCH). The eco-friendly plasticizers market, expanding at a CAGR of 7.0% through 2032, indicating that manufacturers are increasingly exploring alternative formulations to achieve differentiation and sustainability objectives.

Bio-based plasticizers derived from renewable sources such as vegetable oils and citric acid are gaining market traction among environmentally conscious manufacturers seeking to align with corporate sustainability initiatives and consumer preferences for green products. This competitive landscape necessitates continuous innovation and market differentiation strategies to maintain Dioctyl Adipate’s competitive positioning within the broader plasticizers ecosystem.

Raw Material Cost Volatility and Supply Chain Constraints

The production of Dioctyl Adipate depends on stable sourcing of critical feedstocks including adipic acid and 2-ethylhexanol (2-EH), commodities subject to significant price volatility driven by petroleum market fluctuations and geopolitical disruptions. Fluctuations in crude oil prices, disruptions in petrochemical supply chains, and competition for feedstock availability create substantial cost pressures that constrain profitability and market expansion capabilities.

Additionally, the limited availability of specialized raw materials required for certain high-purity grades can lead to supply chain constraints, production bottlenecks, and price volatility, particularly in emerging markets where cost considerations remain dominant factors influencing purchasing decisions.

Rapid Growth in Medical Device Manufacturing and Healthcare Applications

The healthcare sector represents a high-growth opportunity segment for dioctyl adipate, driven by expanding demand for medical-grade plasticizers in device manufacturing. Medical device manufacturers increasingly require materials that comply with stringent biocompatibility standards, including FDA classifications, ISO 10993 standards, and USP Class VI requirements.

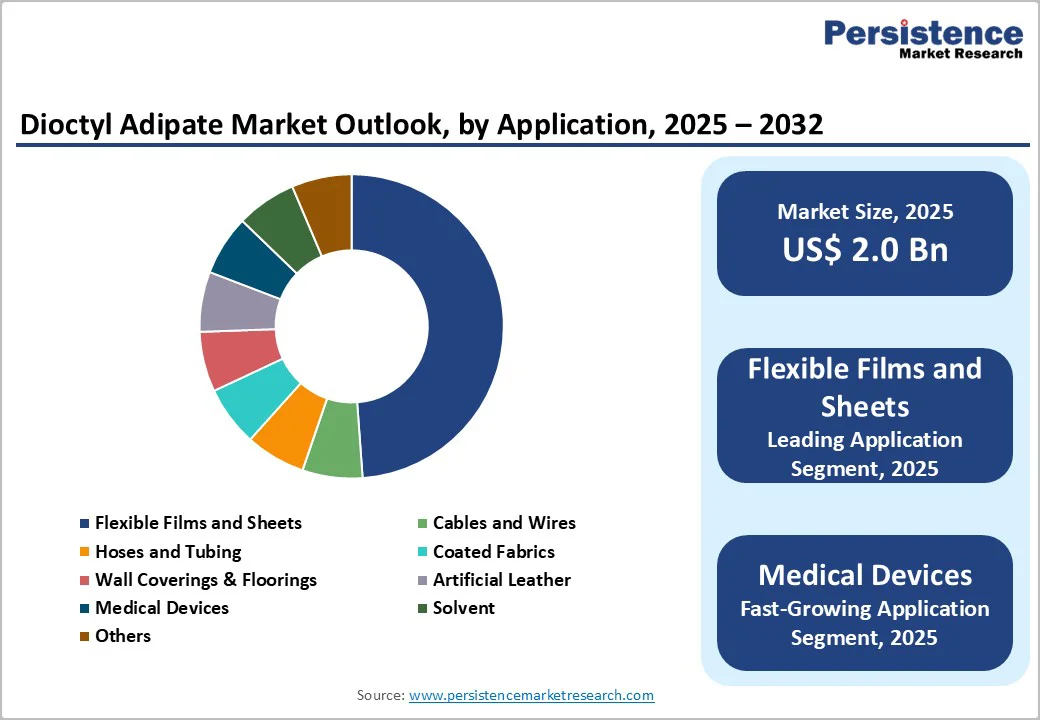

Dioctyl Adipate is used in manufacturing flexible PVC tubing, medical gloves, blood bags, catheters, ventilators, and other critical medical equipment where flexibility, durability, and biocompatibility are essential performance requirements. The segment of Medical Devices within the dioctyl adipate market is classified as a fastest-growing application, anticipated to expand at approximately 6% CAGR from 2025 to 2032.

Expansion into Food Packaging and Emerging Asian Markets

Food-grade Dioctyl Adipate represents a specialized growth segment supported by expanding packaged food consumption and stringent food safety regulations. The FDA recognizes Dioctyl Adipate as an approved food-contact substance under 21 CFR 177.2600, enabling its incorporation into food packaging films, flexible containers, and protective coverings where direct contact with food occurs.

The Food Grade segment is positioned as the fastest-growing category within the Grade classification, anticipated to expand at approximately 5% CAGR from 2025 to 2032.

