ID: PMRREP35162| 181 Pages | 18 Jul 2025 | Format: PDF, Excel, PPT* | Healthcare

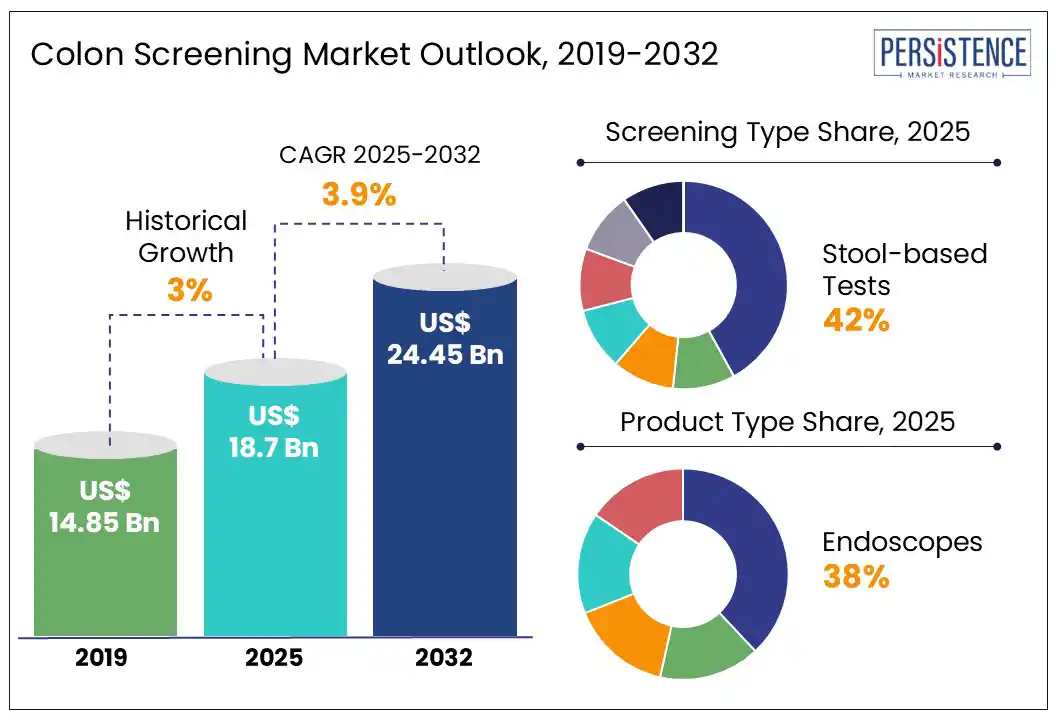

The global colon screening market size is likely to be valued at US$ 18.7 Bn in 2025, and is estimated to reach US$ 24.45 Bn by 2032, growing at a CAGR of 3.9% during the forecast period 2025 - 2032.

Colon screening is an essential procedure for the early detection of colorectal cancer. Common screening methods such as colonoscopy, fecal immunochemical tests (FIT), and stool DNA tests enable timely diagnosis and intervention. With the global rise in colorectal cancer cases, healthcare systems are increasingly investing in accessible and effective screening programs. Early detection not only improves survival rates but also reduces long-term healthcare costs.

