ID: PMRREP35972| 198 Pages | 22 Dec 2025 | Format: PDF, Excel, PPT* | Packaging

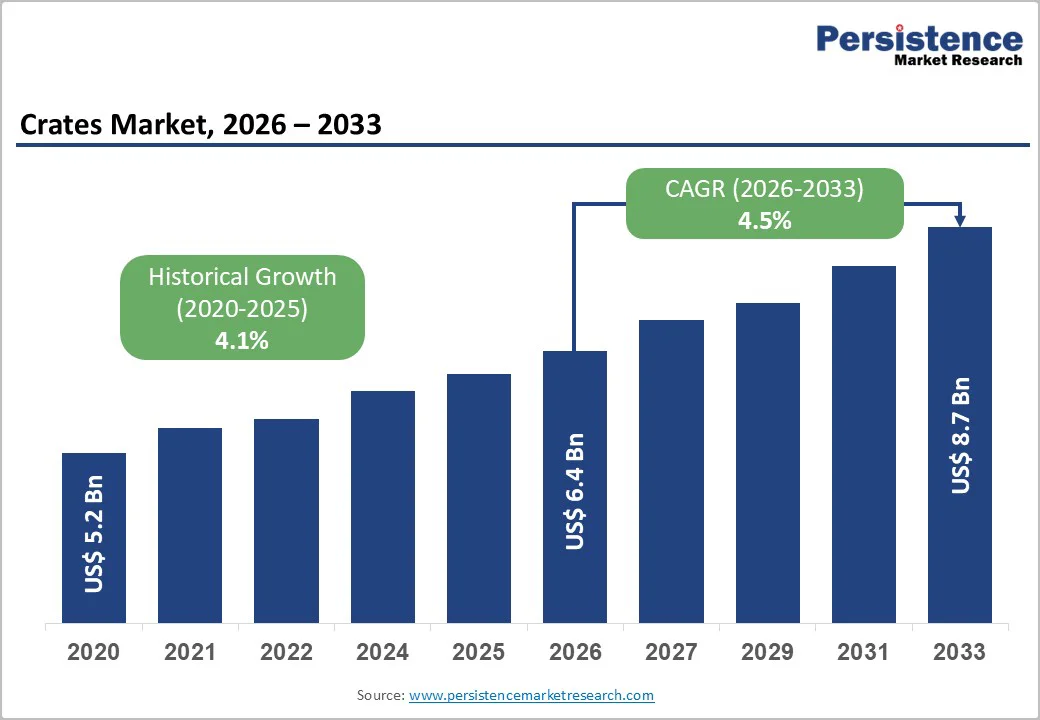

The global crates market size is likely to be valued at US$6.4 billion in 2026. It is expected to reach US$8.7 billion by 2033, growing at a CAGR of 4.5% between 2026 and 2033, supported by rising adoption of reusable and returnable packaging in food and beverage supply chains, rapid development of cold-chain infrastructure, lightweight polymer substitution, and increasing digitization of pooled-crate systems.

| Key Insights | Details |

|---|---|

| Crates Market Size (2026E) | US$6.4 Bn |

| Market Value Forecast (2033F) | US$8.7 Bn |

| Projected Growth (CAGR 2026 to 2033) | 4.5% |

| Historical Market Growth (CAGR 2020 to 2025) | 4.1% |

The expansion of cold-chain logistics is significantly increasing demand for durable, ventilated, and hygienic crates designed for temperature-controlled distribution. Rising consumption of fresh foods, dairy products, frozen goods, and pharmaceuticals has accelerated investments in refrigerated storage and transport fleets, as well as in last-mile cold delivery.

Crates play a critical role in these systems due to their reusability, airflow design, and compatibility with automated handling equipment. As cold-chain networks scale globally, especially in emerging economies, crates used for refrigerated distribution are capturing a growing share of palletized load units. This structural shift directly supports sustained volume growth and underpins the projected market CAGR.