Rising working populations, increasing consumption of packaged and frozen food products, and urbanization trends throughout China, India, and Southeast Asian countries are driving substantial demand for flexible food packaging solutions incorporating Dioctyl Adipate as the preferred plasticizer, creating significant revenue expansion opportunities for market participants.

Technical grade dioctyl adipate commands the leading position within the grade segmentation, accounting for approximately 75% market share in 2025. The dominance of the Technical Grade category reflects its versatility, cost-effectiveness, and widespread applicability across industrial applications, including flexible films, cable insulation, hoses, and coated fabrics.

Technical Grade DOA is specifically optimized for maximizing plasticization efficiency while maintaining cost competitiveness, thereby enabling manufacturers across diverse industries to achieve optimal performance within budgetary constraints.

The broad industrial adoption of Technical Grade across automotive, construction, and consumer goods sectors, combined with mature supply chain infrastructure supporting its production and distribution, establishes this grade as the foundational segment driving overall market volume and revenue generation.

Flexible Films and Sheets as the Leading Application Segment

Flexible films and sheets represent the leading application category for dioctyl adipate, capturing approximately 47% share in 2025. This dominant position reflects the critical role of DOA in enabling the production of flexible, transparent PVC films utilized extensively in food packaging, agricultural applications, and protective coverings.

The global flexible plastic packaging market was valued at approximately US$ 173.3 billion in 2025 and is projected to reach US$ 258.8 billion by 2032, exhibiting a CAGR of 5.9% throughout the forecast period.

The exceptionally low-temperature performance characteristics of Dioctyl Adipate, combined with its outstanding clarity and low migration properties, position it as the preferred plasticizer for manufacturing flexible films intended for frozen food packaging, cold-storage applications, and moisture-sensitive agricultural contexts.

The expanding e-commerce sector, rising demand for convenient packaged foods, and increasing consumer preference for transparent packaging materials that enhance product visibility continue to drive robust demand within the Flexible Films and Sheets segment.

The North American dioctyl adipate market is characterized by sophisticated regulatory compliance frameworks and substantial demand from mature automotive and healthcare sectors. The region represents approximately 18-20% of global market value, driven primarily by the United States’ stringent regulatory environment enforced through FDA oversight and state-level environmental regulations that mandate phthalate-free formulations in consumer products.

North America has demonstrated sustained leadership in adopting non-phthalate plasticizers, with manufacturers prioritizing regulatory compliance and sustainability as strategic competitive advantages. The region’s automotive industry, concentrated in the United States and Mexico, continues to drive demand for high-performance cable insulation and flexible components requiring superior cold-weather performance.

The North American plasticizers market represents a mature but stable segment where innovation in sustainable formulations and regulatory compliance initiatives drive differentiation. Leading chemical producers, including BASF SE, ExxonMobil Corporation, and Eastman Chemical Company, maintain significant production capacity within the region, ensuring reliable supply and technical support for regional customers.

The region’s focus on green building certifications such as LEED and emphasis on sustainable construction materials continues to reinforce demand for non-phthalate plasticizers in flooring, wall coverings, and architectural applications.

Europe dominates the regulatory landscape for plasticizers globally, with the EU REACH regulation establishing the most comprehensive and stringent framework for chemical registration, evaluation, and restriction. The region’s market represents approximately 22-25% of global Dioctyl Adipate consumption, driven by the implementation of progressively restrictive regulations on traditional phthalates and the European Union’s commitment to circular economy principles.

Germany, France, the United Kingdom, and Spain emerge as dominant markets within the European region, leveraging advanced manufacturing capabilities, strong automotive sectors, and substantial demand from construction and healthcare industries.

The European market is characterized by intensified focus on sustainability, with manufacturers increasingly seeking bio-based and environmentally compatible plasticizers to satisfy both regulatory requirements and escalating consumer demand for eco-conscious products.

European manufacturers have also established themselves as technology leaders in developing innovative plasticizer formulations that balance performance requirements with environmental sustainability objectives, positioning the region as a center of innovation and product development within the global dioctyl adipate market.

