ID: PMRREP33048| 200 Pages | 12 Jan 2026 | Format: PDF, Excel, PPT* | IT and Telecommunication

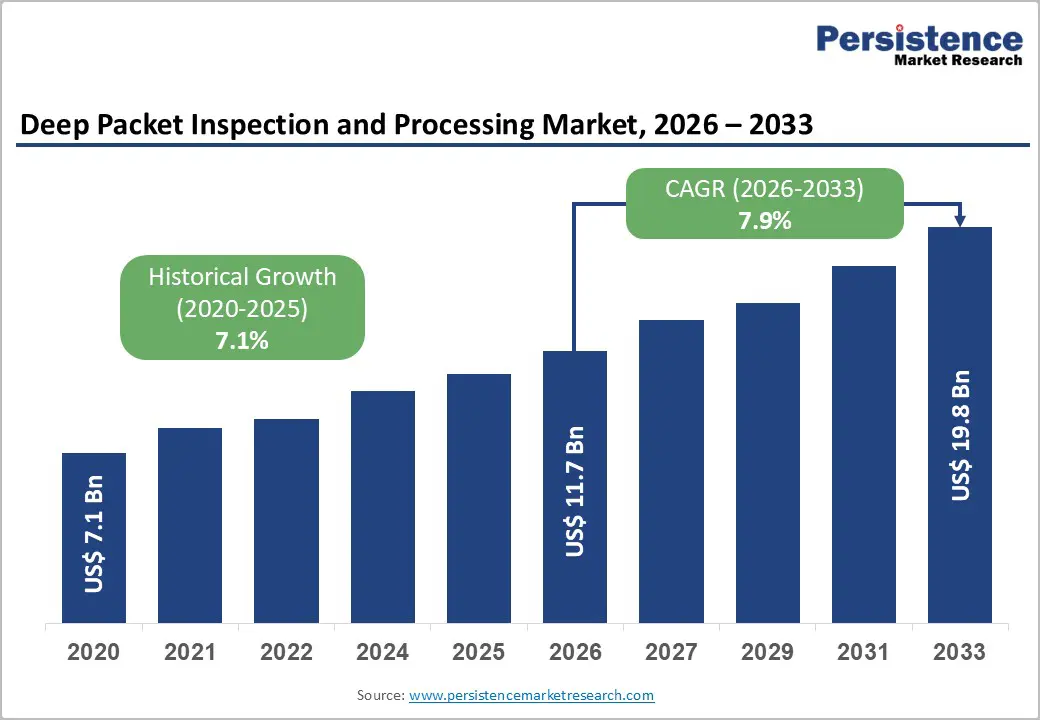

The global deep packet inspection and processing market size was valued at US$ 11.7 billion in 2026 and is projected to reach US$ 19.8 billion by 2033, growing at a CAGR of 7.9% between 2026 and 2033.

The market is driven by enterprise adoption of zero-trust security frameworks requiring continuous traffic monitoring, proliferation of cloud computing creating distributed network complexity, and integration of artificial intelligence enabling advanced threat detection with minimal false positives.

| Key Insighst | Details |

|---|---|

| Deep Packet Inspection and Processing Market Size (2026E) | US$ 11.7 Bn |

| Market Value Forecast (2033F) | US$ 19.8 Bn |

| Projected Growth (CAGR 2026 to 2033) | 7.9% |

| Historical Market Growth (CAGR 2020 to 2024) | 7.1% |

Cyber threat frequency and sophistication have reached unprecedented levels, with Cybersecurity and Infrastructure Security Agency (CISA) reporting 300%+ increase in cyber incidents annually through the 2024-2025 period. Advanced persistent threats, targeting critical infrastructure across government, healthcare, and financial sectors, require real-time packet-level inspection to detect anomalous behavioral patterns. Enterprise data breach costs, averaging US$ 4.5 million per incident and increasing 15% annually, establish compelling business justification for DPI investment. Ransomware attacks, targeting 500+ organizations weekly with average ransom demands exceeding US$ 500,000, create urgent security modernization imperatives. Nation-state sponsored cyberattacks, including state-level infrastructure targeting incidents, establish government security mandates. Major security frameworks including NIST Cybersecurity Framework and ISO 27001, increasingly mandate network visibility and packet-level inspection as control requirements.

