ID: PMRREP4424| 198 Pages | 4 Feb 2026 | Format: PDF, Excel, PPT* | Chemicals and Materials

The global cyclohexane market size is supposed to be valued at US$ 30.56 billion in 2026 and is projected to reach US$ 42.78 billion by 2033, growing at a CAGR of 4.9% between 2026 and 2033. The market expansion is primarily driven by surging demand for nylon intermediates, particularly adipic acid and caprolactam, which are extensively used in automotive lightweighting initiatives and textile manufacturing.

According to the U.S. Department of Energy, a 10% reduction in vehicle weight can improve fuel economy by 6%-8%, accelerating the adoption of nylon-based engineering plastics. Additionally, the global vehicle production growth, reported at 5.6% in 2023 by the Organisation Internationale des Constructeurs d'Automobiles (OICA), reinforces cyclohexane's critical role in high-performance automotive applications, including radiator end tanks, engine covers, and air intake manifolds.

| Key Insights | Details |

|---|---|

| Cyclohexane Market Size (2026E) | US$ 30.56 Bn |

| Market Value Forecast (2033F) | US$ 42.78 Bn |

| Projected Growth CAGR (2026 - 2033) | 4.9% |

| Historical Market Growth (2020 - 2025) | 4.0% |

The automotive industry's strategic shift toward lightweight materials represents a transformative growth driver for cyclohexane consumption. Modern vehicles increasingly incorporate 15-20 kilograms of nylon-based components in engine compartments, fuel systems, air intake manifolds, electrical housings, and structural applications, where superior heat resistance and mechanical properties surpass those of traditional metal alternatives. The Lightweight Automotive Body Panels Market is projected to reach USD 197.3 billion by 2032, growing at a CAGR of 4.9%, directly amplifying cyclohexane derivative requirements.

Electric vehicle adoption creates additional demand momentum, as manufacturers specify nylon components for battery housings, thermal management systems, charging infrastructure, and electrical insulation applications that require exceptional performance characteristics. Global vehicle production rose by 5.6% in 2023, according to ACEA, with major automotive manufacturers implementing aggressive lightweighting strategies to comply with stringent fuel efficiency regulations and reduce carbon footprints.

The global textile industry’s sustained expansion, particularly in technical textiles and high-performance fabrics, is a key driver of cyclohexane demand. Nylon-6 fibers, derived from caprolactam, offer superior tensile strength, abrasion resistance, moisture-wicking properties, and durability, making them essential for sportswear, industrial textiles, tire cord reinforcement, carpets, and functional apparel. Technical textiles are increasingly utilized in automotive tire manufacturing, where multifilament nylon yarns enhance rubber strength and longevity.

Furthermore, nylon fibers play a critical role in construction applications such as geotextiles and reinforcement materials. The U.S. textile sector is steadily adopting Nylon-6 for durable sportswear, while Germany, Europe’s largest manufacturing hub, demonstrates strong growth momentum. The convergence of performance requirements and sustainability initiatives continues to drive innovation in nylon production technologies, ensuring long-term cyclohexane market growth.

Cyclohexane producers face significant supply chain vulnerabilities stemming from their dependence on benzene as the primary hydrocarbon feedstock, which is directly derived from crude oil through steam cracking and catalytic reforming processes. Price fluctuations in crude oil markets create corresponding volatility in benzene availability and costs, directly impacting cyclohexane production economics and profitability. Geopolitical tensions in major oil-producing regions, including disruptions in Middle Eastern supply chains and global trade uncertainties, create additional complexity in raw material procurement planning and force manufacturers to secure alternative feedstock sources at substantial premium costs.

Supply chain disruptions in petroleum refining operations can severely constrain benzene availability, necessitating inventory management challenges and production planning difficulties that cascade through cyclohexane manufacturing operations, ultimately limiting market supply and creating artificial price pressures that dampen demand from price-sensitive end-users.

Environmental regulations on volatile organic compound (VOC) emissions impose significant capital investment and ongoing compliance costs for cyclohexane production facilities across Europe, North America, and increasingly Asia Pacific. Classified as a hazardous air pollutant under frameworks such as EU REACH and U.S. EPA standards, cyclohexane production requires advanced emission control systems, continuous monitoring, and process optimization to meet regulatory mandates.