Regulatory pressure and corporate sustainability commitments are driving the transition from single-use transit packaging to reusable crate systems. Organizations are increasingly focused on reducing scope-3 emissions and packaging waste, prompting procurement teams to favor returnable logistics solutions. Reusable crates distribute their embodied carbon across multiple use cycles, lowering emissions per trip and reducing landfill waste.

Manufacturers are responding by introducing crates made with higher recycled content and designing products for full recyclability at the end of life. These shifts are accelerating investment in crate washing, tracking, and pooling infrastructure, reinforcing long-term demand for durable plastic crates aligned with circular-economy principles.

Rapid growth in e-commerce and warehouse automation is reshaping material-handling requirements, increasing demand for standardized, stackable, and foldable crates. Automated sortation systems, goods-to-person picking, and high-density storage rely on uniform crate dimensions and robust stackability.

In grocery e-commerce, frequent small-batch deliveries increase crate turnover rates, improving the economic viability of reusable systems. Manufacturers are prioritizing automation-ready crate designs and piloting smart features to enhance asset visibility and utilization. These developments strengthen the role of crates as critical load carriers within modern, automated supply chains.

Adopting reusable crate systems requires significant upfront investment in crates, washing and sanitization facilities, tracking technology, and reverse-logistics networks. Compared with single-use alternatives, reusable crates involve higher initial costs, and financial returns depend heavily on recovery rates and usage cycles.

In regions with long transport distances or weak return logistics, the total cost of ownership may be unfavorable. Payback periods can extend over several years in low-turn applications, limiting adoption among cost-sensitive users and in geographically dispersed supply chains.

Achieving full circularity for crates remains challenging due to contamination, composite materials, and uneven recycling infrastructure. Using recycled inputs requires validated supply chains, consistent material quality, and compliance with food-contact regulations.

In markets lacking local recycling facilities, end-of-life crates may incur high transport and disposal costs, increasing operational risk. These challenges slow the adoption of recycled-content crates in certain regions and highlight the need for localized recycling and material-recovery solutions.

Advances in materials science are enabling crates to be manufactured with reduced virgin-plastic content while maintaining structural performance. Hybrid materials and high-recycled-content polymers lower embodied carbon and appeal to sustainability-focused buyers.