Zero-trust architecture adoption, endorsed by the US government through Executive Order 14028 and CISA guidelines, establishes an architectural requirement for continuous traffic inspection and validation. Cloud migration acceleration, with 80% of enterprise workloads projected to operate in cloud environments by 2030, eliminates traditional perimeter-based security models requiring alternative monitoring approaches. Distributed workforce expansion, with remote work adoption reaching 30-40% of enterprise labor forces, creates extended network boundaries necessitating packet-level inspection for endpoint security. IoT device proliferation, with 25+ billion connected devices projected by 2030, expands the threat surface requiring network-level monitoring and segmentation enforcement. Regulatory mandates including GDPR, HIPAA, PCI-DSS, and emerging regulations including CCPA increasingly specify continuous data flow monitoring as compliance requirement.

DPI integration complexity, requiring specialized expertise in network architecture, cybersecurity, and platform-specific implementations, constrains deployment adoption. Latency introduction risks, with inadequately implemented DPI systems increasing packet processing delays from 1-5ms to 50-100ms+, degrade network performance and user experience. Skilled labor shortage, with cybersecurity professionals commanding US$ 120,000-180,000+ annual salaries, limits deployment scaling and maintenance capability. Continuous update requirements, necessitating regular signature and policy updates to maintain threat detection effectiveness, create an ongoing operational burden. Hardware resource intensity, with DPI processing consuming 30-50% of network infrastructure processing capacity, constrains deployment scale. Privacy and liability concerns, with regulatory bodies scrutinizing packet content inspection for potential privacy violations, create legal and compliance risks.

Infrastructure investment requirements, with enterprise-grade DPI deployments requiring US$ 500,000-5,000,000+ initial capital investment depending on organization scale and network complexity, establish significant budget barriers. Software licensing models, with complex per-device or per-gigabit-throughput licensing structures, create unpredictable cost scaling with network growth. Scalability economics challenges, with cost-per-protected-gigabit-per-second declining only 10-15% annually as network throughput expands, constrain ROI timelines. Budget prioritization conflicts, with DPI competing against other security infrastructure investments, including firewalls, intrusion prevention systems, and endpoint detection, limit funding availability. Smaller organization affordability constraints, with SME budgets typically constrained to US$ 50,000-200,000 annually for security infrastructure, exclude many potential users. Return on investment complexity, with DPI benefits including reduced breach costs and compliance attestation, difficult to quantify against direct financial metrics, complicating purchasing justification.

5G network rollout expansion, with 1 billion+ 5G subscribers globally by 2030 and corresponding exponential data traffic growth, establishes a proportionate DPI deployment requirement. Edge computing architectures, requiring distributed DPI deployment at network nodes rather than centralized data centers, create new installation and licensing models. Network slicing capabilities, with 5G enabling isolated network segments for differentiated service delivery, require DPI for enforcement and monitoring. IoT device proliferation within 5G ecosystems, with connected devices generating 500+ exabytes of annual data traffic, necessitates network-level threat detection and management. Market opportunity estimates suggest 5G-related DPI applications will expand from US$ 800-1,200 million (2026) to US$ 2.5-3.5 billion (2033), representing 15% CAGR substantially exceeding overall market growth.

National cybersecurity strategies, with governments globally allocating US$ 50-100 billion annually for cybersecurity infrastructure, establish systematic DPI deployment requirements. Critical infrastructure protection mandates, including CISA's National Cybersecurity Strategy emphasizing real-time network monitoring, create enforcement-backed DPI adoption drivers. Government data center modernization, with federal agencies transitioning to cloud-based infrastructure, requires cloud-native DPI solutions for continued network visibility. Defense contractor compliance requirements, with Department of Defense Information Security Program establishing mandatory DPI deployment standards, drive supply chain adoption. Supply chain security mandates requiring organizations receiving government contracts to implement DPI for threat detection, establishing indirect adoption drivers.