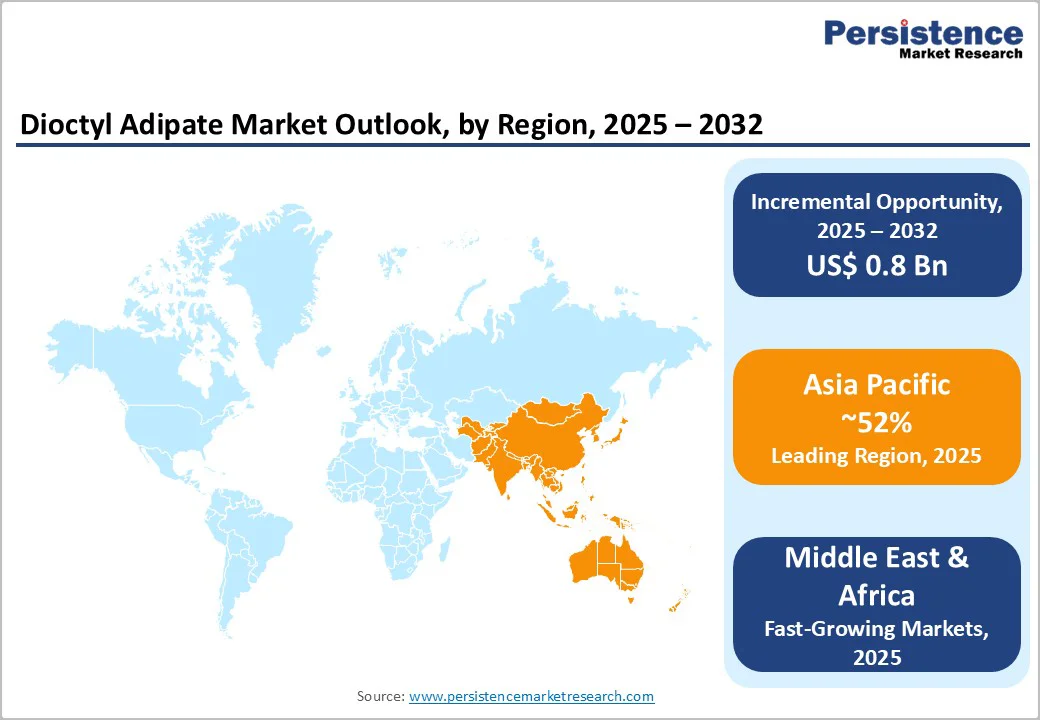

Asia Pacific commands overwhelming market dominance, accounting for approximately 52% of global Dioctyl Adipate market share in 2025, with the region positioned as the fastest-growing geography with substantial long-term expansion potential. China emerges as the undisputed market leader, accounting for the largest production capacity, consumption volumes, and manufacturing scale within the global DOA market.

India represents the second-largest market within the Asia Pacific region, experiencing accelerating growth driven by urbanization, industrial expansion, and rising demand for packaged food products. Japan contributes specialized technical expertise and advanced manufacturing capabilities, supporting production of high-purity grades for pharmaceutical and medical device applications.

The broader Asia Pacific region is experiencing rapid industrialization, urbanization, and infrastructure development that collectively drive surging demand for flexible packaging, automotive components, and construction materials.

The expansion of manufacturing capacity, declining raw material costs relative to developed regions, and favorable government initiatives supporting industrial growth collectively positions the Asia Pacific as the dominant growth engine propelling the global dioctyl adipate market forward throughout the forecast period.

The global dioctyl adipate market exhibits a moderately consolidated competitive structure characterized by the dominance of several multinational chemical corporations alongside an expanding cohort of regional and specialized producers.

BASF SE and ExxonMobil Corporation maintain market leadership positions supported by extensive research and development capabilities, integrated production facilities, and established global distribution networks. These market leaders leverage their technological expertise and scale advantages to develop advanced plasticizer formulations addressing evolving customer requirements and regulatory demands.

The competitive landscape reflects a broader industry trend toward consolidation, with major players seeking to enhance market positioning through strategic acquisitions and capacity expansion projects.

Companies increasingly invest in research and development activities focused on developing bio-based alternatives, enhancing product performance characteristics, and achieving manufacturing process innovations that reduce production costs and environmental impact. This strategic emphasis on innovation and sustainability reflects evolving market demands and regulatory requirements shaping competitive differentiation.

The global dioctyl adipate market is valued at US$ 2.0 billion in 2025 and is projected to reach US$ 2.8 billion by 2032, representing substantial growth driven by expanding demand for non-phthalate plasticizers and regulatory compliance requirements worldwide.

The Dioctyl Adipate market is primarily driven by increasing demand for non-phthalate plasticizers resulting from stringent regulatory restrictions, including EU REACH regulations and FDA restrictions on traditional phthalate-based compounds, coupled with exceptional low-temperature performance characteristics enabling automotive and industrial applications, and expanding healthcare infrastructure driving medical device demand.

Technical Grade Dioctyl Adipate dominates the market, commanding approximately 75% market share in 2025, reflecting its broad industrial applicability, cost-effectiveness, and widespread use across automotive, construction, consumer goods, and packaging applications.

Asia Pacific holds the largest regional market share, accounting for approximately 52% of global Dioctyl Adipate consumption in 2025, driven by rapid industrialization, urbanization, substantial automotive and construction sectors, and expanding food packaging demand throughout China, India, and Southeast Asian economies.

The Medical Devices segment represents a significant growth opportunity, classified as the fastest-growing application category with anticipated expansion at approximately 6% CAGR from 2025 to 2032.

Key market players include BASF SE, ExxonMobil Corporation, Hallstar Industrial, Aarti Industries, which collectively shape market dynamics through strategic initiatives, technological innovation, capacity expansion, and geographic expansion strategies.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn/Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Grade

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author