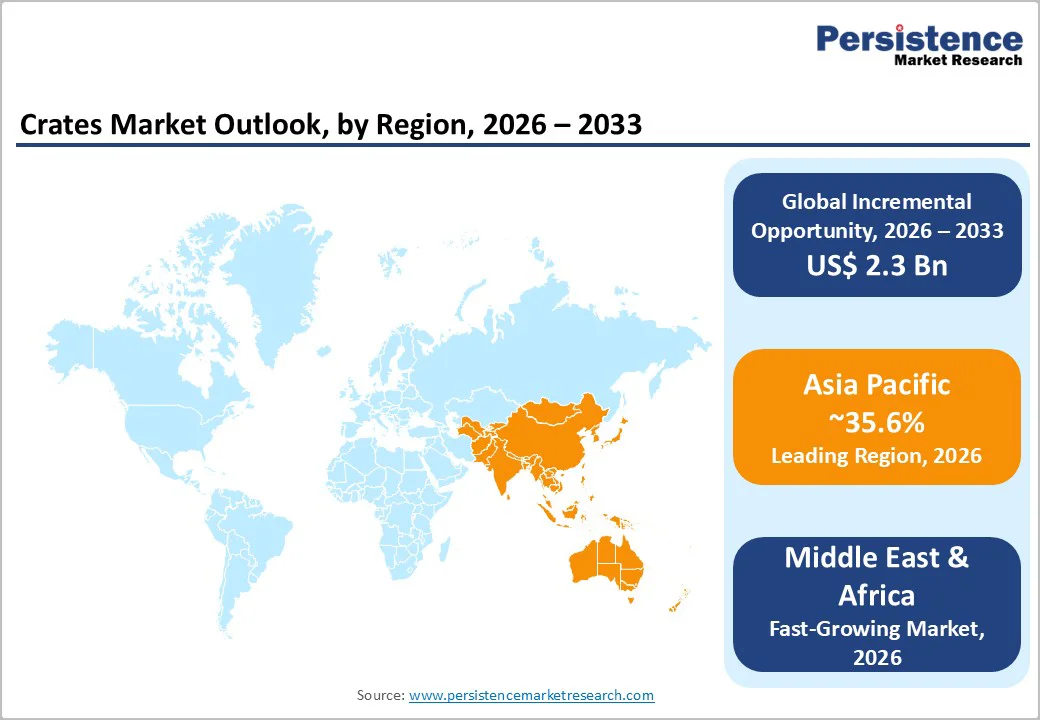

Commercial pilots demonstrate scalability and open a distinct product segment for environmentally compliant logistics solutions. If Asia Pacific, which represents approximately 35.6% of global demand, accelerates procurement mandates for recycled packaging, recycled-content crates could represent a multi-hundred-million-dollar opportunity by 2033 within the ABC Market forecast.

Digital technologies such as RFID, BLE, GPS tracking, and cloud-based asset-management platforms offer significant value by improving crate recovery rates, utilization, and lifecycle visibility. Smart crates shorten payback timelines and reduce losses in pooled systems.

Manufacturers and service providers are increasingly offering tracking-enabled crates bundled with analytics and pooling services. These digital add-ons could represent 5-10% of aftermarket service revenue for crate programs by 2030, creating a high-margin, recurring revenue stream.

Export-oriented fresh-produce supply chains are increasingly adopting pooled reusable plastic containers to reduce product damage, waste, and logistics inefficiencies. Retailers and exporters benefit from standardized crates that comply with hygiene and ventilation requirements.

Based on the 2033 market forecast of US$8.7 Bn and the continued dominance of food and beverage applications, the fresh-produce and grocery crate segment represents a multi-billion-dollar addressable market, offering strong growth potential for pooling operators.