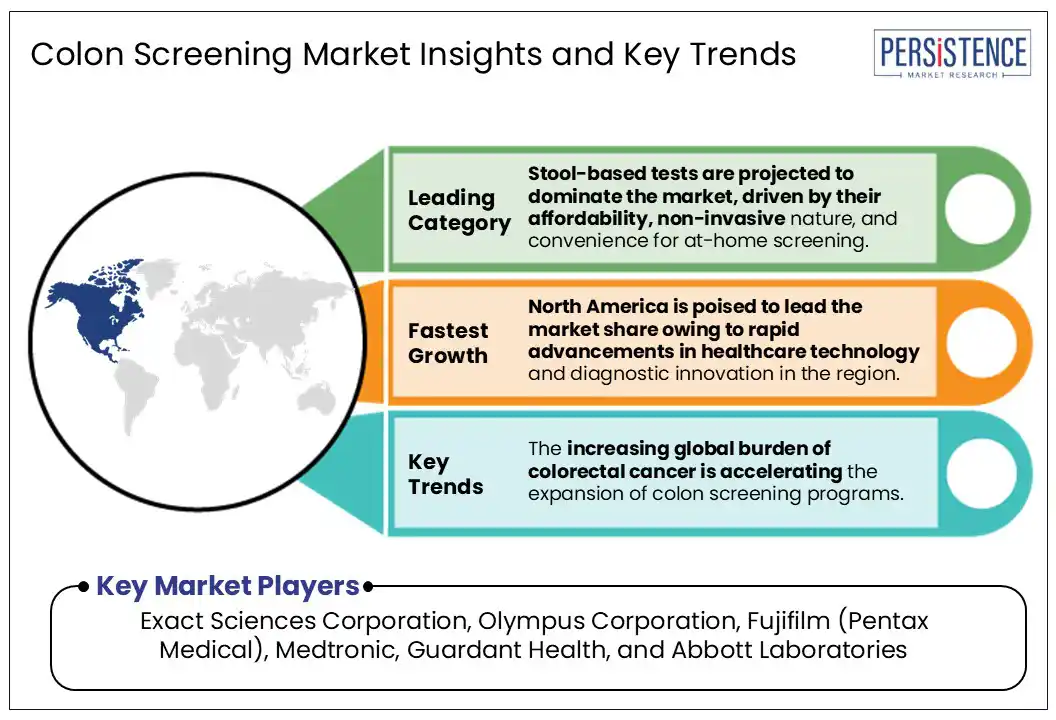

The colon screening market growth is primarily fueled by the rising incidence of colorectal cancer (CRC) around the world, prompting the expansion of diagnostic testing and early detection programs. As reported by the World Health Organization (WHO), 1.9 million new CRC cases were diagnosed globally in 2020, making it the third most common cancer and the second leading cause of cancer-related deaths. With projections indicating over 3.2 million new cases annually by 2040, healthcare systems are prioritizing early screening initiatives.

Countries including the U.S., U.K., and Japan are scaling up their colon screening programs by increasing access to colonoscopy procedures, FIT, and DNA-based stool tests. These efforts aim to detect CRC at earlier stages, thereby improving treatment outcomes and survival rates.

Key Industry Highlights

The expansion of CRC screening programs is creating significant opportunities in the colon screening market, particularly in diagnostics and research. These initiatives promote early detection, reduce mortality, and lower long-term healthcare costs. According to the WHO, CRC cases may cross 3.2 million annually by 2040, reiterating the urgency for large-scale screening efforts.

Countries including the U.S., U.K., and Japan have strengthened their national screening strategies through colonoscopy, fecal immunochemical tests, and stool DNA testing. In the U.S., the CDC’s Colorectal Cancer Control Program (CRCCP) targets an 80% screening rate to minimize late-stage diagnoses. Research indicates that consistent screening could prevent up to 60% of CRC-related deaths and significantly reduce treatment expenditures. Meanwhile, nations such as Germany and France are expanding structured screening through FIT and colonoscopy, while the European Union (EU) is enhancing its CRC screening framework. This growing demand is expected to fuel innovations in AI-powered diagnostics and next-generation screening tools, supported by both governmental initiatives and heavy private sector investments.

While non-invasive methods such as FIT and Fecal Occult Blood Test (FOBT) are extensively adopted for colon screening procedures for their affordability and convenience, sensitivity limitations remain a challenge. This is especially evident in their ability to detect early-stage neoplasms. According to the National Institutes of Health (NIH), FIT shows a 79% sensitivity for colorectal cancer but drops to 24-50% for advanced adenomas. Similarly, FOBT demonstrates around 70% sensitivity, which may result in false negatives and delayed diagnoses. To address these gaps, high-risk individuals are often recommended follow-up colonoscopy for accurate detection. Despite these limitations, large-scale screening initiatives such as the CDC’s CRCCP and the NHS Bowel Cancer Screening Program continue to promote FIT and FOBT, aiming to improve early detection and reduce mortality. These programs are expected to drive innovation and accelerate the market growth in the coming years.

The wide adoption of telemedicine and at-home diagnostic tools is reshaping the landscape of the colon screening market, making early detection more accessible and convenient. Non-invasive options such as stool DNA tests have significantly boosted participation in screening programs, especially in underserved areas. In the U.S., at-home colorectal cancer screening saw a 10% rise between 2019 and 2023, with patented tests such as Cologuard leading the trend. Despite this progress, nearly 40% of eligible adults remain unscreened, presenting a massive opportunity for the market expansion. Companies such as Exact Sciences and Guardant Health are already leveraging AI-based risk assessment tools and telehealth platforms to enhance test accuracy and guide patients toward appropriate screening options. Additionally, public health initiatives by organizations such as the CDC and NHS, including the distribution of free FIT kits, are helping to close screening gaps and enhance the market prospects for colon screening.

Based on screening type, the global colon screening market is categorized into stool-based tests, colonoscopy, flexible sigmoidoscopy, capsule endoscopy, and others. Stool-based tests are projected to account for 42% of the market in 2025, owing to their non-invasive nature, affordability, and increasing adoption in at-home screening programs.

These tests include fecal immunochemical tests (FIT) and guaiac-based fecal occult blood tests (gFOBT), which are widely recommended in national screening initiatives. The U.S. Preventive Services Task Force (USPSTF) and European healthcare agencies endorse these methods, increasing compliance rates.

Following that, colonoscopy is anticipated to hold 35% of the market and remains the gold standard for colorectal cancer detection due to its high sensitivity, which is over 95%, and the ability to detect and remove polyps in a single procedure. Despite its invasiveness, countries including Germany, the U.S., and Japan promote population-wide colonoscopy programs for high-risk individuals.