DPI solutions hold 61.27% market share by installation type, driven by their comprehensive network visibility and threat prevention capabilities. Integrated platforms combining real-time traffic analysis, malware detection, application identification, QoS enforcement, and bandwidth management justify premium pricing and strong enterprise adoption. Advanced features such as multi-tenant architecture, detailed reporting, and seamless integration with broader security ecosystems support demand among large organizations. Market maturity and proven deployments from established vendors like Cisco, Palo Alto Networks, and Fortinet further reinforce buyer confidence. Additionally, managed DPI solutions offered by service providers expand adoption through flexible, consumption-based models.

DPI services are the fastest-growing segment, expanding at nearly 14% CAGR through 2033. Rising network complexity and skills shortages are driving demand for implementation, customization, continuous monitoring, managed threat response, and training services, creating recurring revenue opportunities.

On-premises deployment accounts for 38% market share in the DPI deployment model, driven by regulatory compliance and performance requirements. Data sovereignty laws such as GDPR and national data residency mandates require sensitive data to be processed locally, particularly in BFSI and healthcare sectors. On-premises DPI delivers ultra-low latency of 5-10 ms, significantly outperforming cloud alternatives, making it ideal for performance-critical environments. Organizations also value direct infrastructure control, customization flexibility, and long-term cost amortization benefits.

Cloud deployment is the fastest-growing segment, expanding at 16% CAGR through 2033. Cloud-native DPI offers elastic scalability, rapid threat intelligence updates, lower upfront costs through pay-as-you-go models, and geographically distributed deployments that enhance agility and performance, driving accelerating enterprise adoption.

Integrated DPI installations hold 44% market share by architecture, driven by efficiency and cost advantages. Embedding DPI within core security appliances such as firewalls and intrusion prevention systems eliminates redundant infrastructure and lowers total cost of ownership through consolidated hardware and licensing. Centralized management interfaces simplify policy configuration and incident response, while in-line processing reduces traffic overhead and improves network performance. Integrated deployments also strengthen long-term vendor relationships, supporting customer retention in established enterprise environments.

Standalone DPI is the fastest-growing architecture, expanding at 12% CAGR through 2033. Purpose-built DPI appliances deliver deeper packet inspection accuracy, flexible placement across network points, granular policy control, and independent scalability. Best-of-breed selection and reduced vendor lock-in appeal to advanced security teams managing complex, evolving network architectures.