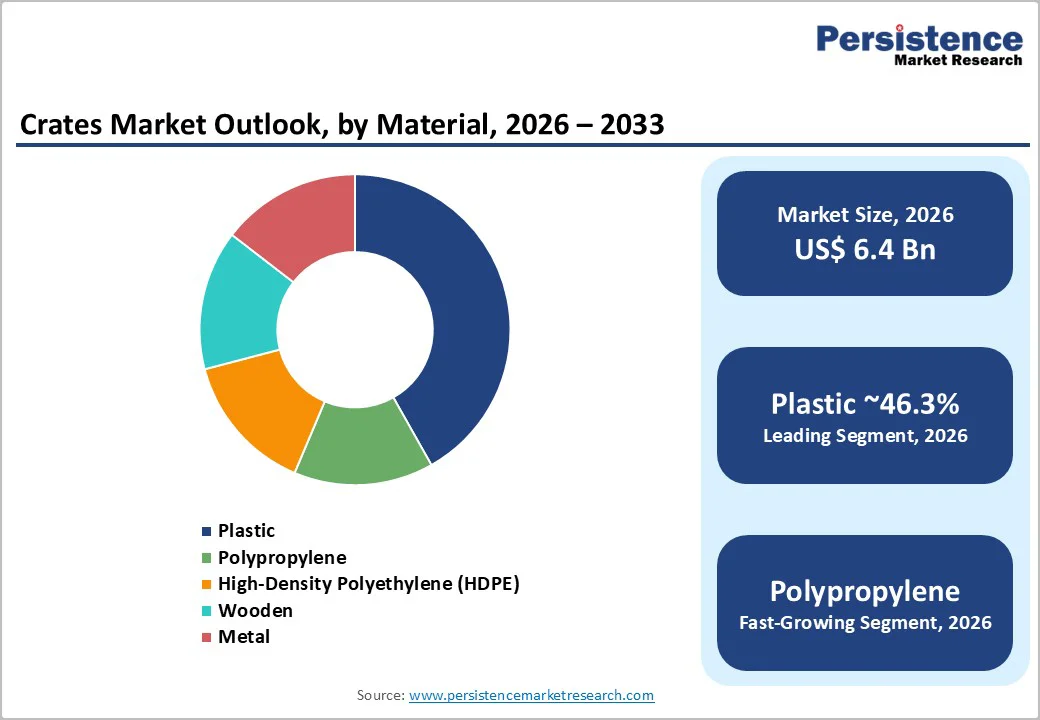

Plastics are expected to account for approximately 46.3% of revenue share in 2026. Plastic crates represent the dominant material segment due to their lightweight construction, long service life, and resistance to moisture, chemicals, and mechanical stress.

High-density polyethylene and polypropylene are widely deployed across beverage distribution networks, grocery retail logistics, pharmaceutical handling, and industrial supply chains, where standardized crate dimensions and repeat-use economics are critical.

Plastic crates integrate seamlessly with automated conveyor systems, robotic picking lines, and palletized warehouse operations, reinforcing their adoption in high-throughput distribution centers. A growing proportion of plastic crates is produced using recycled polymer blends, aligning with regulatory mandates on packaging waste reduction and corporate sustainability goals.

For instance, returnable crates for bottled beverages, dairy products, and fresh produce increasingly incorporate recycled content without compromising structural integrity, strengthening plastic’s long-term leadership in the market.

Polypropylene is likely to be the fastest-growing material segment, supported by its high strength-to-weight ratio, superior impact resistance, and excellent fatigue performance.

PP crates maintain structural stability across a broad temperature range, making them well-suited for cold-chain logistics, frozen food distribution, and export-oriented agricultural shipments. Their lighter weight supports logistics cost optimization by reducing fuel consumption and manual handling strain, both of which are increasingly prioritized in large-scale distribution operations.

Growth is further accelerated by expanded availability of recycled polypropylene and advancements in injection-molding and rib-reinforcement technologies, enabling more durable and ergonomically optimized crate designs. As a result, PP crates are increasingly selected for ventilated produce crates, stackable export containers, and reusable transit packaging, allowing this segment to outpace the growth of other plastic materials.

The food & beverages segment is estimated to account for approximately 37.4% of the revenue share. The food and beverages sector represents the largest end-use segment for crates, driven by high shipment volumes, stringent hygiene standards, and frequent reuse cycles.

Beverage distribution remains a core demand driver, with crates extensively used for bottled water, carbonated soft drinks, dairy products, and returnable glass bottle systems, where uniform crate dimensions ensure efficient stacking, washing, and redistribution.

Fresh and packaged food supply chains further drive demand for ventilated, stackable, and nestable crates, which support product integrity during transport and cold storage. Large retail chains and foodservice distributors increasingly rely on returnable crate systems to reduce single-use packaging, enhance supply-chain traceability, and meet sustainability commitments, resulting in consistent replacement demand and long-term pooling arrangements.

Agriculture and allied industries represent the fastest-growing end-use segment, driven by rising exports of fresh fruits, vegetables, floriculture products, and specialty crops, particularly from emerging production hubs. The expansion of cold-chain infrastructure, packhouse automation, and export-oriented logistics corridors has increased the adoption of reusable crates, reducing spoilage and mechanical damage.

Export-focused supply chains increasingly specify ventilated and stackable plastic crates to comply with international quality, traceability, and phytosanitary requirements, replacing traditional wooden boxes and single-use packaging. Growth is especially strong in fresh produce exports, floriculture logistics, and high-value horticultural crops, where maintaining freshness and visual quality directly influences export realization and profitability.

North America remains a major crates market, supported by advanced retail distribution networks, large-scale beverage supply chains, and well-established reusable-packaging ecosystems. The United States leads regional demand, driven by the rapid scaling of e-commerce grocery fulfillment, omnichannel retail models, and centralized distribution centers.