Capsule endoscopy and flexible sigmoidoscopy are gaining traction but remain secondary choices. The integration of AI into colonoscopy procedures is enhancing diagnostic accuracy, ensuring continued market growth during the forecast period.

By product type, the market segments include endoscopes, CT scanners, capsule endoscopes, and test kits & reagents. Endoscopes are expected to hold a market share of 38% on the global scale in 2025, due to their ability to detect precancerous polyps and early-stage colorectal cancer with an accuracy of over 95%. Colonoscopies, which use advanced high-definition and AI-assisted endoscopes, are considered the best method. This is especially true in Germany, the U.S., and Japan, where national screening programs focus on them.

Test kits and reagents follow closely, accounting for 27% of the market, as non-invasive stool-based tests such as FIT and FOBT continue to gain popularity. Their affordability, at-home convenience, and growing government adoption in Europe and North America support their widespread use.

CT scanners are estimated to account for 20% of the market, with virtual colonoscopy (CT colonography) gaining popularity due to its lower invasiveness. The demand for CT scanners is increased by integrating CT colonography into screening programs in countries including the U.K. and Canada.

North America is poised to lead the market share, capturing a projected 44% of the global market in 2025, primarily driven by rapid advancements in healthcare technology and diagnostic innovation. Tools such as Medtronic’s GI Genius, which utilize AI-powered colonoscopy, have shown a 14% increase in adenoma detection rates compared to traditional methods, enabling earlier diagnosis and reducing mortality. In 2023 alone, over 50,000 colorectal cancer cases were reported in the U.S., highlighting the urgency for improved screening. The region has also seen a 7% rise in screening participation from 2019 to 2024, further bolstered by expanding access to telemedicine services and at-home testing. Government initiatives such as the CDC’s Colorectal Cancer Control Program continue to enhance access and outcomes, contributing to a projected CAGR of 3.5% through 2032.

Europe is projected to hold 24% of the market share by 2025, largely due to Germany, France, and the U.K.'s widespread adoption of screening programs and nationwide initiatives aiming to increase early detection rates.

In Germany, the National Cancer Plan supports biennial FIT/FOBT tests for individuals aged 50 to 54, followed by colonoscopy every 10 years for those 55 and older.

The U.K.’s Bowel Cancer Screening Programme lowered the screening age to 50, increasing participation rates. In 2024, over 60% of the eligible population in the U.K. and Germany participates in CRC screening.

The European Commission’s Beating Cancer Plan aims to screen 90% of the EU population eligible for CRC screening by 2040. Expanding these programs could prevent up to 35,000 deaths annually, reinforcing the importance of government and NGO-supported screening efforts. Advancements in non-invasive tests such as FIT-DNA and AI-assisted colonoscopies are also boosting adoption rates across Europe.

Asia Pacific is projected to be the fastest-growing market for colorectal cancer diagnostics, driven by an aging population in the region and increasing awareness of early detection. China alone recorded 555,477 new CRC cases in 2020, making it the second most common cancer in the country. Japan reported 149,500 new cases, while India saw over 65,000. The rising burden of genetic disorders such as Lynch syndrome and familial adenomatous polyposis contributes to 5% to 10% of all CRC cases in the region.

Governments in South Korea and Singapore are implementing population-wide screening programs to boost early detection. South Korea’s National Cancer Screening Program (NCSP) offers biennial FIT tests for individuals over 50, increasing participation rates.

Asia Pacific's development in colorectal cancer diagnostics is supported by non-invasive stool-based tests and investments in precision medicine, which are improving diagnosis accuracy and customizing screening methods.

The global colon screening market is highly competitive as there is an alarming rise in colon cancer cases worldwide, and this trend has prompted several technology companies to explore collaborations with healthcare institutions, aiming to enhance their consumer reach and improve patient outcomes.

The integration of cutting-edge technologies into colon screening platforms is expected to significantly enhance the accuracy and efficiency of these tests, leading to more precise and early detection of potential issues.

As awareness about cancer treatment and prevention grows, so too will the understanding and knowledge surrounding the importance of regular screenings, empowering individuals across the globe to take proactive steps in safeguarding their health.

The market is projected to reach US$ 18.7 Bn in 2025.

The expansion of colorectal cancer (CRC) screening programs drives the market.

The market is poised to witness a CAGR of 3.9% from 2025 to 2032.

Rising uptake of telemedicine and home testing tools and evolving screening programs are key market opportunities.

Exact Sciences Corporation, Olympus Corporation, and Fujifilm (Pentax Medical) are the key players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Colon Screening Market Size (2025E) |

US$ 18.7 Bn |

|

Market Value Forecast (2032F) |

US$ 24.45 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

3.9% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.0% |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Screening Type

By Product Type

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author