Restrictions under REACH Annex XVII and similar global instruments add operational complexity and increase capital expenditure, particularly for smaller manufacturers lacking resources for sophisticated environmental infrastructure. These compliance obligations elevate production costs without proportional revenue gains, potentially constraining supply growth and limiting market entry for new participants unable to absorb substantial environmental management investments.

The growing global emphasis on circular economy principles and sustainability presents significant opportunities for cyclohexane manufacturers pursuing bio-based production methods and recycling technologies. Research into biomass-derived feedstocks and alternative production routes aims to reduce reliance on petroleum while meeting rising demand for environmentally responsible chemical products. Advanced catalytic processes enabling production from renewable carbon sources, coupled with improved efficiency and waste reduction, position innovative producers to capture premium market segments favored by sustainability-conscious industries.

Investments in green production infrastructure align with initiatives such as the EU Green Deal, creating competitive advantages for companies with certified sustainable sourcing. Leading firms, including BASF SE, demonstrate the commercial viability of low-carbon production strategies, which are expected to drive market share growth among progressive chemical manufacturers throughout the forecast period.

Strategic capacity expansion across Asia Pacific manufacturing hubs offers significant growth potential, particularly in China and India, where industrial infrastructure development and concentrated automotive production are driving cyclohexane demand. Sinopec Group’s recent completion of a 450,000 metric ton per year cyclohexane unit at its Zhenhai refining complex underscores the scale of regional investment, with integrated facility design reducing logistics costs and enhancing supply chain reliability for nylon intermediates.

The electric vehicle segment further accelerates demand for specialized nylon materials with advanced thermal and electrical properties, creating a need for high-purity cyclohexane grades. Integration of cyclohexane production with downstream nylon operations optimizes material flow and cost efficiency, while strategic partnerships between global chemical firms and Southeast Asian industrial clusters enable localized nylon manufacturing and premium margins in emerging EV component applications.

Caprolactam production remains the dominant application segment for cyclohexane, accounting for approximately 43% of global consumption. This leadership is driven by strong demand for nylon-6 fiber and resin across the textile, automotive, and consumer goods industries. Cyclohexane serves as a critical feedstock for caprolactam synthesis, which is polymerized into nylon-6, a material valued for its exceptional tensile strength, elasticity, and abrasion resistance. Nylon-6 is widely used in apparel, carpeting, industrial textiles, and engineering plastics.

Furthermore, automotive manufacturers increasingly integrate nylon-6 components for lightweight panels, connectors, and under-hood applications, with electric vehicle producers emphasizing its use in battery enclosures and thermal management systems. This segment is expected to maintain its dominance throughout the forecast period, supported by rising textile demand and automotive lightweighting trends.