Major retailers and food distributors increasingly rely on pooled returnable crate systems, supplied by providers such as IFCO, CHEP, Tosca, ORBIS Corporation, and Rehrig Pacific, to improve asset utilization and reduce packaging waste.

Regulatory oversight from agencies such as the U.S. Food and Drug Administration (FDA) on food-contact materials, combined with state-level sustainability and extended producer responsibility initiatives, continues to accelerate the adoption of reusable and recycled-content plastic crates.

Investment activity in the region increasingly targets warehouse automation, RFID- and IoT-enabled crate tracking, and crate-as-a-service business models. For example, digital pooling platforms that provide real-time asset visibility are gaining traction among beverage bottlers and fresh-produce distributors, enabling higher-margin value-added logistics services and long-term supply contracts.

The Middle East & Africa represent the fastest-growing regional market for crates, driven by logistics infrastructure expansion, rising food imports, and rapid development of cold-chain capacity. Countries such as the UAE and Saudi Arabia serve as regional logistics hubs, supported by large-scale investments in ports, airports, and inland distribution.

Operators such as DP World, Agility Logistics, and regional cold-chain providers have expanded temperature-controlled warehousing and last-mile food logistics, directly increasing demand for durable, reusable crates.

Retail expansion and growth in organized foodservice across Gulf Cooperation Council countries are accelerating the adoption of standardized plastic crates for distributing fresh food, beverages, and meat. Regulatory alignment with international food safety standards and sustainability agendas under national transformation programs has encouraged interest in pooled crate systems and recycled-content materials.

Limited local recycling infrastructure in parts of Africa creates both cost pressures and opportunities for investment in regional polymer recovery, washing, and reprocessing facilities, positioning reusable crate suppliers as long-term infrastructure partners rather than commodity packaging vendors.

Asia Pacific is projected to lead the global crates market with approximately 35.6% share, reflecting its role as both the largest demand center and a key global manufacturing hub. China anchors regional supply through its large-scale plastic manufacturing base and export-oriented logistics, while domestic retailers and e-commerce platforms increasingly deploy standardized reusable crates in grocery and fresh-food delivery networks.

Japan’s leadership in warehouse automation and robotics has reinforced demand for precision-molded crates compatible with automated storage and retrieval systems. In India, accelerated investment in cold-chain infrastructure, agricultural logistics, and organized retail is driving rapid uptake of ventilated and stackable crates for fruits, vegetables, dairy, and fisheries, with domestic manufacturers such as Nilkamal and other regional players expanding capacity.

Across ASEAN markets, export-driven agriculture and seafood processing have increased reliance on reusable crates to meet international quality and traceability requirements, positioning the Asia Pacific as the most structurally diversified and resilient regional market.

The global crates market shows moderate concentration at the pooled-service level and higher fragmentation among regional manufacturers. Global pooling operators hold significant influence in reusable crate systems, while numerous local producers supply customized solutions. Consolidation and strategic partnerships are gradually increasing market concentration, particularly in pooled logistics and reusable packaging services.

Leading players emphasize integrated pooling services, recycled-material innovation, and digital differentiation, while smaller firms compete through niche specialization, cost efficiency, and regional responsiveness.

The global crates market is estimated to be valued at US$6.4 billion in 2026.

By 2033, the global crates market is projected to reach approximately US$8.7 billion.

Key trends include rising adoption of reusable and returnable packaging, increased use of plastic and recycled-content crates, growth of cold-chain and fresh food logistics, integration of automation-compatible and stackable crate designs, and gradual adoption of digitally trackable and pooled crate systems.

By material, plastic crates represent the leading segment, accounting for approximately 46.3% of total market share, driven by their durability, lightweight nature, and suitability for repeated reuse across food, beverage, and retail logistics.

The crates market is projected to grow at a CAGR of 4.5% between 2026 and 2033.

Major players include Schoeller Allibert, IFCO Systems, Brambles (CHEP), Orbis Corporation, and Rehrig Pacific Company.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Material

By Product Type

By End-Use Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author