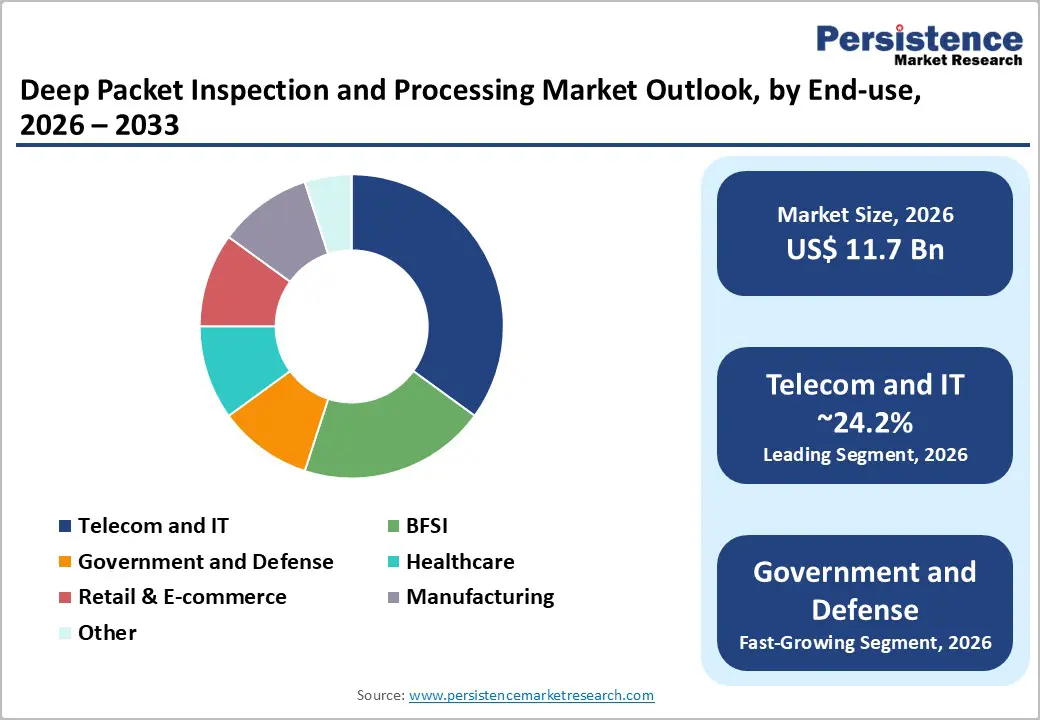

Telecom and IT sectors account for 24.26% market share in the DPI end-use landscape, driven by carrier infrastructure needs and enterprise network security adoption. Telecom operators and ISPs deploy DPI for bandwidth management, quality-of-service enforcement, subscriber experience enhancement, and network optimization. Large enterprises use DPI to strengthen cybersecurity, ensure regulatory compliance, and protect SaaS platforms and data center traffic. Cloud service providers further expand adoption by integrating DPI for customer data protection and threat prevention.

Government and defense represent the fastest-growing end-use segment, expanding at 16% CAGR through 2033. Growth is fueled by national security mandates, critical infrastructure protection requirements, defense contractor compliance standards, and classified data monitoring needs. Increased public investment in cybersecurity workforce development and international intelligence cooperation further accelerates DPI deployment across government networks.