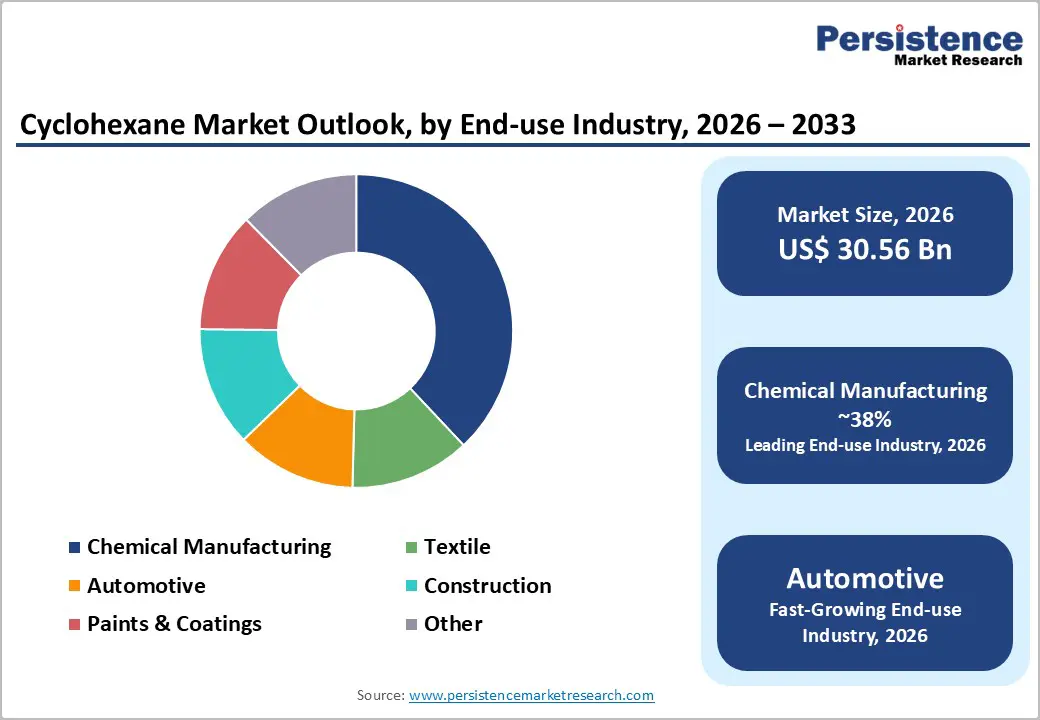

Chemical manufacturing constitutes the largest end-user segment for cyclohexane, holding a dominant market share of 38% market share, due to its critical role as an intermediate in adipic acid and caprolactam synthesis for nylon polymer production across diverse industrial sectors. Beyond polymer intermediates, cyclohexane serves as a solvent and extractant in specialty chemical manufacturing, organic synthesis, and industrial applications such as paints and coatings.

Leading producers, including BASF SE, ExxonMobil Chemical, and Sinopec Group, operate integrated facilities that combine cyclohexane production with downstream nylon manufacturing, ensuring operational efficiency and supply chain reliability. Continuous advancements in process optimization, catalyst technology, and high-purity grade development drive demand, while industry trends favor vertically integrated petrochemical complexes that enhance logistics economics and create significant technical barriers to entry.

North America remains a high-value, innovation-driven cyclohexane market, supported by advanced refinery infrastructure, robust manufacturing capabilities, and abundant feedstock from domestic crude oil resources. The U.S. accounted for nearly 81% of regional consumption in 2025, driven by strong demand for nylon resins and synthetic fibers in automotive, electronics, and packaging applications. In 2023, the U.S. Department of Energy allocated USD 180 million to enhance chemical manufacturing efficiency, including cyclohexane production optimization through advanced catalyst development and process integration.

Extensive R&D investments, technological innovation, and established supply chains position North America as a key supplier for domestic and export markets. Automotive applications dominate regional demand, with lightweight nylon components supporting fuel efficiency and compliance with EPA regulations, driving steady growth at an estimated 5.4% CAGR.

Europe is a key cyclohexane market, driven by advanced automotive manufacturing and stringent environmental regulations promoting sustainable production and lightweight material adoption. Germany leads regional consumption, supported by world-class automotive capabilities and BASF SE’s Ludwigshafen complex, a global hub for cyclohexane and nylon intermediates. In 2023, the EU automotive industry produced 12.1 million vehicles, each incorporating significant nylon-based components in engine compartments, interiors, and electrical systems, fueling robust demand.

France and Italy further contribute through luxury automotive and premium textile production. Regulatory emphasis on circular economy principles creates opportunities for bio-based technologies and advanced compliance systems. BASF’s investment in Ludwigshafen to enhance efficiency and reduce energy use underscores this trend. Europe is projected to be the fastest-growing region, driven by sustainability, technological innovation, and downstream chemical investments.