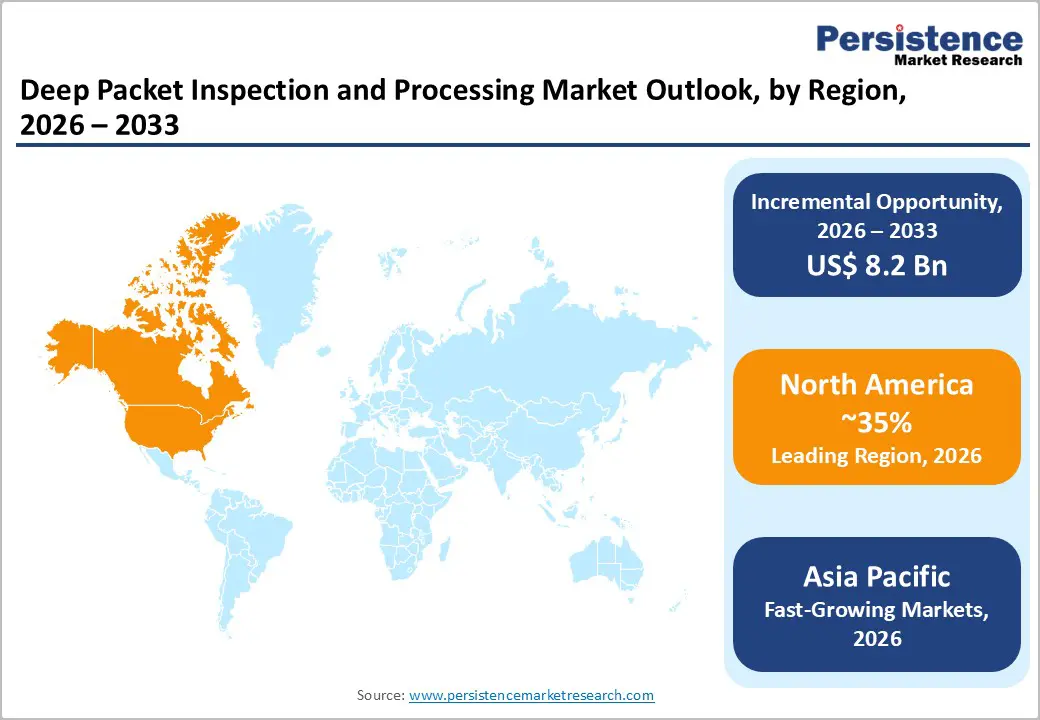

North America commands approximately 35% of global Deep Packet Inspection market share, valued at approximately US$ 4.1 billion in 2026 with projections approaching US$ 7.0billion by 2033. The United States represents the dominant regional market contributor, accounting for 80% of North American market value, driven by advanced threat landscape and regulatory compliance emphasis.

Cybersecurity investment prioritization, with US federal government allocating US$ 20-30 billion annually for cybersecurity infrastructure modernization and threat response. CISA cybersecurity initiatives, including National Cybersecurity Strategy implementation and zero-trust architecture promotion, establish systematic adoption mandates. Financial services sector requirements, with BFSI institutions managing 40-50% of global financial transactions subject to SEC, FINRA, and OCC regulations increasingly mandating DPI deployment.

Europe represents approximately 25% of the global share, valued at approximately US$ 2.6 billion in 2026. United Kingdom, Germany, France, and Spain collectively represent 75% of European market value, reflecting advanced regulatory environment and enterprise security emphasis.

GDPR compliance requirements, with regulatory enforcement escalating to US$ 50+ million penalty thresholds, drive systematic DPI adoption for data protection compliance. NIS Directive implementation, establishing network and information systems security requirements for critical infrastructure operators, creates adoption mandates. Financial Conduct Authority regulations, with FCA requiring enhanced monitoring of financial transactions and communications, drive BFSI sector adoption. Privacy regulation evolution, with emerging regulations including ePrivacy Directive amendments establishing data inspection requirements, expands adoption drivers.

Asia Pacific demonstrates robust growth dynamics, commanding approximately 22% market share with projections increasing to 28-32% by 2033. The region valued at approximately US$ 2.5 billion in 2026 is anticipated to reach US$ 5.5 billion by 2033, representing fastest-growing regional market with an estimated CAGR of 12%.

Cybersecurity infrastructure modernization, with China, Japan, India, and Southeast Asian governments implementing national cybersecurity strategies requiring DPI deployment. Telecommunications infrastructure expansion, with 5G deployment and associated data traffic growth creating proportionate DPI demand across telecom operators. Government regulation emphasis, with China's Cybersecurity Law and India's National Data Protection Framework establishing DPI deployment requirements.

The global study on deep packet inspection and processing market at PMR explains that the market holds diversified interests as the vendors upgrade their bandwidths and new cutting-edge technology integrates, allowing new key players to compete.

Companies focus on strengthening the marketing and distribution channels and integrating it with new technologies such as AI and predictive decision making. Major players also do collaborations and mergers with other significant brands that help them in enhancing customer experience along with easy purchase as there is tough competition in the market. This expands the deep packet inspection and processing market in new market regions.

The Deep Packet Inspection and Processing market is estimated to be valued at US$ 11.7 Bn in 2026.

The key demand driver for the Deep Packet Inspection (DPI) and Processing market is the rapid growth of network traffic combined with escalating cybersecurity and regulatory compliance requirements.

In 2026, the North America region will dominate the market with an exceeding 35% revenue share in the global Deep Packet Inspection and Processing market.

Among the End- use, Telecom and IT holds the highest preference, capturing beyond 24.2% of the market revenue share in 2026, surpassing other End- use type.

The key players in Deep Packet Inspection and Processing are Allot Ltd., BAE Systems, Blue Coat Systems, Inc. and Cisco Systems, Inc.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Bn, Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Installation

By Deployment Mode

By Organization Size

By End - Use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author