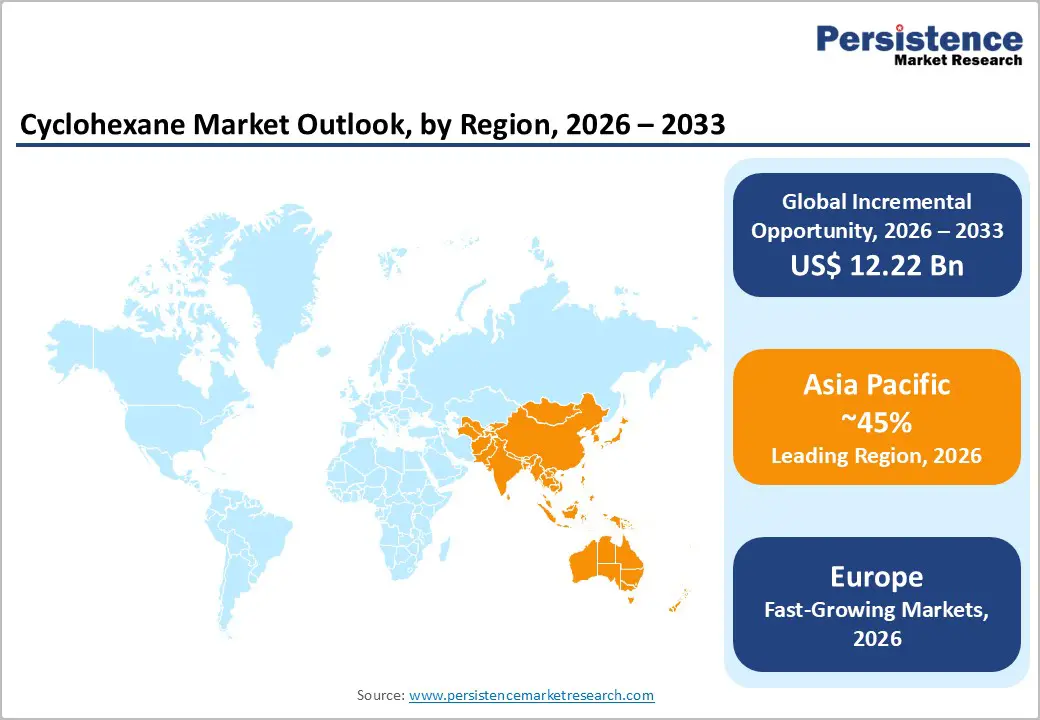

Asia Pacific dominates the global cyclohexane market, accounting for approximately 45% of total consumption, driven by a strong concentration of nylon manufacturing facilities, rapid textile industry growth, and expanding automotive production. China leads the region with extensive industrialization, large-scale caprolactam facilities, and abundant petrochemical feedstock, and is projected to achieve the highest CAGR of about 5.2%.

India’s growing textile sector further boosts demand through increased nylon-6 fiber production for global apparel markets, supported by rising income levels and infrastructure development. Southeast Asian countries offer additional opportunities through favorable policies and industrial expansion. Cost advantages, skilled labor, and large domestic markets attract multinational investments in localized production. Japan remains significant for high-purity cyclohexane applications in advanced automotive manufacturing. Sinopec’s 450,000 metric ton annual capacity at Zhenhai exemplifies the region’s momentum in integrated production and supply chain efficiency.

The global cyclohexane market exhibits moderate consolidation, with major players such as BASF SE, Chevron Phillips Chemical Company LLC, ExxonMobil, and Sinopec Group commanding significant production capacity. Numerous mid-sized and regional manufacturers remain competitive through specialization and geographic focus. Leading companies pursue aggressive capacity expansions and invest in advanced catalyst technologies to improve efficiency and strengthen their position in high-growth Asian markets. Emerging trends favor vertical integration with nylon fiber and resin manufacturing, creating operational efficiencies and high entry barriers. Consolidation increasingly benefits large, diversified chemical firms with strong financial resources, customer relationships, and technological capabilities.

The global cyclohexane market is projected to reach US$ 30.6 Billion in 2026, expanding to US$ 42.8 Billion by 2033, representing a CAGR of 4.9% throughout the forecast period, supported by escalating nylon intermediate demand across automotive, textile, and chemical manufacturing sectors.

Rising automotive industry demand for lightweight materials supporting fuel efficiency improvement and electric vehicle component manufacturing, combined with expanding global textile consumption in developing economies and increasing industrial utilization of nylon-based materials in construction and manufacturing applications, represent the primary market growth catalysts.

Caprolactam production commands the largest market segment with 43% of global cyclohexane consumption, driven by extraordinary demand for nylon-6 fiber and resin production across textile, automotive, and engineering plastic industries requiring this critical monomer.

Asia Pacific dominates global cyclohexane consumption with approximately 45% market share, driven by concentrated nylon manufacturing capacity in China, India, and Southeast Asia, while Europe emerges as the fastest-growing region due to sustainable production emphasis and automotive lightweighting initiatives.

Electric vehicle component manufacturing represents the highest-growth opportunity, with specialized nylon materials required for battery enclosures and thermal management driving incremental cyclohexane demand as global EV production accelerates, complemented by sustainable production technology development addressing environmental regulatory requirements.

BASF SE, Chevron Phillips Chemical Company LLC, ExxonMobil, Sinopec Group, Huntsman Corporation, Reliance Industries Limited, and Dow Chemical Company represent major global manufacturers commanding significant production capacity and market share through technological excellence and strategic geographic positioning.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Application

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author